Matteo Colombo

Investment Thesis

Bonds have done poorly since the beginning of the year as a result of a sudden rebalancing of monetary policy. While inflation has been the main topic of debate for over a year now, I believe that a slowdown in economic activity represents the main risk in the high-yield credit market today. The likelihood of a recession is growing every month, which adds further pressure on the performance of junk bonds. Given the abovementioned risk, high-yield bonds are an unattractive investment at the moment, despite a significant increase in yield.

Strategy Details

The BlackRock Corporate High Yield Fund (NYSE:HYT) invests in high-yield corporate bonds. The primary investing goal of the fund is to deliver current income to owners. To achieve this target, HYT pays a monthly dividend.

If you want to learn more about this strategy, please click here.

Portfolio Characteristics

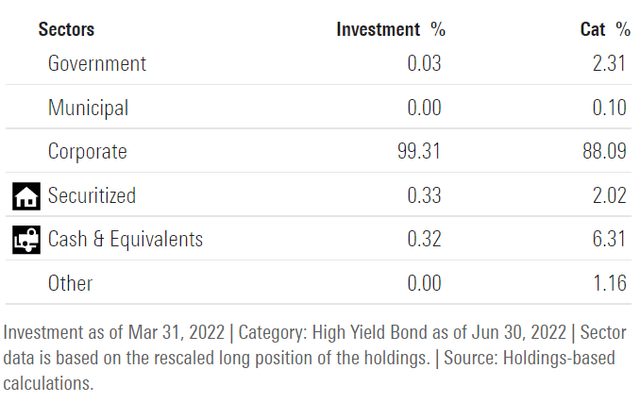

The fund invests exclusively in high-yield corporate bonds. Corporate bonds are generally seen as riskier than government bonds since governments can always print more money in order to service their debt.

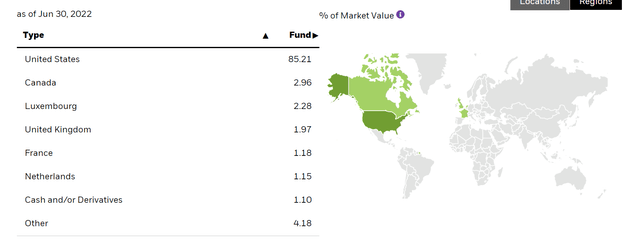

In terms of geographical allocation, the U.S. accounts for ~85%, followed by Canada (~3%) and Luxembourg (~2%).

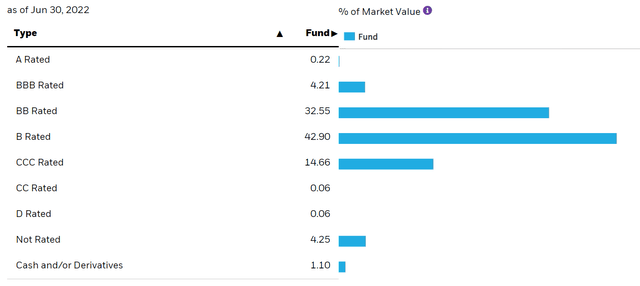

~90% of assets are rated below BBB. These securities carry high default risk. Less than 5% is assigned to BBB-rated bonds, which is in line with the strategy’s goal of investing primarily in corporate junk bonds.

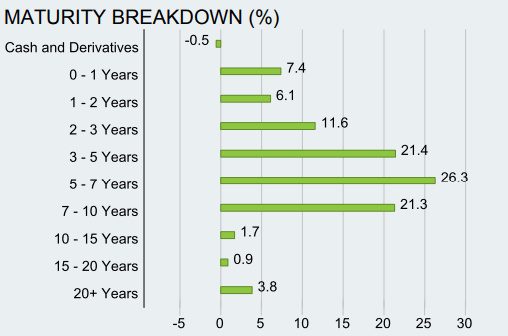

According to iShares, the portfolio’s average maturity is ~6 years. However, it’s interesting to note that over 46% of constituents have a maturity of less than 5 years.

iShares

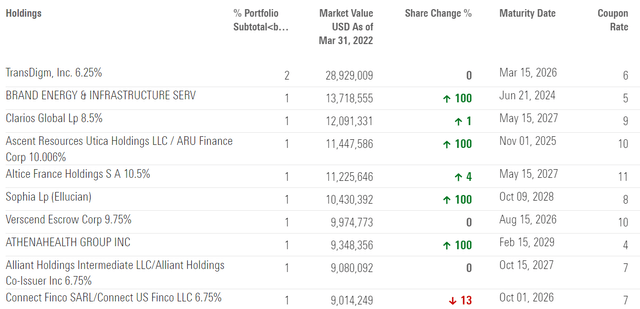

The fund is currently invested in 1,427 different bonds. The top ten holdings account for ~10% of the portfolio, with no single issuer weighing more than 2%. All in all, I believe that HYT is very well-diversified across issuers. That said, investors shouldn’t forget that correlation between issuers tends to increase in moments of stress, especially in the high-yield space. If you believe that an economic downturn is likely to occur over the next 12 months, that will probably remove some of HYT’s diversification benefits.

Based on data from iShares, the fund has an effective duration of ~5.5, meaning that for each 1% increase in interest rates, the portfolio’s NAV is expected to decrease by 5.5%. That is in line with other high-yield strategies, such as the iShares iBoxx $ High Yield Corp Bd ETF (HYG).

HYG has a ~9.5% TTM dividend yield, which is one of the reasons why this fund is popular among income investors. The yield has only once been higher over the last decade, and that happened during the March 2020 COVID-19 panic.

The Deteriorating Economic Outlook Is A Major Risk For HYT

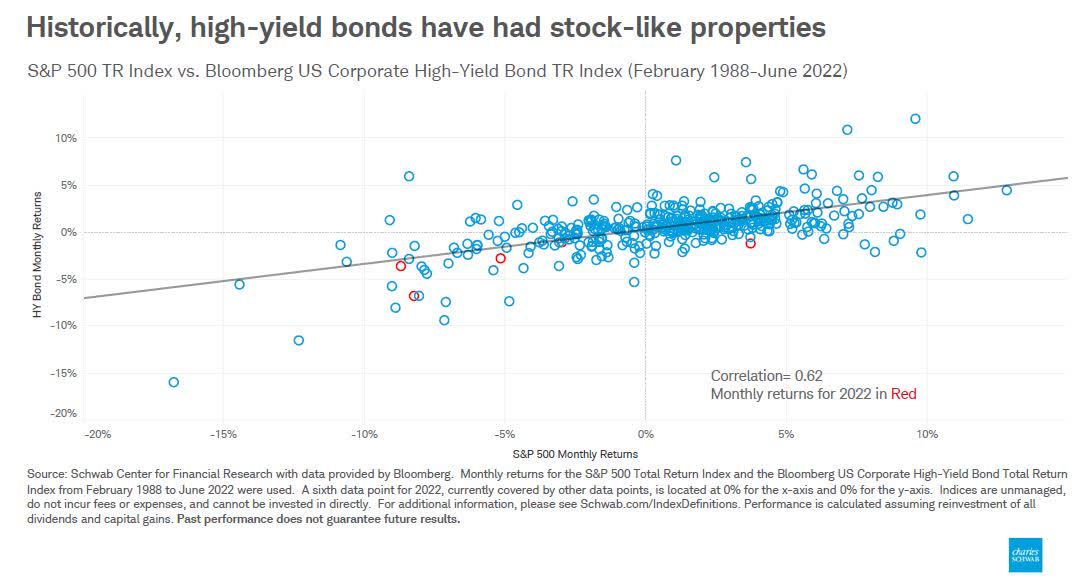

The economy has been slowing down considerably over the last months and that is problematic for high-yield bonds. This asset category tends to have stock-like characteristics as evidenced by the positive correlations returns between the two. 2022 has been consistent with historical evidence. In other words, an economic slowdown that would push equity prices lower is likely to have a similar impact on high-yield bond prices.

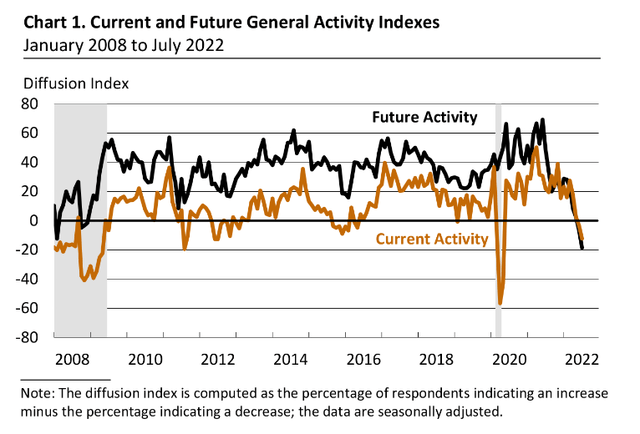

Charles Schwab

The recent data brings compelling evidence of a slowdown in economic activity. The US Philly Fed Business Index is among the latest indicators confirming this trend. According to the report, “firms expect overall declines in activity and new orders but increases in shipments and employment over the next six months”. Other indicators such as US PMI New Orders and the Weekly Leading Index are also giving investors some clues as to where the economy is heading.

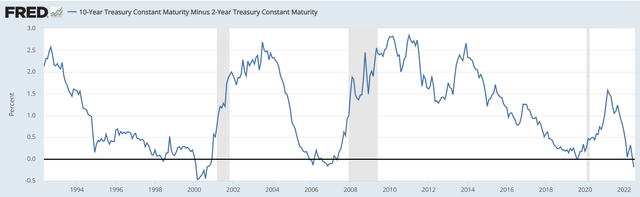

When it comes to negative economic growth, the credit market has historically been an excellent recession indicator. The recent yield curve inversion is another red flag. Investors are foregoing term premia and betting on a reversal in monetary policy over the next 12 months, while the yield curve has steepened dramatically at the front end, creating a new risk for high-yield issuers, who might run into difficulties when refinancing short-term debt.

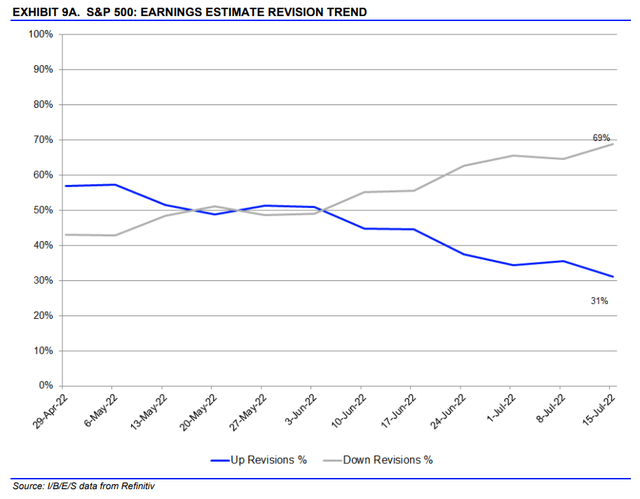

Wall Street is rapidly catching up to the divergence between earnings estimates and the state of the economy. EPS down revisions are now representing over 69% of total revisions, whereas up revisions are only accounting for 31%. It’s interesting to note that this trend shifted in late May 2022 and has been growing in recent weeks. Lower earnings are a problem not only for equities but also for high-yield issuers that generally tend to have profitability or leverage issues.

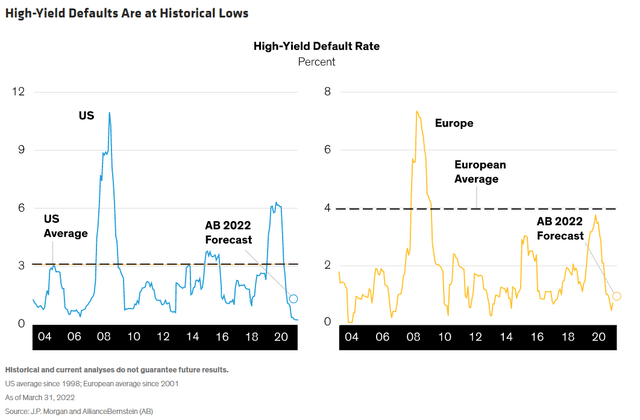

Despite the numerous warning signs, some analysts continue to believe that the high-yield space remains attractive. Take this recent report from AllianceBernstein that encourages investors to buy the dip in high-yield bonds:

With central banks tightening aggressively to beat down inflation, growth is beginning to slow—and the risk of recession is ticking higher. Historically, creditworthiness has soured when growth slows. But instead of bracing for a wave of downgrades and defaults, we think income-seeking investors should embrace the high-yield corporate bond sector.

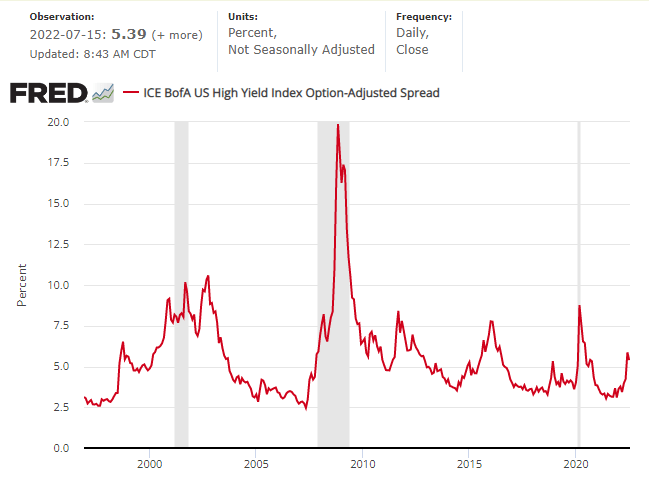

The main bullish argument is that the high yield market is in good shape now and that current yields are providing enough compensation for investors to take additional risk. However, I would argue that it’s always calm before the storm. While defaults are still at historical lows, we have seen numerous moments in the past where the high yield market imploded in less than 24 months after such lows were reached.

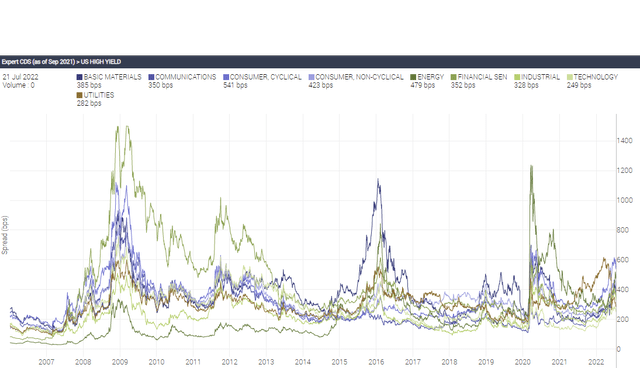

While I agree with the fact that the situation remains under control in the junk credit market, CDS and credit spreads are reminding us that something is brewing and things could get much worse. I wouldn’t, therefore, exclude another drop in junk bond prices over the next couple of months when the economy turns south.

FRED

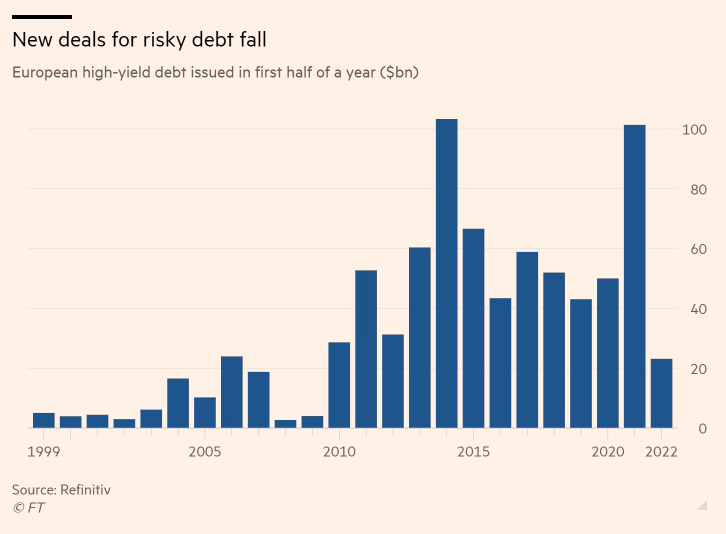

At least, one thing is certain for now. Investors’ appetite for risky high-yielding bonds has been decreasing and I don’t see any catalyst in sight that’s going to reverse this trend in the near future. To put things in perspective, European and US high-yield bond issuance in the first half of the year has dropped by over 50%, reaching its lowest level in the first half since 2009.

Financial Times/Refinitiv

Key Takeaways

Bonds have performed poorly since the start of the year due to an abrupt rebalancing of monetary policy. While inflation has been the primary topic of discussion for over a year, I believe that the greatest threat hanging over the high-yield credit market today is a slowdown in economic activity. Every month, the probability of a recession seems to be growing, putting further pressure on junk bond returns. Given the aforementioned risk, I believe that investing in a basket of high-yield bonds such as HYT is an unattractive investment.

Be the first to comment