Editor’s note: Seeking Alpha is proud to welcome Soraya Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Viktorcvetkovic/E+ via Getty Images

Thesis

IDEXX Laboratories is a well-entrenched business that has spread its tentacles throughout the whole ecosystem of veterinary care while also establishing itself in adjacencies like livestock & poultry and water testing. The enterprise has sticky, recurring revenues from the sale of instruments and related consumables as well as its SaaS offerings. However, the quality of the enterprise is already reflected in the price (recent decline notwithstanding) while the business faces macro uncertainties and stiff competition. Given conservative assumptions and employing a margin of safety, I believe the IDXX stock is attractive below $320.

Business overview

IDEXX operates across three business segments: Companion Animal Group (“CAG”), Water and Livestock, and Poultry and Dairy (“LPD”).

Companion Animal Group

These include diagnostic and information management products and services for the veterinary industry. Products range from in-clinic diagnostic solutions (e.g. single-use test kits) to traditional hematology and blood/urine chemistry analyzers and related consumables. Services include outside reference laboratories (IDEXX has a worldwide network of 80 labs) but also a whole suite of on-prem and cloud-based IT solutions which provide recurring revenue. These include practice management systems like IDEXX Neo which help manage a typical veterinary practice and other offerings like VetConnect PLUS which provide a holistic view of IDEXX diagnostics, identify abnormalities using patient history, and help interpret lab results.

IDEXX Neo Features (IDEXX Website)

This division is responsible for ~90% of the revenue (as of FY 2021).

Water Quality Products

IDEXX provides a range of water testing solutions that help evaluate bottled water, recreational water, wastewater etc. for contaminants (e.g. E. coli). Customers include utilities, government labs, beverage and pharmaceutical companies. This division is responsible for ~5% of the revenue (as of FY 2021).

Livestock, Poultry and Dairy

These include diagnostic tests and services that help track animal health and screen against common viral infections. In addition, IDEXX’s SNAP tests platform helps detect antibiotic residues and the presence of other contaminants in milk. This division is responsible for ~4% of the revenue (as of FY 2021).

Other, human medical offerings include Covid-19 testing products and point-of-care analyzers used in time-critical settings like emergency rooms.

Recent Results

IDEXX recently released results for the 2Q results for FY22 came in a little soft. Revenue grew 4.2% YoY to $860.55 million, missing analyst expectations by $1.57 million despite 6 downward revisions in the preceding three months. Similarly, EPS of $1.58 missed expectations by $0.05 on the back of higher discrete R&D spend. Management also lowered the FY2022 revenue growth outlook from 7.5% – 10% in Q1 to 5.5% – 8% in Q2 largely due to the expected decline in clinical visits in the second half of the year, softening demand due to macroeconomic factors, and currency headwinds. The CAG business continued to exhibit strong growth along with the water business while LPD showed negative growth due to fewer African swine fever testing in China. IDEXX also announced a bolt-on acquisition of ezyVet to further bolster its practice management SaaS portfolio.

Reading the latest earnings call transcript, it seems obvious that the tapering revenue growth is largely due to lower clinical visit frequency related to staffing issues at the clinics while the underlying demand is even more robust thanks to a remarkable 10% increase in the pet population in the last two years (a statistic shared in the earnings call). This implies a short-term uptick in revenues once vet clinic capacity catches up with latent demand.

In addition, IDEXX continued its strong innovation track record by introducing several new offerings including:

- Introduction of 4Dx Plus test for detecting vector-borne diseases

- Expansion of fecal Dx antigen testing ability

- A kidney disease marker which helps manage chronic kidney disease

- Enhanced PCR testing service

Financials

When it comes to financials, I prefer to look at a set of key metrics to gauge the quality of the enterprise and the authenticity of the earnings (accounting earnings vs. actual free cash flow).

|

IDEXX Financial Ratios |

2017 |

2018 |

2019 |

2020 |

2021 |

TTM |

|

Return on Capital Employed |

58% |

64% |

50% |

41% |

56% |

59% |

|

Gross Margin |

56% |

56% |

57% |

58% |

59% |

59% |

|

Operating Profit Margin |

21% |

22% |

23% |

26% |

29% |

26% |

|

FCF margin |

15% |

13% |

13% |

20% |

20% |

13% |

|

Cash Conversion Ratio (CCR) |

113% |

74% |

71% |

93% |

85% |

65% |

Return of capital employed has historically been in the 50%+ range. In the future, I expect this to trend even higher as the share of revenue from consumables, diagnostics and SaaS offerings increases relative to equipment sales.

Gross and operating margins are also high, which demonstrate an ability to pass on inflation to customers without an outsized impact on the bottom line.

Cash flow conversion is also in the 70%+ range, showing that earnings are real and that the business can fund the majority of the growth internally. This is important in the context of the macroeconomic risks wherein the worst case scenario, access to capital markets may get restricted.

Balance sheet

Below are key metrics that I use to evaluate balance sheet strength.

|

IDEXX Balance Sheet |

2017 |

2018 |

2019 |

2020 |

2021 |

TTM |

|

Debt-to-Capital Ratio |

104% |

101% |

86% |

61% |

60% |

77% |

|

Interest Cover |

12.9x |

14.4x |

17.8x |

21.7x |

31.1x |

28.5x |

|

Long-Term Debt |

606 |

601 |

699 |

936 |

863 |

768 |

|

Total Debt |

1,261 |

1,000 |

1,070 |

1,003 |

1,031 |

1,497 |

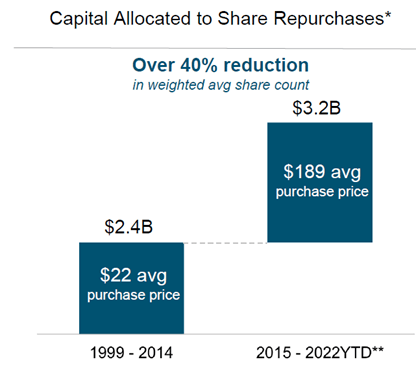

The debt-to-capital ratio is a tad high but not unusual for a growth company. Given the high interest coverage ratio, IDEXX can comfortably service the debt obligations. The total debt of around $1.5 billion also compares favorably against a market cap of ~$33 billion. Along with the high return on capital, this shows that the business has the ability to return cash to shareholders while also retaining enough profits to fund future growth. In fact, IDEXX has been assiduously buying back stock all along. Here’s the chart from the recent investor day presentation showing funds allocated to share repurchases:

IDEXX Investor Day 2022

Peer Comps

IDEXX’s main publicly traded competitor is Zoetis, another excellent company that I hope to analyze in future. In addition, I’ve also added Elanco Animal Health (ELAN) which competes primarily in the LPD category. At its core, IDEXX is mainly a diagnostics company while Zoetis and Elanco are therapeutics companies. However, with the purchase of Abaxis in 2018, Zoetis is also trying to establish a foothold in the diagnostics space. In addition, Zoetis has also purchased ZNLabs and Ethos Diagnostic Science to develop a reference lab offering. Nevertheless, IDEXX is the clear market leader in the diagnostics space and the dominance has only grown over the years as evidenced by revenue growth exceeding industry growth.

Below I compare IDEXX with its competitors on growth, profitability and valuation.

|

Growth – 3 year |

Profitability (TTM) |

Valuation (TTM) |

||||

|

Company |

Revenue |

EPS |

ROCE |

CCR |

PE – GAAP |

EV/EBITDA |

|

IDEXX |

13.0% |

18.6% |

59% |

65% |

51.3 |

35.77 |

|

Zoetis |

9.8% |

15.9% |

27% |

68% |

39.85 |

26.53 |

|

ELAN |

14.8% |

NM |

3% |

– |

NM |

13.52 |

IDEXX has shown superior revenue and EPS growth over the past three years relative to competition while maintaining a superior return on capital and high cash conversion ratio. This points to a lucrative business model, smart capital allocation and attractive growth opportunities. Understandably, Mr. Market has rewarded the company with a higher valuation compared to peers.

Valuation

Most of the articles I’ve read on Seeking Alpha suggest that IDXX stock is too expensive at the moment. However, quality companies usually trade at rich valuations, but many make up for it through long-term earnings growth. To give an extreme example, an investor could have bought Microsoft at the top of the tech bubble in 1999 and still made a nice return by holding for the long term. The key is the quality of the franchise and the longevity of growth.

So what is the fair value for the stock? Below, I examine the valuation of this stock across a range of scenarios using my proprietary DCF model.

Scenario 1: Low growth, margin contraction and market share loss (Revenue growth: 6%;Margin expansion: -50 basis points)

Scenario 2: Decent growth, margin constant and static market share (Revenue growth: 9%;Margin expansion: 0 basis points)

Scenario 3: Strong growth, margin expansion and market share gain (Revenue growth: 12%; Margin expansion: 100 basis points)

In my valuation, I’m also taking into account the value of cash, option grants, outstanding debt (including lease commitments) and capitalized R&D expenses. Below are details for a typical scenario:

|

Valuation |

|

|

Present Value of FCFF in high growth phase (15 years) |

$14,252,494.87 |

|

Present Value of Terminal Value of Firm |

$27,744,256.53 |

|

Value of operating assets of the firm |

$41,996,751.40 |

|

Value of Cash, Marketable Securities & Non-operating assets |

$144,454.00 |

|

Value of Firm |

$42,141,205.40 |

|

Market Value of outstanding debt (incl. operating leases) |

$995,229.55 |

|

Market Value of Equity |

$41,145,975.86 |

|

Value of Equity in Options (using Black Scholes method) |

$395,927.87 |

|

Value of Equity in Common Stock |

$40,750,047.99 |

|

Value of equity per share |

$481.90 |

The table below shows the fair price across the three different scenarios corresponding to different IRRs for a 15 year period (equal to the growth period assumption).

|

IRR – 15 yrs |

Scenario 1 |

Scenario 2 |

Scenario 3 |

|

6% |

$208.19 |

$337.16 |

$612.71 |

|

8% |

$166.30 |

$267.28 |

$481.90 |

|

10% |

$133.87 |

$213.48 |

$381.71 |

|

12% |

$108.57 |

$171.77 |

$304.49 |

|

14% |

$88.68 |

$139.21 |

$244.58 |

To explain, if an investor believes in Scenario 3 and would like to make at least a 10% return on their investment, they can purchase the stock at $381.71. Personally, I have reasonable confidence in this scenario but I would also like to have a margin of safety. The margin, of course, is inversely proportional to the quality of the enterprise. Given IDEXX’s attractive attributes and prospects, I would be happy with a 15% margin of safety here, which leads me to a price of ~$320.

Risks

I see three main risks with IDEXX: recession, inflation, and margin compression.

Recession

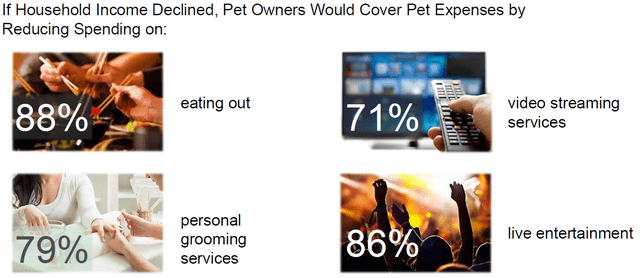

A recession-induced weakening of demand could be a big risk. Pet care spend, after all, is not the highest priority when discretionary income dries up. Management is keen on addressing this concern and shared that pet owners are willing to make financial sacrifices by reducing spend on other categories.

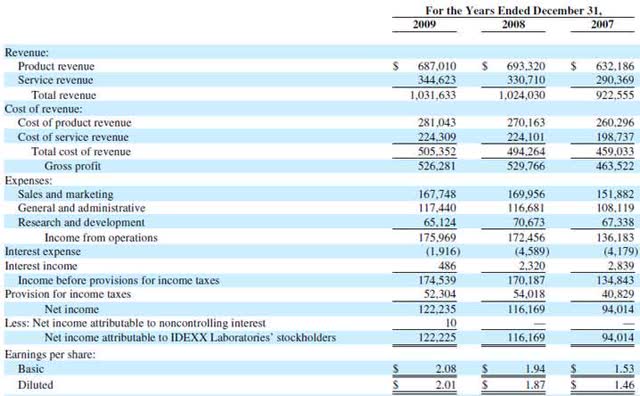

However, the proof is in the pudding. In order to validate management’s argument, I reviewed IDEXX’s 10-K form for 2009 and saw that both total revenue and EPS increased from 2007 to 2009.

Inflation

In the current environment, an ability to pass on inflationary impacts to the customers is essential for maintaining profitability. In general, moaty businesses with high gross margins are better positioned to raise prices while, paradoxically, they are also less impacted by inflation because the margin profile provides a buffer against higher costs. IDEXX does not disappoint here. In the latest earnings call, management shared that IDEXX executed a 4% hike in prices for the first half of 2022 and another 1.5%-2% in August.

Margin Compression

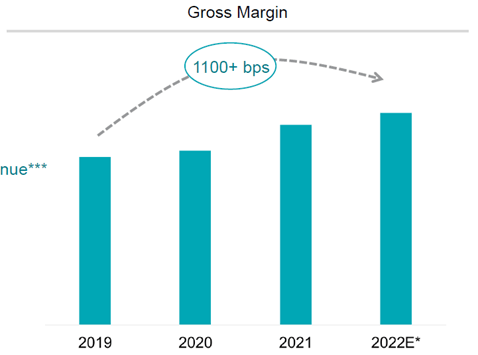

It is an iron law of capitalism that high-margin businesses attract fierce competition. And unless those margins are protected by durable competitive advantages, they are likely to be whittled away. Fortunately, IDEXX has a history of not only maintaining but expanding its gross margins, supported by prohibitive switching costs and an outstanding customer experience.

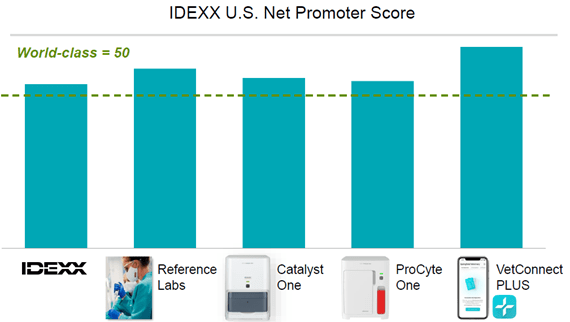

Investor day 2022

If a veterinary practice already has IDEXX equipment and runs on IDEXX’s practice management software, then it is very difficult to stop buying associated consumables or switch to a different software which may result in critical data loss. Not just resting on its laurels, IDEXX also delights the customers as evidenced by a high net promoter score (a measure of customer satisfaction) across its range of products and services.

Investor day 2022

Therefore, I do not see any possibility of margin deterioration in the near term. If anything, management has guided towards a further margin expansion.

Growth Catalysts

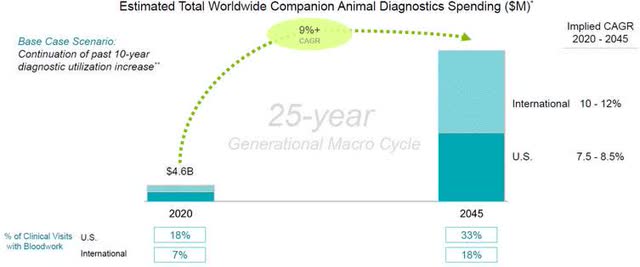

Pet care industry has numerous tailwinds and a long growth runway which will probably result in multiple winners over the long term. This is underpinned by the humanization of pets, increased pace of innovation in the space, and wider technology adoption. The slide below best illustrates the opportunity ahead.

Investor Presentation at Raymond James 43rd Annual Institutional Investors Conference

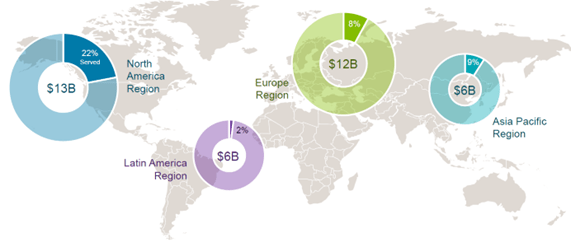

IDEXX calculates that its TAM is around ~$37 billion, of which it currently serves only 15%.

Investor Day 2022 Presentation

Consequently, IDEXX is still in the early innings of expansion in several geographies. It not only has the opportunity to win market share in the US, but also expand its international presence.

Conclusion

Given the earnings power, the strong industry tailwinds and outstanding management of IDEXX, I believe this stock should trade at a premium valuation. However, the current price of $396.43 (as of August 12th) does not offer a sufficient margin of safety. Personally, I would consider building a position around $320 (the stock traded at ~$328 in June this year) for a long-term hold.

Be the first to comment