Filip_Krstic/iStock via Getty Images

Overview

HubSpot (NYSE:HUBS) is a CRM (Customer Relationship Management) software-as-as-a-service company. The software can be called freemium in that it leverages a slimmed-down free product to drive customer adoption. It then monetizes through one of several subscription offerings across its platform, with services for sales, marketing, and customer service. These are each offered independently and as part of one of several bundles that the company provides.

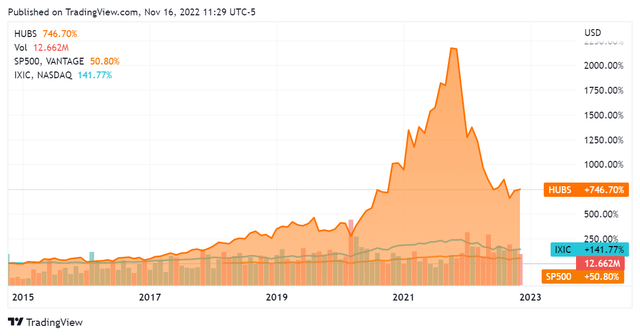

Founded in 2006, HubSpot has seen rapid growth and entered the public markets via an initial public offering in Q4 2014. The stock has seen significant appreciation since then, outpacing the SP500 & NASDAQ indices by a significant multiple:

SeekingAlpha.com HUBS 11.16.22

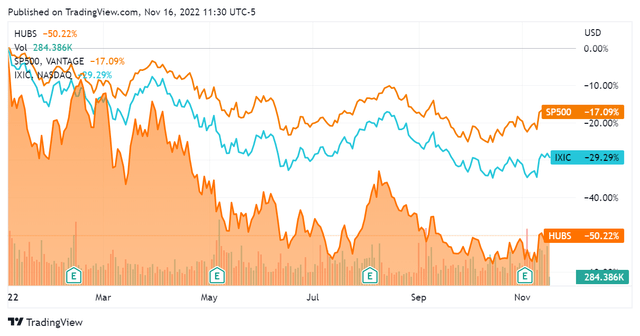

Appreciating ~13% after its latest earnings report, HubSpot remains far below either index YTD.

SeekingAlpha.com HUBS 11.16.22

This article will look into HubSpot’s financials and other business metrics to determine if it presents an opportunity for investors on a fundamental basis.

Earnings & Financials

HubSpot came out strong for its Q3 2022 performance, beating consensus on non-GAAP EPS by $0.18 (EPS of $0.69) and on revenue by $17.89M (quarterly revenue of $443.96). This represented 38% year-over-year growth on a constant currency basis. Additionally, the company added 8,000 customers to bring it to a total of 158,905 – a 24% year-over-year growth. Notably, this customer base is distributed across 120 countries.

Broadening our scope to include the last 10 quarters, we see that HubSpot has demonstrated consistent revenue growth across this period.

SeekingAlpha.com HUBS 11.16.22

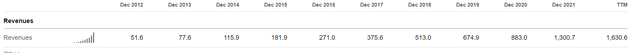

Notably, the 10 year picture reconfirms this steady growth. HubSpot did not miss a bit during the pandemic period, continuing to grow revenues with no downtick.

SeekingAlpha.com HUBS 11.16.22

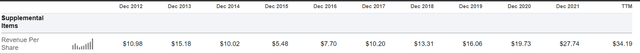

This revenue growth also fed into driving the company’s per-share valuation, with revenue per share consistently growing over the last 5 years. This metric is more volatile prior to that due to standard technology company practice of issuing a large number of shares as equity compensation to its employees.

SeekingAlpha.com HUBS 11.16.22

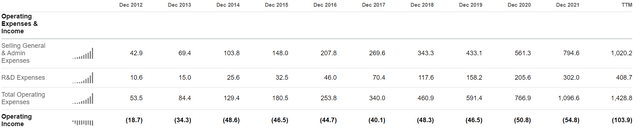

Unfortunately the profitability picture is less exceptional. The company has faced a significant growth in costs along with its revenues across each line item. G&A expenses, research and development expenses both grew in line with revenues, yielding a consistent operating loss that nearly doubled vis-à-vis the 2021 fiscal period on a TTM basis.

SeekingAlpha.com HUBS 11.16.22

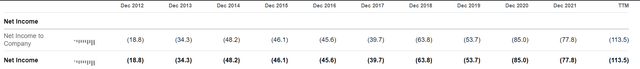

This also flowed through to a negative net income throughout these reporting periods, demonstrating that auxiliary costs also continued to grow for the firm. Notably the trailing twelve months loss on net income has also accelerated on a trailing twelve months basis.

SeekingAlpha.com HUBS 11.16.22

So far I am seeing a fairly standard set of accounting statements for a technology company experiencing double digit revenue growth, and I would be hesitant to come to any hard conclusions on this basis. The cash flow statement will elucidate the picture more clearly, and hopefully we see growth in cash flows irrespective of its increasing cost base.

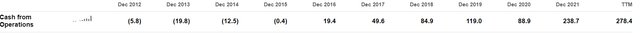

This is indeed the case. HubSpot has scaled cash from operations and has seen this metric be positive since the 2016 fiscal year. Notably, its 2021 showing was particularly strong and the trailing twelve months number is the highest yet. This makes me less concerned about its cost inputs and indicates that it is funneling cash from its business back into its own growth.

SeekingAlpha.com HUBS 11.16.22

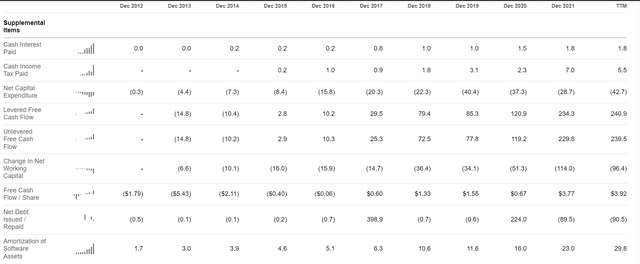

This is confirmed by the company’s ongoing capital expenditure, which is a telling metric for how much a business is investing in itself. The numbers that HubSpot is posting for this are quite high for a software business; along with its high research and development costs, I can infer that it is continuing to build the infrastructure for its product base and also diversifying it. This is confirmed by management on the latest earnings call.

Additionally, we see that HubSpot has actually been a cash flow positive business since 2015. Its free cash flow generation has accelerated every year since then, with 2021 showing a doubling of free cash flow generation as compared to 2020.

Also worth noting is the consistently small disparity between levered and unlevered free cash flow. Since levered cash flow prices in how much cash the company lost to servicing debts, we can clearly infer here that it is not dealing with a burdensome dollar amount of debt service. The cash interest paid per year confirms this, and the number is indeed small relative to its overall revenues and free cash flow generation.

SeekingAlpha.com HUBS 11.16.22

Additionally, the free cash flow per share that HubSpot is reporting has been positive since 2017 and quite robust in 2021. The trailing twelve months cash flow per share is also increasing, which is a strong signal of rising per-share value.

Conclusion

HubSpot is a software company that is continuing to post double digit growth across both customers and revenue. Although it is expending significant costs for this growth, it is and has been cash flow positive for some time. Additionally, it is not overinflating its shares with dilution, seeing a significantly rising per-share revenue and per-share cash flow.

I believe that the the company should pay off well given management’s excellent track record, and this business is sound from a fundamental perspective. Overall I like what I am seeing with HubSpot and I am set on calling it a buy.

Be the first to comment