Mario Tama/Getty Images News

I wrote a bullish article on HP Inc. (HPQ), commonly known for Hewlett-Packard printers and computers, in November here. In many respects, Dell Technologies (DELL) is in the same boat for low investment valuations and business model setup, selling computer/printer hardware while offering various services for them. Both have performed better than the S&P 500 over the last 12 months, and may continue to do so even in a mild recessionary macro environment.

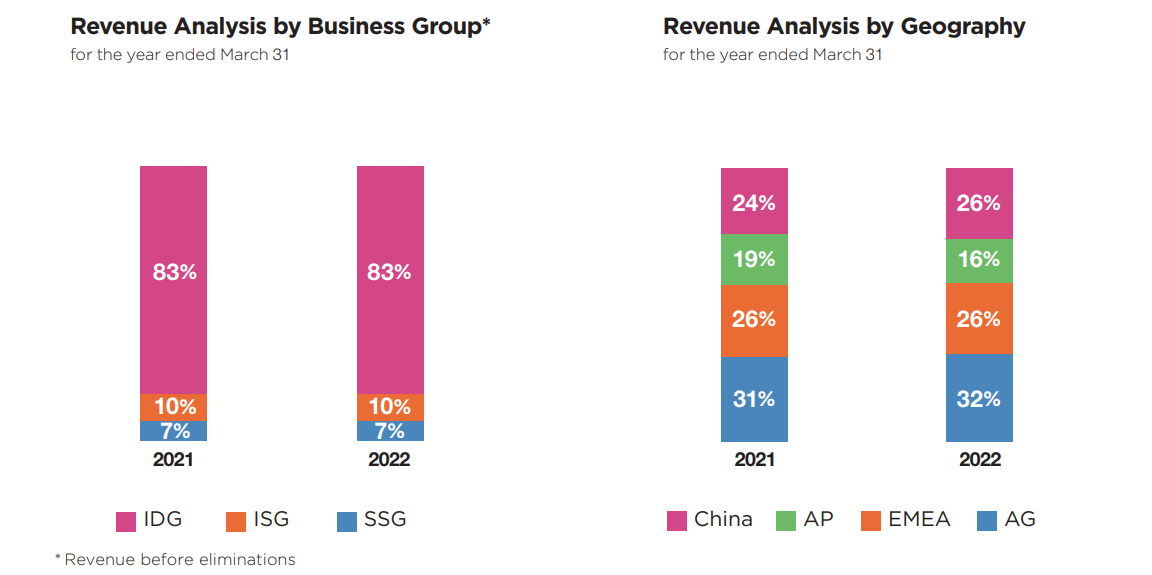

Another equity investment idea for those wanting exposure to a leading computer hardware giant outside the U.S. is the Lenovo Group ADR (OTCPK:LNVGY) or its direct share listing (OTCPK:LNVGF), with more complicated tax and liquidity issues for U.S. investors. Lenovo is an international conglomerate building and selling computer products all over the world, with a concentration of assets in Asia (China 26% of sales), based out of Hong Kong. The stock’s valuation is even cheaper than HPQ or DELL, and its long-term growth prospects may be brighter.

Sidestepping many of the capital transfer problems experienced by mainland China-listed firms and the crackdown on Big Tech by Chinese authorities in 2021, Lenovo’s Hong Kong address allows it to send big dividend checks to American investors and theoretically provides better direct access to its assets in a liquidation or sale of the company. This legal design is the opposite of the much-maligned Alibaba (BABA) (OTCPK:BABAF) setup, which cannot pay a dividend with strict capital controls on nearly 100% of assets and sales inside Chinese territory and provinces.

In June, the company announced its first factory in Eastern Europe was now open in Hungary. According to the company,

The Hungary facility is part of Lenovo’s global manufacturing and supply chain strategy that serves customers in 180 markets from 35+ manufacturing sites around the world – including Argentina, Brazil, China, Germany, Hungary, India, Japan, Mexico and the USA. Lenovo is widely recognized for its global hybrid manufacturing model that includes a mix of both in-house and contract manufacturing. A key source of competitive advantage for the company, it provides greater efficiency and control over product development and supply chain operations, enabling customer needs to be responded to more effectively. In May 2022, Lenovo jumped seven places in a year, and is now ranked #9 in the Gartner Global Supply Chain Top 25 for 2022. The recognition highlights Lenovo’s leadership as a purpose-driven organization and operational center of excellence in the global supply chain community.

