Mrinal Pal/iStock Editorial via Getty Images

ICICI Bank (NYSE:IBN), India’s second-largest bank, again delivered an impressive set of quarterly results, led by a +22% YoY core pre-provision operating profit (PPOP) growth on continued momentum across loan growth and net fee income. The ~Rs4bn net slippage was another key highlight, reflecting favorable normalized credit cost trends. With its asset quality intact and the visibility of earnings growth set to improve going forward, I see a clear path to the bank sustaining strong ROEs in the coming years. As ICICI leverages its extensive distribution franchise and best-in-class digital infrastructure to further extend its growth runway amid an improving post-COVID backdrop as well, the valuation gap relative to key peer Kotak Mahindra should narrow.

| 2023e P/E | 2024e P/E | |

| ICICI Bank | 19.7x | 16.9x |

| Kotak Bank | 27.0x | 23.2x |

Source: Market Data as of 3rd August 2022

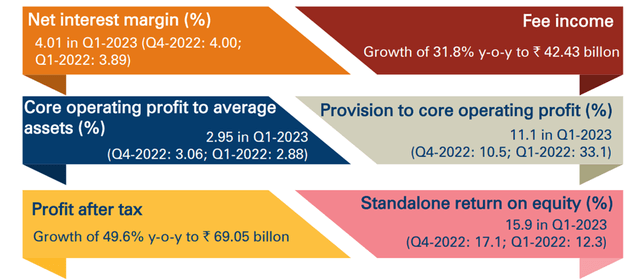

Core Operating Metrics Outpace Expectations

ICICI reported a strong quarter yet again, led by net interest income growth of ~21% YoY and even stronger net fee income growth of ~32% YoY. Although this was partially offset by higher operating expenses, margins still expanded at a healthy ~9bps pace on a sequential basis. For context, the elevated opex was driven by a ~20% YoY increase in employee expense – given this was largely due to the company passing through the fair value impact of its stock options, though, I view this as a one-off impact. Meanwhile, the cost-income ratio (ex-treasury) was a solid ~42% – up by ~140bps sequentially, but well below pre-COVID levels of ~45%. As a result, PPOP was up ~19% YoY, outpacing HDFC Bank’s ~15% YoY growth during the corresponding period. Assuming the cost-income ratio sustains at 41-42%, expect operating leverage to remain high, benefiting the mid-term PPOP growth runway.

Based on the strong Q1 2023 result, the near-term industry outlook looks bright – this quarter’s solid margin expansion reflects the improvement seen at Kotak Bank, despite the yield benefit of rate hikes yet to fully flow through to the P&L. Given ICICI has one of the best deposit franchises in India as well as a higher floating rate composition within its portfolio, the bank is well-positioned to drive margins even higher. Having also delivered a ~20% PPOP CAGR in recent years, I see no reason why ICICI won’t be able to deliver a high-teens % core PPOP through 2025 in a base case scenario. The key here will be the extent of the coming repo rate hikes and management’s ability to manage any competitive pressures in mortgages and other consumer retail products.

Impressive Growth Momentum Continues in Lending Business

ICICI’s domestic loan growth is clearly on the right track – mortgages were up 22% YoY, while share gains in SMEs/business banking led to ~35% YoY gains. Accelerating growth in unsecured credit at 40-60% YoY contributed to the remainder of the YoY growth, driving a robust ~32% YoY core fee growth. More importantly, ICICI has achieved this growth without compromising on its loan book composition – the bank has gained share in cards and mortgages, but its market share remains relatively low in the SMEs, rural and corporate sectors at 4%-5%. Overall, advances were up ~21% YoY this quarter (another consecutive quarter of strong loan growth), although the sequential loan growth of 4.3% QoQ was particularly impressive given it was the highest for a Q1 since the 2013 fiscal year. The outlook for loans looks bright as well – the economy is opening up post-COVID, which means ICICI should benefit from an improvement in revolvers, along with potential untapped growth opportunities from Production Linked Incentive (PLI) schemes.

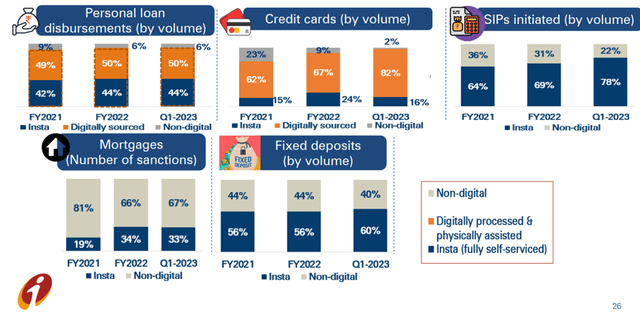

Another key highlight from ICICI’s result was the increasing traction in digital channels, helping to amplify the pace of disbursements – per management, digital contributed ~94% of personal loan disbursements, ~98% of credit cards sourcing, and ~33% of mortgage loans. The digital factor could be key at a time when HDFC Bank is getting increasingly aggressive post lifting of the RBI ban on new issuance of cards. Thus far, ICICI has likely lost some market share YTD, particularly in credit card spending, but with its strong digital capabilities, ICICI retains the potential to regain market share and outperform on loan growth over the mid-term.

Asset Quality Improvement Supports Double-Digit ROE Outlook

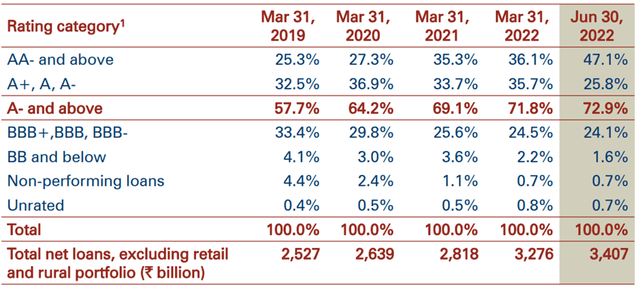

Gross non-performing loans (GNPLs) are trending favorably as well, reaching 3.6% of loans (down ~20bps sequentially) on strong ~16% recovery rates (of opening GNPLs) – for comparison, ICICI has generally seen GNPLs trend between 10% and 13% in recent quarters. The non-NPL stressed portfolio also improved by ~50 bps to 2.2% of loans, helped by a reduction in the restructured portfolio as well as improvements in the sub-BB book. No surprise then that net slippage also outpaced expectations at ~Rs4bn despite elevated agriculture stress, driving the overall core credit cost to near-zero levels.

Meanwhile, ~Rs11bn has been added to the contingency fund (now ~1% of loans), bringing the overall provision coverage ratio on stressed/restructured loans higher to 74.3% (up by ~640bps). This means ICICI’s provision coverage is catching up with HDFC Bank (HDB), despite its higher secured mix – for context, HDB also saw its coverage ratio rise ~670bps to 84% during the corresponding period. In turn, this affords ICICI more flexibility heading into potential macro turbulence, supporting its mid-term ROE sustainability and high-teens % core PPOP growth runway.

Long-Term Compounding Potential Intact

With another strong quarter in the bag, featuring outperformance on NIMs and core PPOP growth on the back of an improving net interest/fee income outlook, ICICI looks set to extend its lead within the Indian banking industry. The bank has also seen strength in its asset quality (consistent with the sector), emphasizing that any COVID overhang is likely behind us. Thus, the path to near-term upside will likely rest on NIMs and Current Account/Saving Account (CASA) trends, placing ICICI in pole position given its best-in-class deposit franchise in a rising rate backdrop. Valuation-wise, the stock offers compelling value at the current discount to peer Kotak, particularly given ICICI’s material growth and profitability improvement relative to historical levels.

Be the first to comment