powerofforever/E+ via Getty Images

Note: All amounts discussed are in Canadian dollars.

When we last covered H&R Real Estate Investment Trust (OTCPK:HRUFF), (TSX:HR.UN:CA) we gave it a bullish rating based on prospects of a multiple expansion. In a market where we found little to like, H&R stood out for value and quality. Specifically, we said,

A 16X multiple on that extremely high quality income stream would get us to a price of $19.20 in five years. 16X is a substantial discount on where both these assets trade today, but even that multiple creates a 46% upside. Now, that may sound less to some, but it is a very healthy rate of return when combined with the 4% dividend yield.

Source: Maintaining A Buy Post Spin-Off

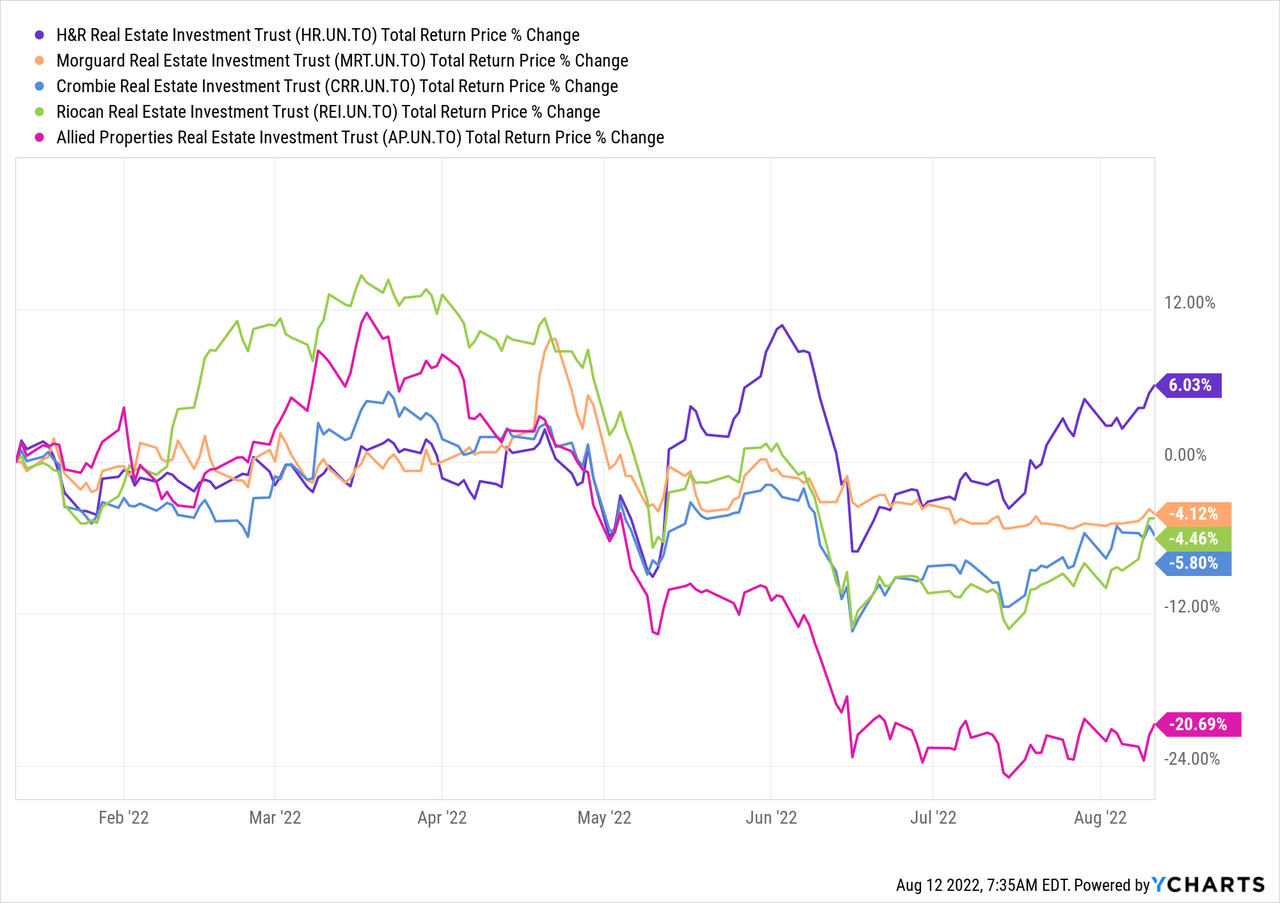

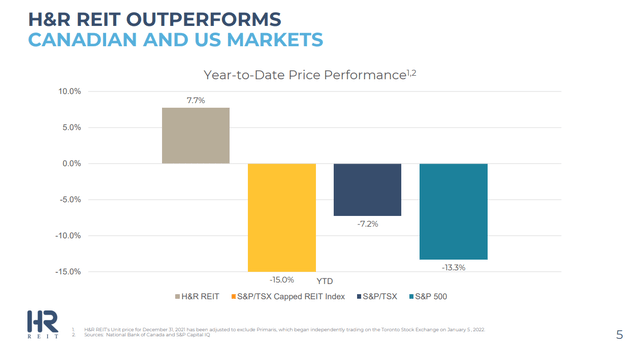

That was followed by a rather large anti-climax as the stock has not moved much. Still, the total return of 6% is nothing to scoff at, considering what the other similar Canadian REITs we cover have done.

H&R has also handily thrashed the broader indices year to date. Note that our price chart above starts from the day of our article on January 12, 2022.

With Q2-2022 results out, we decided to see if this outperformance had a fundamental basis to continue.

Q2-2022

H&R delivered 28.4 cents of funds from operations (FFO) and that was in line with consensus and slightly below where we projected things would come in. Cash distributions for the quarter were at 13.5 cents, representing a very healthy, sub-50% payout ratio. Post Q1-2022, we had noted that H&R had deployed about $175 million during 2022, pursuing buybacks. This continued in a strong fashion, although at a slightly slower pace.

22,125,300 Units of the REIT (“Units”) repurchased since January 1, 2022 under the REIT’s normal course issuer bid (“NCIB”) at a weighted average cost of $12.97 per Unit, an approximate 41% discount to Net Asset Value (“NAV”) per Unit(3), for a total cost of $287.1 million;

Source: H&R Q2-2022 Results Press Release

H&R had the cash flow after distributions to continue buybacks, but it also added to its coffers through aggressive asset sales.

11 properties totaling $238.3 million were sold during the six months ended June 30, 2022; and

4 properties totaling $167.7 million are under binding agreements to be sold.

Source: H&R Q2-2022 Results Press Release

Properties sold were across the spectrum, with residential, retail and office segments involved. Sales overall happened slightly above IFRS values, validating the NAV. Unlike with US GAAP, in the case of IFRS, a “gain on sale” in the income statement is a straight giveaway that management got prices above what they considered fair. One notable and unique transaction was that for the property at Wynford Drive.

In July 2022, the REIT entered into an agreement to sell 100 Wynford Drive, an office property in Toronto, ON including 100% of the future income stream derived from the Bell lease (“Bell lease”) until the end of the lease term in April 2036 to an arm’s length third party, for approximately $120.7 million which approximates the June 30, 2022 IFRS values. Closing of the sale remains subject to certain customary conditions being satisfied and is expected to occur in September 2022. Although the REIT will legally sell the property, the transaction will not meet the criteria of a transfer of control under IFRS 15 Revenue from Contracts with Customers, as the REIT will have an option to repurchase 100% of the property for approximately $159.5 million in 2036 or earlier under certain circumstances. As such, the REIT will continue to recognize the income producing property in the statements of financial position.

Source: H&R Q2-2022 Results Press Release

This “right to repurchase” is very similar to that which we saw with “The Bow” and gives H&R an extremely high inflation call option. Should property values really move up substantially, H&R can buy it back at a fixed price and only lose a modest amount of upside.

Outlook

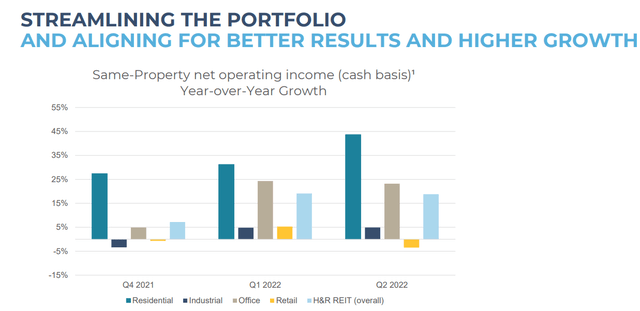

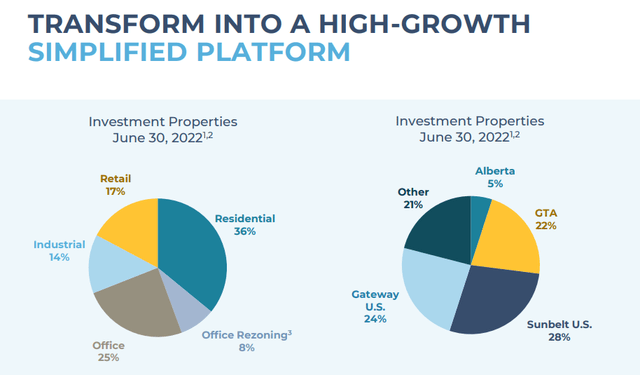

H&R is bringing a lot of residential property space online, and it is coming at perhaps the best possible time.

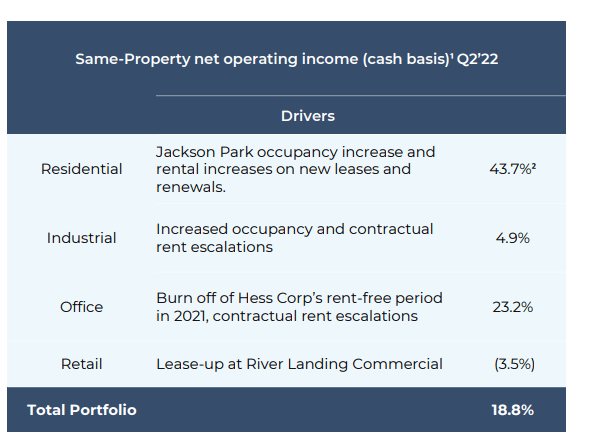

H&R Q2-2022 Presentation

Rents are soaring everywhere, and you can see that in how Jackson Park’s Residential properties are contributing to same property net operating income (NOI). The story has been the same for some time.

This quarter we saw some weakness in retail, but overall, we expect H&R’s quality portfolio to deliver good NOI growth over the next 12 months.

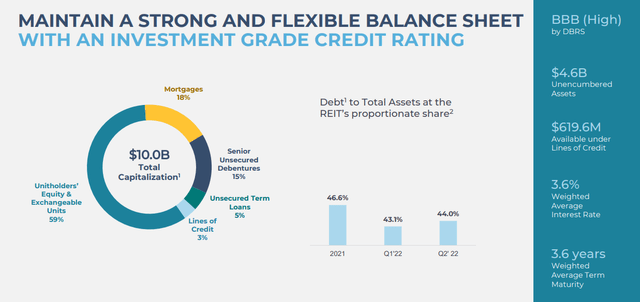

From a valuation standpoint, H&R believes its NAV to be $22.14. Historically, there has been a lot of doubt about these values, especially, with the large Calgary office segment looking “half past dead”. H&R has answered that concern by repeatedly selling assets above its own NAV. This continues to validate the underlying asset value, and this is also getting more credence from the fact that debt has now been reduced to 35% of gross assets. The more debt you have in relation to assets, the more your equity fluctuates if you have miscalculated the asset value. With increasing asset sales and further stock repurchases, H&R is making life very difficult for the bears.

Verdict

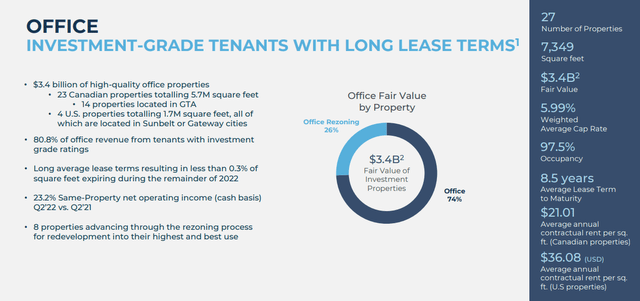

If you believe in the management and the NAV, there are few places where you will get such a good deal. We can hear the “yes, but the office segment” retorts. So far, that has not remotely been an issue, with the company selling assets almost at will. The Bell Canada (BCE) building was perfect in every way, and we will remind investors that it made up 4.7% of total rent. That 4.7% again, is of total rent, not office segment rent. The remaining properties are on solid ground as well, with long-term leases.

There are two negatives here and investors should be aware of these before they jump in. The first being that the weighted average debt term is excruciatingly small at 3.6 years.

So this fits better with those thinking 2% interest rates being the norm longer term, rather than for those thinking we are going to 6%.

The other negative here is that a lot of H&R’s outperformance and NAV jumps can be traced back to the USD strength.

If that reverses, there will be a huge lead balloon to deal with. Overall, we like the company and are maintaining our Buy rating with a $16.00 price target.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment