Portra/E+ via Getty Images

Hudson Pacific Properties (HPP) is a real estate investment trust which focuses on acquiring, repositioning, and developing high-quality office and state-of-the-art studio properties in the high-growth & high barrier to entry market. Currently, the company owns approximately 98.4% of the operating partnership, up significantly from FY 2015, when it had just 61% of the total partnership. The company’s portfolio includes office properties comprising an aggregate of approximately 15.8 million square feet, studio properties comprising about 1.5 million square feet, and some supporting production facilities.

Additionally, due to its high rental income-yielding properties, which have been generating significant cash flows even in the current adverse economic conditions, the company has been able to generate substantial cash flows. Also note that the company has been paying significant dividends since its inception. Even in H1 2022, where many Office REITs are facing considerable trouble with their cash flows and dividend payments, the company has paid about $85 million in dividends.

Furthermore, since its IPO in 2010, management has acquired significant properties while keeping debt and equity structure at moderate levels. That is the reason why, over the period, significant value has been generated for the shareholders.

The current inflationary environment and recent debt maturity have created negative sentiments about the company. As a result, the stock price has dropped more than 68% over the last 12 months, despite a robust business model. At this price, stock gives long-term investors an attractive opportunity to enjoy a high dividend yield and a significant upside potential with a minimum risk of permanent capital loss; in my view, Hudson properties is a strong buy.

Historical Financial Performance

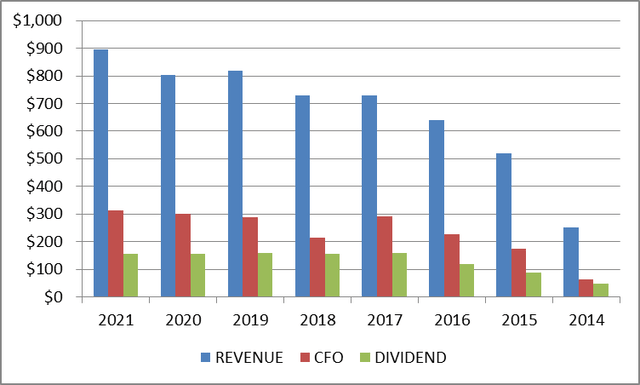

Financials (In Million Dollars) (author )

Over the last 12 years, revenue has grown more than five times, with a consistent year-over-year growth, led by strategic acquisitions, such as the acquisition of EOP Northern California Portfolio in the year FY2015. Those initiatives have helped the company to grow its overall asset base. Along with that, the revenue growth has significantly exceeded the overall percentage of equity dilution, which is the reason why the stock has soared more than 166% from the low of 2012 till the year FY2020.

Moreover, over the period, the company’s asset base has grown more than eight times, which seems a substantially strong performance in the office REIT industry. Also, in recent years, management has reduced the percentage of dividend payments with the aim of retaining the cash flow to acquire new businesses and properties; those acquired businesses are contributing significantly to the growth of the HPP. Over the period of time, debt has kept at moderate levels, which is below 50% of the total assets. It seems that management has been acting conservatively and doesn’t want to expose the company to high-risk situations.

For the last four quarters, the company has been generating record-high revenues, and as the share price is falling significantly, management is using generated money to buy back the shares, which shows that management is decisively working to create shareholders value.

Strength in the business model

Since its IPO, HPP has generated huge cash flows and has paid a significant dividend. There lies significant strength in the business model, which has enabled the company to grow its asset base more than eight times, along with the significant growth in FFO, which has outperformed the industry average significantly and has created huge value for the shareholders.

High Barrier to entry

One of the major competitive advantages that the company has been enjoying is its operations in high barrier-to-entry markets, where HPP faces generally low competition as compared to other places, and with the high demand for its properties, the company doesn’t face any major trouble obtaining tenants on time and at the reasonably attractive rates, that’s the reason why over the period company has been enjoying good occupancies (in 2015 occupancy dropped due to the new acquisitions). And because of this strong advantage, the company could be able to generate significant cash flows. Along with that, the company focuses on the markets where there is significant growth potential, and from these focused strategies, it seems that management wants to create a strong business model and has been focused on long-term value creation.

Strong tenant base

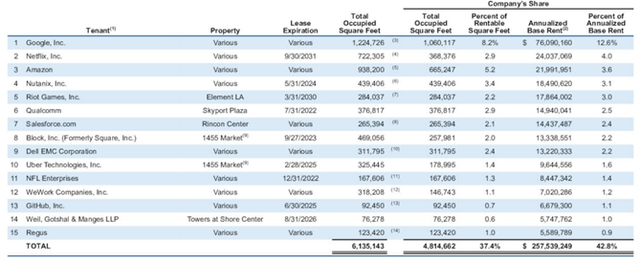

Tenant base (Quarterly report)

As of June 2022, the 15 largest tenants in the HPPs office portfolio represented approximately 42.8% of the Company’s share of total annualized base rent generated by the office properties. company’s three largest tenants are Google, Inc., Netflix, Inc., and Amazon, contributing a significant part of the company’s rental income. Such a strong and financially stable customer base gives the company an edge and helps it keep a steady rental income even in adverse economic conditions.

Strong capital structure

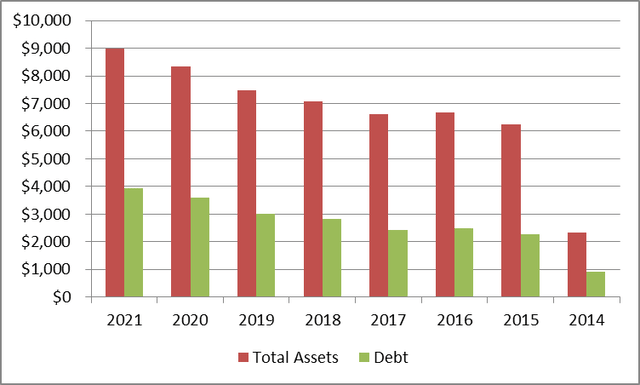

Financials (In Million Dollars) (author)

Since its IPO, HPP has remained well-capitalized and maintained a growth-oriented and conservative capital structure. Despite significant growth in the business, debt levels have been managed very conservatively. Over the last 12 years company came up with 17 offerings with an aggregate proceed of about 5.2 billion.

Also, significant cash reserves and a cash retention strategy provide HPP with substantial capital to pursue acquisition and execute growth strategies while keeping a conservative capital structure. Access to capital and a conservative capital structure gives HPP a significant advantage over many of its competitors.

Risk

The anticipated risk of permanent capital loss seems low at the current market price, but various factors could affect the stock price in the upcoming quarters.

Recent debt maturity

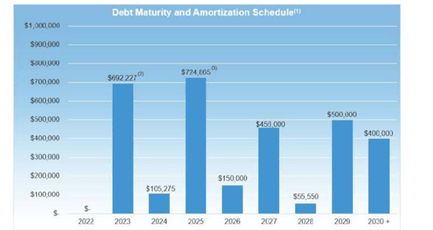

Upcoming Debt Maturity (annual report)

Going ahead, in FY 2023, the company has more than $690 million of debt due, which has brought significant fear amongst investors. And due to the current adverse economic environment, many strong REITs have been facing substantial problems in renewing debt facilities, which has affected the whole REIT industry sentiments; in such conditions, the company might face trouble renewing debt, which might affect the company’s financials. Also, the refinanced debt might bring significant interest costs for the company.

But, the investor must consider that company’s financial strength is substantially strong and has been producing significantly higher FFO, along with that it has retained its credit ratings at BBB- for a long time; by considering these points, it seems that HPP will be able to refinance its debt, but interest rates on new debts might increase significantly.

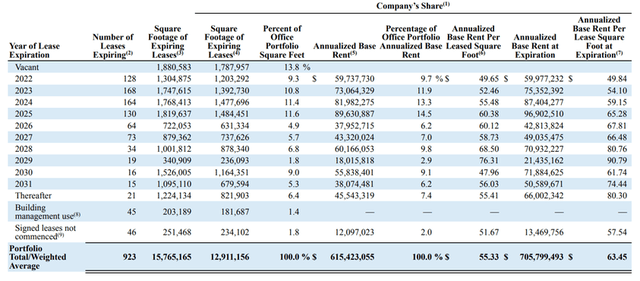

Lease maturity

lease maturity (quarterly report)

In the next 2 years, a significant part of the lease is going to expire, and the company might face trouble renewing the lease agreement at a reasonable price, which might reduce its FFO in upcoming quarters, and to refinance its matured debt at a reasonable interest rates company will require strong FFO.

The company’s ability to sign new lease contracts at a reasonable price and ability to obtain debt refinancing at affordable cost becomes the key factors that will determine the stock movement going ahead.

Recent developments

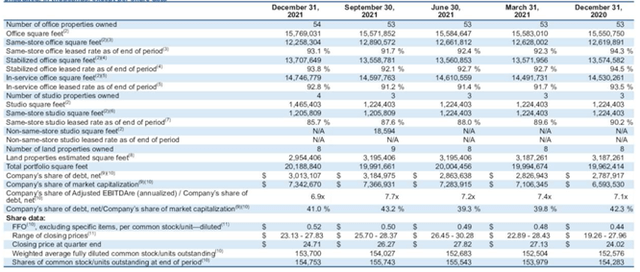

Quarterly financials (Quarterly reports)

Significant growth in FFO has been seen in the last few quarters. Recent acquisitions, along with strategic buyback of common shares, have created huge value for the shareholders.

In the second quarter of FY2022, the company’s FFO was $74.6 million or $0.51 per diluted share against about $74.4 million or $0.49 per diluted share in the same quarter of FY2021. Along with that, full-year 2022 FFO guidance of more than $2 per diluted share.

Cash rents were up 16% with an occupancy rate of 90.8%, and have lease proposals for about 55% of the remaining 2022 expiration in the service office portfolio. for the upcoming period, management sees robust demand for Class A office, high-quality stages, support space, and production services.

In this quarter company signed over 700000 square feet of new and renewal office leases and also successfully extended contracts with some of its important tenants; as for the upcoming expiries, the company has been putting much more effort to be competitive and has been working on lease renewals.

Along with that company has some of the properties in the developmental phase, like sunset Glenoaks and Washington, which will be completed in 2024, and currently, HPP has received planning approval for its two projects, which according to management, upon stabilization, will produce significant cash flows.

Conclusion

Despite adverse economic conditions, the company has been generating huge sums of money, which is due to its strong business model and conservative capital structure; it seems that due to its strong financial position company could obtain refinancing for upcoming debt maturities and, with time market will realize the company’s intrinsic value, in such case stock will not remain at this price.

Currently, the stock is trading for $10, and according to management, the company will post an FFO of more than $2 for the overall FY2022, reflecting that company has been trading at just five times its upcoming FFO. Whereas the industry average ratio is more than ten times their respective FFO. Along with that, the company’s growth over the period has significantly exceeded the industry average and has a conservative capital structure which has been providing a significant margin of safety. Furthermore, the recent acquisitions will produce considerable cash flow in the upcoming quarters.

In my view, due to the current market sentiments, the stock has become significantly undervalued; I assign a strong buy rating to HPP.

Be the first to comment