Kwarkot/iStock via Getty Images

I have been bullish on H&R REIT (TSX:HR.UN:CA) (OTCPK:HRUFF) throughout 2022 and have written two bullish theses. My most recent one I wrote was in October of 2022 and concluded:

This is one of my favorite REITs with management interests fully aligned with shareholders by taking advantage of opportunities to increase book value by selling assets at accretive valuations and repurchasing shares at low valuations. This is a low risk play to realize double digit returns as I maintain my $18/share price target and investors can enjoy the 5% dividend yield while waiting. The dividend is well covered as the FFO payout ratio has been between 45-55% annually.

Source: H&R REIT: Buy On The Dip

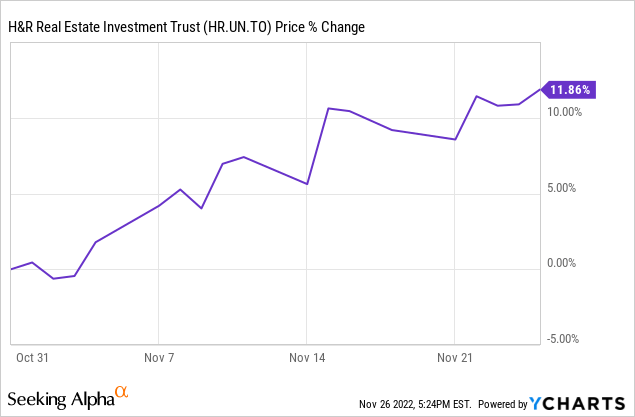

Since last writing the stock has increased ~12% which came on the heels of releasing Q3 2022 results which did not disappoint. Management announced a 9% increase to their monthly distribution starting in January 2023 meaning investors can expect a ~5% dividend yield going forward at the current price of $12.55/share. This may not seem like much but a special cash distribution of $0.40 per was declared to Unitholders as at December 30, 2022 in addition to the dividend increase and 22 Million units have been purchased in 2022.

Q3 2022 Results

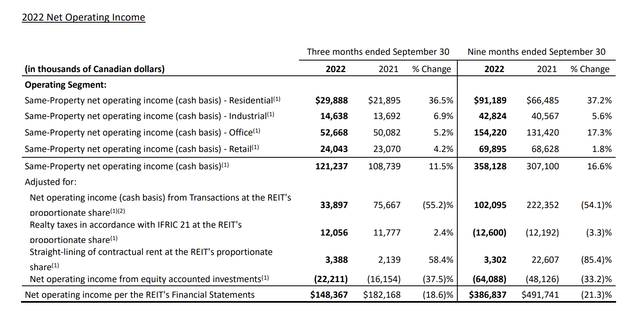

Although 9-month results won’t stack up to 2021 results due to the Primaris REIT (PMZ.UN:CA) spinoff, Same-Property NOI growth is the key metric that should be assessed.

H&R REIT (Q3 2022 Report)

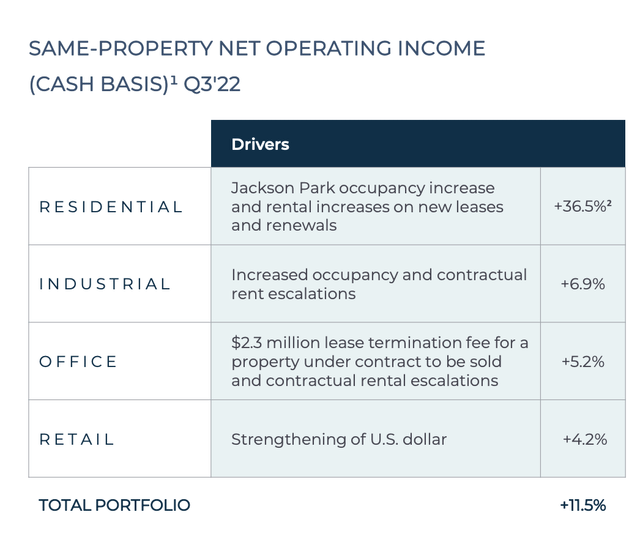

This growth does have to be taken with a small grain of salt as they realized some FX gains on some U.S. dispositions. The REIT also realized a $2.3 Million lease termination fee received in Q3 2022 from an office property under contract to be sold for Hess Corporation (HES) as well as the lease extension and amending agreement entered into by the REIT with HESS in November 2020, where Hess received a seven-month free rent period from December 2020 to June 2021 for its premises in Houston, TX and agreed to extend the term of its lease for an additional term of 10 years beyond its then current expiry of June 30, 2026 which in its absence would have held office Same-Property NOI flat.

On the other hand, residential Same-Property NOI was up 37% as a result of the increase in occupancy at Jackson Park in New York. In addition, the River Landing Commercial space in Miami, FL has reached stabilization and is now 77% leased. The major tenants are the Office of the State Attorney, and Public Health Trust of Miami-Dade County, the latter of which has their commencing in Q1 2023 and will occupy 63,007 square feet. Aside from this most of the increase in NOI has come purely from increased rental rates.

H&R REIT (Q3 2022 Investor Presentation)

Net Asset Value

The strong Q3 results justified management’s decision to increase their reported NAV by ~3% since Q2 2022.

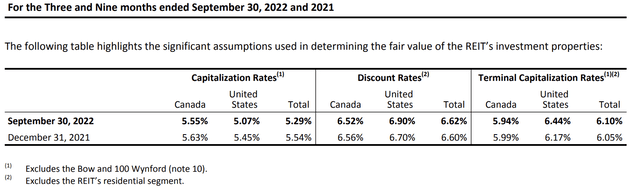

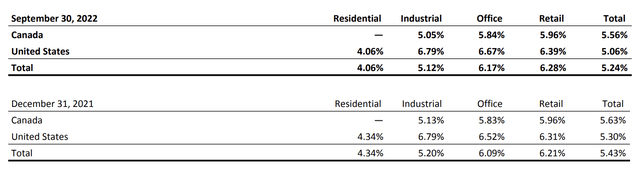

However, speculating on liquidation values of real estate values is filled with many difficulties. While NOI is easy to assess, applying general cap rates on a diverse portfolio of assets is unlikely to be accurate. Management has used rates in line with what you could find in a Colliers or CBRE report but determining where these rates will go in the next 6-12 months is where difficulties lie.

H&R REIT (2022 Q3 Investor Presentation)

Let’s take a look at how to approach NAV.

Annualized Q3 NOI should provide a conservative outlook for NOI over the next couple years. The likely revenue increases will come from increasing occupancy at their JV properties at River Landing, Shoreline Gateway and Hercules Phase 2 (discussed further in previous articles). On the Industrial side two Canadian properties under development in the REIT’s industrial business park in Caledon, ON were substantially completed and transferred to investment properties in 2022. 34 Speirs Giffen Avenue totalling 105,014 square feet, has been leased to Lindstrom Fastener (Canada) Ltd. and 140 Speirs Giffen Avenue, totalling 77,754 square feet, has been leased to Coast Holding Limited Partnership both for a term of 10 years and the leases will commence in December 2022. In addition we should be able to expect modest YoY increases in rental rates.

H&R REIT (2022 Q3 Investor Presentation)

The increases in revenues from these residential and industrial properties will likely be offset in the near term by dispositions in 2022 that include the sale of two Canadian office properties including 100 Wynford, two Canadian retail properties and two automotive-tenanted retail properties in Arizona. In addition, H&R sold a 123,000 square foot single tenanted office property in Burlington, ON for $26.0 million.

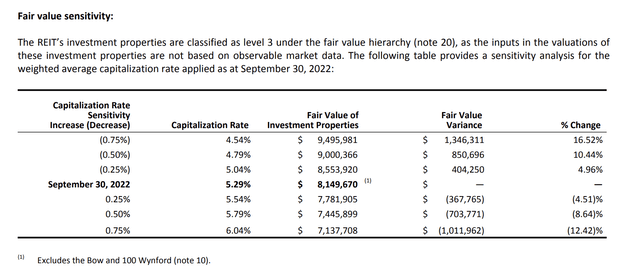

Acquisition activity has been non-existent and all other properties under development or re-zoning are at least 1.5 years away from being accretive. A 5.29% capitalization rate is reasonable even for some of their office and retail space and since residential space should account for a greater portion of NOI in the future this is what I’ll use.

