Mohammed Haneefa Nizamudeen

Shares of synthetic lethality-focused precision oncology company IDEAYA Biosciences (NASDAQ:IDYA) have posted a 65% gain over the past 3 years and a 40% loss over the past 12 months.

Encouragingly, share price has rebounded by over 50% from recent lows after prior setback (partner GSK waiving its option for MAT2A program IDE397) was overshadowed by highly promising data update for lead drug candidate darovasertib in uveal melanoma. Management team took advantage of renewed optimism to augment the balance sheet with $80M secondary offering, providing them operational runway into 2026 (love to see this rare balance sheet strength in small cap names).

While it’d be easy to write this one off given we missed the recent bottom, I remind readers that each evaluation of a company’s investment prospects is all about the current snapshot and whether it offers us highly asymmetric risk/reward across a multi-year timeframe.

Figure 1: IDYA weekly chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price top out in the high $20s in 2021 before steadily taking a hit during the biotech bear market over the past year. In hindsight it’s evident that the point of maximum pessimism was below the $10 level (double bottom), and from here I would expect a rebound back to mid-twenties could be in short order. Thus, my initial take is that readers would do well to accumulate dips in the near term with eye toward 2023 catalysts (including darovasertib moving into the final phase 3 study).

Overview

Founded in 2015 with headquarters in California (81 employees), IDEAYA Biosciences currently sports enterprise value of ~$400M and Q2 cash position of $400M (includes financing proceeds) providing them operational runway of around 4 years.

Fireside Chat at Morgan Stanley Healthcare Conference provides an excellent synopsis, as CEO Yujiro Hata notes that the company was founded just over 6 years ago with core focus to build the leading synthetic lethality precision oncology company (starting emphasis on MTAP deletion with lead program IDE397, a potential best-in-class MAT2A inhibitor). MTAP is thought to represent 15% of all solid tumors.

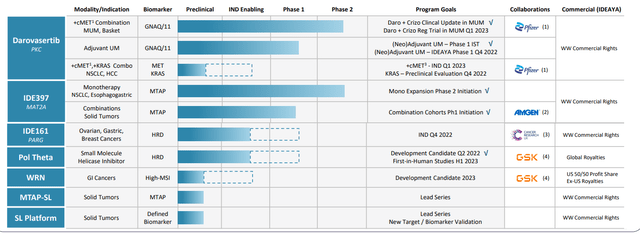

Figure 2: Pipeline

Beyond MTAP, the company has a broad portfolio including PARG (first-in-class asset with IND targeted for 4th quarter this year). Another potential first-in-class program is moving forward via partner GSK, Pol Theta (first-in-human study slated for first half 2023).

Behind that, another potential first-in-class program also partnered with GSK is WRN (Werner Helicase) with development candidate targeted for next year (biomarker is MSI-High). Platform is very broad with both target and biomarker discovery using a double CRISPR knockout approach. In terms of drug discovery, there is a significant focus on structural biology and computational chemistry (why all programs in clinical program represent first-in-class opportunities going after drug targets that historically have been very difficult to drug including helicases, polymerases and nucleases).

Additionally, CEO comments that in general they’d like to be on track to submit one new IND per year to year and a half (could be shorter during certain times, such as near to medium term with PARG and Pol Theta). As for big pharma partnerships, MAT2A is partnered with Amgen and darovasertib with Pfizer (along with aforementioned strategic collaboration with GSK on Pol Theta and WRN). Regarding rational combinations, consider that Pol Theta collaboration is with GSK’s approved PARP inhibitor niraparib and WRN with their approved PD-1 antibody dostarlimab. Amgen’s MAT2A clinical cooperative with PRMT5 inhibitor was put in place about a month ago as well. Last but most relevant to the near term is the Pfizer crizotinib (ALK, ROS1) combo with darovasertib (recent data quite promising and changes the investment narrative).

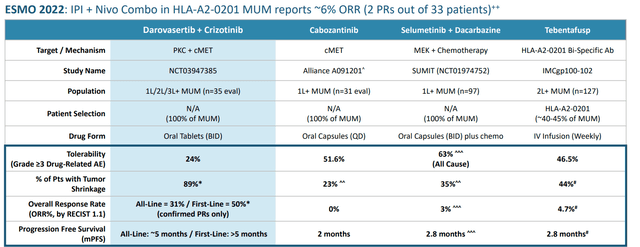

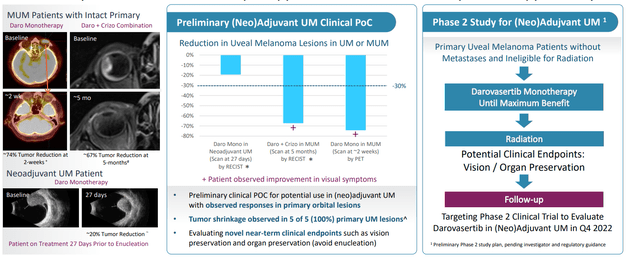

Regarding these combo results, CEO notes that it is the culmination of 3 to 5 years of clinical development work (discovered the synthetic lethal interaction of PKC and cMET). MUM (metastatic uveal melanoma) is an indication of high unmet need where competitors have achieved low single digit overall response rate and PFS (progression-free survival) of just 2 to 3 months.

Figure 3: Darovasertib + crizotinib combo data is a big step up from peer results and comparator benchmarks

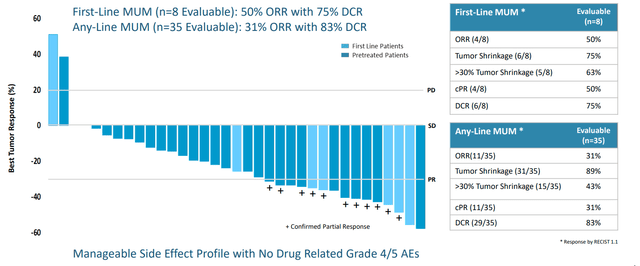

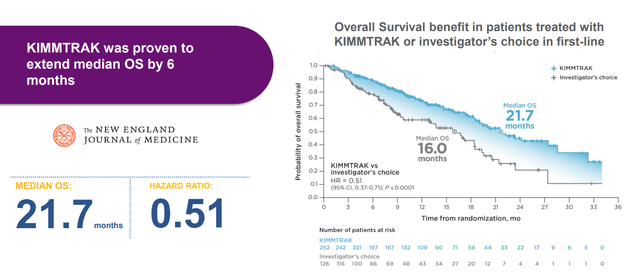

In 35 evaluable patients (8 were front line), they reported 31% ORR versus historical ORR of 0% to 5%. This includes Immunocore’s (IMCR) Kimmtrak, though to be fair this drug is unique in that ORR did not translate into the more meaningful survival benefit observed (12-month overall survival at 73%). PFS of 5 months in any line compared favorably to 2 to 2.8 months for benchmarks (median PFS not reached yet) and CEO states that ability to double median PFS in front-line is a viable goal (two surrogate endpoints for efficiently moving forward in phase 3 via ORR and PFS, both of which are potentially approvable). Company is guiding for initiating registrational study in Q1 of 2023.

Figure 4: Darovasertib + crizotinib combo data offers potential first-line differentiation with unprecedented improvements in ORR and PFS

The company also presented data in the neoadjuvant uveal melanoma setting (metastatic site for patients is predominantly in the liver). These results showed dramatic tumor shrinkage in 5 of 5 ocular lesions (over 70% reduction for monotherapy in just 2 months of treatment and over 60% by RECIST in another). The fact that monotherapy activity as well as combination provides added confidence in synergies here.

Figure 5: Neoadjuvant uveal melanoma data shows promise and provides expansion opportunity

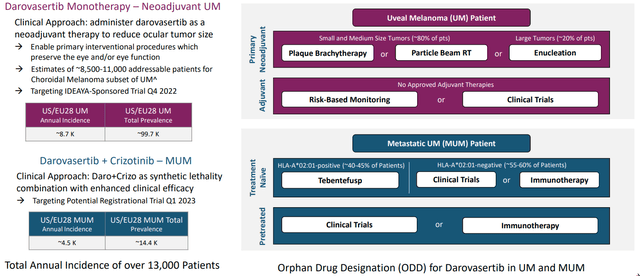

Company sponsored trial in the neoadjuvant setting will get started in Q4 this year. As for size of this opportunity, annual incidence in US and EU is 8,500 patients (total prevalence just under 100,000 patients). There are no systemic viable treatment options, as patients receive plaque brachytherapy (metal device clamped to the eye, rough treatment to go through). Second option is proton radiotherapy (lose their vision in many cases) and ~20% of patients have their eyes removed when tumor is too big. Perhaps a strike against management is that they don’t make much mention of Immunocore’s TCR therapeutic Kimmtrak which extended OS by 6 months.

Figure 6: Statistically significant improvement in OS, the gold standard endpoint, for Kimmtrak in 1L mUM

IDEAYA’s CEO is excited about the potential to give darovasertib as a monotherapy in that neoadjuvant setting (up to the point of maximal benefit). Novel endpoints could be used such as vision/eye preservation, which is being used by another company in this space with a local therapy (precedence). Having an oral therapy in neoadjuvant setting would be more convenient and monotherapy agent would have acceptable AE profile. Third, they’ve proven activity in metastatic setting which would positively influence patient and physician decision-making process (give it in earlier part of patient journey).

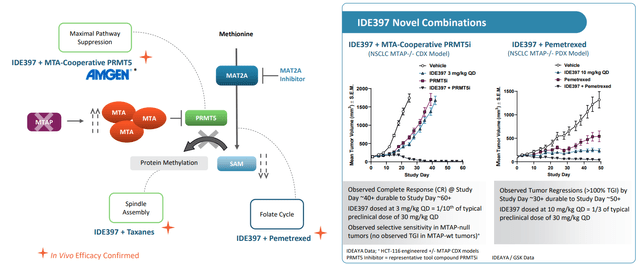

Moving on to MAT2A inhibitor IDE397, phase 1/2 study is ongoing (monotherapy expansion cohorts initiated) and supply agreement with Amgen (AMGN) lets them evaluate combination with MTA-Cooperative PRMT5 inhibitor AMG-193 in MTAP-null solid tumors. Preclinical data was quite compelling with complete responses shown in models out to 60 days at extremely low doses (allowed them to reduce IDE397 dose by 10x and reduce PRMT5 dose by 4x-5x and still see these CRs).

Figure 7: Preclinical rationale for IDE397 combinations included with pemetrexed and PRMT5i (Source: corporate presentation)

Select Recent Developments

On July 27th IDEAYA announced it entered into clinical trial collaboration and supply agreement with Amgen (AMGN) to evaluate the combination of IDE397 with AMG-193 (PRMT5 inhibitor) in a phase 1 study. IDEAYA is pursuing the drug candidate as both monotherapy and via combinations with taxanes and pemetrexed as well. The MTAP deletion patient population is estimated to represent around 15% of solid tumors (including 15% of NSCLC, 28% of esophageal, 26% of bladder, and 10% of esophagogastric cancers). Under the deal, IDEAYA will provide drug supply to Amgen, who will be the sponsor of the phase 1 combo trial (jointly share external costs and oversee clinical development).

Not all is right with this program though (to my eyes at least), as partner GSK waived its right to IDE397 (devil’s advocate is they did not see anything compelling enough to warrant opting in). Also, as they did not generate any actual responses in patients, the company is touting “molecular responses” based on changes in mean variant allele frequency (obtained via circulating tumor DNA or ctDNA). 4 of 13 evaluable patients (31%) achieved a ctDNA molecular response, and 3 of these 4 were observed at higher doses in Cohorts 5 and 6 (also in 2 of 2 NSCLC patients). The company considers this to be a preliminary sign of clinical activity, but again I remind readers for me that’s still a way of covering up a 0% actual response rate.

On August 29th, IDEAYA announced achievement of preclinical development milestone with ongoing IND-enabling studies for its Pol Theta Helicase development candidate. First-in-human study is slated for 1H 23, to evaluate the combination with GSK’s PARP inhibitor niraparib in patients harboring tumors with BRCA or other homologous recombination (HR) mutations or homologous recombination deficiency (HRD). Regarding economic terms, keep in mind IDEAYA stands to receive up to $485M in milestone payments as well as high single digit to sub-teen double digit royalties.

Lastly, on September 6th it was encouraging to see an Investigator Sponsored Trial (IST) initiated to evaluate darovasertib monotherapy in neo-adjuvant and adjuvant settings in primary, non-metastatic uveal melanoma patients. Again, the concept for this study originated from anecdotal observations in a MUM patient treated with darovasertib who also had an intact primary lesion in the eye (reduction in the lesion was observed at an initial scan with improvement in visual symptoms). Investigator Mark Shackleton noted that the trial could enable “a potential paradigm-shifting approach to reduce the size of ocular tumors prior to primary treatment”, which in turn could lead to better outcomes for these patients with such high unmet need.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $400M (includes $80M from recent secondary offering (took place at $10.50/share). Net loss rose by around 50% to $22.1M, while research and development expenses rose slightly to $22.8M. G&A expenses fell slightly to $5.6M. Management is guiding for operational runway into 2025, which looks appropriate to me. In general it appears they’ve been a good steward of resources, as the company had an accumulated deficit of $212.8M as of Q2.

Another competitor in the synthetic lethality space worth checking into for comparison is Repare Therapeutics (RPTX), for which I wrote an initial article last month. The company’s pol-theta program should move into the clinic at some point in 2023.

As for institutional investors of note, Biotechnology Value Fund owns a 5% stake in the company (as does Point72 Asset Management). RTW Investments owns a 6.5% stake and Avidity Partners owns a 6.6% stake. As for insiders, CEO Yujiro Hata owns over 600,000 shares.

As for relevant leadership experience, it’s interesting to note this is a founder-led company as CEO Hata launched IDEAYA as its first employee and led it to IPO in May 2019. Prior, he served as Chief Operating Officer at Flexus Biosciences until it was bought out by Bristol-Myers Squibb and as VP, Corporate Development & Strategy at Onyx Pharmaceuticals (through Kyprolis and Stivarga approvals) until it was bought out by Amgen for $10B. Chief Scientific Officer Michael White served prior as CSO for Tumor Biology at Pfizer. SVP, Head of Biology and Translational Sciences Mark Lackner served prior at Genentech for 14 years including in the area of Oncology Biomarker Development. I see additional ex-Genentech executives in leadership including Mick O’Quigley (SVP, Development Operations).

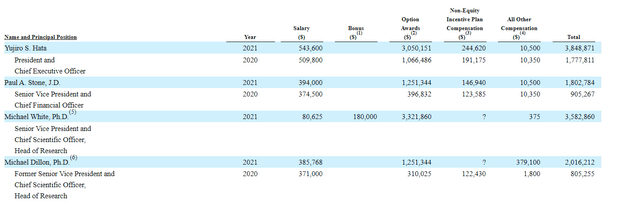

Moving on to executive compensation, cash portion of salaries is in a reasonable range (sub $500k). Likewise, options awards and non-equity compensation does not appear excessive to my eyes.

Figure 8: Executive compensation table

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Moving onto useful nuggets from members of the ROTY community, back in March, Steven Goldman highlighted useful nuggets from his Zoom call with the CEO. He also noted that it could make sense for partner GSK to simply buy the company out rather than opt-in (collaboration assets pair nicely with its PD-1 and PARP inhibitors).

Regarding IP, the company owns 45 distinct patent families including 10 issued US patents, 33 pending US applications, 12 pending applications under Patent Cooperation Treaty, 32 issued foreign patents and 88 pending foreign applications. Expected expiration dates range from 2038 to 2042. For IDE196 (darovasertib), the company in-licensed IP from Novartis including 4 issued US patents, 23 issued foreign patents, 2 pending US applications and 24 pending foreign applications (expiration between 2035 to 2038). As for synthetic lethality pipeline, the company has U.S. patent applications directed to composition of matter, pharmaceutical compositions and/or methods of treatment of cancer for each (MAT2A/MTAP, PARG/HRD, POLQ/HR, WRN/high MSI, etc.).

Final Thoughts

To conclude, it’s evident that recent data update for lead program darovasertib significantly derisked its development in the mUM indication (not to mention increased its ultimate market opportunity via potential expansion into adjuvant and neoadjuvant setting). Long time readers know about my “monotherapy activity rule” and how it leads me to be more comfortable with investments, particularly in the lucrative oncology space.

Blackseed Bio notes that ~1,000 mUM patients in US+EU who are ineligible for treatment with Immunocore’s Kimmtrak amounts to a $300M to $400M market in first-line disease alone (contrast that to current $400M EV). As there are no approved adjuvant therapies in uveal melanoma (8,500-11,000 addressable patients for Choroidal Melanoma subset), this opportunity greatly adds to ultimate commercial prospects as well should data continue to pan out. Also, as noted prior that despite overall survival benefit Kimmtrak has a low single digit response rate.

Figure 9: Potential for uveal melanoma and MUM treatment paradigm to change with darovasertib monotherapy & crizotinib combination

On the other hand, as the rest of the synthetic pipeline is still in preclinical stages, I view it as a highly interesting “call option” as these assets should pair nicely with GSK’s PD-1 and PARP inhibitors should data pan out in the clinic (would think partner decides to simply buy them out if all goes well).Lastly, as the area of synthetic lethality continues to see growing interest year over year from both big pharma and biotech players, I see IDEAYA (along with my prior recommendation of Repare Therapeutics) as promising up and coming players offering investors a less speculative way to gain exposure to this space (sport derisking data sets and big pharma partnerships).

For readers who are interested in the story and have done their due diligence, IDYA is a Buy and I suggest accumulating dips in the near term.

From an ROTY perspective (focus on next 12 months), I’m likely to revisit this one in the first half of 2023 with an eye on thesis progression, especially for lead GSK-partnered assets as they get started in the clinic. I’d also find it more attractive if we can get a pullback to 50 day moving average around $12.

As for risks, GSK opting out of collaboration programs such as Pol-Theta would likely have an outsized negative effect on share price. Likewise, any delays in the clinic for darovasertib moving into pivotal studies would not be well-received. Investors and those interested in this name should also keep a close eye on competitor Repare Therapeutics with its Pol-Theta program as well, especially into 2024 as initial phase 1 data sets come out to determine who has the early edge. Synthetic lethality field on the whole is in very early innings and still has a lot to prove via human data as well.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment