courtneyk/E+ via Getty Images

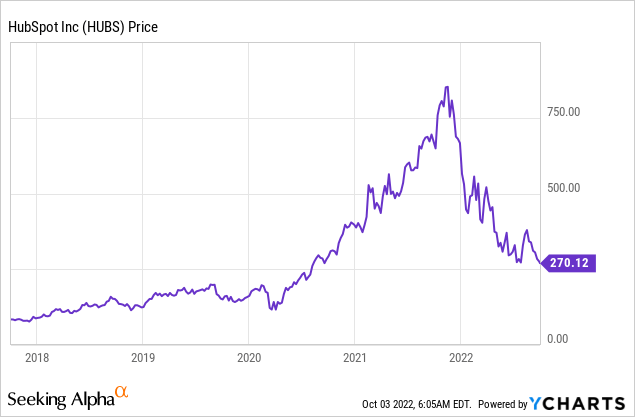

HubSpot (NYSE:NYSE:HUBS) is a leading marketing platform with a strong brand and community around its product. The business focus on actually listening to its customers, which has helped them grow into a marketing king. HubSpot has recently been chosen by RBC analysts as a top software pick coming of a recession, I agree with this thesis. HubSpot has a track record of solid revenue growth, with a 40% compounded annual growth rate since 2014. In addition, the business has a high retention rate and has gradually been improving its free cash flow and profitability. The stock price has been butchered by ~67% from its all-time highs in November 2021. Thus in this post I’m going to break down the company’s business model, financials and valuation, let’s dive in.

Business Model

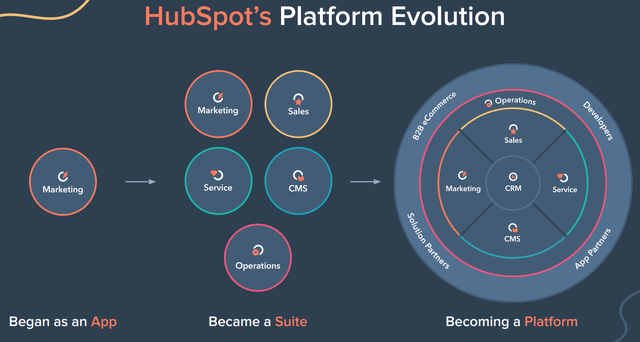

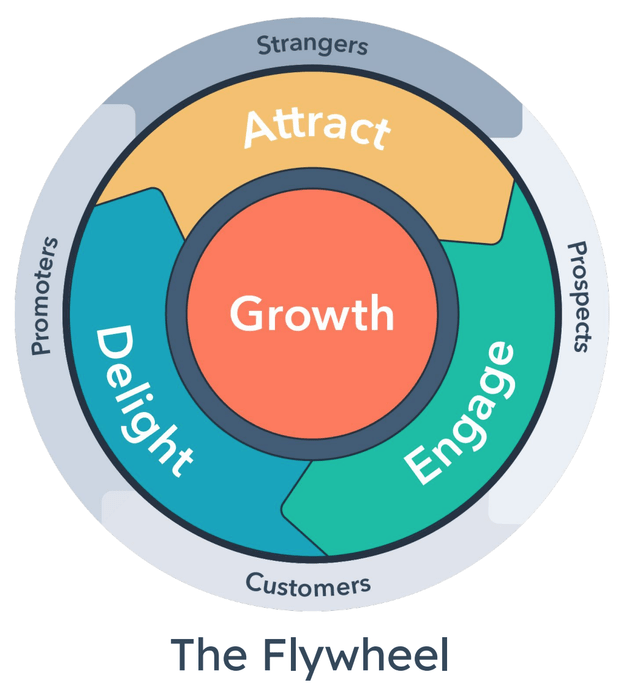

I previously wrote a post on HubSpot which covered its Business model in detail, here is a quick review with new product updates for the second quarter. HubSpot is most famous for its CRM or “Customer Relationship Management” software which basically acts as a database for customer contacts. Salesforce (CRM) leads the CRM industry for enterprises, while HubSpot caters for the small-medium size business. HubSpot combines its CRM with a leading marketing automation platform which was the flagship app of its business. The company even defined a new category by coining the term “inbound marketing“. This involves a value-based approach to “attract, retain and delight” customers. Traditional marketers can think of this as content marketing, but HubSpot created a real buzz around its app. HubSpot is also useful for “Localization marketing” which involves tailoring content to specific regions and geographies. As shown on the graphic below, HubSpot started with marketing and then expanded to sales enablement, customer service, and even operations. Then the platform was further developed to enable integrations with other solutions, developers, and e-commerce and App partners. You can think of this transition as similar to what Salesforce did, except they started with a Sales engine before expanding to marketing, service and analytics.

Hubspot Platform (Investor Presentation 2022)

In the second quarter, HubSpot increased it marketing hub pricing for enterprises as it added more sophisticated functionality. This includes AI-powered AB testing, revenue attribution reporting, and more. This “pricing power” is a key part of HubSpot’s strategy, as they offer a free tier to small businesses just getting started but then grow with the business.

The company also launched its CMS Hub Free, which is a content management system that you can use to build a simple website. Unlike WordPress which is the world’s most popular CMS platform, popular with many blog websites. HubSpot offers its Free CRM (Customer relationship management) database with it. This means customers can build a website and then capture customers in one place. In the first month of launch, HubSpot CMS had nearly 4,000 free signups and saw a 110% increase in marketplace transactions.

Growing Financials

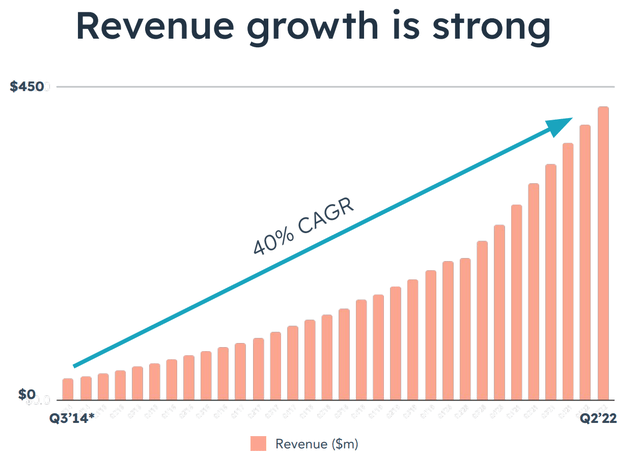

HubSpot generated solid financial results for the second quarter of 2022. Total revenue was $421.8 million, which increased by 36% year over year and beat analyst estimates by $12.4 million. This was driven by strong subscription revenue of $412.4 million, up a rapid 37% year over year. Professional services revenue was $9.4 million, which did decline by 10% but this was actually a positive sign as it represents the lower margin part of the business.

Revenue Growth (Q2 Financials )

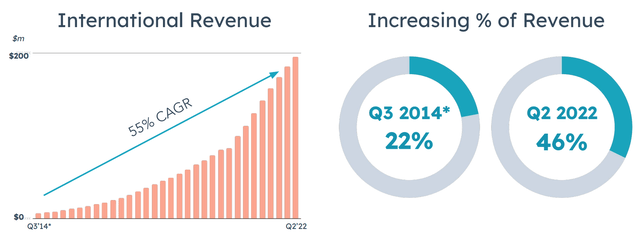

HubSpot has grown its customer base by 25% year over year to over 150,000 customers, with the majority of these being SMB’s and venture-back startups. HubSpot’s multi-product “land and expand” strategy is working well so far, as over 50% of its customers use multiple HubSpot products. The great thing about HubSpot being a marketing platform is they have data on what works for growth and what doesn’t work from many companies in the industry. This allows them to continually improve their strategy, while simultaneously recycling their learnings as general principles for customers. HubSpot actually “talks” to its customers. Small Medium sized businesses have told them they want to do “more with less” and HubSpot helps them to do this with tiered pricing and efficiency improvement tools. Domestic revenue demonstrated consistent growth and popped by 35% year over year. But International revenue was the major growth driver popping by 37% year over year or a rapid 49% on a constant currency basis. A strong dollar impacts international revenue and creates FX headwinds, but it is still nice to see growth in the region. HubSpot can also choose to keep some of its international earnings in local currency and then invest locally to avoid pesky exchange rates. Growing internationally is a key part of the company’s growth strategy. It is working well so far, jumping from 22% of total revenue in 2014 to 46% by 2022.

International Revenue (Hubsport Q2 Earnings report)

HubSpot has also increased its average subscription revenue per customer by 14% year over year, on a constant currency basis, or 10% overall to $11,200. This was driven by increased multi-product or “multi-hub” adoption via upsells to customers.

A great metric to track with SaaS companies is “Deferred revenue” this is a payment from a customer who is still waiting for the service to be provided. For example, when a customer is invoiced for a one-year subscription, that revenue is not technically “earned” yet. It is “parked” on the balance sheet as a “liability” and then “earned” as revenue each month as the service is provided. In this case, HubSpot has $474 million, which is fairly substantially and it also increased by 31% year over year.

Billings are the actual invoice amounts billed to customers, in the second quarter this was $433 million up 30% year over year or 39% on a constant currency basis.

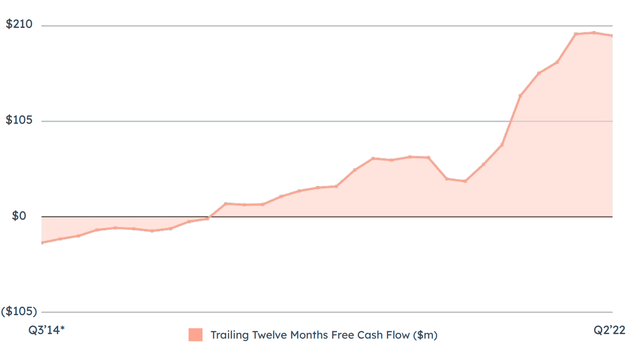

HubSpot has vastly improved its cash flow position over the past few years from negative levels in 2014 to over $200 million in the trailing 12 months. In the second quarter alone, the company generated $22.4 million in free cash flow, which was just ~$3 million less than the equivalent quarter last year.

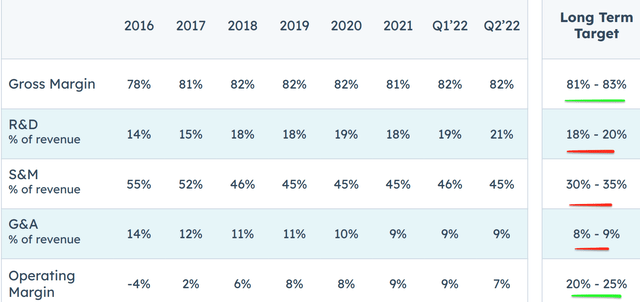

As a software company, HubSpot has a solid gross margin of 82% which increased by 1% year over year. Its Operating margin was 7% which did decline by 2% year over year but this was mainly driven by FX headwinds. Earnings Per Share “Normalized” was $0.44, which beat analyst expectations by $0.02.

HubSpot has a solid balance sheet of $1.4 billion in cash, cash equivalents and short term investments. With $453 million in long term debt of which just $19.4 million is short term debt, due within the next two years.

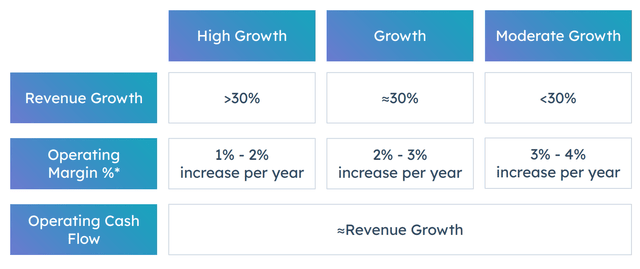

Moving forward HubSpot is balancing profitability with rapid growth. For example, during a “high growth” scenario the business is expecting greater than 30% revenue growth with a 1% to 2% increase in operating margin per year. Whereas during “moderate growth” levels management is forecasting less than 30% revenue growth but a strong 3% to 4% increase in operating margin. In the past few quarters, HubSpot has been firmly in the “high growth” camp with revenue growth well above 30%.

Growth/Profitability Scenario (Q2 Investor presentation)

Long term, HubSpot is forecasting its gross margin to stay between 81% and 83%. While its R&D as a portion of the revenue will stay between 18% and 20%. The beauty of a software company is there are low fixed costs and it is highly scalable. Therefore, we can expect high operating leverage over time. For example, the business is expected to see improving efficiencies in its Sales and Marketing costs. These are expected to make up between 30% and 35% of total revenue long term, down from the 45% level currently seen which would be a stark improvement. In addition, a long-term operating margin of 20% to 25% forecasted would be solid for the company.

Hubspot financials (created by author Ben at Motivation 2 Invest)

Advanced Valuation

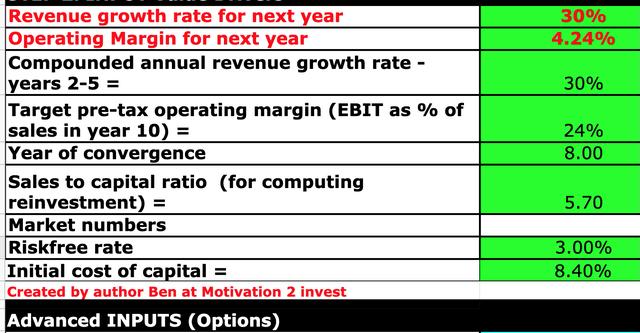

In order to value HubSpot, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 30% revenue growth per year, over the next 2 to 5 years which is fairly conservative and would represent a “moderate” growth scenario.

Hubspot stock valuation 1 (created by author Ben at Motivation 2 Invest )

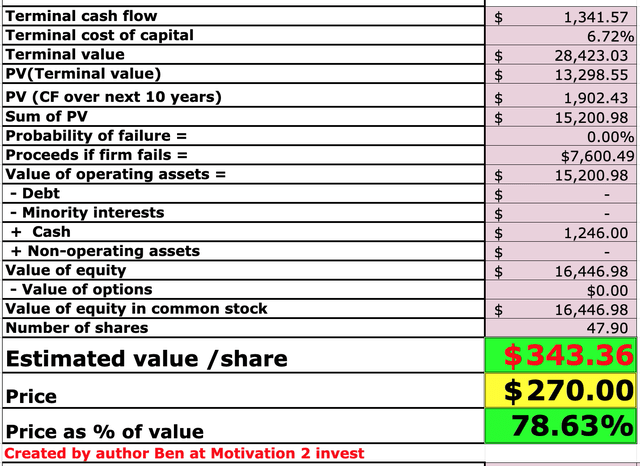

I have also forecasted the business to continue to increase its operating margin, as per the business’s long-term target to 24%, over the next 8 years. It also should be noted that a 23% operating margin is the average for the software industry, thus these estimates look to be very reasonable, given its upsell model. To increase the accuracy of the valuation, I have also capitalized R&D expenses.

Hubspot stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $343 per share, the stock is trading at $270 per share at the time of writing, which means the stock is 22% undervalued.

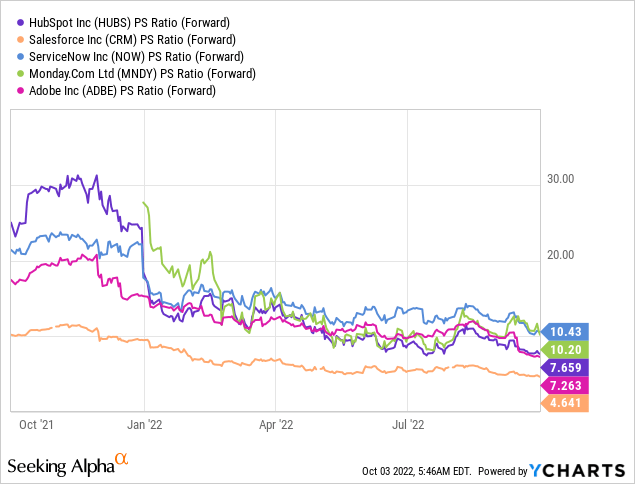

As an extra data point, HubSpot trades at a Price to Sales ratio = 7.6 which is 44% lower than its 5-year average. Relative to other SaaS companies, HubSpot is trading at a mid-range valuation, as you can see from the chart below.

Risks

Recession/Longer Deal Cycles

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. I personally believe that even if a “recession” wouldn’t occur naturally the negative news cycle is already impacting the consumer and causing lower spending. In HubSpot’s earnings call, management highlighted they are seeing “lengthening deal cycles” and more decision-makers involved in each deal.

High Startup Exposure

HubSpot also has high exposure to small businesses and startup companies which could be a risk, given the majority of startups tend to fail, especially during an economic downturn. For example, even the world’s greatest Venture capital firm Kleiner Perkins, which backed companies such as Amazon and Google in the early days has an investment failure rate of ~45%. Venture capital firms tend to spread their bets and usually, one or two great “10X” investments make up for a whole lot of failures. I look at a recessionary economy as a rough sea, small businesses are like little boats which definitely feel the waves crash more than large ships.

Competition

SaaS platforms are getting easier to develop and thus the industry is becoming more competitive. Salesforce and Adobe dominate the enterprise, while HubSpot has found its niche in the SMB market. However, there are some review websites which criticize HubSpot’s pricing structure which steeply increases after the free plan. Other alternatives with a better pricing structure include Active Campaign, Freshsales, Zoho, etc.

Final Thoughts

HubSpot is the king of marketing for small and medium-sized businesses. Its strong brand, community, and data at as a competitive advantage. In addition, the company has a solid track record of great financial performance and this is poised to continue in the future. The stock is undervalued intrinsically and relative to historic multiples, thus I believe this could be a great buy for the long term.

Be the first to comment