Orbon Alija

Investors should not be basing forward-looking investment decisions on one of the most lagging of all economic indicators, which is the jobs report. In a similar vein, the Fed should not be basing future monetary policy decisions on the same indicator, especially when the effects of its tightening campaign have yet to fully impact the real economy. The only indicator that lags more is the rate of inflation. Chairman Powell intimated that sentiment in his speech at the Brookings Institute on Wednesday. Still, Fed officials will undoubtedly harp on the 263,000 jobs supposedly created last month that were above expectations for 200,000, as though that is some kind of game-changer. In fact, the economy is more likely to have lost jobs.

I say supposedly because the payroll number from the Bureau of Labor Statistics is an estimate subject to large revisions in the months and year after the initial report. The BLS has a track record of overestimating and underestimating job growth at turning points in the economy. Today, it is likely overestimating, because we know the rate of economic growth is slowing, in particular for the manufacturing sector. This survey also counts jobs and not the number of workers employed. Therefore, one worker who finds a second part-time job is counted as one new job. This survey also excludes the self-employed, who are typically more vulnerable to a deterioration in economic conditions.

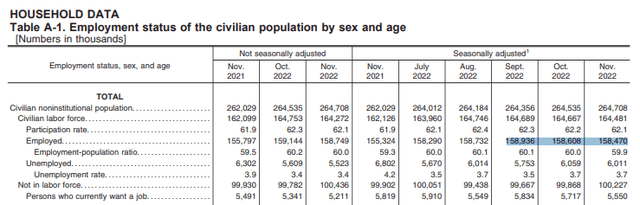

This is why the BLS also has a household survey, which counts the number of individuals, including the self-employed, who have jobs and not the number of jobs. It tends to lead the payroll survey at inflection points in the economy, and it paints a very different picture of the labor market in this morning’s report. Note below that the number employed not only declined in November, but in October as well. Last month, the household survey shows a loss of 138,000 jobs. The loss was even larger in October at 328,000. This is the number that the Fed and investors should be focusing on.

That said, we are still seeing a gradual deceleration in payroll job growth, as the average monthly gain in 2021 was 562,000, which fell to 392,000 this year, and has declined in each of the past three months at a number below 300,000. Furthermore, the average three-month change for total nonfarm and private payrolls has decelerated each of the past three months. This is the rate of change the Fed wants to see.

Another factor at work is the irregularity of this post-pandemic expansion. Despite a slowing rate of economic growth, employers are fearful of not having enough skilled workers on hand for when growth picks up again. Therefore, they are retaining staff that they would probably not have in prior business cycles, which has been indicated in PMI surveys in recent months. This gives the impression that the economy is stronger than the reality on the ground, which falsely raises inflation concerns.

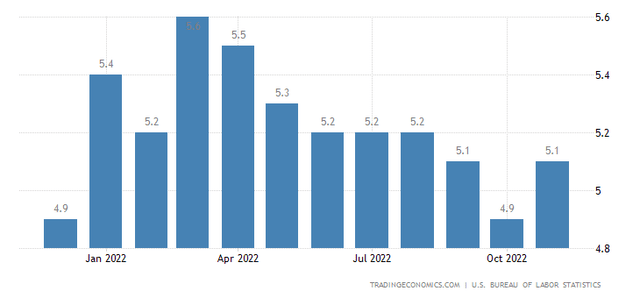

Another concern was the spike in wage growth last month. Granted, we did see annualized wage growth increase from 4.9% in October to 5.1% in November, but the growth rate is in a steady downtrend from its high of 5.6% in March. More importantly, the length of the average workweek for all employees declined by 0.1 hour from 34.5 to 34.4, which wipes out the increase in average hourly earnings in terms of weekly take-home pay.

The bottom line is that you have to look past the headline number of 263,000 jobs to understand that this was a much weaker report than advertised. That is why I asserted shortly after its release that the market will recover by the end of the day. This is exactly the kind of report that the Fed wants to see, and I continue to believe that short-term rates will peak with the Fed’s final rate increase of 50 basis points at its December meeting.

Be the first to comment