SvetlanaSF/iStock via Getty Images

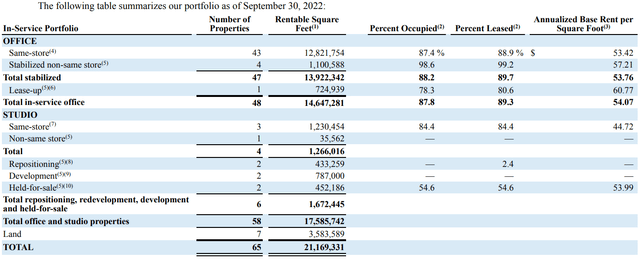

At last count, Hudson Pacific Properties, Inc. (NYSE:HPP) has a 22 million square feet portfolio comprising 53 office, five studio, and seven land properties.

Q3-2022 10Q

The properties are located across Northern and Southern California, the Pacific Northwest, Western Canada and London, U.K. The REIT’s modus operandi is to build a portfolio of properties located in “high barrier-to-entry, innovation-centric submarkets with significant growth potential.” In line with that objective, it’s a leading publicly-traded owner of office space in Silicon Valley, along with being the largest independent owner/operator of studios in Los Angeles. Almost 22% of its annualized base rent comes from tech giants Alphabet (GOOG) (GOOGL), Amazon.com, Inc. (AMZN), and Netflix, Inc. (NFLX). Balance of its top 15 office tenants include a lot of familiar and some downtrodden names.

Q3-2022 Supplemental

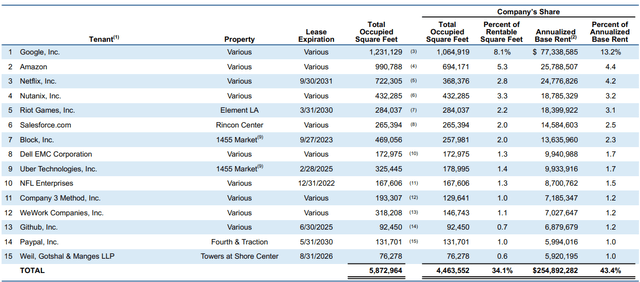

To state the obvious, the last few years have not been kind to office properties and that’s reflected in the total return of this primarily office REIT.

HPP’s 25-cent quarterly dividend payments remained unchanged through all the turbulence and now it yields close to 9%. Let us review the recently released Q3 results to gauge whether this is an opportunity to buy or continue to standby.

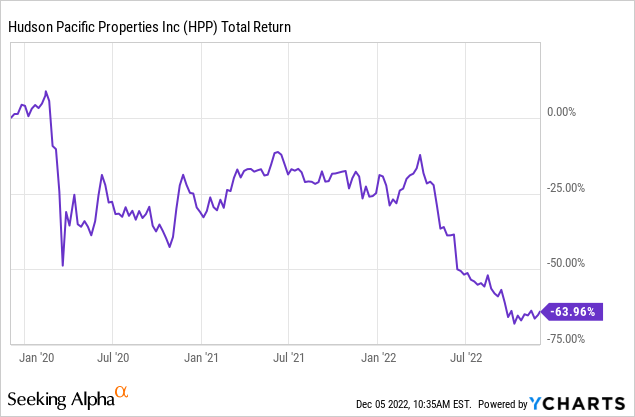

Q3-2022

HPP’s Q3-2022 highlighted the many challenges that are facing office properties. The REIT executed 65 new and renewal leases totaling 381,364 square feet with cash rents increasing 3.4% from prior levels. Those leases still caused a slippage in same store office occupancy, which dropped off from 92.2%, down to 88.9%.

Q3-2022 Supplemental

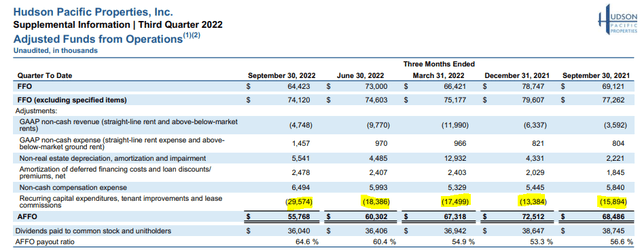

To retain tenants and sign new leases, HPP’s tenant incentives were quite strong with almost $30 million being spent to lure tenants. This is double that of what it spent in the same quarter last year.

Q3-2022 Supplemental

That drove up HPP’s adjusted funds from operations (AFFO) payout ratio to 64.6% from 56.6% a year earlier. We will note here that HPP’s AFFO calculation is far better than what we see in many REITs which don’t remove tenant incentives and recurring capital expenditures from AFFO numbers. The company was also very active in the capital markets with multiple transactions being completed during the quarter.

Q3-2022 Supplemental

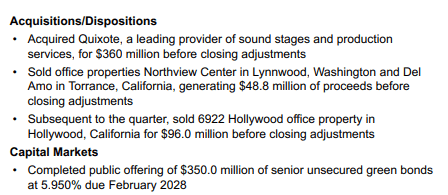

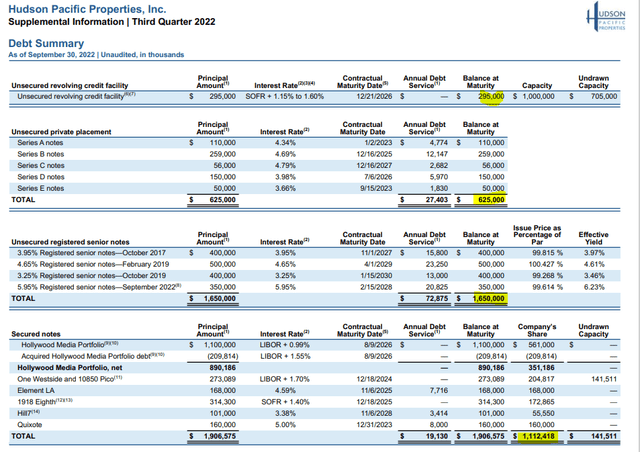

HPP’s debt to adjusted EBITDA rose to 7.7X but that came primarily via the Quixote acquisition. That purchase may seem a bit odd to investors and management addressed it in their conference call.

In the third quarter we acquired Quixote, a leading stage and production services provider, which was a key component to our strategy to build a premier full service global studio platform. With its combination of stage lease rights, production gear and vehicles, Quixote further enhances our ability to capitalize on robust production spend on and off our own Sunset Studio lots. Quixote is also a strong complement to our purchase of Zio Services as well as Star Waggons last year. With the closing, our studio segment now comprises of approximately 13% of our NOI, with only one month of contribution from Quixote. If we pro forma that. back to the start of the year, that number would be 15%.

Source: Q3-2022 Transcript

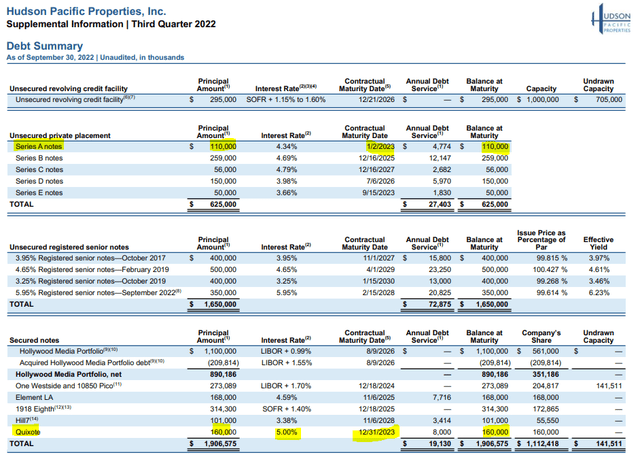

The decision to add debt was interesting to say the least, but HPP does have adequate liquidity ($951.7 million according to management) to do it at present. Debt maturities are not pressing either and only $270 million comes due in the next 12 months.

Q3-2022 Supplemental

The company should be able to generate about $150 million in AFFO after dividends in the next five reported quarters, so that creates additional buffer alongside the room on the credit facility.

Outlook

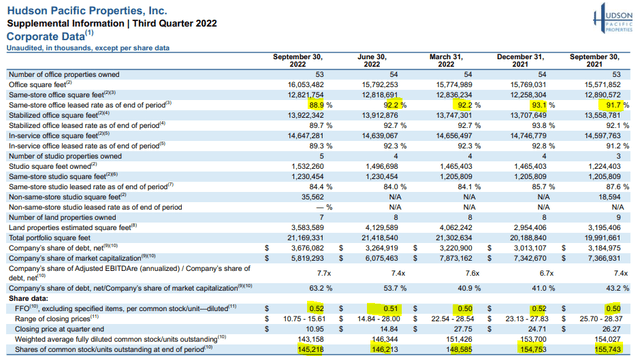

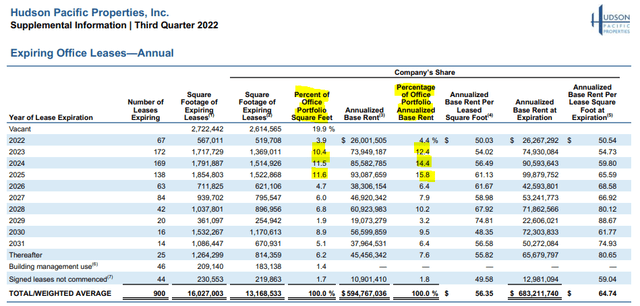

While the immediate future is not a pressing concern, like all office focused REITs, investors have closely scrutinized the lease expiration schedule.

Q3-2022 Supplemental

Over the next three years, about a third of owned square feet and approximately 40% of the base rent, comes up for renewal. Keep in mind that about $410 million of the total $ 683 million base rent comes from the San Francisco area. That’s going to be the tough sell to any investor.

As Michelle Tandler and many others have captured, the downtown area looks like a ghost town, even at 9.00 am on Monday morning.

Michelle Tandler-Twitter

Below are some more pictures with the important question.

Michelle Tandler-Twitter

Actual physical occupancy of that office space is extremely low today.

According to a new report by the security firm Kastle, San Francisco’s total downtown office occupancy sat at 39% in late September, one of the lowest amounts in the nation despite having seven months since the lifting of mask mandates in March.

Prior to COVID-19, San Francisco’s office occupancy percentage was constantly at or near 100%, with many companies, especially tech firms, fighting for office space. However, following the beginning of the COVID-19 pandemic in March 2020, occupancy free-fell to under 10%. Throughout 2020, the rate struggled to stay above 10% as companies refused to move back into offices because of the high number of restrictions, as well as more companies liking the new remote work setup. This led to downtown businesses, reliant on people coming into the city for work, being decimated as a result.

Source: California Globe (emphasis ours)

So, while it’s easy to get excited with the $2.01 of expected FFO and wonder why you would not buy at a 5X FFO multiple, the threats remain rather extreme.

Verdict

The stock is cheap. 5X FFO is about as beaten down as it can get and the only path is upward. We’re kidding of course to highlight the common irrational thinking we tend to see on such names. Nothing stops something trading at 5X moving down to 3X and you can still take another 40% loss. From a NAV perspective, consensus is that NAV is closer to $30/share (S&P Global). The bull case can materialize if San Francisco shows signs of life and HPP can navigate through upcoming renewals without losing much ground on occupancy. Alternatively, HPP can demonstrate validity of NAV by selling properties at low cap rates and paying down debt. Interestingly, Fitch has maintained the investment grade rating of HPP despite the challenges.

Hudson Pacific Properties, Inc. 4.750% CUM PFD C (NYSE:HPP.PC)

One alternative for investors here is to play the long side via a safer, high-income play. HPP.PC shares had a low yield on par of 4.75%, but thanks to the big price drop, now yield over 8.7%. The case for preferred stock could have been stronger if most or all of HPP’s debt was secured debt. That’s unfortunately not the case.

Q3-2022 Supplemental

Nonetheless the stock does represent an interesting play on just the plain viability of the firm. Obviously, Moody’s (MCO) does not agree with that thinking and recently downgraded preferred shares from investment grade to two notches into junk space.

New York, October 12, 2022 — Moody’s Investors Service (‘Moody’s’) has today downgraded Hudson Pacific Properties, L.P.’s (‘Hudson Pacific’) senior unsecured rating to Baa3 from Baa2. In the same rating action, Hudson Pacific Properties, Inc.’s preferred stock rating was also downgraded to Ba1 from Baa3. The rating downgrade reflects Hudson Pacific’s high financial leverage as measured by net debt to EBITDA (including Moody’s standard adjustments) which remains elevated, as a result of its more aggressive financial policies and debt in its consolidated joint ventures. The outlook is stable.

The stable outlook reflects the REIT’s proven capital access, stable occupancy rates and positive leasing spreads on new and renewal leases.

Downgrades:

..Issuer: Hudson Pacific Properties, Inc.

…. Issuer Rating, Downgraded to Baa3 from Baa2

….Preferred Stock, Downgraded to Ba1 from Baa3

Source: Moody’s

We agree that there are risks here, but if we had to play the bet, we would do it via the preferred shares. While both the common and the preferred yield close to 9%, keep in mind that the common dividends can get cut in a hurry. We have seen this in the office space with SL Green Realty (NYSE:SLG) reducing their dividend by 13%, despite what looked like a sub 60% payout ratio.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment