Anne Czichos/iStock Editorial via Getty Images

When we last covered International Business Machines Corporation (NYSE:IBM), we discussed the Q2-2022 results and were not impressed by the company’s trajectory. Our key points from that article are quoted below.

Based on US dollar strength, we would estimate that the earnings revisions have not even begun to price it all in.

We think technology is likely to get a larger share of the slowdown as it benefited the most from the 2021 euphoria.

We might get interested in IBM in the high double digits, but for now, we stay out.

Source: Big Blue Sees Deep Red

IBM has not exactly thrilled either the bulls or the bears since then, but we did not have any regrets about the decision.

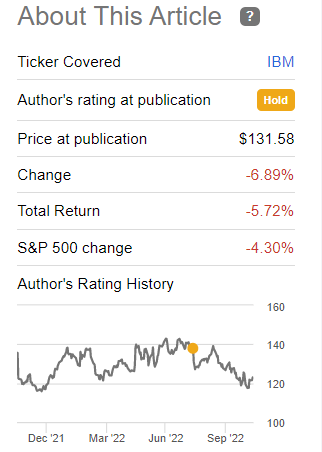

Seeking Alpha

We look at Q3 numbers and tell you if we can raise our buy under price.

IBM Q3 2022 Earnings Results

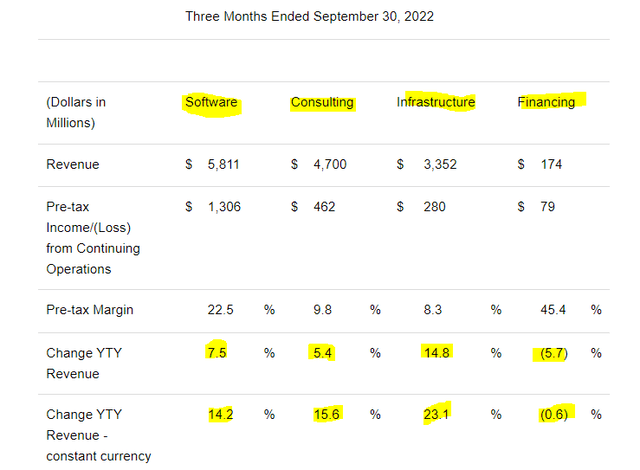

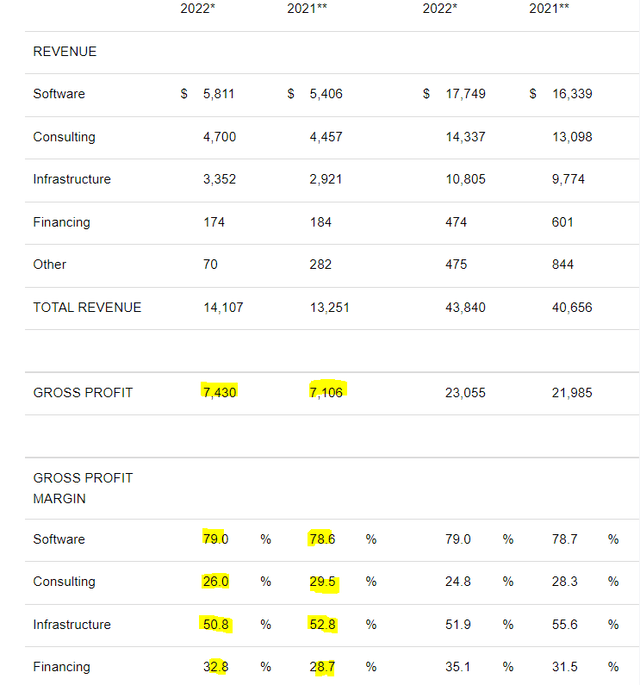

IBM beat the consensus adjusted (non-GAAP) earnings estimates ($1.80) by a penny but the market was more thrilled with the revenue number which came in more than half a billion above the mark. In a quarter marked by exceptional US dollar strength, a revenue beat of such a magnitude is extremely impressive. We can see further breakdown of this among the individual reporting segments. Three out of the four reported double-digit sales increases if we stripped out the currency impact.

This is quite a change from IBM of the previous years and the company also raised its guidance for revenues for the full fiscal year and said it expected at least $10 billion of free cash flow.

What We Liked

Beyond the impressive revenue strength, IBM really brought it home for investors by maintaining gross margins in a very challenging environment. With the dual hits of inflation and US Dollar strength, one would have expected to see gross margins weaken substantially. Management referred to the size of this headwind on the conference call as well.

The big wildcard if you want to use it is what’s going to happen to the U.S. dollar. Now you see what’s happened to us this year. This year, third quarter let’s put it in perspective as I said a little over eight-point gap between constant currency and actual rates. As you’ve seen in our backup charts, it’s about a $1.1 billion revenue by the way, that’s about a $0.15 profit and EPS impact in a quarter that we’ve had to overcome operationally. Now that again will continue to the extent the U.S. dollar doesn’t devalue over time.

Source: IBM Q3-2022 Conference Call Transcript

We did see some weakness with overall gross margins dropping from 53.6% to 52.7%, but that is far less than what we thought would occur. On a segment level, two out of the four actually had improvements in gross profit margins.

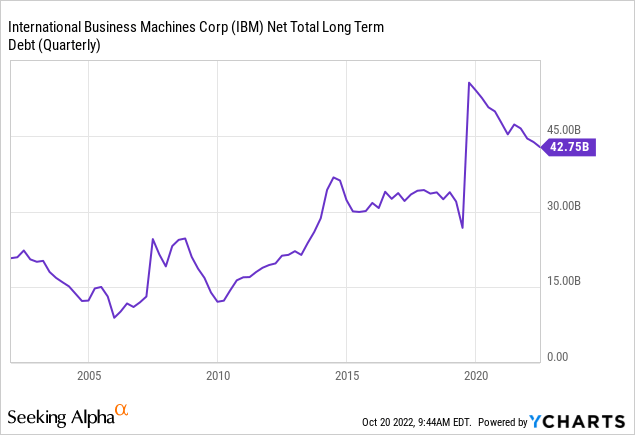

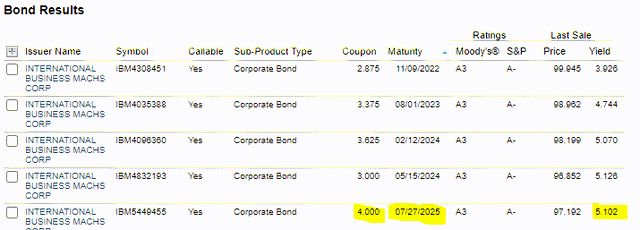

IBM has also got its refinancing done at an attractive rate earlier this year. The 2025 maturities issued in July for a 4% coupon have already moved up to a 5.1%

IBM also issued 2052 maturities in February of this year while the bond bubble had not even begun to implode. Those 3.43% coupon bonds now yield 6.01% and have dropped 35% in price.

These issuances put it an enviable position where it can just redeem the upcoming maturities with free cash flow over the next 2-3 years without having to tap the debt markets. This removes interest rate headwinds which are quite apparent on many other companies.

What Was The Sore Point?

GAAP results include the impact of a one-time, non-cash pension settlement charge of $5.9 billion ($4.4 billion net of tax) related to the transfer of a portion of the company’s U.S. defined benefit pension obligations and related plan assets to third party insurers, announced on September 13, 2022.

Source: IBM Q3-2022 Press Release

IBM set aside a certain amount of money to fund defined benefit pension obligations. On transfer to the third party, it was determined that IBM was overoptimistic with their return assumptions and the amount of cash set aside for the defined benefit, would not quite cut it. The net hit to IBM to get it off their books was $5.9 billion. As this expense is eligible for a tax write-off, the net impact was $4.4 billion.

This is not chump change and exceeds the entire free cash flow till the third quarter for IBM. IBM did announce this a little before the quarter end in a separate SEC filing, and perhaps that is why there was no discussion on the conference call. But we still see it as a significant hit.

Where’s The Buy Point?

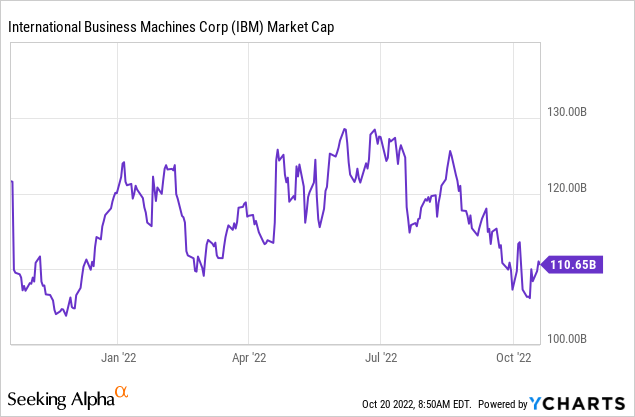

The $10 billion outlook for free cash flow on the current market capitalization is quite impressive.

If currency headwinds reverse next year, we could see this number move up to $11-$12 billion and that free cash flow yield would be enticing. Keep in mind though that from a shareholder’s perspective, IBM just blew through half of that with the pension charge.

IBM’s dividend yield is attractive for a large-cap firm, but in the context of rising interest rates, we don’t see this as enough by itself.

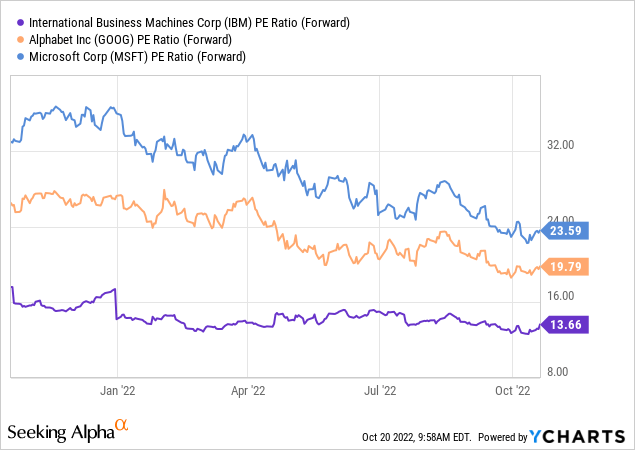

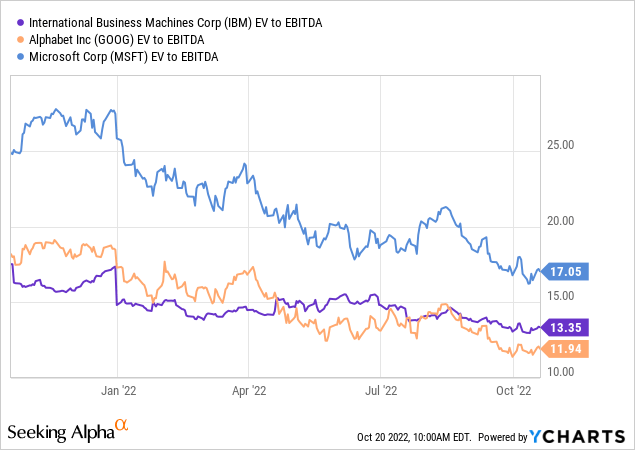

The P/E multiple remains low and at 13x earnings, no one will complain that you are paying an arm and a leg for this. IBM has also defied skeptics by upgrading guidance despite numerous unexpected headwinds. It is also quite cheap relative to the big cloud players like Microsoft Corporation (MSFT) and Alphabet Inc. (GOOG) (GOOGL), to name just two.

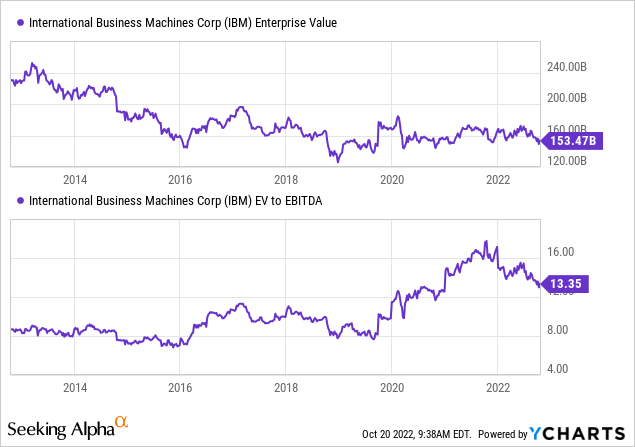

But the bigger issue to get behind the company remains the total valuation when debt is included. EV to EBIT or EV to EBITDA don’t look attractive at all.

You can see that on this correct measure, GOOG is actually cheaper than IBM.

The reason the IBM stock price is low, despite the big jump in Enterprise value, is because a good deal of that EV is via debt. To IBM’s credit, it has paid down a bit of the Red Hat acquisition related debt, but it still impacts our valuation perception today.

With the rapid rise in interest rates and a plethora of opportunities around, we don’t think we will chase IBM up here and continue to look for a two-digit price to get interested.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment