KLH49

Do you follow me on Twitter?

If so, you probably saw this teaser the other day: “What does Ida Fuller have to do with @RealtyIncome – ticker $O? Stay tuned…”

It’s an interesting story I’ve shared before on at least one of my platforms. But it seems like a great time to share it again: the story of Social Security’s first recipient.

Before you scoff too much, don’t worry. I’m not telling this true tale to say Social Security alone can get you through today.

It can’t.

I’m telling you it because there’s a somewhat comparable asset you can add – one that can’t be accused of being a Ponzi scheme. And one I’m personally invested in that I can’t help but recommend again today.

If you want to know why Realty Income (NYSE:O) is in my radar yet again, I’ve got the details down below.

But first, let me tell you about Ida May and how she made history in January 1940.

Source: @rbradthomas (Twitter)

America’s First Social Security Beneficiary

Going to government websites is typically some shade of frustrating, anxiety-inducing, or boring as a general rule. But sometimes, amidst all the red tape, legalese, and overwhelming amounts of data, there’s a treasure or two.

I consider one particular page on the official Social Security page to fit that bill. It’s filed under Social Security History with the title “The First Social Security Beneficiary.”

And it goes like this:

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874, on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont, where one of her classmates was Calvin Coolidge.

That would be America’s 30th president, serving from 1923 to 1929.

Today, we know that era as The Roaring 20s, which ended in 1929 as the economy collapsed. Yet WhiteHouse.gov describes Coolidge as being committed:

… to [preserving] the old moral and economic precepts of frugality amid the material prosperity which many Americans were enjoying during the 1920s era.

Clearly, that goal didn’t pan out in the end – whether it was Coolidge’s fault or not. But like him or dislike him, he was president, nonetheless. And “Aunt Ida” would have interacted with him on some level at some time.

I wonder what she thought of him?

We don’t know that (as far as I’m concerned). But we do know that:

Ida May never married and had no children. She lived alone most of her life but spent eight years near the end of [it] living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Sounds like a pretty basic person, right? Some might even call her boring.

But, as I keep telling you all, boring can be beautiful.

A Better Story Still

Ida’s story, as told by Social Security, continues with:

“Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand, she dropped by the Rutland Social Security office to ask about possible benefits.

She would later observe: “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it.

“Her claim was taken by Claims Clerk Elizabeth Corcoran Burke and transmitted to the Claims Division in Washington, D.C., for adjudication. The case was… sent to the Treasury Department for payment in January 1940.

The claims were grouped in batches of 1,000 and a Certification List for each batch was sent to Treasury. Miss Fuller’s claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.”

Now, as I eluded earlier, times have changed. For starters, $22.54 is worth little today. And everyone knows Social Security isn’t sustainable as-is.

It’s barely lasting now for some people amidst rising inflation. But that’s why we have boring but beautiful dividend-paying stocks.

As Aunt Ida found out with Social Security, they send you your promised payments on schedule. They’re routine. Reliable.

Also similarly, they run off of a simple platform: You pay into them. They pay back to you.

Better yet, they’re based on actual, sustainable business practices run by people who understand the true value of money. (Unlike other entities we could mention.)

And in that small, sustainable crowd, Realty Income stands out especially.

The Basics

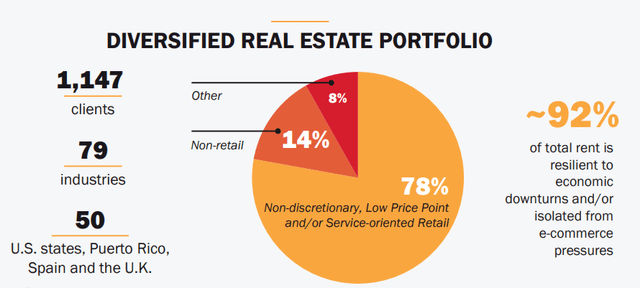

Realty Income is a net lease REIT that owns 11,733 free-standing properties located in 50 U.S. states, Puerto Rico, Spain, and the U.K.

