Sundry Photography/iStock via Getty Images

Introduction

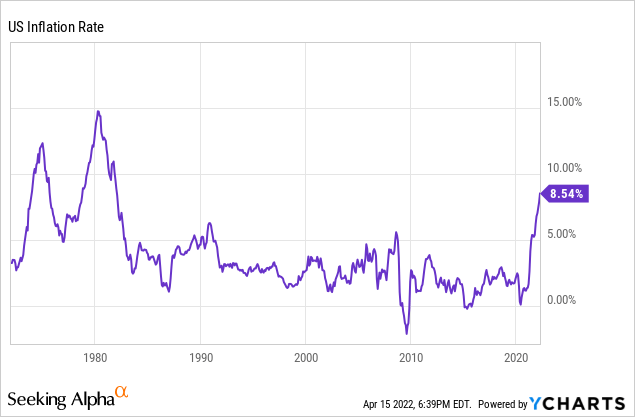

The annual inflation rate in the US accelerated to 8.5% in March 2022, the highest seen since December of 1981, up from 7.9% in February and compared with market forecasts of 8.4%. The cause of the increase in basic goods and services has been energy prices rising 32% from the prior months leading to a 48% increase in gasoline prices. Food prices jumped 8.8%, which is the most since May 1981. All of this largely attributable to Russia’s invasion of Ukraine which we have all heard about and the necessary sanctions imposed by nations.

It is unknown at this point whether these sanctions will last weeks, months or years, but one thing is for certain that rising inflation was going to be a concern sooner or later as a result of worldwide COVID stimulus and persistent supply shortages. The sanctions have only added to these inflationary pressures which seem like they are here to stay.

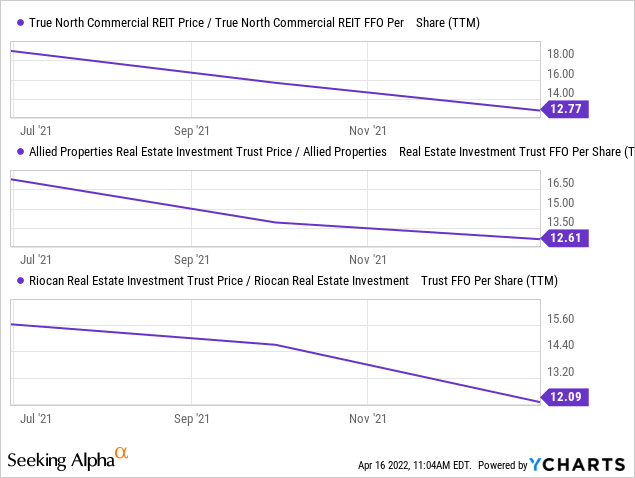

Governments have done an impeccable job at keeping records on inflation, asset prices to compare to periods of high inflation on the other are in limited supply earlier. That being said there are two periods since 1970 where inflation rose higher than 6% for consecutive years. These periods were in 1973-1975 and 1977-1981 which were attributable to the OPEC oil embargos and the Nixon administration attempting to fund the Vietnam War and social programs requiring substantial stimulus that lead to the abandonment of the gold standard.

Although gold had some extremely strong years during this period which gets a lot of hype during periods of high inflation, on a 3-year trailing return basis investors lost a significant amount of their wealth in the eighties as inflation pressures died down. Real estate on the other hand was the best performing asset through these periods when compared to gold, stocks, bonds and commodities. Investors in real estate would have maintained their wealth throughout the eighties as inflationary pressures died down and proved to be a much better “buy and hold” investment between the 1970 and 1990.

There are many ways to buy exposure to real estate including an owner occupied house, or publicly traded vehicles such as REITs or ETFs but this is not the purpose of this article to discuss. The purpose of this article is to present a compelling opportunity in H&R Real Estate Investment Trust (OTCPK:HRUFF) that well positioned to provide returns well above inflation for the next few years.

Although most REITs can perform well during periods of rising inflation, I am a greater fan of residential REITs. Long-term tenants are a plus from a cash flow predictability standpoint but short-term leases can be a plus in periods of rapidly rising inflation as leases can be more easily reflective of rising rental rates and residential REITs tend to have the shortest leases terms of all REITs. Not only that, H&R has been selling much of its office and retail assets to redeploy funds into residential space where they can take advantage of rising lease rates.

Background

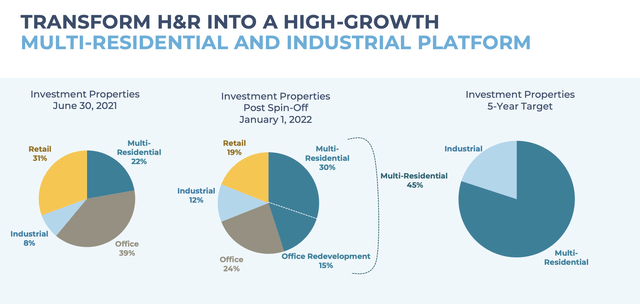

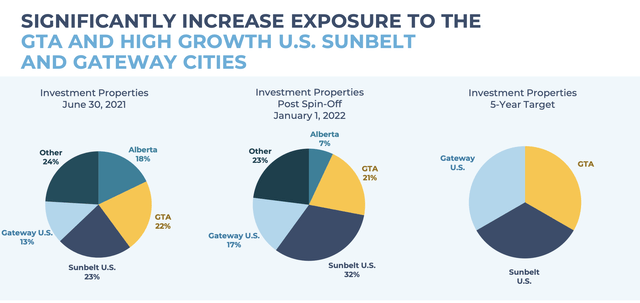

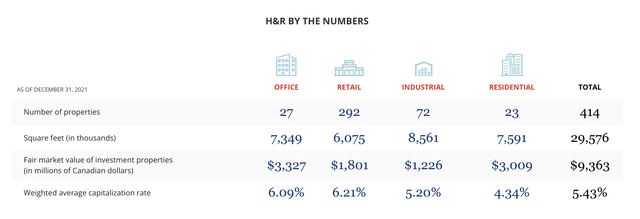

H&R is one of Canada’s largest real estate investment trusts with total assets of approximately $10.5 Billion as at December 31, 2021. H&R has ownership interests in a North American portfolio comprised of high-quality office, industrial, residential and retail properties. H&R is currently undergoing a five-year, strategic repositioning to transform into a simplified, growth-oriented company focusing on residential and industrial properties which was announced in October of 2021. Properties are located in Toronto, Montreal, Vancouver, and high growth U.S. sunbelt and gateway cities.

www.hr-reit.com www.hr-reit.com

In August of 2021, H&R entered into agreements to sell a 100% ownership interest in the land and building of the 2.0 Million square foot Bow office property in Calgary, AB. In addition, H&R also entered into an agreement to sell a 100% ownership interest in the 1.1 million square foot Bell office campus located in Mississauga, ON. Total gross proceeds from these dispositions were approximately $1.47 Billion. The closing of these transactions occurred in October 2021.

In October 27, 2021, H&R announced its intention to spin off its enclosed mall portfolio and together with Healthcare of Ontario Pension Plan created Primaris REIT. Primaris REIT’s scale, portfolio composition and capital structure were designed to allow Primaris REIT to grow and thrive in the new retail landscape. The Primaris Spin-Off was completed on December 31, 2021.

Primaris REIT has substantial scale, a differentiated low leverage financial model and a full service, vertically integrated management platform. Primaris REIT’s board of trustees and management are independent with no overlap with H&R’s board of trustees and management, and operates as a distinct and separate publicly-traded entity. Primaris REIT’s units began independently trading on the TSX under the ticker PMZ.UN on January 5, 2022.

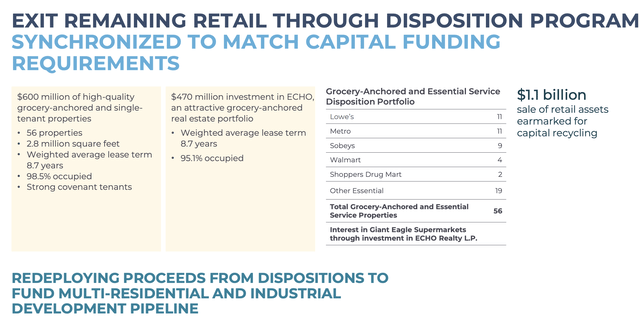

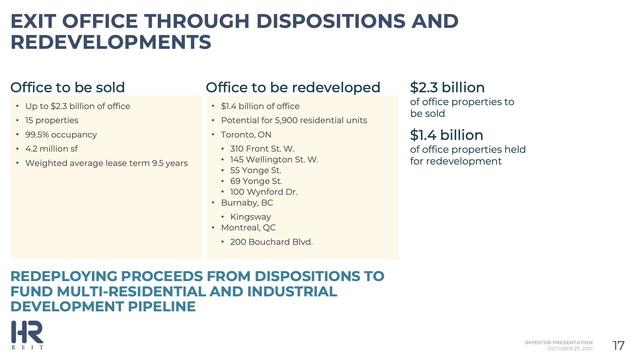

H&R plans to reduce retail exposure by $1.1 Billion. The immediate sales include 56 properties of high-quality grocery-anchored and single tenant properties at $600MM and the $470 Million investment in ECHO, an attractive grocery-anchored real estate portfolio. H&R also plans to sell 15 office space for $2.3 Billion and plans to redevelop $1.4 Billion worth of office space into 5,900 residential units.

www.hr-reit.com www.hr-reit.com

Investment Thesis

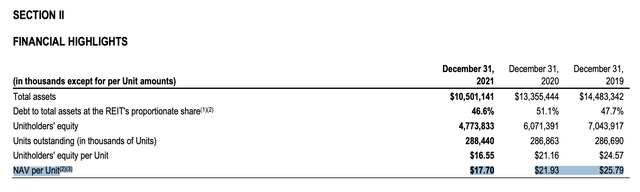

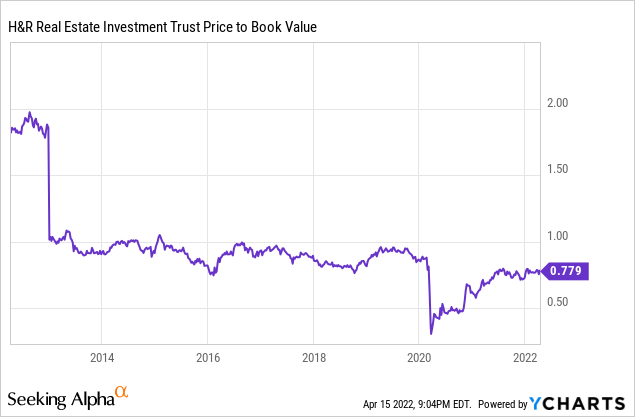

H&R’s NAV is estimated to be at $17.70 post spin-off which is ~35% higher than its current market price which is among the lowest it has been in its history.

www.hr-reit.com

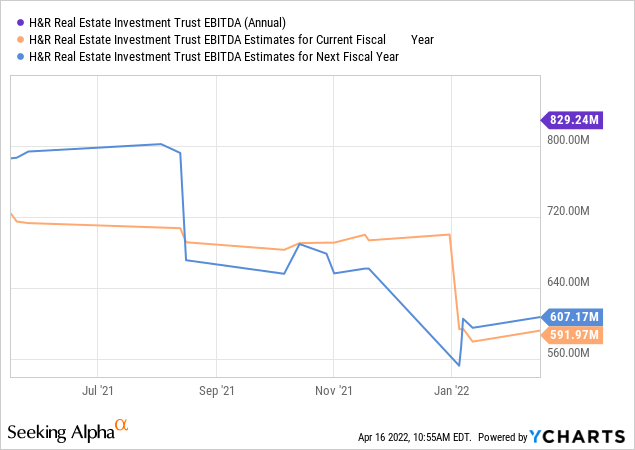

H&R likely trades at a discount to NAV due to the likelihood of reduced profitability as the analyst community expects a ~30% reduction in profitability over the next couple years due to disposition of assets as the Bow accounted for $62MM and the Primaris assets accounted for $116MM in FFO. Investors also don’t like the breadth of asset classes as there is still 58% of assets in the less attractive retail and office spaces (this includes those earmarked for residential redevelopment) and the uncertainty of how quickly and efficiently they can redeploy the capital from the recent dispositions.

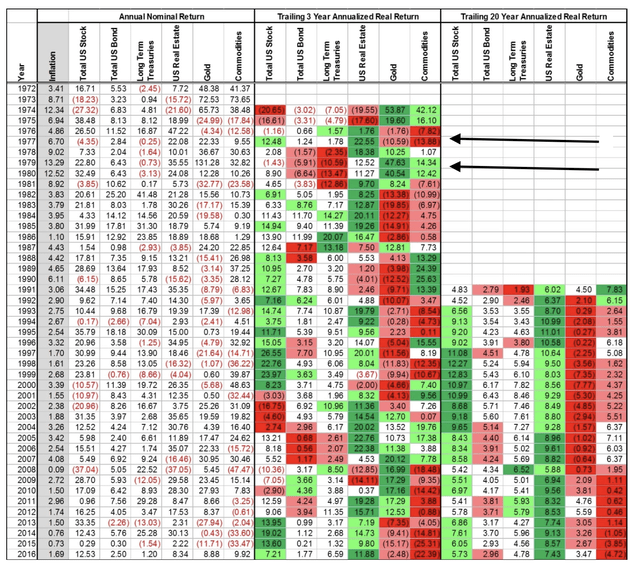

Although profitability will come in less for the next couple of years, there are developments that are in the pipeline as described below. In addition even a 30% decline in FFO would still mean a reasonable 12x FFO multiple for fiscal 2022 which is comparable to many of its Canadian REIT counterparts.

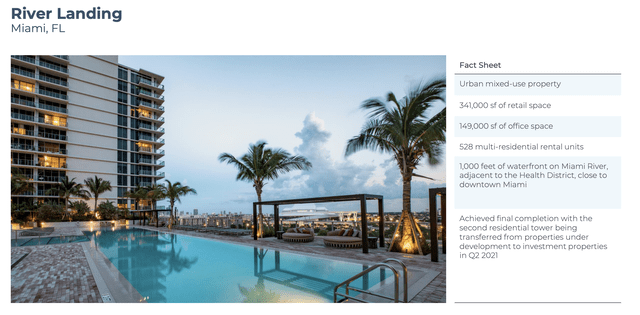

River Landing Development

River Landing is an urban in-fill mixed use property site in Miami, FL which was completed in Q2 2021. River Landing includes approximately 341,000 square feet of retail space, approximately 149,000 square feet of office space and 528 residential rental units. It is adjacent to the Health District with approximately 1,000 feet of waterfront on the Miami River, two miles from downtown Miami.

As at December 31, 2021, residential occupancy was 94.9%, exceeding management’s expectations on leasing velocity, while retail occupancy was 79.6% with the remaining retail lease-up expected to occur during the first half of 2022. Major retail tenants include: Publix Super Markets Inc., Hobby Lobby, Burlington, Ross Stores Inc., T.J. Maxx, Old Navy and Planet Fitness.

During Q2 and Q3 2021, the REIT signed two major office leases with Office of the State Attorney – Miami-Dade County to occupy approximately 50,000 square feet and Public Health Trust of Miami Dade County to occupy 43,351 square feet. As at December 31, 2021, committed office occupancy was 64.0%.

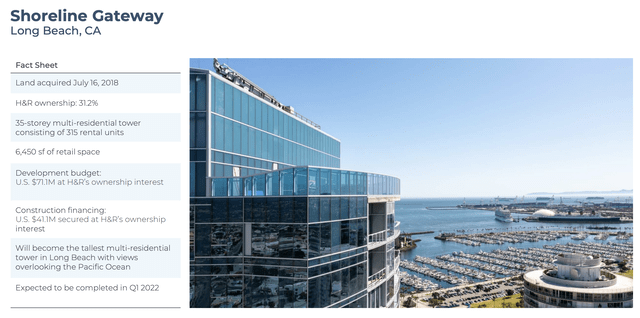

Shoreline Gateway

H&R owns a 31.2% non-managing ownership interest in a residential development site which will consist of a 315 luxury residential rental unit tower with 6,450 square feet of retail space. Located in Long Beach, CA, “Shoreline” will become the tallest residential tower in Long Beach with 35 floors enjoying views overlooking the Pacific Ocean.

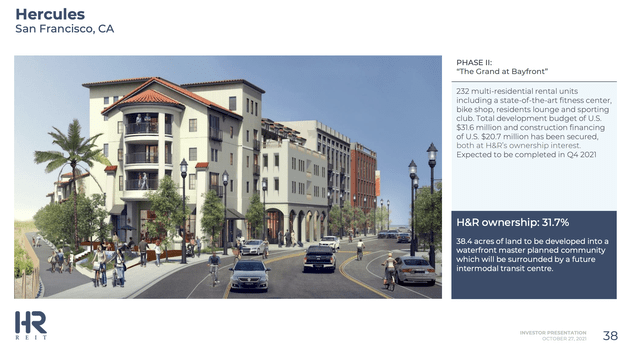

Hercules Project

H&R owns a 31.7% non-managing ownership interest in 36.2 acres of land located in Hercules, CA, adjacent to San Pablo Bay, northeast of San Francisco, for the future development of residential rental units. This waterfront, multi-phase, master-planned, in-fill mixed-use development surrounds a future intermodal transit centre, including train and ferry service, and is adjacent to an 11-acre future waterfront regional park.

Expected to be completed in Q4 2021.

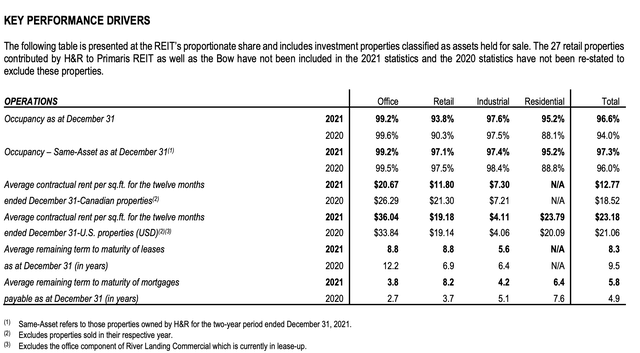

Investors love retail and industrial real estate and are smug towards the office and retail as evidenced by the cap rates in their portfolio. However the occupancy rates on these assets are 99% and 95% for office and retail use respectively and the remaining office space has a weighted average remaining lease term of 9 years therefore these assets are not exactly “duds” and selling at a ~6% cap rate is a more than fair price and if a sale doesn’t occur right away these assets can reliably contribute to FFO.

A weighted average remaining term of only 4 and 6 years in their residential sector allows for some cash flow predictability in the near term but the terms are also short enough that as inflation persists they can roll over these leases into higher rate leases.

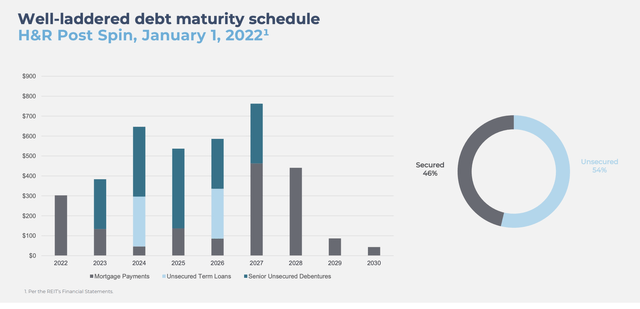

H&R’s weighted average interest rate on debt as at December 31, 2021 was 3.7% with an average term to maturity of 4.0 years and a well laddered maturity schedule which should allow interest rates to remain low enough relative to their expected capitalization rates of 4.34% and 5.20% on residential and industrial assets respectively.

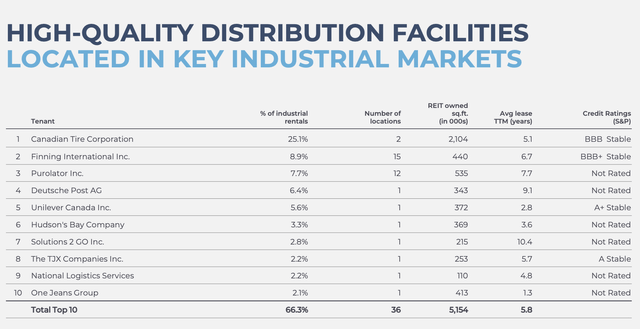

The spread on their residential assets is a little thin which necessitates leverage to be a little on the high side at 7.2x Debt to EBITDA at February 2022. However, only 47% of debt is secured and at the property level and with 97% total occupancy the debt is very manageable. I also note the industrial segment is largely made up of investment grade tenants like Canadian Tire (OTC:CDNTF) and Finning International (OTCPK:FINGF).

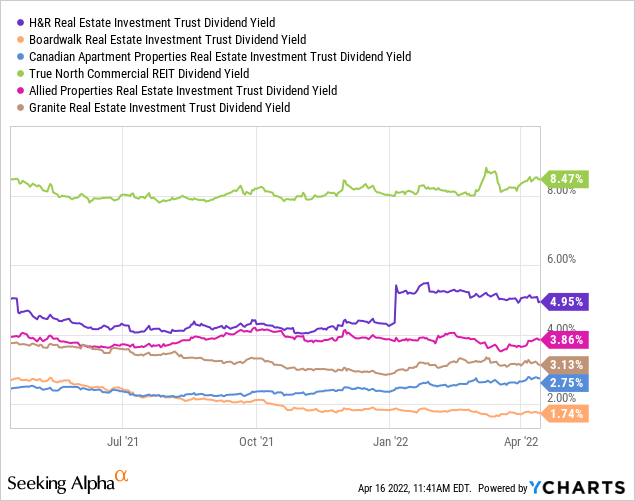

H&R currently trades at a respectable ~5% dividend yield which is quite high relative to other Canadian REITs and maintains a manageable payout ratio of 45-55% of FFO.

Conclusion

I believe H&R is as good an investment as any to take advantage of the inflationary environment as they should be able to redeploy funds from the Bow and Primaris sales into assets that can take advantage of more favourable lease rates and even if it takes 5 years for the market price of ~$13/share to reach its NAV of ~$18/share (and assuming NAV stays constant) that would equate to capital gains of at least 7% annually in addition to the 5% dividend. I believe that this REIT is well positioned for double digit returns that can easily keep pace and even beat inflation.

Be the first to comment