D-Keine/E+ via Getty Images

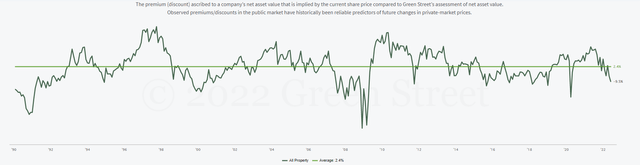

REITs (real estate investment trusts) are now the cheapest they have been in years, according to GreenStreetAdvisors, a leading REIT research firm:

REITs trade at large discounts to NAV (GreenStreetAdvisors)

Premiums to net asset value (“NAV”) have now turned into large discounts to NAV. The average discount is about 10%, according to GreenStreetAdvisors, which is famous for being conservative with its estimates.

If you use the consensus estimates of other analysts, the average discount expands into 15-20% range, and it is not uncommon to find even high-quality REITs trading at much greater discounts than that.

In fact, there are some REIT property sectors that have dropped particularly heavily in 2022, causing them to trade at discounts now surpassing 30%!

That’s primarily what we are buying at High Yield Landlord.

We aim to buy high-quality real estate that’s professionally managed, diversified, and liquid, at pennies on the dollar. It is not exactly rocket science, but it is a strategy that has consistently paid off for us.

We aggressively accumulate REITs when they are available at large discounts to the underlying value of their real estate, and then hold them to earn rental income, and wait patiently for long-term appreciation.

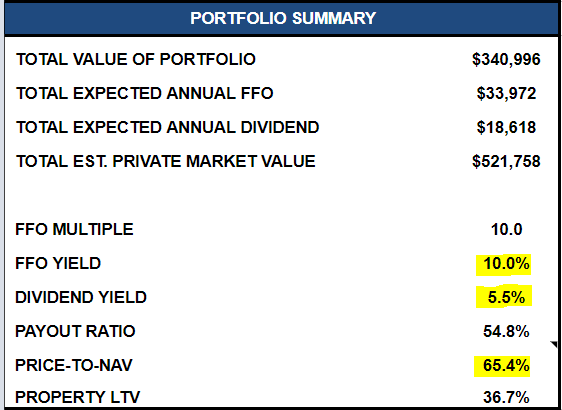

Right now, our portfolio is priced on average at a 10% cash flow (FFO) yield, out of which 5.5% is paid to us in dividends, and the remaining 4.5% is reinvested in future growth. Our selection of REITs also trades on average at a 35% discount to our estimate of net asset value, which essentially means that we are buying real estate at 65 cents on the dollar:

High Yield Landlord Core Portfolio Summary (High Yield Landlord)

That’s especially cheap when you consider that our selection of REITs enjoys strong balance sheets that can withstand rising interest rates, enjoy recession-resilience, and profit from the surging inflation.

Historically, REITs have traded on average at a small premium to NAV, which is well-deserved given all the advantages that they enjoy when compared to private real estate.

Our guess is that once interest rates peak and inflationary pressures cool off, the narrative will change and REIT valuations will recover closer to historic norms.

In the meantime, we continue to buy more shares week after week, and in what follows, we highlight two of our most recent purchases:

STAG Industrial (STAG)

STAG Industrial, Inc. is an industrial REIT that owns mainly warehouses and distribution centers in the US.

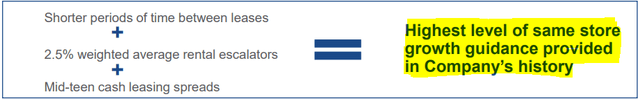

The company is doing better than ever with the highest level of organic growth in the company’s history. This is because its rents are deeply below market and its leases are now gradually expiring, which allows it to hike rents by 15-20%:

STAG Industrial’s growth is accelerating in 2022 (STAG Industrial)

STAG Industrial owned Amazon distribution center (STAG Industrial)

Its balance sheet is also the strongest in its history with a strong BBB investment-grade credit rating and significant liquidity to pursue new acquisition/development opportunities.

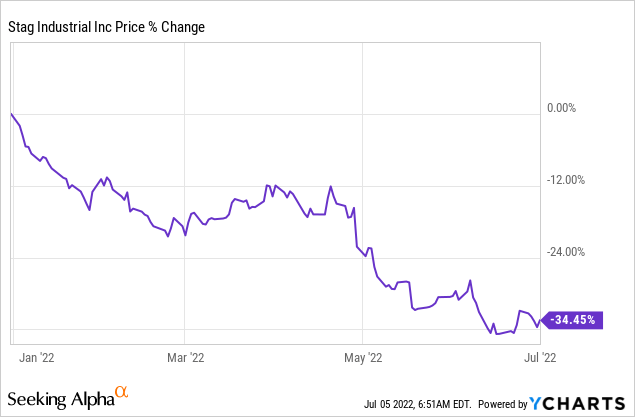

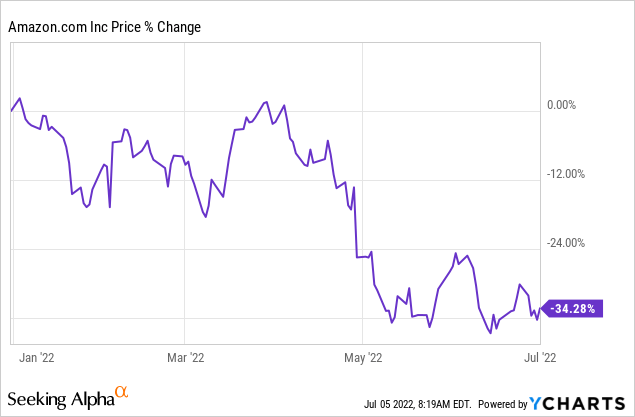

Despite that, STAG has dropped by 34% in 2022, suffering one of the worst sell-offs of the entire REIT sector:

Industrial REITs sold off so heavily because they are perceived to be the “tech segment” of the REIT sector.

Amazon (AMZN) is STAG’s biggest tenant, and its share price has also dropped by 34%, indicating that it could face a slow-down in growth:

Amazon may deserve the 34% drop since it was quite aggressively valued prior to the sell-off, but in the case of STAG, the sell-off does not make sense since it was very reasonably valued in early 2022.

Moreover, STAG’s guidance has only improved and the company’s organic growth has even accelerated this year. The market appears to price STAG as if its growth prospects were a function of Amazon’s growth, but in reality, Amazon only accounts for a few percentage points of its revenue, and the rest is well diversified.

STAG benefits from the growth of e-commerce, but it also benefits from the acceleration in on-shoring. China’s zero-tolerance policy on covid-19 and Russia’s recent invasion of Ukraine have shown international companies that there are significant indirect costs to being overly reliant on such countries.

Now, on-shoring is back on the rise, and since STAG’s rents are below market and its leases are relatively short, it is well-positioned to grow in the coming years.

Therefore, we believe that its discounted valuation is an opportunity. We expect ~50% upside and while we wait, we earn a near 5% dividend yield and the company is also set to grow its cash flow per share at a high single digit growth rate.

Vonovia (VNA / OTCPK:VNNVF, VONOY)

Vonovia SE is the leading landlord in Germany. Its portfolio of apartment communities is worth over $100 billion, which is much more than its U.S. peers AvalonBay (AVB) and Camden (CPT).

Vonovia is not officially structured as a REIT, but it behaves like one. It buys apartment communities, rents them out, pays dividends, and aims to grow via rent/occupancy increases and new property acquisitions or development.

Vonovia apartment community (Vonovia)

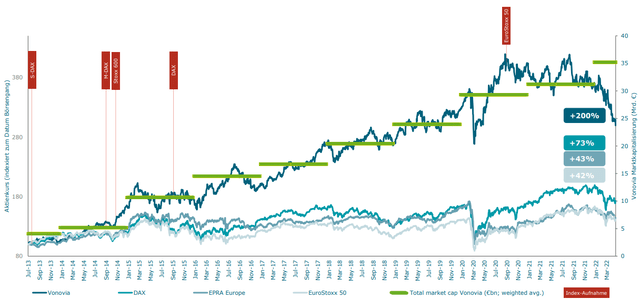

Historically, it has been perceived to be a “blue-chip” given that:

- It owns very defensive properties;

- It has a fortress balance sheet;

- Its management has a great track record;

- The dividend has been steadily increased;

- And it has been a strong outperformer over the years.

Vonovia has a strong track record of shareholder value creation (Vonovia )

Apartment communities are mostly recession-proof, they benefit from inflation, and the negative impact of rising rates should not be considerable given the strength of its balance sheet.

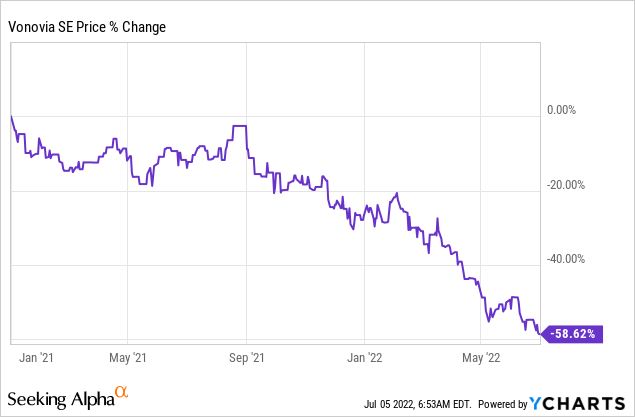

Put simply, this is exactly what you would want to own in an uncertain world, and yet, the shares are down very heavily over the past year:

The drop is mainly caused by the war in Ukraine, which is likely to cause even more inflation in the near term as well as a recession. Vonovia’s rent increases will lag the inflation in the near term because of how rent increases are regulated in Germany and this has caused investors to sell off the stock.

But in the long run, apartment communities will remain great inflation hedges, and eventually, the rents will catch up to the inflation.

Yet, the shares are now priced at a 50% discount to NAV, which is unprecedented for Vonovia. It is even cheaper than at the lowest point of the pandemic.

Vonovia has guided for strong growth in 2022 so the discount makes even less sense. We expect 50-100% upside and while we wait, we earn a 5.7% dividend yield.

Bottom Line

Right now, everybody seems to worry about rising rates, inflation, and a likely near-term recession.

We don’t deny that there will likely be some pain in the near term.

But unlike others who panic and sell, we also recognize that these issues are temporary in nature, and they don’t justify a drastic repricing of essential real assets.

Eventually, inflationary pressures will cool off as supply chain issues are resolved, we will likely go into a recession, and interest rate hikes will again turn into interest rate cuts. Recessions typically last only a year or two and before you know it, prices will recover like they always do.

Those who can think long-term will be rewarded for taking the right actions today.

Be the first to comment