David Ramos

Introduction

As a dividend growth investor, I always search for new ways to invest in income-generating assets. I frequently add to my current holdings when I believe they are attractively priced. I also use market volatility to my advantage by starting new positions to diversify my portfolio and increase my dividend income without needing as much capital. I believe this approach can help me maximize my returns over the long term.

The IT sector, which I lack exposure to, is a dynamic industry that plays a crucial role in the modern economy. Companies in the IT sector are responsible for developing and providing a range of technology products and services, including software and hardware. IBM (NYSE:IBM) used to be a leading company in the sector, with a long history of innovation and a strong track record of success. Two years ago, I believed shares were not worth your time, yet the company has made decent progress. I am not afraid to admit my mistakes, and I will revisit the company in this article.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

International Business Machines Corporation provides integrated solutions and services worldwide. The company operates through four business segments: Software, Consulting, Infrastructure, and Financing. International Business Machines Corporation was incorporated in 1911 and is headquartered in Armonk, New York.

Fundamentals

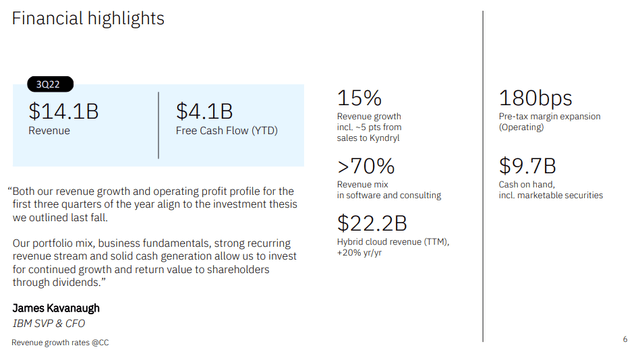

The revenues of IBM have seen a downward trend over the last decade. In 10 years, the sales of IBM declined by more than 40%. The decline can be associated with the company’s weakening legacy business, the Kyndryl (KD) spinoff, and other divestments of non-core business. In 2021 and 2022, we begin to see steady growth in sales. In the future, as seen on Seeking Alpha, the analyst consensus expects IBM to keep growing sales at an annual rate of ~4% in the medium term.

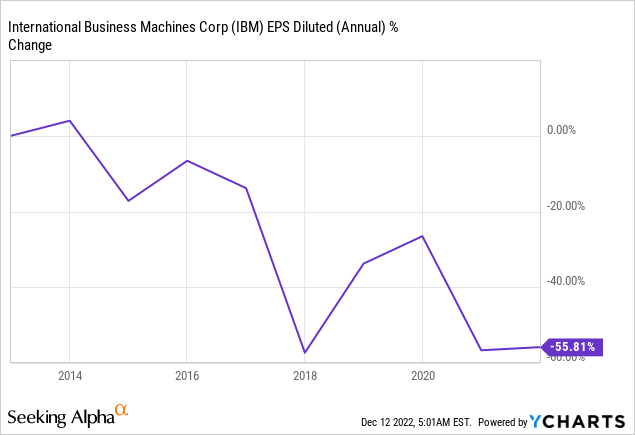

The EPS (earnings per share) has also decreased significantly over the last decade. In ten years, the EPS of IBM has declined by almost 56%. The EPS declined despite IBM commencing an aggressive buyback plan over the decade. As with the sales over the last two years, we see an improvement in the EPS growth and even some margin expansion. In the future, as seen on Seeking Alpha, the analyst consensus expects IBM to keep growing EPS at an annual rate of ~9% in the medium term.

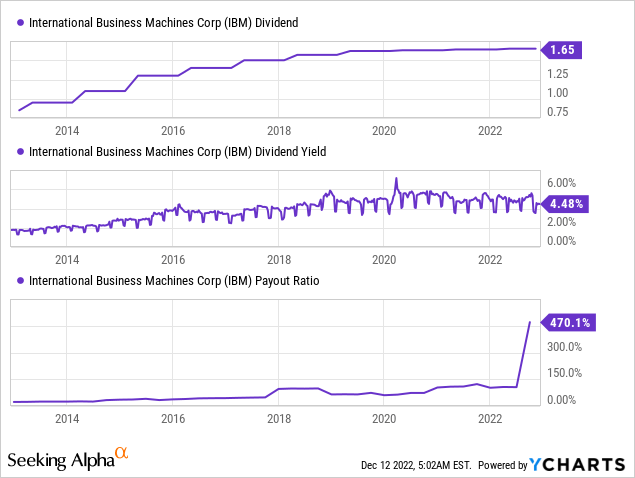

IBM is a dividend aristocrat as it has increased its annual dividend for more than 25 years. However, dividend growth has slowed down significantly to 0.6% in 2022. It happened due to the slow sales and EPS growth. The yield is enticing at 4.5%, and the payout ratio, as seen below, may be misleading. The 470% payout ratio is due to a one-time non-cash expense, but when using non-GAAP EPS, the payout ratio is manageable at 75%.

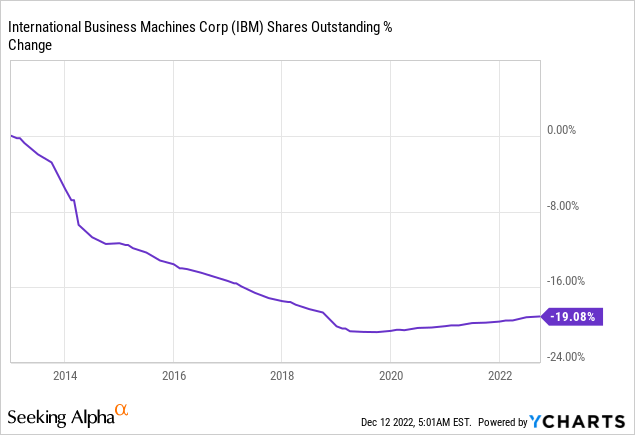

In addition to dividends, companies return capital to shareholders via buybacks. Buybacks supplement the EPS growth as they lower the number of outstanding shares. Over the last decade, the number of IBM shares declined by almost 20%. Yet over the previous two years, as the dividend payout ratio increased, the buybacks halted, and the number of shares rose by 4%. Buybacks are effective when the company is growing, which is the opposite of IBM. Thus, the company spent billions on buybacks at much higher prices.

Valuation

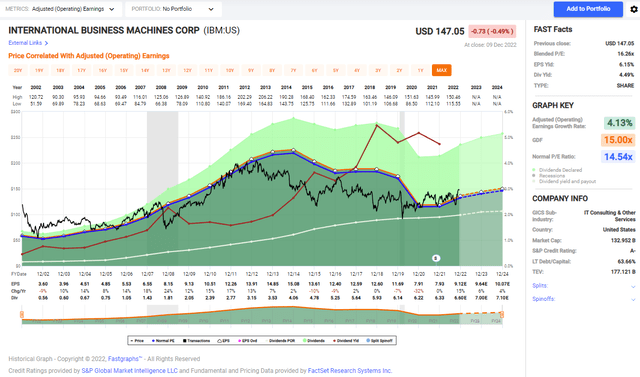

The P/E (price to earnings) of IBM, considering the 2022 forecasted EPS, is 16.2. It is roughly the same valuation we saw a year ago, and one of the highest points in the last twelve months. Since the Q3 reports the share price has increased significantly together with the valuation. Investors were happy with the results and the improving fundamentals. The current valuation doesn’t seem out of line if the company executes as the analysts predict.

The graph below from Fastgraphs shows how the market has become more optimistic regarding IBM over the last two years. The average P/E ratio in the previous twenty years was 14.5, and you can see that since 2012 shares have been trading below it. Since 2020, we can see that shares have been trading for a higher-than-average valuation. It makes sense as the EPS growth forecasted in the medium term is higher than the average annual growth rate of 4.13% in the last twenty years.

To conclude, although IBM’s fundamentals are improving, we see sales and EPS growth that can reignite the dividend and buybacks growth. Its valuation seems fair, but I am still not convinced that it is an attractive investment opportunity. While the company’s financial performance and market position have improved in the past two years, it must show outstanding growth opportunities and limited risks.

Opportunities

One of the critical opportunities for IBM is that it operates across the entire value chain of the technology industry. The company provides its customers with a range of services and products, from consultation and advisory services on needed products to the infrastructure and cloud products essential for businesses today. Then IBM advises and offers a wide range of software and AI solutions tailored to specific needs on its infrastructure. It provides a competitive advantage in a crowded and competitive market.

Moreover, IBM has demonstrated decent execution in recent years, with sales growth and margin expansion even in the current inflationary environment. Despite the challenges posed by rising prices and other economic factors, the company has managed to increase its revenues and improve its profitability. It is a testament to IBM’s focus on efficiency and cost-cutting measures and its ability to adapt to changing market conditions. The company’s strong financial performance in the face of inflationary pressures is a positive sign of demand for its products and services.

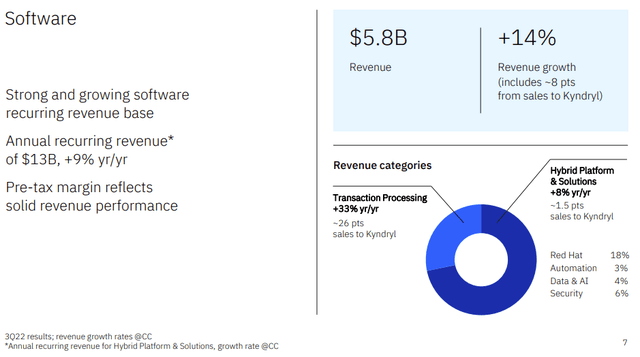

This year, IBM’s 9% increase in recurring revenues to $13B is a promising sign that the company may be on track to successfully shift its business to a higher-margin model. This increase in recurring revenues indicates that the company is making progress in its efforts to transition to a more stable and predictable revenue stream, which is essential for long-term success in today’s technology market. The fact that these revenues are coming from high-margin areas such as cloud services indicates that IBM is progressing in moving away from lower-margin businesses.

Risks

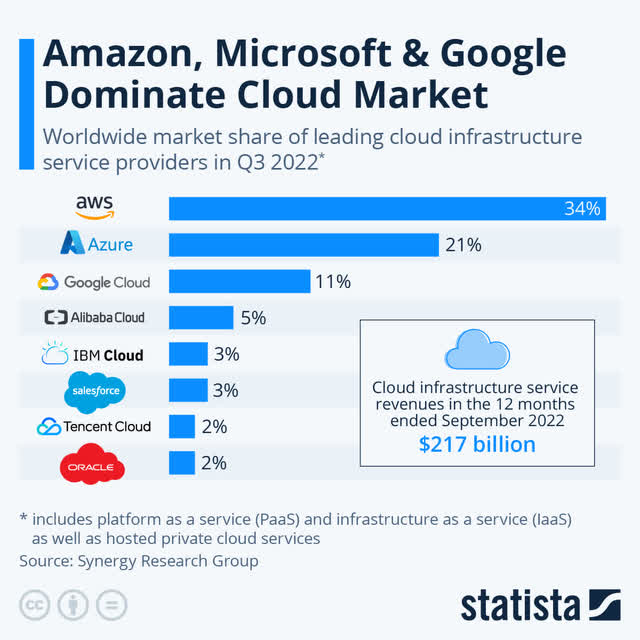

IBM operates in a highly competitive and rapidly changing industry, and there is no guarantee that the company will be able to continue to adapt and succeed in the face of new challenges and developments. IBM’s cloud business is prominent for the company’s growth plan. While the cloud business keeps growing, its peers are growing faster. It results in a lower market share, and despite having a decent product, it only has 3% of the market as it competes with giants like Alphabet (GOOG) (GOOGL), Amazon (AMZN), and Microsoft (MSFT).

Arvind Krishna’s turnaround of IBM looks promising, but it is still fragile at this stage. Although the company has made significant progress under Krishna’s leadership in recent years, it has only been two years since he took over as CEO. As a result, the company’s turnaround is still in its early stages and is not yet fully complete. The company is still more than 50% away from its all-time high EPS, and the analysts’ consensus for 2023 shows 0% sales growth in 2023. It means that there are still challenges and risks that the company must navigate to continue its success.

A potential recession could slow digital transformation and cloud migration investments as companies delay or reduce their investments. In the face of economic uncertainty and tighter budgets, businesses may choose to put off implementing new technology solutions and focus on more immediate concerns. It could have negative implications for IBM, as it relies heavily on growth in these segments. A slowdown in demand for these services could impact IBM’s financial performance and potentially harm its ability to continue its turnaround.

Conclusions

I realize now that I was wrong not to give the new management team grace. As the new leaders of the company, they were in a difficult position and had been working to navigate a challenging business environment. Instead of judging them too quickly, I should have given them the benefit of the doubt and time and space to implement their vision and strategy for the company. I now see that this approach is fairer and will ultimately lead to better outcomes for me as an investor.

Therefore, I was wrong to rate IBM a Sell. Yet, despite the company’s recent progress, the fragile nature of its turnaround and the not-yet-attractive enough valuation, combined with the harsh competition in the market, make it a Hold at this time. IBM has made significant progress under Arvind Krishna’s leadership. However, there are still many challenges and risks that the company must navigate to continue its success, and I will follow them as I hold my tiny position.

Be the first to comment