Maria Marganingsih/iStock via Getty Images

Investment Summary

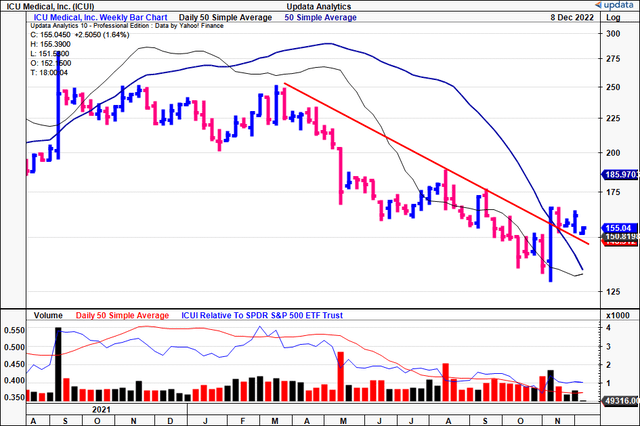

As we look to diversify allocations across the broad healthcare spectrum, we have no choice but to rigorously analyze the beaten down pocket of the market. We recently turned to ICU Medical (NASDAQ:ICUI) with indicators recently showing a sharp reversal with momentum off its 18-month low. As you’ll see in the chart below, the stock has just broken out from a 10-month downtrend, crossing above both 50DMA and 205DMA’s in for the last 4 weeks. We had been constructive on ICUI early in 2022 in the first snapback rally of the broad market. Naturally, sentiment shifted as we positioned towards factors of quality and resiliency.

With ICUI’s latest moves it warranted us to revisit the position and we’re here today to discuss the notable takeaways of our latest findings. One factor key to the investment debate here is its acquisition of Smiths Medical. A fantastic deep dive of the acquisition and its potential challenges can be found by reading Seeking Alpha author Stephen Simpson’s analysis on the transaction. We note it was a standout for the company at the top-line this quarter, however, there’s not enough to suggest a large turnaround here in our estimation. Rate hold.

ICUI breakout above long-term downtrend

Weak bottom-line growth for ICUI this quarter

Unpacking the 10-Q we saw that revenue reached $598mm, a significant increase of 78% compared to the previous year’s $336mm. This growth can be attributed to the acquisition of Smiths Medical. Smiths Medical contributed $262mm in revenue for the quarter, a $39mm increase over the previous quarter. It should be noted that Smiths Medical’s financial reporting calendar included 5 additional business days in the quarter, which accounted for approximately half of the increase in revenue. The remaining growth can be attributed to improved customer order fulfilment and a reduction in back order levels.

Additionally, adjusted EBITDA for the third quarter increased by 29% YoY to $93mm, compared to $72mm the previous year. Turning to cash flow and the balance sheet, the third quarter saw a net outflow of $18mm in free cash flow.

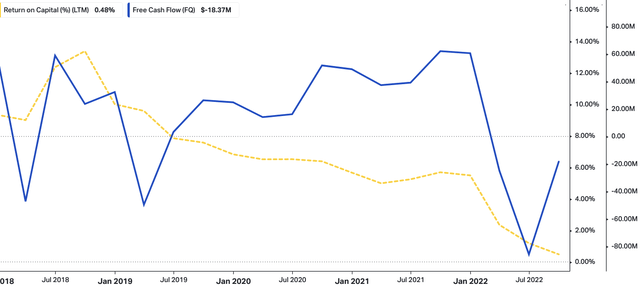

Exhibit 1. Bottom-line growth contracting YoY. This is a key risk with $1.7Bn in debt, producing quarterly cash outflows of $18mm

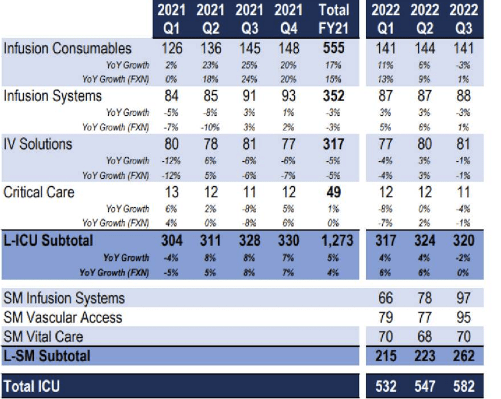

Image: ICUI Q3 FY22 Investor presentation.

This represents a significant improvement compared to the previous quarter’s net outflow of $86mm, but we’d point out it is primarily a function of lower working capital. That combination would be more than acceptable in our opinion is the outflows matched up with a sufficient return on capital employed that outpaced the WACC hurdle, thereby generating economic profit.

However, as you’ll see below [Exhibit 2], trailing return on capital employed has been drifting lower along with the free cash outflows. We see this quite often with investments into questionable growth initiatives, mature growth industries, capital intense business models, thin, profitless operating margins and low net operating profit after tax (“NOPAT”). On closer inspection, we definitely see a number of these risks in this investment debate, evidenced by the weak return on capital. Moreover, it exited the $1.7Bn of debt on $249mm of cash and investments. And finally, Brian Bonnell’s remarks regarding working capital/capital budgeting this period on the earnings call:

[O]n inventory, that’s been the largest area of investment for us this year. It’s $150mm to date. We do see that peaking by Q1 of next year and then probably stable after that. I don’t know if it goes down, but certainly stable. And that alone should allow us to see some positive free cash flow next year. And then I think while it will take a while since we are going to continue investing in the integration as well as the quality systems, yes, eventually, at some point, we do get to where free cash flow is in line with our GAAP net income.”

This confirms our neutral thesis.

Exhibit 2, trailing return on capital drifting lower along with repeated free cash outflows. Capital budgeting would need to be generating return at a greater intensity to generate future economic value in our opinion

Data: HBI, Refinitiv Eikon, Koyfin

Notable divisional highlights:

As for the legacy ICU business, revenue for the quarter remained flat on a constant currency basis at $320mm, but decreased by 200bps on a reported basis. The Infusion Consumables and Infusion Systems lines both saw a 100bps increase in constant currency and a 300bps YoY decrease on a reported basis, while IV Solutions saw a 1% decrease on both measures.

With respect to The Smiths Medical businesses, management did note it has exceeded its expectations in terms of aggregate revenues. Smiths Medical brought in a staggering $262mm, as mentioned, with Infusion Systems, Vascular Access, and Vital Care contributing $97mm, $95mm, and $70mm respectively.

This split can be attributed to a combination of additional billing days and streamlined IT systems and labor processes, which allowed for the swift resolution of back orders. However, it should be noted that these achievements came at a higher cost base. While the domestic business has seen significant improvement, the international operations remain a work in progress. Despite this, Q3 OpEx declined compared to the second quarter by approximately $6mm, due to the realization of synergies, lower personnel costs, and timing factors. That’s important considering the thin growth vertically down the P&L.

It’s worth noting that restructuring, integration, and strategic transaction expenses were $14mm and of course related to the integration of the Smiths Medical acquisition. This was the same level of spending as in the second quarter, and management expect to maintain a similar level of expenditure in the fourth quarter.

We’d also advise that bottom-line growth was weak for the company and this is a key risk factor to share price appreciation moving forward in our estimation. Adjusted diluted earnings per share for the third quarter was $1.75, compared to $2.07 the previous year.

With these factors in mind for ICUI, we find it hard to harvest the kind of equity premia investors are paying for this year, factors such as EPS upside, high return on capital and market divergence. In our opinion, there may be more selective opportunities available at this point in time.

Valuation and conclusion

We’d note that consensus prices the stock at 23.5x forward non-GAAP EPS, ahead of the sector median. Given the lack of EPS upside to date, the peer median of 19.5x forward P/E is more appropriate. At 19.5x consensus FY23′ EPS estimates, this derives a price target of $78. Hence, without a directional view on the market, we rate ICUI a firm hold for now.

Be the first to comment