| Real Estate Assets ($148 Million * 4 / 5.29%) | $11,909 |

| Cash | $65 |

| Debt | $5,983 |

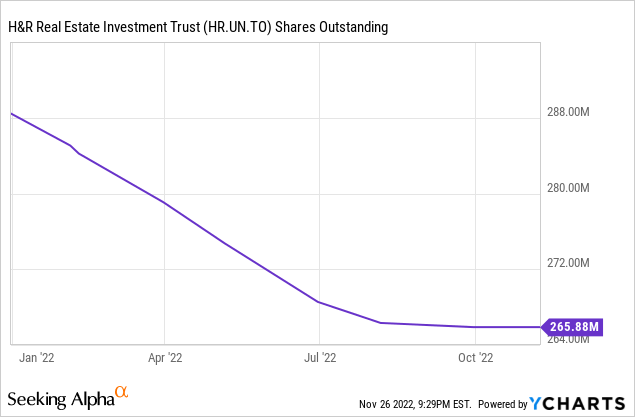

| Units Outstanding | 267 |

| NAV/share | $22.43 |

*Figures in Millions except NAV per share

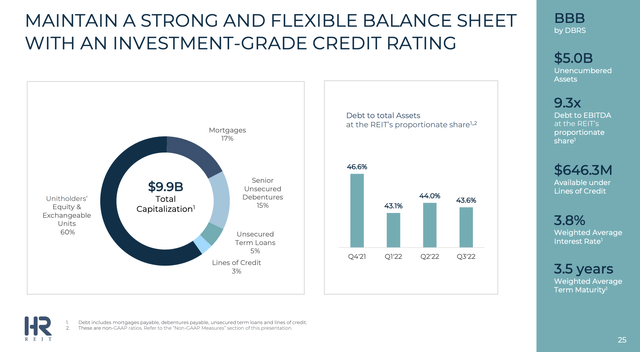

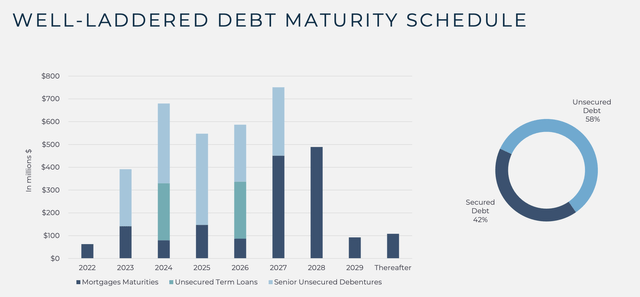

As we can see my estimate is in line with managements, however there is the issue of rising rates in Canada as a result of the hawkish Bank of Canada. Debt to assets is only 34% but the REIT has enjoyed very low interest rates in recent years with a weighted average interest rate of 3.8% which makes low cap rates at ~5.24% cap rates very profitable but become a lot less profitable when refinancing into ~5% rates or even more. The REIT has over $1 Billion in mortgage debt being refinanced over the next two years while realized cap rates have been compressing as a result of the portfolio redisposition into higher class residential assets.

H&R REIT (2022 Q3 Investor Presentation)

H&R REIT (2022 Q3 Investor Presentation)

H&R REIT (2022 Q3 Report)

Based on management guidance even a 100 bps increase in capitalization rates would decrease NAV by only 25% which would still be ~35% above the current market price of ~$12.55/share. Therefore, the possibility of even higher rates in the future does not justify the 44% discount to NAV.

H&R REIT (2022 Q3 Investor Presentation)

Concluding remarks

I still believe this REIT is one of the cheapest on the market and management seems to agree as they have bought back 22 Million shares throughout the year at a weighted average price of $12.99/share (a 42% discount to NAV). As leasing activity picks up on their new residential and industrial properties I expect further increases to the dividend and/or share buyback program which will narrow the discount to NAV. This is extremely feasible as the current payout ratio is only 45% of FFO. I maintain my $18/share price target even in the face of rising rates, but I am happy to collect the ~5% dividend yield while I wait.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment