David Ramos

Anyone watching the markets recently knows that the US dollar has been very strong. Last month, I discussed how this would especially impact tech and service giant IBM (NYSE:IBM), as I figured the company would need to cut its full year guidance as a result. After the bell on Monday, the firm released its second quarter results, and while the headline numbers initially looked good, the stock dropped in the after-hours session.

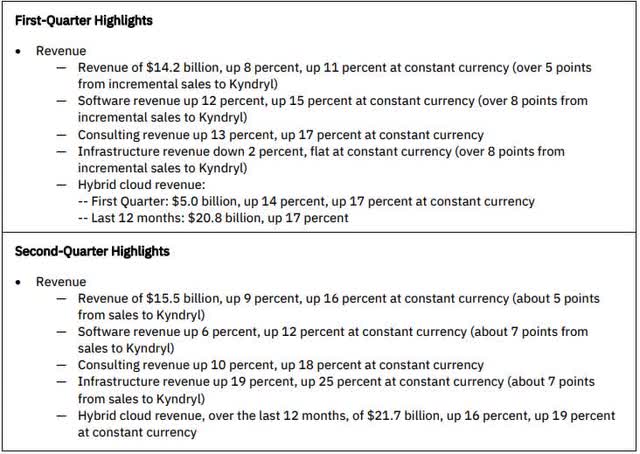

For the second quarter, IBM came in with revenues of more than $15.53 billion, beating street estimates by more than $350 million. This was up 9 percent over the prior year period, or up 16 percent at constant currency – with about 5 points from sales to Kyndryl (KD). That 7 percentage point gap adjusted for currencies was more than double the 3 points we saw in Q1 of this year, thanks to the strength of the greenback. Since the spin-off still makes the comparisons to a year ago a little fuzzy, the graphic below shows how key segment results have trended so far this year:

IBM Segment Results (Company Earnings Reports)

I was a little disappointed at the significant decline in the software growth rate, especially taking out the Kyndryl sales, even after the currency issues. That’s probably the main reason hurting the stock despite the top line beat. Infrastructure revenues really took off in the period, which is likely the main driver of the overall beat. Consulting revenues basically showed the main story ongoing right now, that is a solid business whose reported numbers get hurt by foreign exchange.

IBM beat on the adjusted bottom line by two cents, which isn’t surprising given that it has beat in all but two quarters over the past five years. However, GAAP gross margins declined over Q2 2021 in all three major segments, with the total gross margin percentage declining by 1.8 percentage points to 53.4%. In the end, GAAP EPS were up 6 cents year over year to $1.54, but as usual IBM made tons of adjustments to get the adjusted EPS figure look a lot better.

The main premise of my prior IBM article was that we were likely to see management cut its full year total revenue forecast, and that’s exactly what happened here. The company is still guiding to revenue growth in the high mid-single digit area, but that is in constant currencies. The issue here is that the currency headwind forecast is now expected to be 6 points, up from a 3 to 4 point range back at the April report.

Likewise, the free cash flow forecast went from a range of $10 billion to $10.5 billion to now about $10 billion. While that doesn’t seem like a big change, you have to remember that IBM is using about $6 billion of that for the dividend, which means the amount left over after those cash payments is a bit less. This means that less money is available for other uses, which primarily is debt repayments currently. Given how interest rates around the globe have risen a bit lately, and the Fed could hike again next week, paying back less debt moving forward dings the long-term profitability and cash flow situation just a little.

I’ve talked about IBM shares stalling out in the low $140s recently, and that seemed to be the case again here. The stock hit a high of $140.31 on Monday before pulling back, and we’re under $133 in the extended hours session right now. The average price target on the street continues to be around $144 currently, but that could tick down a little with guidance coming down slightly. As the chart below details, the stock in Monday’s after hours has now lost the 50-day moving average (purple line), and stands just about $2 above the 200-day (orange line). Without a quick recovery, the 50-day will likely roll over soon and start trending lower, which could provide some resistance.

IBM Past 12 Months (Yahoo! Finance)

In my previous article, I talked about a buy point being where IBM yielded about 200 basis points above the 10-Year Treasury. That US bond has seen its annual yield come down a bit since, but IBM also did lower its forecasts as I expected. As a result, I’m adjusting my yield point to 225 basis points more, which is a yield of about 5.24% currently. Based on what I’m expecting in dividends over the next 12 months, that means I’d be more interested in IBM around $126.55.

In the end, IBM was forced to cut its annual guidance thanks to the stronger US dollar. While revenues and adjusted earnings beat forecasts, software sales seemed a little light to me, and currencies were certainly a major impact. Management did take down its forecast when including foreign exchange, which will also result in a little less free cash flow being produced. With the stock trading towards the upper end of its range recently, Monday’s Q2 report became a sell the news event for IBM. Given we might see a lot of these types of reports in the coming weeks, I wouldn’t jump in right away.

Be the first to comment