designer491

Published on the Value Lab 9/8/22

ETFs offer a range of exposures, and one which we think is not suitable for the current environment are convertibles. While YTD declines reflect some of the lost value in their call options, we worry about the value of a small, fixed income downside protection in an environment where recession will be associated with higher rates, rather than the other way around, which is how the market typically speculates. As such, the iShares Convertible Bond ETF (BATS:ICVT) and others like it should be avoided.

Economic View

The economic view is rather simple in our view. Unemployment declined shockingly despite the rate hikes. Inflation can only get worse under those circumstances. On top of that consumer spending has declined while corporate spending hasn’t. We may get forceful rate hikes to reduce employment right as the pass-through of already evident reduced consumer spending takes effect. Overall, we think markets are in a tough spot, and we’re not out of the recession woods yet, we probably haven’t even stepped in.

ICVT Breakdown

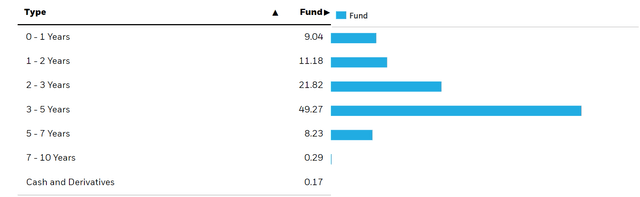

What does that mean for ICVT? 40% of the convertibles are from high-tech companies and the maturity profile is as follows.

ICVT Maturities (Blackrock.com)

The duration of the convertibles assuming no option is exercised isn’t very long, but it is skewed towards bonds with a technical 3-year maturity at least, which is a relevant duration that levers the value of the bond to rising rates quite severely. On the equity side of the convertible, the embedded option is a call on tech. There are a lot of enterprise tech companies that saw good earnings just now, and the tune could soon change. Moreover, weak markets overall put enterprise tech in the front-lines of a sell-off. We believe the value of these call options could become more eroded, and with shortening exercise periods, that hit to value just becomes more severe, offset only by the potential volatility. Of course, if it’s perceived as consistently to the downside that doesn’t help much.

On the equity side the call option is levered to tech, which is quite an uncertain bet given the current market set up, and on the debt side the long-ish duration with rising rates does it no favours either.

Conclusions

The problem is lacking downside protection. That is much of the point of convertibles, and the reason why when negotiated in a low-interest rate environment, the coupons are weak. These small coupons worsen duration, which average at around 1.7 years. The coupon rate is only 1% on average. If the markets fall as rates rise, that downside protection is reduced: a false friend. On the other hand, an option bet on tech upside is risky with the rationale for a negative direction being strong in our view. We think convertibles negotiated in the pre-rate hike regime are structurally unfavoured. Never a nice bet unless you have a very exact thesis. For an ETF, which definitionally is inexact, it’s not suitable right now.

Be the first to comment