Jean-Luc Ichard

While most Americans were busy spending time with their families and loved ones yesterday, Politico dropped a bombshell claiming the Federal Trade Commission is likely to file an antitrust lawsuit to block Microsoft Corporation (NASDAQ:MSFT) from acquiring Activision Blizzard (ATVI) for $69 billion. Both Microsoft and Activision shareholders were looking forward to this deal going through, and Activision seems the perfect fit for Microsoft’s portfolio given that the game developer will open new doors for the tech giant to expand its presence in the fast-growing video game industry. At a time when tech stocks are getting hammered because of challenging macroeconomic conditions, the last thing Microsoft investors want is the FTC meddling with the company’s growth plans. This analysis aims to determine the probability of the FTC challenging Microsoft’s deal for Activision based on empirical evidence and recent developments. Based on the findings uncovered in this research, we will assess how Microsoft shareholders will be impacted by an antitrust lawsuit against the deal.

Has The FTC Blocked Big Deals In The Past?

A good place to start this analysis is to establish the FTC’s real-world authority in blocking multi-billion-dollar deals. Theoretically, the FTC is tasked with challenging deals that harm consumers and competition in general, but it’s more important to assess the watchdog’s track record in meeting this objective.

Back in December 2021, the FTC sued to block Nvidia Corporation’s (NVDA) $40 billion deal for British chip design company Arm Ltd. owned by Softbank Group. In a press release, the FTC wrote:

The proposed vertical deal would give one of the largest chip companies control over the computing technology and designs that rival firms rely on to develop their own competing chips. The FTC’s complaint alleges that the combined firm would have the means and incentive to stifle innovative next-generation technologies, including those used to run datacenters and driver-assistance systems in cars.

After battling with the FTC for several months, Nvidia called off the deal for Arm last February, citing significant regulatory challenges were preventing the transaction from moving forward. This is one of the biggest deals to have ever been blocked by a regulator, not just in the U.S. but on a global scale.

Back in 2015, Comcast Corporation (CMCSA) was forced to abandon a $45 billion deal to acquire Time Warner Cable due to regulatory pressures as well.

In addition to completely blocking deals, the FTC might take a different approach by forcing companies to divest key assets before granting approval to a business combination. Back in 1999, the FTC challenged Exxon Corporation’s $80 billion deal to merge with Mobil Corporation. After a legal battle that went back and forth, the FTC allowed the deal to go through under the condition that 2,431 Exxon and Mobil gas stations would be divested by the two companies. Upon completion of this deal term, this became the largest retail divestiture in the Commission’s history.

Similarly, the FTC allowed the $27 billion merger of Reynolds American and Lorillard in 2015 as the companies agreed to divest four cigarette brands (Winston, Kool, Salem, and Maverick) to Imperial Brands (OTCQX:IMBBY) to settle the Commission’s anti-competitive claims.

Empirical evidence clearly suggests that the FTC is very active in blocking/challenging anti-competitive deals. This may not be welcome news for Microsoft investors who were expecting the Activision deal to go through smoothly.

The FTC Is Becoming More Powerful

If you are a Microsoft shareholder or someone who roots for the Activision deal to go through, there is more bad news. Last July, the FTC approved a new policy giving itself the power to preemptively block/challenge mergers if an acquirer has previously had trouble with anticompetitive deals. This is a power move that takes the policy framework back to where it was before 1995 by requiring acquirers to seek the approval of regulators before announcing deals. Also, this power move coincides with President Biden’s not-so-favorable stance on the expansion efforts of corporate behemoths. Signing an Executive Order to promote healthy competition in the U.S. last July, President Biden said:

We’re now 40 years into the experiment of letting giant corporations accumulate more and more power. And where — what have we gotten from it? Less growth, weakened investment, fewer small businesses. Too many Americans who feel left behind. Too many people who are poorer than their parents.

With new-found power, the FTC is very likely to come down on Microsoft hard in the coming months.

Microsoft Shares Might Be In For A Wild Ride

The tech giant is facing regulatory pressures not just in the United States but across the globe. Last week, the Competition and Markets Authority in the UK released a statement by Sony Group Corporation (SONY), in which Sony opposes Microsoft’s deal with Activision based on a few major reasons. According to Sony, if this deal is allowed to go through:

- Consumer interest will be harmed as Microsoft will wield the power to take popular games, including Call of Duty, away from other gaming consoles.

- Microsoft, in the long run, will have the incentive to exclude rivals from accessing popular games although the company might not restrict access in the short term.

- Competition in the industry will be harmed as both existing and emerging players will find no incentive for competing with Microsoft.

- Independent developers would be harmed as Microsoft’s monopolistic power will tilt the odds in favor of the company, not developers.

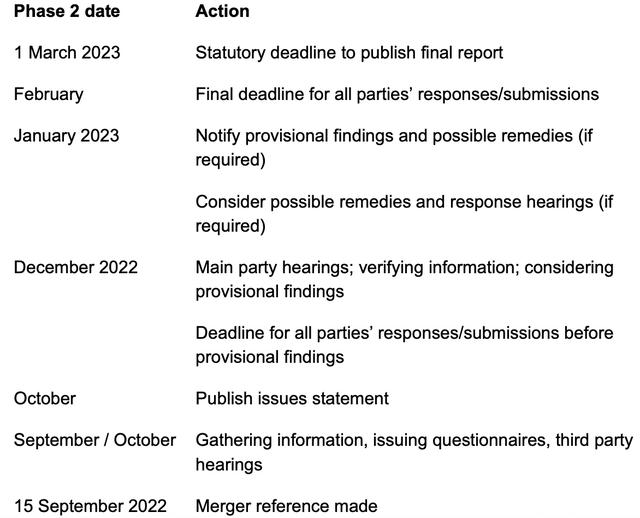

Microsoft, in a statement, vehemently denied these accusations, but a statement alone will not be sufficient to impress the UK watchdog. As illustrated in the below timeline, the CMA is scheduled to announce its final decision next March, but before that, the company is set to come under scrutiny in the coming months as the watchdog moves forward with its in-depth investigation of the proposed business combination.

Source: Competition and Markets Authority in the UK

Elsewhere in China, it is rumored that authorities are not willing to go ahead with a simplified procedure to evaluate the merits of this deal despite Microsoft’s application to do so. The deal, therefore, is likely to attract more scrutiny in China as well.

With macroeconomic challenges including rising inflation, rising interest rates, and the rising dollar already causing headaches for Microsoft and its investors, the regulatory scrutiny that is on the cards for the next few months will only add to the list of worries for the company. In the worst-case scenario, the deal would be called off, but even in the best-case scenario, the FTC and other watchdogs are likely to force Microsoft to offer meaningful assurance to its competitors including Sony that popular titles such as Call of Duty will be available to them indefinitely. If regulators force Microsoft to sell some of its gaming rights, that would not come as a surprise either.

Takeaway: Control The Controllable

Investors, for now, will only have to look for regulatory decisions to determine whether the deal for Activision will be allowed to go through. There are a lot of uncontrollable factors in play, including regulatory decisions and challenging macroeconomic conditions. What we do know is that Microsoft still has a long runway for growth even without Activision Blizzard’s gaming portfolio and that macroeconomic conditions will turn for the better in the next phase of the business cycle. Long-term-oriented investors, therefore, should embrace the volatility in MSFT stock today to identify investment opportunities.

Be the first to comment