David Ramos

International Business Machines Corporation (NYSE:IBM) provides integrated solutions and services worldwide. The company operates through four business segments: Software, Consulting, Infrastructure, and Financing.

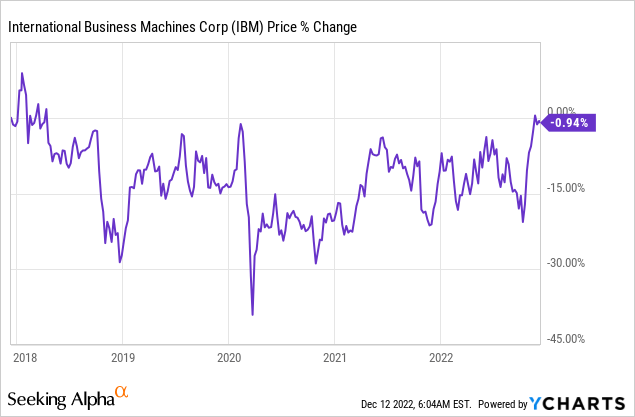

The company’s stock has substantially outperformed the broader market in 2022, however, when we look back at the last 5 years, IBM’s stock price has not moved much.

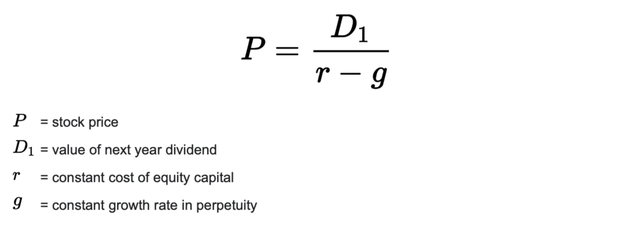

For this reason, many investors have become interested in IBM not for its growth, but for its relatively high dividend yield. In today’s article, we are going to take a look at how much these dividends are worth and whether the current price level could be an attractive level to start accumulating shares of the company. To come up with a fair value for the stock, we will be using a simple and well-recognised dividend discount model, namely the Gordon Growth Model (GGM).

Fair value

Gordon Growth Model

The GGM is a relatively simple and widely recognised dividend discount model, used to value the equity of dividend paying companies. The main assumption of this model is that the dividend will grow indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

In our opinion, while IBM may not be completely insensitive to business cycles it has a strong track record of paying dividends and growing its dividend payments.

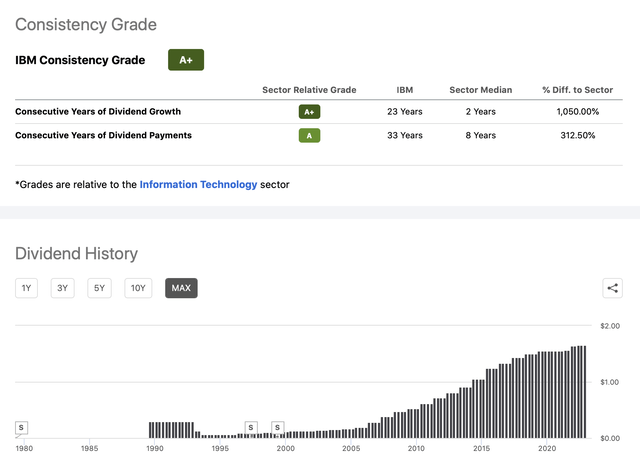

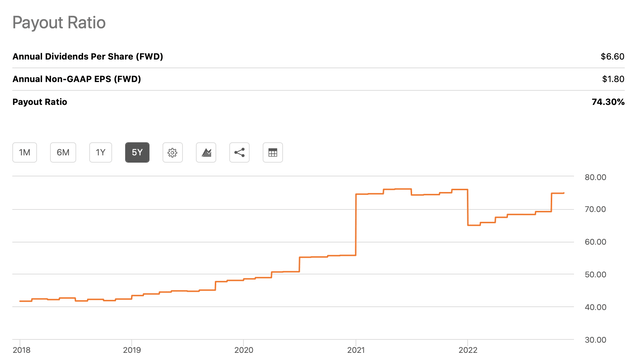

Dividend history (Seeking Alpha)

As IBM has been paying dividends for the last 33 years consecutive and they have even grown their payments each year in the last 22 years, we believe that the GGM could be a suitable method to estimate IBM’s fair value.

When considering future dividend growth, we also have to understand whether the current dividend is safe and sustainable. While IBM has a dividend coverage ratio of 1.36, meaning that they can still cover their dividends, the payout ratio has been rising steadily over the past 5 years. As potential investors, this is something to keep in mind, as a dividend pause or cut can have a substantial negative impact both on the stock price and our calculated intrinsic value.

The maths behind the GGM is described by the following formula:

To come up with a realistic estimate of IBM’s fair value, we have to make sure that the input data is reasonable, especially the required rate of return and the growth rate in perpetuity.

1.) What should be our required rate of return?

For our calculations, we normally prefer to use the company’s weighted-average cost of capital (‘WACC’) as the required rate of return. The current WACC of the firm is estimated to be 9.25%.

2.) What could be a reasonable constant dividend growth rate in perpetuity?

A range of growth rates can be defined by looking at the firm’s historic dividend growth. Important to keep in mind that the growth rate has a substantial impact on the calculated fair value. Assuming unrealistically high growth rates may lead to a substantial overestimation of the intrinsic value.

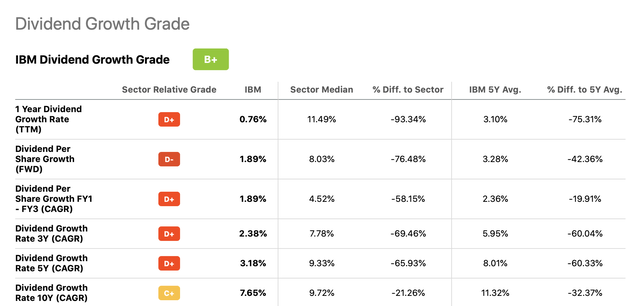

Dividend growth (Seeking Alpha)

Based on historical dividend growth rates, a range of 2% to 4% appears to be an appropriate choice.

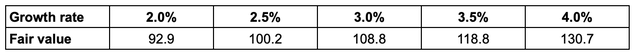

The following table summarizes the results of our fair value calculation (in USD per share) using a 9.25% required rate of return and the above defined range of constant sustainable dividend growth rate.

As IBM’s stock is currently trading above $147, we believe that there is little room for upside, based on this dividend discount model.

For this reason, we do not recommend starting a new position or adding to existing positions at the current price levels. But does it mean that the stock is a sell?

Other considerations

While the stock is currently selling above our estimated fair value range, we believe there are several other factors that we need to look at before we draw our conclusion on the stock’s rating.

Price multiples

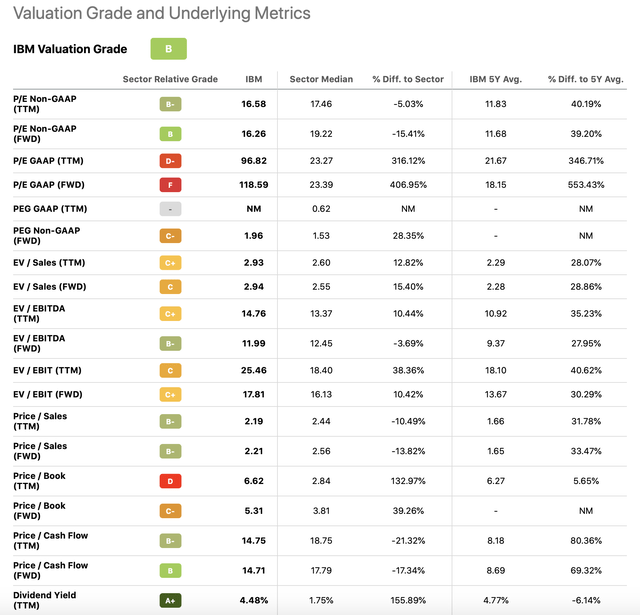

When looking at some of the traditional price multiples, we can see that IBM is trading substantially below the “Information Technology” sector median. On the other hand, all metrics currently are higher than the firm’s 5Y average.

Valuation metrics (Seeking Alpha)

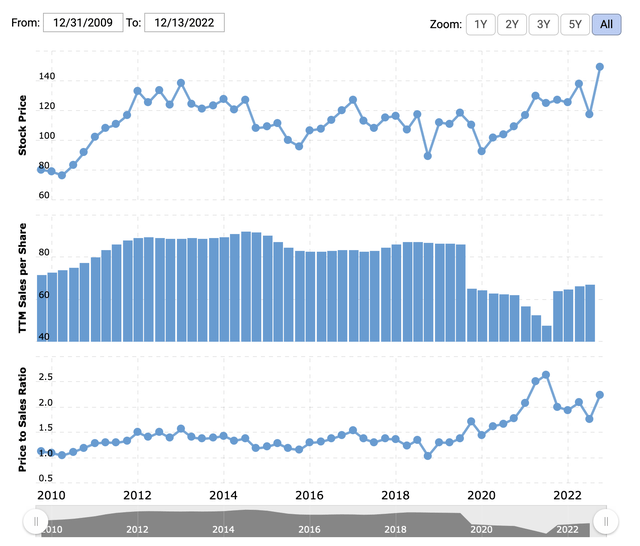

Let us look at an example. The chart below shows IBM’s historic P/S ratio. While net sales have substantially dropped in 2019 and have not increased meaningfully since then, the stock price has gone up. This resulted in a P/S multiple expansion.

We do not believe that the multiple expansions in general are justified, especially in the current macroeconomic environment. While there are growth opportunities ahead for the firm (more about it later), we would like to see how IBM can executes on these and what impacts they may have on their sales and margins.

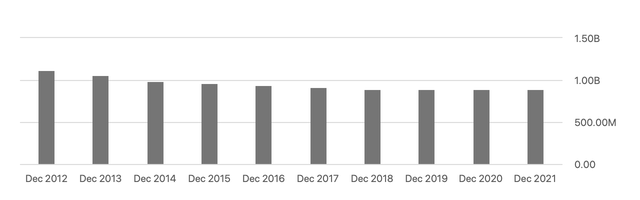

Share buybacks

First of all, dividends are not the only returns to shareholders. During the last decade, the firm has been also purchasing back substantial amount of shares. To be precise, they have reduced their number of shares outstanding by as much as ~20%.

Shares outstanding (Seeking Alpha)

This return is not considered in our fair value calculation using the GGM.

Balance sheet

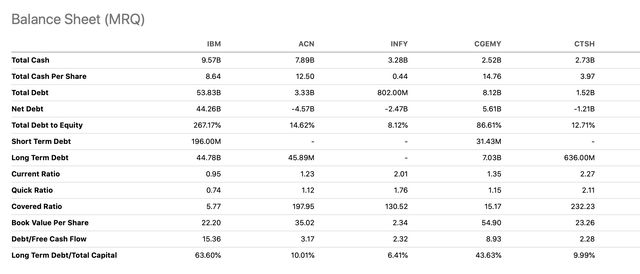

Let us also take a brief look at the firm’s balance sheet, in comparison with some of IBM’s peers/competitors.

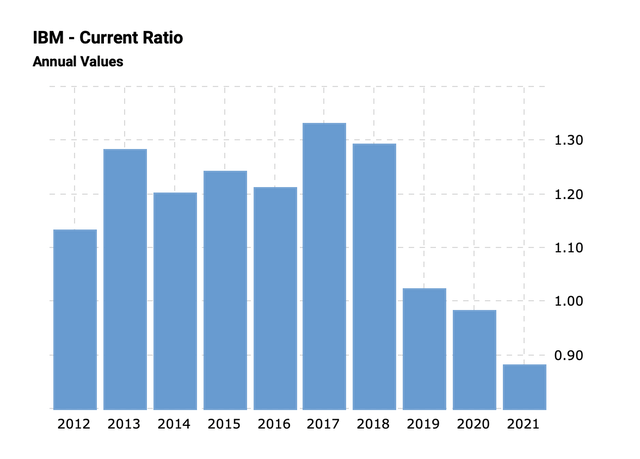

In our opinion, two lines are important to highlight here: current ratio and quick ratio. The current ratio compares all of a company’s current assets to its current liabilities and measures a company’s ability to pay short-term obligations or those due within one year. The quick ratio is similar, but it does not account for the inventory. Metrics above 1, indicate that the firm has sufficient current assets to cover their current liabilities, meaning that they have more financial flexibility. Historically, current ratio readings well-above 1 have not been uncommon for IBM.

Current ratio (macrotrends.net)

Now, however, both metrics are below 1, which we believe could be a risk going forward.

Higher near term growth

Further, the potential for higher near-term growth is also not taken into account, when using the GGM. And as the firm’s latest quarterly results have been quite strong, higher near-term dividend growth could be a possibility.

– Revenue of $14.1 billion, up 6 percent, up 15 percent at constant currency (about 5 points from sales to Kyndryl)- Software revenue up 7 percent, up 14 percent at constant currency (about 8 points from sales to Kyndryl)- Consulting revenue up 5 percent, up 16 percent at constant currency- Infrastructure revenue up 15 percent, up 23 percent at constant currency (about 9 points from sales to Kyndryl)- Hybrid cloud revenue, over the last 12 months, of $22.2 billion, up 15 percent, up 20 percent at constant currency

Other growth opportunities include, the planned acquisition of Octo, to provide exclusive services to the federal government, and the firm’s recently announced partnership with Vodafone, to explore quantum computing cyber security. In our opinion, this is an especially exciting opportunity as cyber security is becoming more and more important. On the other hand, we have to keep in mind that there is fierce competition in the sphere, which could be a potential risk for IBM.

To sum up

While we believe the firm is not attractive currently from a valuation and balance sheet point of view, a sell rating is not justified.

The recent Q3 results are promising, but we would like to see both the valuation and the balance sheet metrics improve, before we would consider the valuation justified.

Partnerships with Octo and especially with Vodafone could provide growth opportunities for the firm in the years to come.

We currently rate IBM’s stock as “hold”.

Be the first to comment