Specifically, Lenovo Group engages in the development, manufacture, and marketing of technology products and services, including personal computers, workstations, servers, storage, smart televisions, plus mobile products such as smartphones, tablets, and applications. Services and software related to each device are also offered. For 2022, Lenovo is ranked the #2 global computer supplier for market share, measured by machines and gadgets sold behind Apple (AAPL). [Think about the disconnect between Lenovo’s $12 billion market cap vs. Apple’s $2,200 billion!]

Improving Financials

COVID-19 lockdowns and supply chain problems created by the pandemic of 2020-22 have definitely affected sales and profits. However, management has done a masterful job of delivering record revenue and income over the past year, despite major supply headwinds in China.

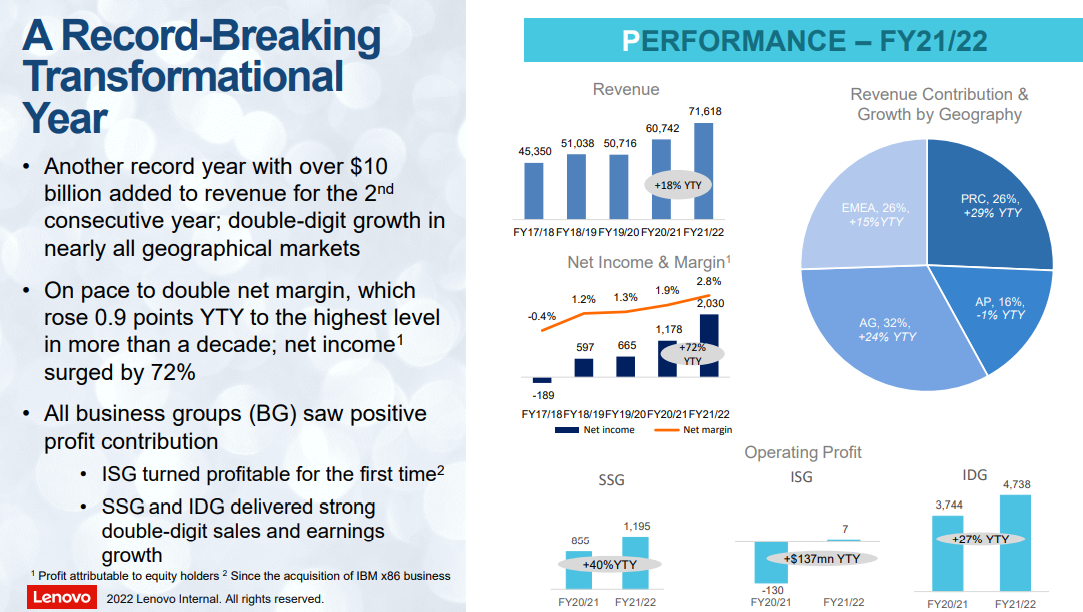

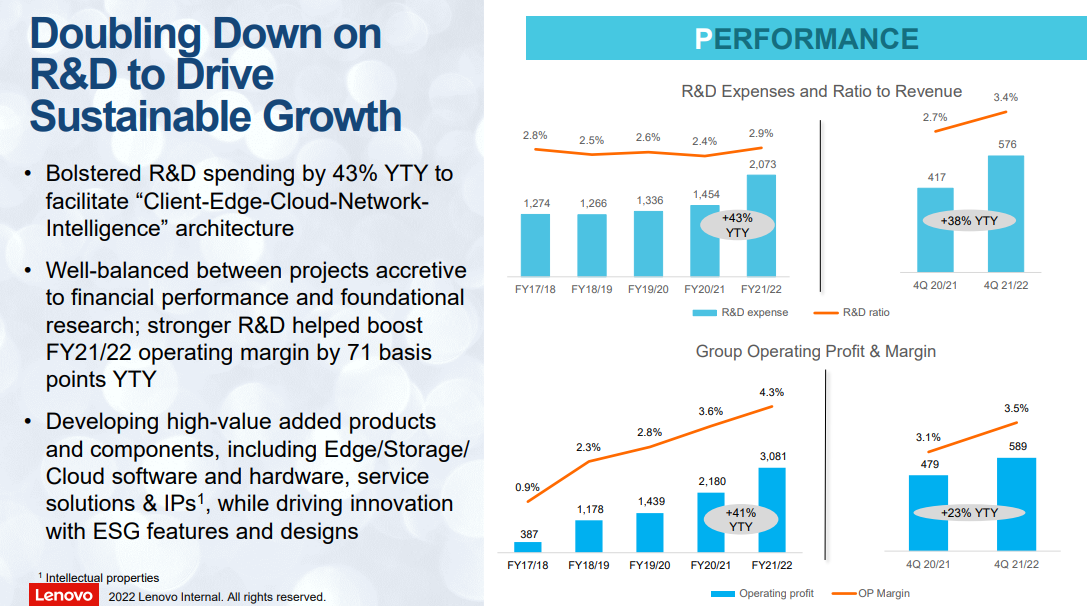

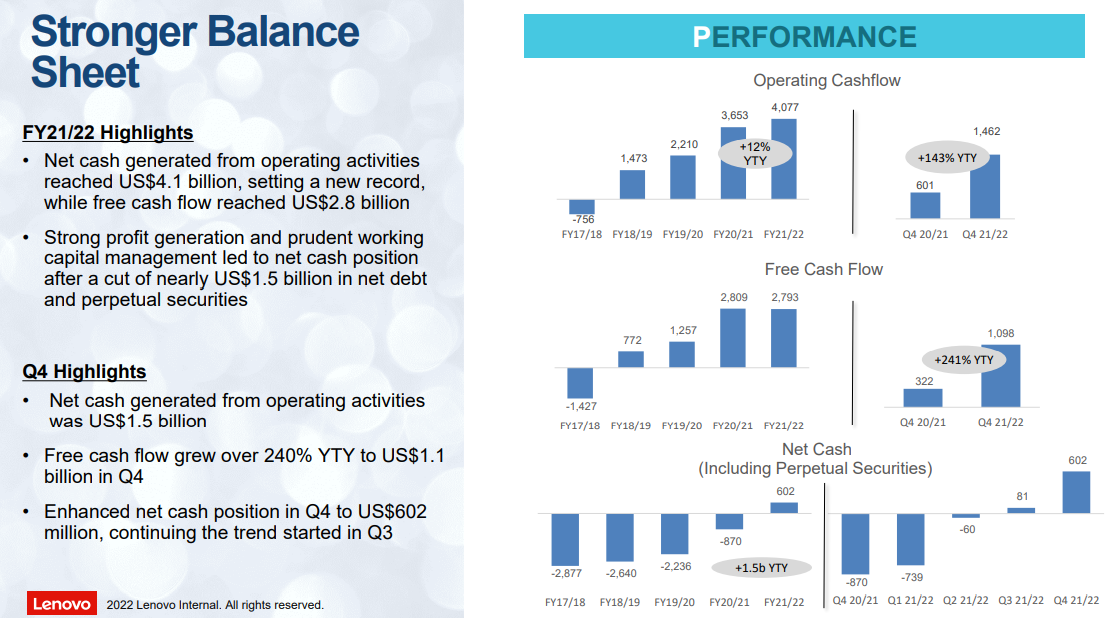

Below are slide summaries of the record 2021-22 fiscal year ending in March, taken from its Q4 Earnings Presentation and Annual Report posted in May. Operating profits and final income numbers were terrific, even with a massive increase in Research & Development efforts. Cash flow was at a record (free cash flow nearly so vs. last year) and $1.5 billion in debt was prudently retired.

Q4 Presentation

Q4 Presentation

Q4 Presentation

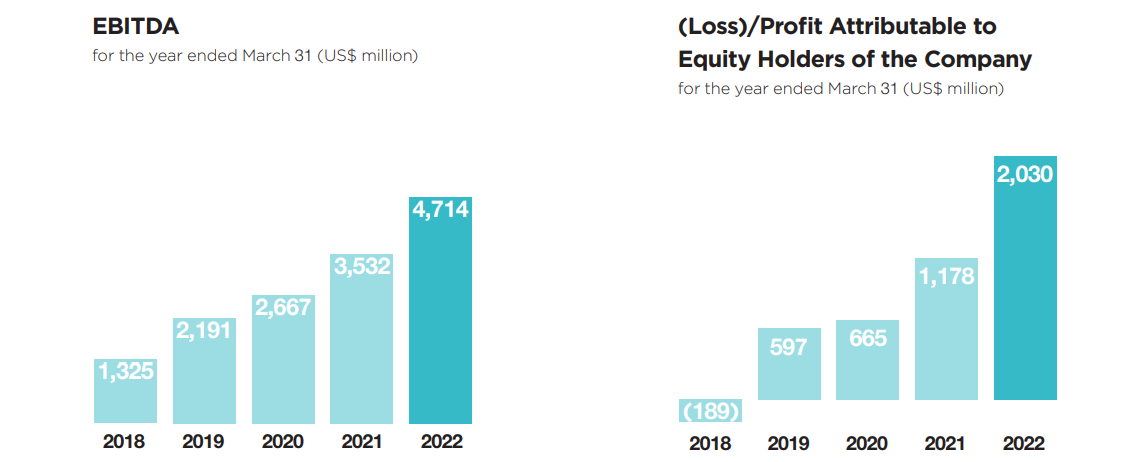

You can review the amazing growth in EBITDA and income over the past five years below. A breakdown of sales by operating division and region are also pictured.

2022 Annual Report

2022 Annual Report

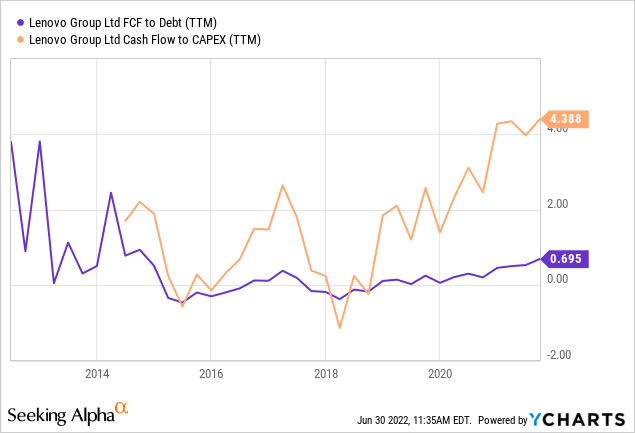

More good news: yearly free cash flow generation is now running at 70% the level of total debt, meaning all debt could theoretically be paid off in 18 months. This is a super-conservative number vs. companies generally in the S&P 500, where ratios of five or ten years are common. In addition, overall cash flow is running at 4x the rate of capital expenditures. Taken together, both are sitting at their strongest positions since 2014, if not later.

YCharts

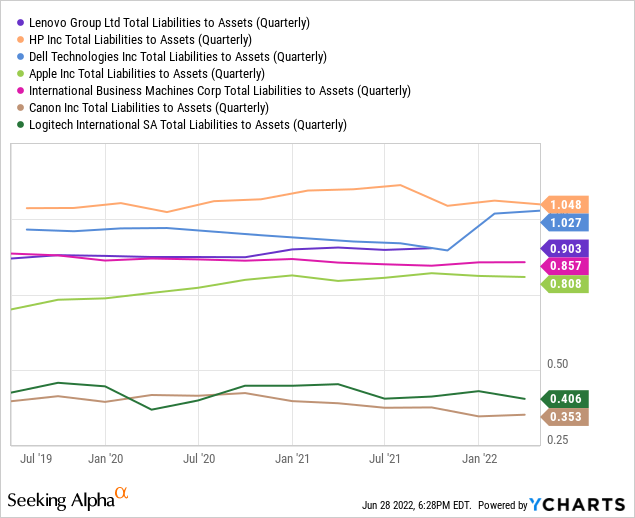

The total liabilities to assets ratio is higher than I would like, but on a par with HP and Dell, the closest competitors and peers for Lenovo. You can review this financial strength idea vs. other related businesses like Apple, International Business Machines (IBM), Canon (CAJ), and Logitech (LOGI).

YCharts

Perhaps the biggest negative looking at the fundamental returns of the business is low final net profit margins around 2.4%. This is the weakest of the peer group, as the company follows a typical Asian business growth plan of gaining market share and sales first. Maximizing income is left for future years. There are pros and cons to this approach for investors. I would prefer they try to exit business divisions and assets with lower margins and returns.

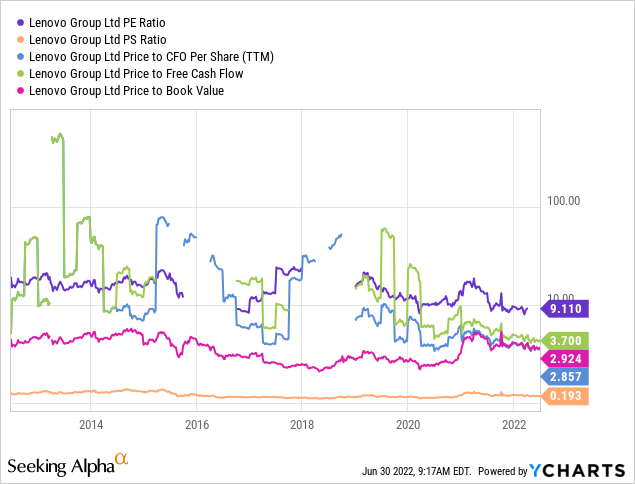

Super Cheap Valuation

Low margins are my biggest worry, assuming a global recession is next. However, if steady growth in Lenovo’s businesses continues, its stock could be one of the most undervalued Big Tech ideas available to global investors in June 2022. Believe it or not, the current valuation is the cheapest in over a decade on a variety of fundamental metrics. I am pegging its overall valuation on a combination of factors is nearly the same bargain as during the height of pandemic panic selling during early 2020. On price to earnings, cash flow, and free cash flow, Lenovo is trading at a better entry point than available in the past 10 years.

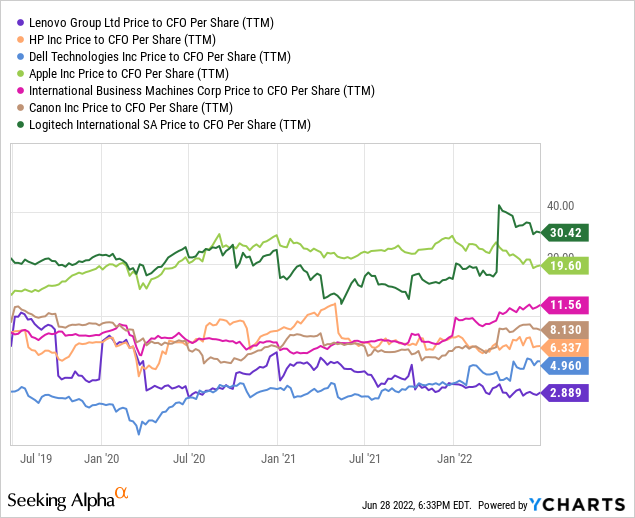

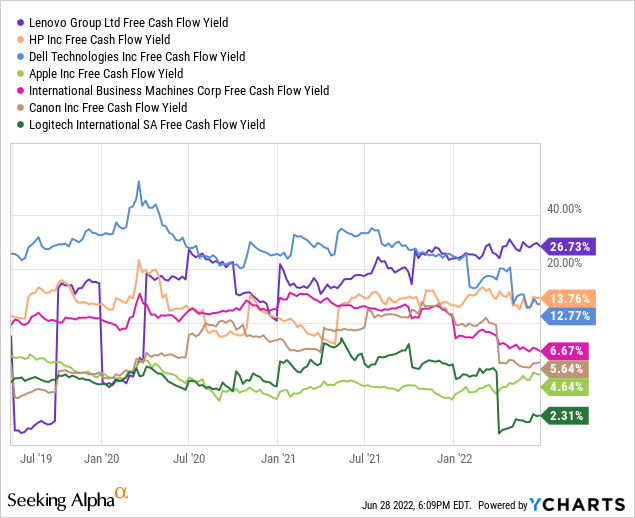

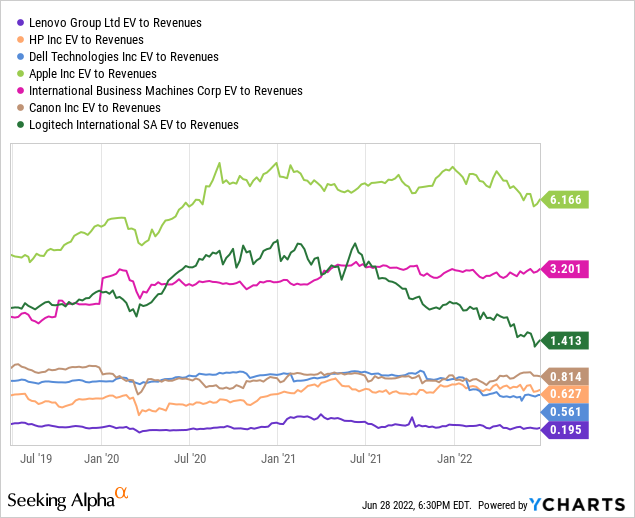

YCharts

Against the peer group, the ratio of price to trailing 12-month cash flow is absurdly low at 2.9x. And free cash flow yield of 26.7% (a favorite tool of Warren Buffett) on the current $19 ADR price is equally a screaming buy for growth-oriented tech investors. This yield is double the equivalent return from HP and Dell!

YCharts

YCharts

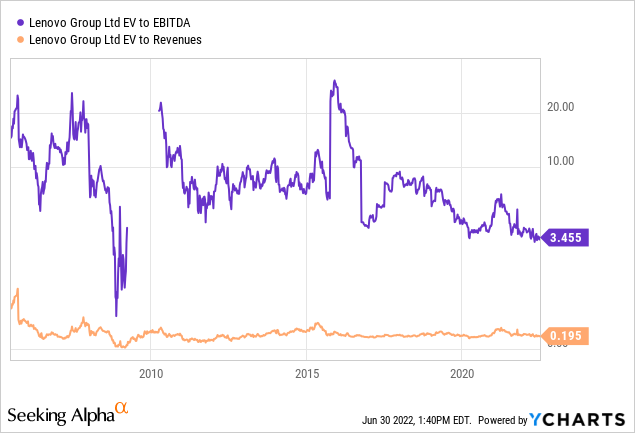

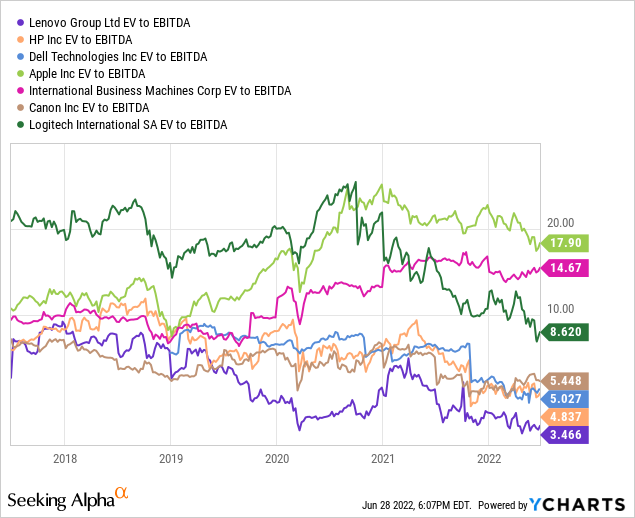

Including debt on top of equity capitalization, enterprise value vs. EBITDA (earnings before interest, taxes, depreciation and amortization) is at a decade low, while EV to Revenues is well below average for the company.

YCharts

Both of these calculations are well below all peers and competitors today, largely a function of its low profit margin. The question is how low is too low?

YCharts

YCharts

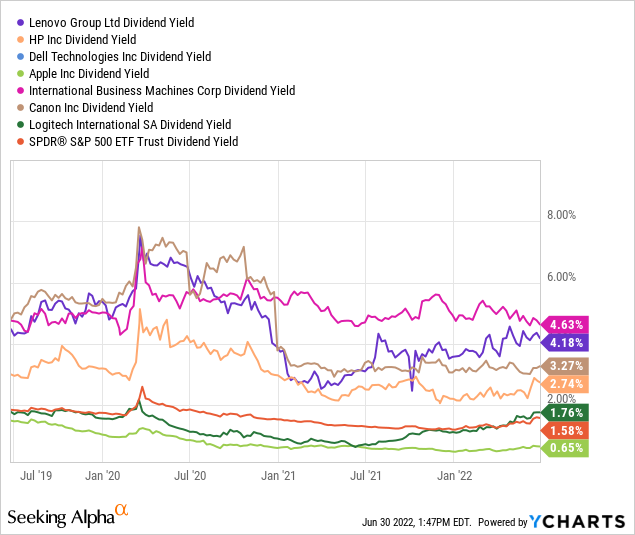

Last but not least, income investors hunting for yield (to match better with 8% YoY CPI gains in the cost of living) may want to seriously consider Lenovo. Its 4.2% trailing cash distribution yield is quite high vs. the equivalent S&P 500 rate of 1.6%, and nearly the best rate of the peer group.

YCharts

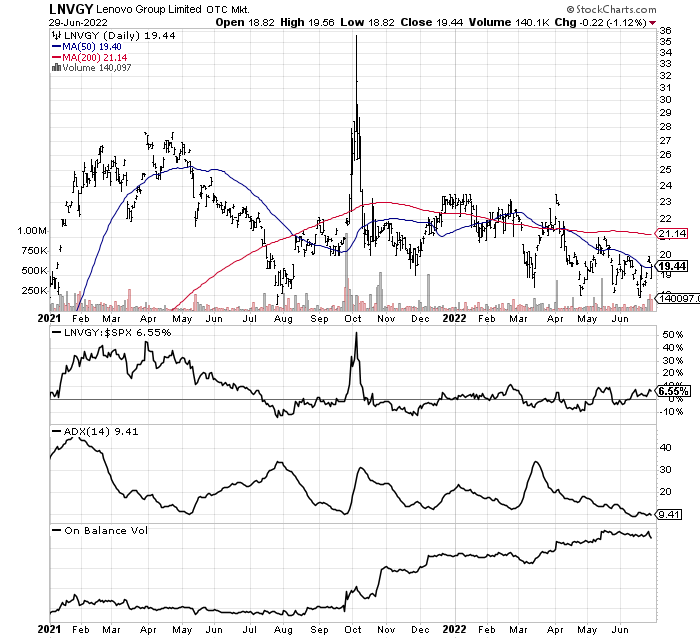

Accumulation Trading Pattern

What initially drew my attention to Lenovo was an incredibly high score in one of my favorite quant sorting formulas. Despite a slow zigzag lower in price since April of last year (ignoring the September-October spike on the push for a mainland China listing of the stock, pulled by the company), there has been scant evidence of significant selling pressure. In fact, daily On Balance Volume trends have been quite constructive since September, and the stock’s total return has bested S&P 500 performance during calendar 2022 so far. Perhaps signaling a prolonged upturn in the stock is approaching, a low 14-day Average Directional Index score under 10 in June is a bullish development. My read of the technical backdrop is any good news from the company could push it out of this year’s basing pattern, above the 200-day moving average around $21 currently. Then, momentum investors and Wall Street analyst interest could set off a run into the mid-$20s by early 2023.

StockCharts.com

Final Thoughts

The bargain valuation doesn’t come without some risk. The clear and present danger of a worldwide recession is beginning. I place the odds at better than 50/50 the United States is already in a period of contracting real GDP (with Q1 GDP revised down to -1.6% and the latest Atlanta Fed GDPNow estimate for Q2 reported as negative this morning). A drop in demand for technology and computer products would translate into lower cash flow and income, offsetting any positives from China reopening after its extensive first-half 2022 COVID shutdowns.

Another risk is Hong Kong’s accounting standards may be less rigid than in America. The company makes an effort to follow GAAP accounting protocol with PricewaterhouseCoopers as its external auditor (per annual report), but such doesn’t fall under the same rigor as an SEC compliant and filed U.S. audit. Lastly, a China/Taiwan reunification war would be very problematic for the company directly from its effect on regional operations and sales, and indirectly from the potential for a consumer backlash outside Asia against manufactured goods with any type of China-input component. While both of these risks and ultra-bearish scenarios seem unlikely, the odds are not zero. Each investor needs to understand the outlier event downsides before committing capital.

A final piece of the bullish puzzle is the vast majority of sales and assets are domiciled outside of the U.S. At some point in the near future, the dollar will come under serious selling pressure from our record sovereign debts/deficits. When that day comes, owning overseas-focused investments will be a winning strategy. As such, Lenovo is a great diversification play for American investors.

I am modeling worst-case downside risk to $15 in a deep recession (-20% TR), versus upside to as high as $30 (+60% TR) if investors come to understand the growth and value story for Lenovo over the next 12-18 months. Given today’s quote around $19, I rate the shares a Buy for individual investor portfolios. A robust dividend payout and demographic trends toward a digital world are both quite helpful for long-term investors. If record operating results continue, Lenovo could outline well-above average total returns for years to come.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment