AnthonyRosenberg/iStock Unreleased via Getty Images

The Vanguard Small-Cap Value ETF (VBR) has returned just 1.75% compared to the S&P 500 (VOO) return of 4.92% in the past year. I analyzed the top 177 holdings that account for 50% of the total assets out of the 927 companies in this ETF, looking for companies that offer a dividend yield of over 3% and are reasonably valued. Invesco (IVZ), Hanesbrands (HBI), Newell Brands (NWL), VICI Properties (VICI), and Old National Bancorp (ONB) provide a good dividend yield and are oversold. One wouldn’t look to small-cap stocks for good dividend income, but these companies may be good income candidates in a long-term portfolio.

Best and Worst Performers in the Vanguard Small-cap Value ETF

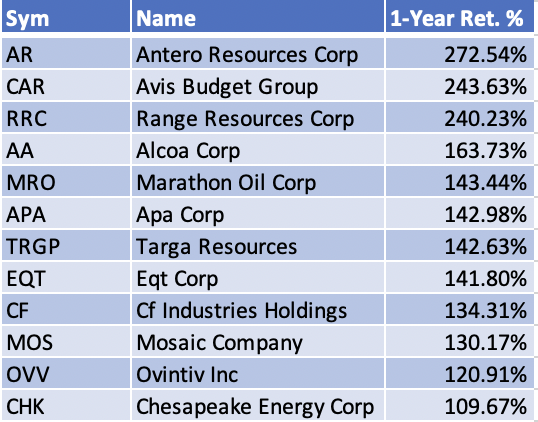

Twelve companies out of the top 177 holdings in this ETF have returned over 100%, with Antero Resources (AR) leading with a 272% return (Exhibit 1). Oil and gas, fertilizer, and metals companies make up most of this list.

Exhibit 1: Best Performers in the Vanguard Small-cap Value ETF

Best Performers in the Vanguard Small-cap Value ETF (Barchart.com, iexcloud.io, author compilation)

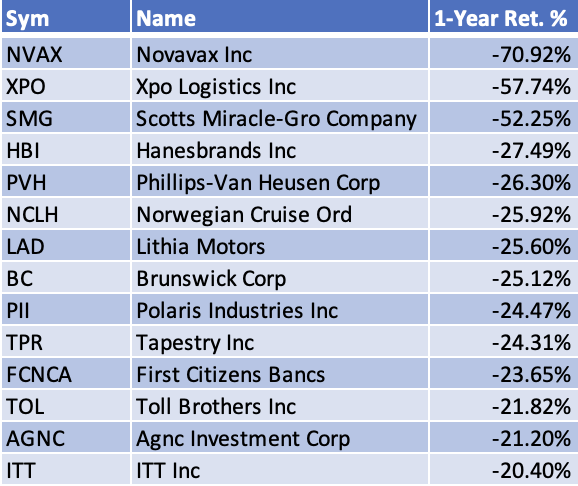

Fourteen companies in the top holdings have lost over 20% of their value in the past year. Novavax (NVAX), XPO Logistics (XPO), and Scotts Miracle-Gro (SMG) have lost over 50% (Exhibit 2).

Exhibit 2: Worst Performers in the Vanguard Small-cap Value ETF

Worst Performers in the Vanguard Small-cap Value ETF (barchart.com, iexcloud.io, author compilation)

Note: You can download the performance data of the entire list of 177 companies from my Google Drive.

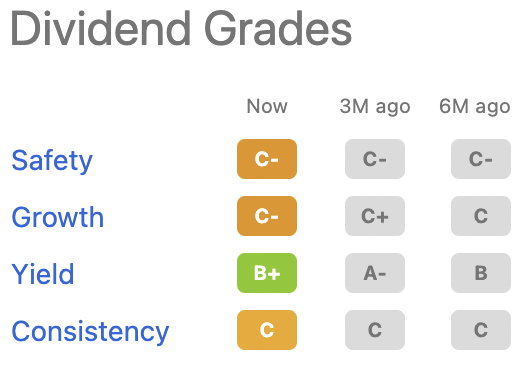

A Good Asset Manager is on Sale

Invesco (IVZ), an asset manager with $1.5 Trillion in assets under management [AUM], has lost 17% of its value in the past year. It trades at $21, which is close to its 52-week low of $18.42 and offers a reasonable dividend yield of 3.24%. It trades at a GAAP forward P/E of 7.6x compared to its 5-year average of 10.1x and sector median of 11x. Revenue growth is challenging for many asset managers, with negative market returns pressuring assets under management. But, the company saw a month-on-month increase of 1.6% in assets under management and an inflow of $5.3 Billion in March. It has a safe dividend payout ratio of 22% despite an overall “C-” grade for dividend safety from Seeking Alpha (Exhibit 3). It gets the “C-” grade partly due to its “D” grade for a cash dividend payout ratio of 45%. It has good financial performance with a return on equity [ROE] of 15%. Invesco is the home of the famous NASDAQ 100 ETF – QQQ. Invesco is a good asset manager to own for the dividend yield.

Exhibit 3: Invesco’s Dividend Grades from Seeking Alpha

Invesco Dividend Grades from Seeking Alpha (Seeking Alpha)

Great Brand Give Newell Brands its Competitive Moat

Newell Brands is another good dividend yielder on this ETF with a yield of 4.11%. The company can grow its revenue at a low single-digit pace annually, but there is potential for low-priced competition to put further pressure on revenue growth. The company has a lot of powerful brands, and those brands give it a competitive moat (Exhibit 4). The company is valued at a forward EV to EBITDA multiple of 9.49x compared to its five-year average of 11.7x. However, the company’s dividend safety is a concern with its high dividend payout ratio [TTM] of 69% and cash dividend payout [TTM] of 66%. The company offers good financial performance with an ROE of 14.4% and a return on invested capital [ROIC] of 6.15%. Its competitor, Tupperware (TUP), has a lower ROIC of 4%. The company has lost 12% in the past year but has gained 4.8% in the past month.

Analysts are expecting the company to earn $1.90 per share in 2022. It would give the company a P/E of just 11.7x, and there have been seven upward revisions to EPS estimates in the past three months and just two downward revisions. The company has excellent products and brands. It should do well in the long term, and you get to collect a good dividend.

Exhibit 4: Newell’s Great Brands

Newell’s Great Brands (Newell)

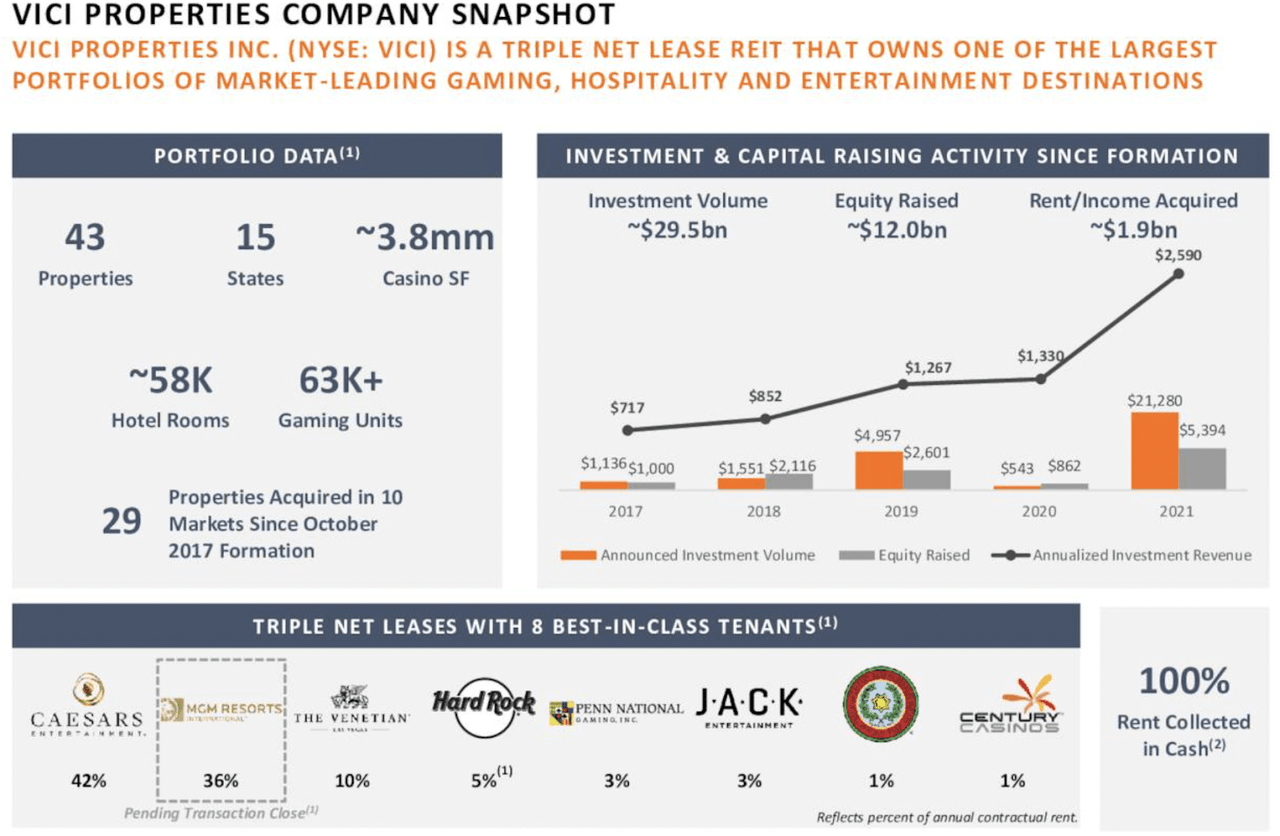

Is VICI Properties a Sure Bet?

VICI Properties is a triple net lease real estate investment trust [REIT] that has risen 5.9% in the past year. VICI owns 43 properties in 15 states in the casino and entertainment real estate segment, with Caesars Entertainment (CZR) as its largest tenant (Exhibit 5). It has done well in the past month, giving a 10% return. It has a forward dividend yield of 4.95%. It is trading at a price to adjusted funds from operations [AFFO] multiple of 15.1x, while the sector median is 18.9x. Analysts’ expectations for funds from operations [FFO] are mixed. They have downgraded VICI’s funds from operations [FFO] expectations five times in the past 90 days.

The gaming, hospitality, and entertainment sectors are slowly recovering from the disruption caused by the COVID-19 pandemic. Caesars Entertainment – the largest lessee of VICI Properties – reported total occupancy rates of 86% and 94% weekend occupancy for Q4 2021. They are also beginning to see business conventions return to Las Vegas. Business conventions returning to Las Vegas is good news for Caesars and VICI Properties.

The consumer is in a solid position coming out of the lockdowns induced by COVID-19. I expect this strength in demand for in-person entertainment and gaming to continue throughout the year. Brian Moynihan provided an excellent example illustrating the consumer’s power in the Q1 2022 earnings call. He said that customers who had an average balance of $1,400 pre-pandemic now have an average balance of $7,400. Customers who had an average balance of $3,250 pre-pandemic now have an average balance of $12,500. Consumers have higher savings and are eager to travel and spend money, which should help gaming and entertainment report solid sales and earnings in 2022. The strength of the consumer should help VICI Properties to continue collecting its rent and put out significant profits. VICI Properties is a good bet for 2022.

Exhibit 5: VICI Properties Looks Oversold in the REIT Space

VICI Properties Looks Like an Interesting REIT (VICI Properties)

Hanesbrands Looks Oversold

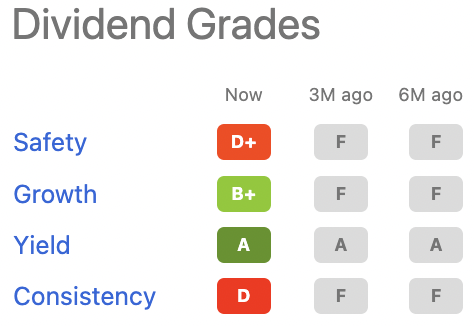

I agree with Seeking Alpha contributor – Gen Alpha – that Hanesbrands is too cheap to ignore. It is among the worst performers in the top holdings in the Vanguard Small-Cap Value ETF, having lost over 25% of its value in the past year. It offers a dividend yield of 4.2% and gets an “A” grade for dividend yield from Seeking Alpha (Exhibit 6). It trades at a forward EV to EBITDA multiple of 7.9x versus its five-year average of 9.8x.

Analysts expect the company to earn $1.76 per share in 2022. That would give it a forward P/E multiple of 8. The company is focused on strengthening its balance sheet and has reduced its leverage ratio below 3x. The company is looking to maintain a net debt to EBITDA multiple of between 2-3x for the long term. Hanesbrands has announced a three-year $600 million share repurchase plan. The company expects revenue growth at a CAGR of 6% and adjusted EPS at a CAGR of 9% over the next three years [2022 to 2024]. Hanesbrands is trading cheaply; it owns many great brands, including Champion, and is strengthening its balance sheet, doing share buyback, and offering a great dividend. Hanesbrands is an excellent stock to hold for the long term.

Exhibit 6: Hanesbrands Dividend Grades from Seeking Alpha

Hanesbrands Dividend Grades from Seeking Alpha (Seeking Alpha)

Old National Bancorp vs. Valley National Bancorp

Old National Bancorp and Valley National Bancorp (VLY) are both in this ETF, with Old National Bancorp losing 18% of its value and Valley National Bancorp losing 8% of its value in the past year.

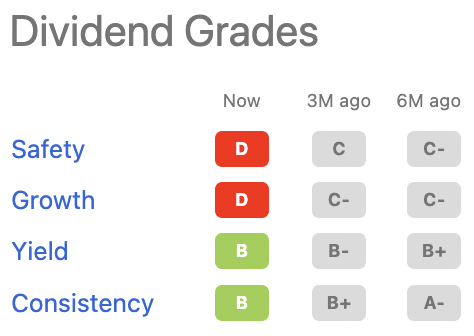

Old National is a mid-western bank that has just completed its merger with another mid-western bank – First Midwest. The two banks do not have much overlap in their markets, and that should aid in integrating the operations. The bank trades at a forward price to book multiple of 0.8x. It is expected to earn an EPS of $1.58 in 2022, giving it a P/E of 9.6x. Analysts have mixed feelings about this bank, with three upward and three downward revisions to earnings estimates for the year. This Seeking Alpha contributor – Stephen Simpson – has mixed feelings about this bank, but he thinks Old National Bancorp may be undervalued. Banking is a very competitive business, but Old National is undervalued and offers a decent dividend yield. It offers a dividend yield of 3.6%. However, it gets poor grades on dividend safety and growth from Seeking Alpha (Exhibit 7).

Exhibit 7: Old National Bancorp Dividend Grades from Seeking Alpha

Old National Bank Dividend Grades from Seeking Alpha (Seeking Alpha)

Valley National Bancorp may be fully valued with its forward price to book value of 1x. I am leaning toward Old National only because it is slightly undervalued compared to Valley National. It offers a dividend yield of 3.5%. It gets similar dividend grades from Seeking Alpha with poor grades for safety and growth compared to Old National.

These are five good dividend payers from a diverse set of industries in the Vanguard Small-Cap Value ETF, which have underperformed in the past year. Invesco is a good asset manager that is on sale. Hanesbrands is a unique player in both the innerwear and activewear category in the consumer discretionary. Newell Brands has dominant brands in wide range of categories, from home appliances to outdoor and recreation, that can be good long-term holding in a portfolio. VICI Properties is a REIT that is benefitting from a recovery in gaming and entertainment. Finally, Old National Bancorp is a regional bank that may be undervalued. It is working on integrating its First Midwest acquisition and offers a good dividend for a patient investor.

Be the first to comment