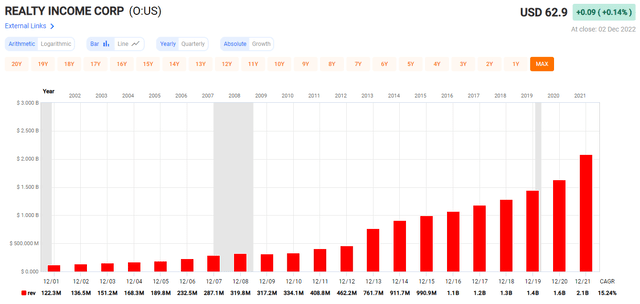

The company was founded in 1969 by William and Joan Clark and it went public in 1994 on the NYSE. Revenue growth has mushroomed since that time from $49 million to around $2 billion (end of 2021).

I’ve been a shareholder in Realty Income for over a decade and the San Diego-based REIT is now my largest holding.

In 1994 Realty Income owned 630 properties in 5 different industries and today the portfolio is 19x larger (11,733 properties) in 79 industries.

Realty Income Investor Presentation

One of Realty Income’s primary competitive advantages is scale, and because of the sheer size ($53 Billion Enterprise Value) it can selectively pursue large-scale sale-leaseback or portfolio transaction opportunities without creating financing contingencies or concentration risks.

Public net lease REITs account for ~4% of total US net lease addressable market and < 1% of the total European net lease addressable market. Given the immense scale of Realty Income, the company can take advantage of attractive consolidation opportunities in the extremely fragmented net lease space.

Realty Income can easily pursue even larger sale-leaseback transactions without compromising prudent client and industry diversification metrics. This capacity to buy in bulk is an important differentiator because it allows the company to maintain diversification.

Last week the company announced that it had closed on the acquisition of the land and real estate assets of Encore Boston Harbor and Casino from Wynn Resorts (WYNN), marking its first acquisition in the gaming industry. As previously announced, Realty agreed to purchase the casino for $1.7B in a sale-leaseback deal.

Realty Income Investor Presentation

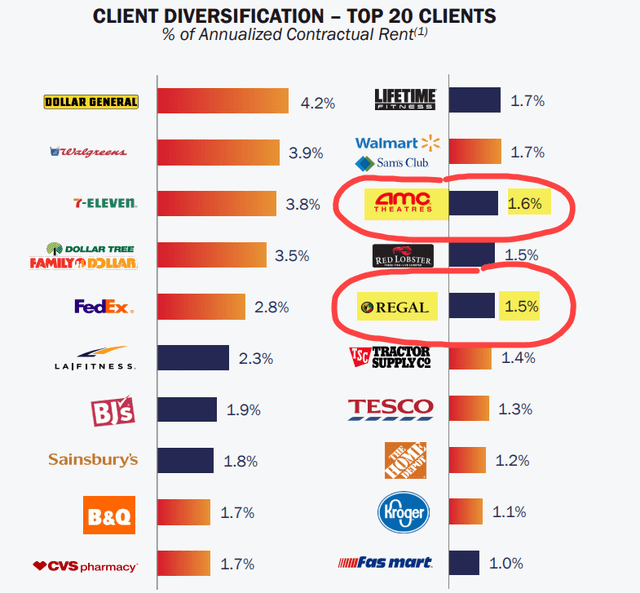

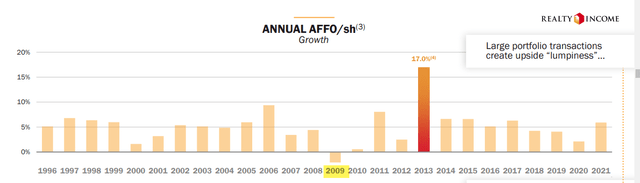

As you can see above, AMC and Regal account for 3.1% of Realty Income’s annualized rent, and importantly, even during Covid-19 the company was able to generate positive earnings (or AFFO per share). In fact, as shown below, the company has generated positive earnings growth in 25 of 26 years.

Realty Income Investor Presentation

The Balance Sheet

Now let’s touch on another important competitive advantage for Realty Income: The Fortress Balance Sheet.

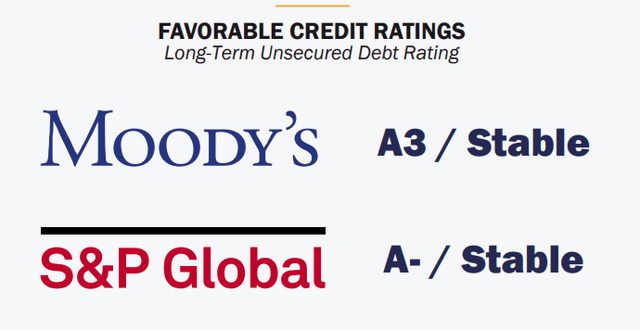

For starters, the company is one of only seven S&P 500 REITs with two A3/A- ratings or better.

Realty Income Investor Presentation

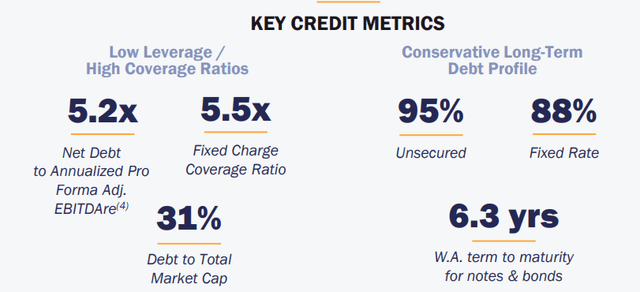

As of Q3-22 Realty Income’s net debt to annualized adjusted EBITDAR was 5.2x and Fixed Charge Coverage was 5.5x. In Q3-22 the company upsized its US commercial paper program from $1 billion to $1.5 billion and established a euro commercial paper program with a capacity of $1.5 billion.

The combined $3 billion commercial paper program, which is backstopped by its multicurrency $4.25 billion revolving credit facility, gives the company flexibility to efficiently match fund short-term funding needs.

Realty has limited near-term refinancing risk of only $23 million of mortgage debt coming due through the end of 2023 and the next unsecured debt maturity is not until 2024. As shown below, Realty’s debt to total market debt cap is just 31%.

Realty Income Investor Presentation

Show Me The Money

The fundamental source of asset values derives from the expected cash flows that can be obtained from owning the asset. For stocks, these cash flows from dividends or other cash distributions resulting from earnings or the sale of the firm’s assets… earnings are the source of cash flow to shareholders. – Stocks for the Long Run

In Q3-22 realty Income generated $0.98 per share of AFFO, representing 7.7% year-over-year growth. The company also tightened the AFFO guidance range by $0.06 to $3.87 to $3.94, maintaining the midpoint at a 9% year-over-year growth rate.

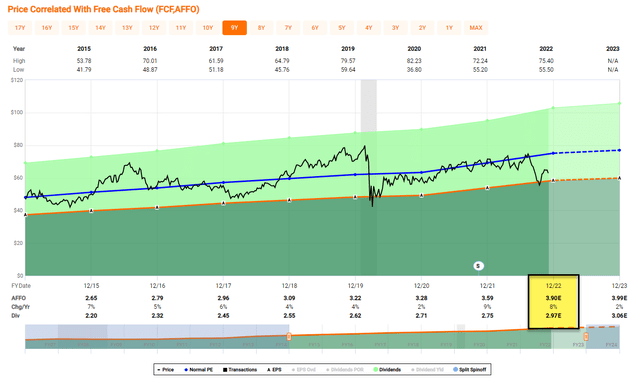

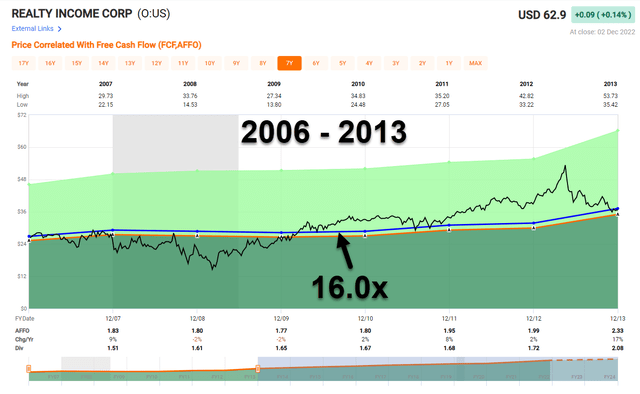

In terms of valuation, let’s first look at the average P/AFFO multiple from 2006-2013:

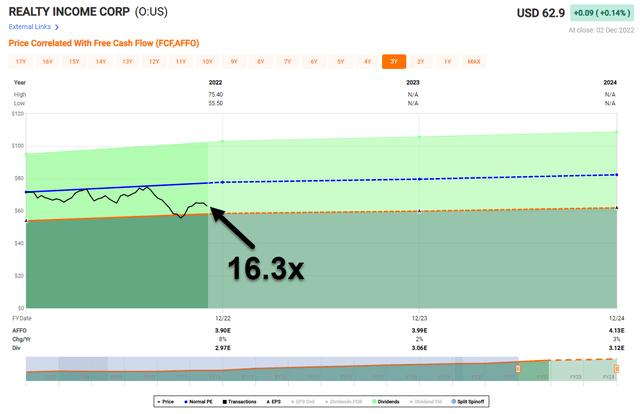

As you can see, Realty’s average P/AFFO multiple was 16.0x compared with the current multiple of 16.3x. What this means is that the company is trading at roughly the same multiple that it traded when the portfolio was much smaller, and the company did not enjoy an A-rated balance sheet.

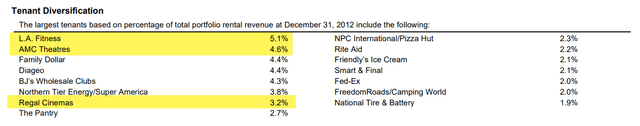

In other words, Realty was a much riskier REIT in 2012 when it had enhanced exposure to theaters, around 13%:

However, by using its scale and cost of capital advantages, the company has been able to de-risk the portfolio and deem the “pandemic proof” stamp of approval.

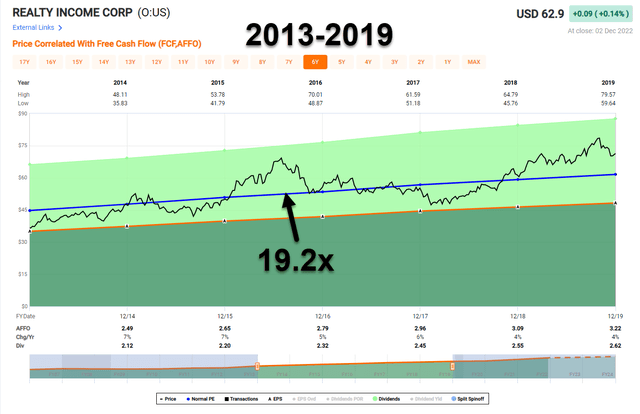

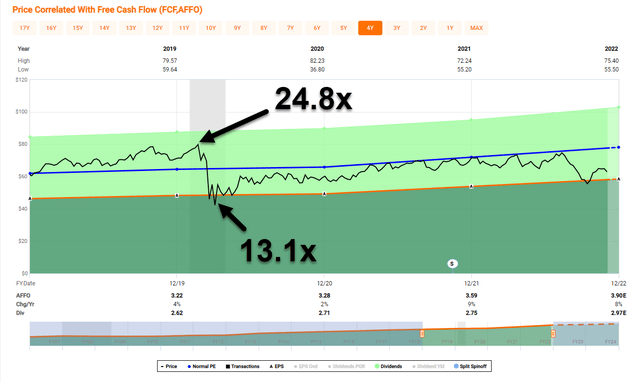

Now as you can see below Realty Income’s multiple improved from 16x (2006-2013) to just over 19x from 2013-2019:

That multiple expansion was largely due to Realty Income’s dominating cost of capital advantage, which allowed the company to generate impressive earnings and dividends.

As you can see below, Realty traded at 24.8x before Covid-19 and fell to 13.1x in March 2020.

So, riddle me this, what is Realty Income’s $2 billion of rent checks worth?

I would argue more than 16.3x…

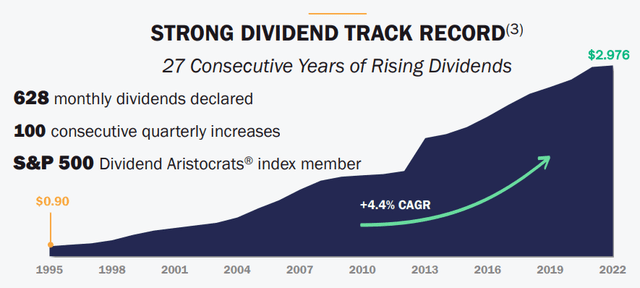

The dividend yield is now 4.7% and the payout ratio is in the best shape ever: 76%. The dividend streak has also grown to 27 consecutive years of increases in a row:

Realty Income Investor Presentation

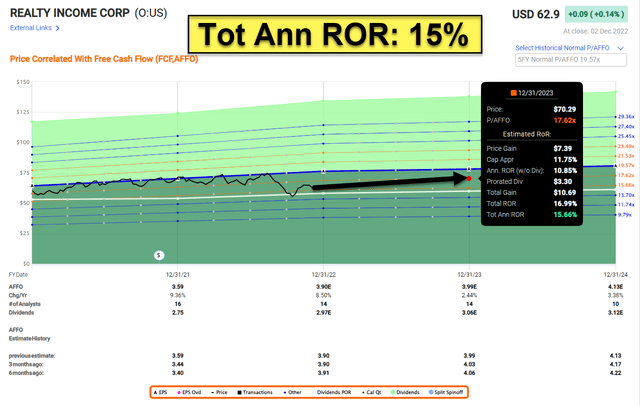

Given elevated borrowing costs (rising rates), we don’t expect Realty Income to generate the same growth it experienced over the last 10 years. We consider 17-18x a reasonable multiple for O, given the quality of the economic moat.

Translation: Our 12-month total return estimate is 15%.

That being said, we cannot rule out M&A which could move the needle for Realty Income. We’re watching Spirit Realty (SRC) very closely as we consider this Texas-based REIT a prime-time target for “the monthly dividend company”.

Also, given the fact that Realty has entered the casino sector, we wouldn’t be surprised to see more gaming in the portfolio.

In Closing…

Years ago, when I was meeting with Realty Income’s former CEO, Tom Lewis, he would refer to Aunt Ida as the textbook example of Realty Income’s core customer.

Over the decades, as Realty Income has evolved into a powerhouse REIT, it has never forgotten its customers…

We believe that sustainability is much more important than the magnitude of economic profits when assessing economic moats. In other words, a highly certain 20-year stream if modest economic profits is much more moat worthy than a few years of extraordinary high returns on invested capital. – Why Moats Matter

I’m confident that Aunt Ida would agree!

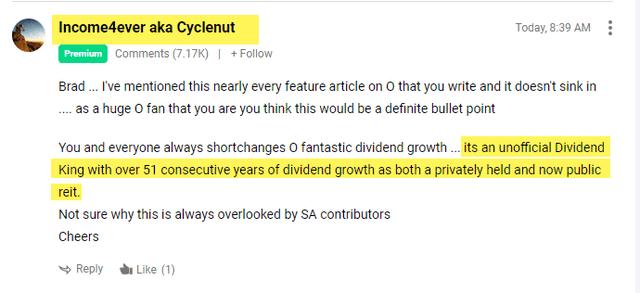

I also want to point out that Seeking Alpha premium member, Income4ever aka Cyclenut reminded me recently that Realty Income is “an unofficial Dividend King with over 51 years of dividend growth as both a privately held and now public REIT”.

Happy Holidays…

O, O, O, Merry Christmas

Be the first to comment