Introduction

When oil prices began plunging last week it did not take Husky Energy’s (OTCPK:HUSKF) Canadian oil and gas brother, Vermilion Energy (VET), much time to use this as cover to reduce their already unsustainable dividend payments. Whilst they technically have held out longer, Husky Energy is very likely to follow this move and thus given the current very challenging underlying operating conditions, I believe that investors should expect their dividend yield to shortly fall to zero.

Dividend Coverage

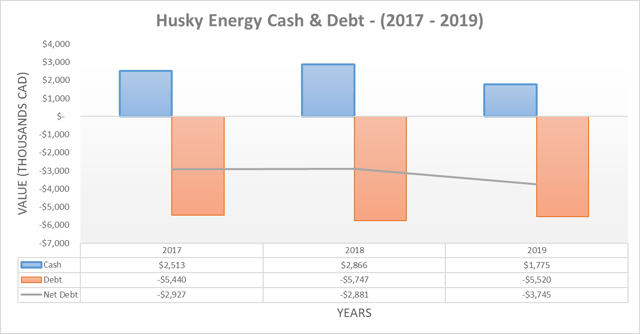

When assessing dividend coverage, I prefer to forgo using earnings per share and use free cash flow instead, since dividends are paid from cash and not from “earnings.” The graph included below summarizes their cash flows from the last three years:

Image Source: Author

When oil and gas prices crashed in 2015-2016 they suspended their dividend payments and only reinstated them again in 2018. Unfortunately, throughout both 2018 and 2019, these were not covered by organically generated free cash flow and thus relied on debt funding, which calls into question their sustainability even if oil and gas prices had not recently plunged.

Looking forward to the future, it does not appear as though 2020 would have seen their dividend coverage improve materially even if commodity prices remained static with 2019. Their original capital expenditure guidance for 2020 ranged between C$3.2b and C$3.4b, along with a further C$200m of capitalized interest expense. This aggregated to a total of between C$3.4b and C$3.6b, which is very similar to that of C$3.649b for 2019 and thus indicates that their ability to sustain their dividend payments would have remained stretched even if commodity prices remained the same as 2019. Whilst they have recently reduced their capital expenditure for 2020 by C$900m, even if they generated the same operating cash flow as 2019, which given the plunging commodities prices seems very unlikely, their free cash flow would still be approximately neutral and thus still provide no scope to cover their dividend payments.

Financial Position

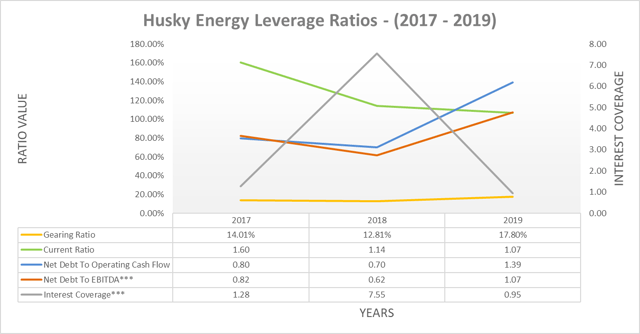

Since their dividend coverage is questionable even in better times, their financial position will be instrumental in determining whether their dividend payments are sustainable. The two graphs included below summarize their financial position from the last three years:

Image Source: Author

Whilst overall their financial position appears decent and likely to remain solvent throughout a potentially extended downturn, due to their very low interest coverage, they retain minimal ability to safely fund their dividend payments through additional debt. Their main strength lies in their liquidity with a current ratio of 1.07 and a cash balance of C$1.775b, both being positive attributes. This is especially relevant with C$400m of their debt maturing in 2020; however, it also highlights the importance of suspending their dividend payments.

Whilst they ended 2019 with a cash balance standing at the aforementioned C$1.775b, after repaying their C$400m of debt and C$503m of dividend payments, their cash balance would drop to only C$872m. Even though this still sounds ample, it should be remembered that during 2019 their free cash flow was negative C$955m. Given the plunging commodity prices that will likely offset their aforementioned capital expenditure reductions, they could very possibly run out of cash if their dividend payments are not curtailed shortly. Given the current underlying operating conditions and previously discussed capital expenditure guidance for 2020, it seems unreasonable to expect their free cash flow to perform any better during 2020 than 2019. Whilst they could rely on asset divestitures or debt financing to plug this gap, the former could prove difficult to execute during a downturn, whilst the latter seems risky as their interest coverage is already stretched.

Conclusion

Considering their dividend yield is sitting around 14% as of the time of writing, it appears as though the market is already anticipating a dividend reduction. Given this, I believe a neutral rating is appropriate due to the general uncertainties around oil and gas prices in both the short to long term. Thankfully, their financial position remains decently strong enough that they should be capable of navigating these rough times without resorting to value destructive measures, provided they make sensible capital allocation decisions by suspending their dividend payments.

Notes: Unless specified otherwise, all figures in this article were taken from Husky Energy’s Quarterly Reports, all calculated figures were performed by the author.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment