Galeanu Mihai/iStock via Getty Images

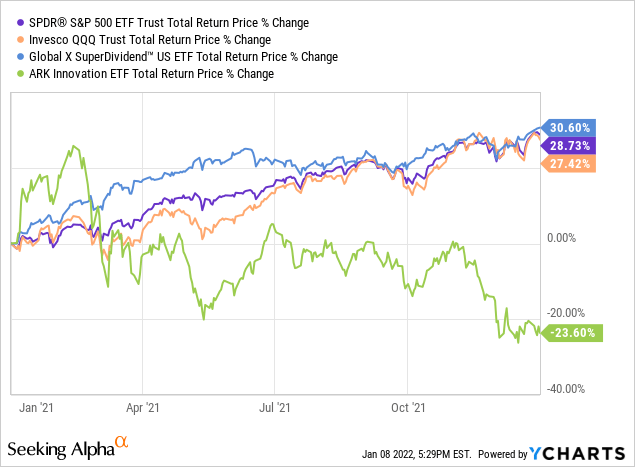

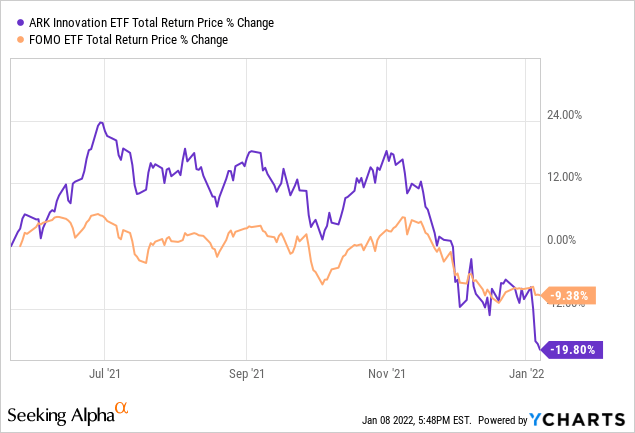

In 2021, we were blessed to beat the leading market indexes like the S&P 500 (SPY) and Nasdaq (QQQ) by over 30%. Furthermore, our real money Core Portfolio at High Yield Investor outperformed its index – the Global X Super Dividend U.S. ETF (DIV) – substantially while also absolutely crushing disruptive tech as evidenced by the abysmal performance seen in the ARK Innovation ETF (ARKK):

There were three key factors that contributed to that outperformance:

- Sticking religiously to fundamental value instead of chasing hot stocks and fads

- Reducing investment thesis uncertainty by asking management teams key questions

- Selling puts and calls strategically

In this article, we will discuss these three key factors as well as the three factors that we believe will give our portfolio an edge once again in 2022.

#1. Sticking religiously to fundamental value instead of chasing hot stocks and fads

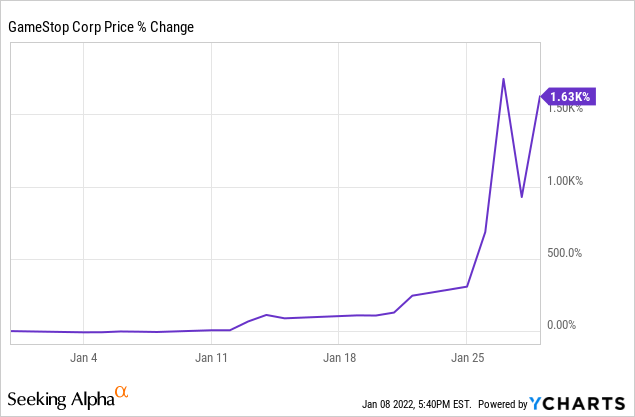

At the beginning of 2021, meme investments and ARK stocks were flying high. GameStop (GME) was going to the moon:

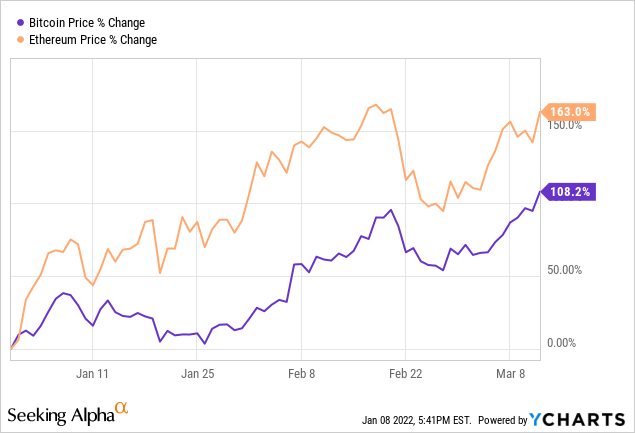

…Bitcoin (BTC-USD) and Ethereum (ETH-USD) were in the midst of another legendary bull run:

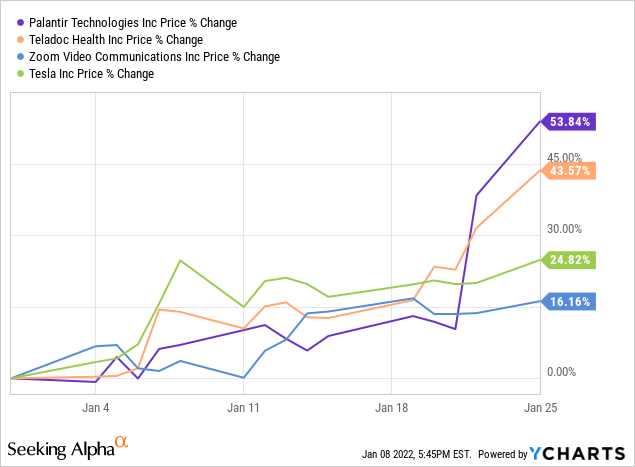

hot tech stocks like Teladoc (TDOC), Palantir (PLTR), Zoom (ZM), and Tesla (TSLA) were also booming after roaring through the second half of 2020:

For value investors like us, it would have been very easy to get caught up in the hype and suffer from a severe case of fear of missing out (“FOMO”) syndrome.

In fact, the IPO and SPAC markets had gotten so hot that a fund started in 2021 that literally had the ticker symbol (FOMO) and held SPACs.

Well, as it turns out, there was nothing to fear missing out on, as the second half of 2021 is well summed up in the stock charts of funds like ARKK and FOMO:

Instead of chasing these hot trends, thankfully we were able to stick to our value investing principles and searched out for and invested patiently in overlooked value opportunities which sparked our outperformance.

What guided our approach here was quite simple

1. At the time, the COVID-19 shot was just about to be released. While COVID-19 fears remained very high, leading market sentiment to heavily favor high-growth disruptive tech and severely punish traditional businesses, we believed that this created an opportunity. We believed that – between the COVID-19 restriction weary American public, the vaccine, and increasing natural herd immunity in the U.S. – disruptive tech companies were about to lose their biggest tailwind and traditional businesses would bounce back stronger than the market was currently pricing in. As a result, we loaded up our portfolio with traditional businesses that generated strong profits and reliable cash flows in a normalized environment and had the balance sheet strength and competitive advantages necessary to tide them over in the meantime.

We also waited for special opportunities throughout 2021 where market fears on a specific company became far overblown and opened an opportunity to buy in at a wide margin of safety.

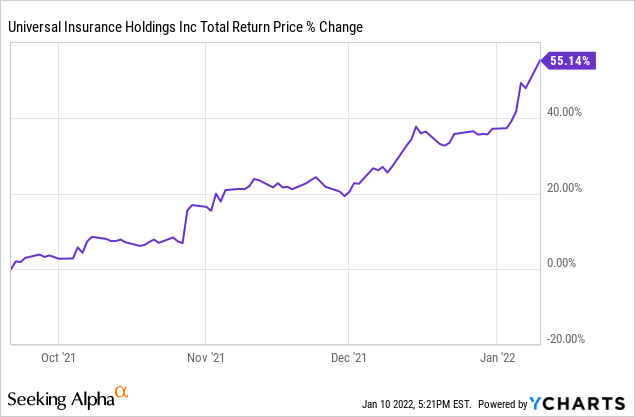

These opportunities included buying little-known insurance company Universal Insurance Holdings (UVE) as it was selling off during hurricane and tropical storm fears this past late summer/early fall:

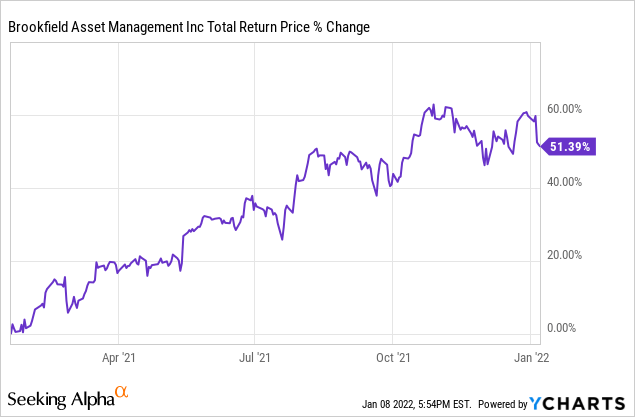

… buying asset managers like Brookfield Asset Management (BAM) in 2020 while they were lagging in recovery from the COVID-19 crash at the same time that the tech stocks, cryptos, and meme stocks were going to the moon:

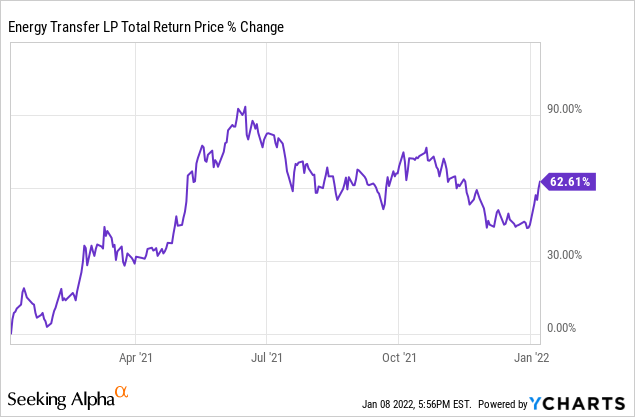

…or even buying deeply undervalued Energy Transfer (ET) at a time when green energy stocks were soaring and hydrocarbons were getting thrown out due to a combination of overblown energy transition and COVID-19 headwind fears:

#2. Reducing investment thesis uncertainty by asking management teams key questions

Another key to our outperformance in 2021 was reducing investment thesis uncertainty and boosting the courage of my convictions in going against the crowd by asking key questions to companies that we were targeting for investment.

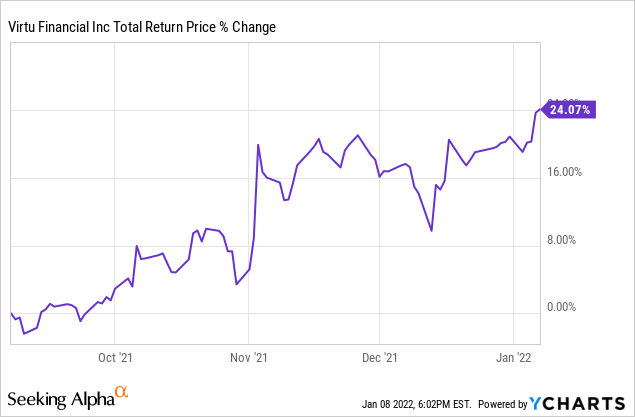

For example, in early September, high frequency trader/market-maker Virtu Financial (VIRT) was in the midst of a bearish decline amidst concerns and negative headlines about payment for order flow potentially getting banned. However, the stock was trading at dirt cheap multiples, gushing free cash flow, was paying out a hefty and very safe dividend yield that had breached 4%, was pursuing numerous organic capital-light growth projects, and had even signaled that it was about to buy back shares hand-over-fist.

Did we dismiss it by saying that the company was clearly at risk and therefore the sell-off was justified? No. Instead, we contacted the company and asked them some pointed questions about the risks involved and the company’s plans to unlock value for shareholders. Satisfied with the answers, we invested at what turned out to be near the bottom and soon our conviction was validated when the company announced in its earnings release several weeks later that it had bought back a lot of shares and was continuing to do so moving forward:

We then trimmed our position back down to size on the spike in the wake of earnings for an annualized gain north of 105% and have held the rest of our position since then.

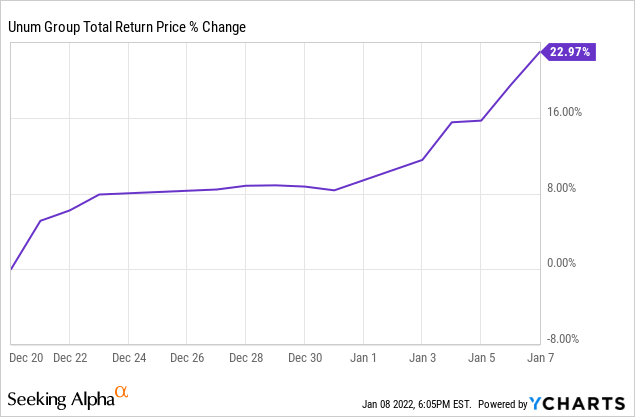

We did the same with Unum Group (UNM), learning that the company was committed to its fat dividend (whose yield had crossed well north of 5% at the time we bought) as well as its mid-single digit annualized dividend growth rate and was even buying back some shares, which gave us the courage to buy shares during the Omicron variant sell-off in mid-December. The results in the few weeks since have validated our courage that we might have lacked had we not spoken with the company:

There are numerous other examples where we have interviewed companies on behalf of our members at High Yield Investor and have been equipped to buy and sell opportunistically as a result.

#3. Recycling Capital Opportunistically

Last, but not least, we were able to recycle capital opportunistically throughout 2021. Back on November 15th we sold our shares in Atlantica Sustainable Infrastructure (AY) for a strong 21.6% return in less than a month and a half. We said at the time:

We continue to find attractive arbitrage opportunities in the renewable energy yield space as Mr. Market continues to bid up some businesses aggressively while leaving others behind for reasons that we find to be short-sided or altogether misplaced.

We took advantage of this back on July 20th when we sold our AY position and recycled the proceeds into Clearway Energy (CWEN.A) as we saw a great opportunity to arbitrage valuation differences between two very similar renewable YieldCos. In the process, we locked in a nice 34% annualized profit on AY and then purchased CWEN.A at a meaningfully higher dividend yield and at what we believed was a much greater discount to fair value. That trade also paid off handsomely as CWEN.A (28.34% total return) substantially outperformed AY (-3.01% total return) over that time period:

As a result, the risk-reward had moved back in favor of AY, which has once again outperformed CWEN.A and generated a very nice 21.6% return for us in a short period of time since then. Today we decided to once again pull the trigger on our capital recycling efforts as we saw an attractive opportunity to further enhance our renewable energy exposure.

We then recycled that capital from AY into Algonquin Power & Utilities (AQN), which actually owns a stake in AY and has a well-diversified portfolio across utilities and renewable power investments. Since then, that trade has paid off as AQN is up slightly and AY is down substantially.

As a result, AY now trades in our Strong Buy range once again as the forward dividend yield has crossed north of 5% and the stock trades near 20% below our Buy Under Price. Therefore, we decided now was a good time to buy back in.

There are countless other examples of times over the past year where we sold fully valued stocks and reinvested the proceeds into deeply undervalued opportunities which then went on to substantially outperform the market moving forward, including a few just this past week. This constant cycle of buying at deep value, holding for the ride up towards fair value, and then recycling the proceeds into another compelling value opportunity is not only a lower-risk way to invest thanks to the wide margins of safety in these investments, but the recycling also speeds up the compounding process.

How We Approached Challenges

Of course, not all of our investments worked out perfectly immediately. Our first major challenge came in the form of Winter Storm Uri. While it boosted our investment in ET substantially, it caused our investment in Vistra Corp. (VST) to crater. In fact, on February 26th, 2021 we wrote to our members:

Vistra Corp. (VST) is a riskier utility bet for us given its checkered past of going through bankruptcy, lower quality generation portfolio, and need to deliver on an ambitious renewables investment program. Additionally, it offers a low dividend yield right now, though it promises to buy back large sums of shares and grow its dividend aggressively in the years to come. The reason we own it is because its free cash flow yield is incredibly high (~25% when we first purchased it). That said, we have kept our exposure small.

Today, our caution was proven warranted, as shares tumbled sharply (down nearly 20%) on the release of earnings and the announcement of up to a $1.3 billion hit from the recent severe winter storm that hit its area of operations especially hard.

That said, we believe that this is a worst-case scenario and even then the maximum potential forecasted hit represented less than 10% of their market cap while the stock sold off by nearly 20%. Meanwhile, Q4 results were very strong, it remains committed to its capital allocation plan, including its recommended dividend trajectory and debt reduction.

VST also has plenty of liquidity on hand: $2.4B in total available liquidity as of year-end 2020 and “consistently maintained, and it continues to maintain, sufficient liquidity to conduct its operations in the ordinary course.” As of Feb. 25, VST has over $1.5B of cash and availability under its revolving credit facility.

Furthermore, we take confidence in our VST position knowing that Brookfield Asset Management (BAM) is a fellow shareholder and had this to say about the company during one of its shareholder letters:

“Several years ago, we formed a consortium to acquire distressed debt in a Texas-based electricity generator called Energy Future Holdings. In 2016 following a lengthy Chapter 11 bankruptcy proceeding, the company emerged from bankruptcy as Vistra Energy… we believe the trading price of the company’s shares remains remarkably inexpensive and have the potential to increase considerably. As a result, we intend to hold a portion of our own investment in Vistra for a much longer duration.

This – in addition to a thorough interview with the company in which we asked pointed questions – gave us the courage to double and triple down on our VST investment at prices in the mid-teens. While the timing of our initial entry into the company was obviously not ideal and we had to wait for most of the year to see our thesis play out, patience paid off. The lesson here was that no one can always perfectly time a purchase and that seemingly random events like 100-year winter storms can happen at any time to disrupt an investment thesis. However, by doing thorough due diligence and having patience, even ill-timed entries to stocks can still generate market-beating returns over time.

Our worst investment of the year was in Compass Minerals International (CMP). We bought the stock with the simple investment thesis that it owned world-class assets like its Goderich salt mine, had substantial inflation resistance, and operated a simple business model whereby it distributed a significant portion of its free cash flow to shareholders via a nice dividend that was close to a 5% yield at our initial purchase price. Meanwhile, the company was selling off non-core assets and deleveraging in order to further simplify and de-risk the business model.

However, over the summer management announced the discovery of a massive Lithium deposit next to one of its assets and undertook a strategic review in how to best exploit this discovery to generate long-term value for shareholders.

On the Q3 earnings call, management made it clear that they are taking the company in a sharply different direction: from a simple operations-focused business model that generates stable cash flow today and passes it on to shareholders while keeping leverage under control, to a more speculative “invest today for higher long-term returns on capital several years down the road” company.

Most importantly, CMP slashed its dividend to a meager $0.15 per quarter and announced it would be investing in developing its Lithium resource as well as pouring capital into a new equity stake in a fire retardant company with significant growth potential. Management claims it will generate 20%+ returns on capital from these new growth ventures, but it will take time to see if that is actually true and there is the uncertainty of how much dilution will be suffered in the meantime.

The dividend is clearly not a priority and it would not shock us if they eliminate it altogether in the future as it sounds like the company will probably need to raise additional equity in the future to fully fund its CapEx plans and also has ambitions to significantly reduce the leverage ratio from here over time.

Furthermore, the company’s core salt business saw strong demand, but weak profits as inflationary pressures are pinching them and they don’t expect to see pricing catch up for another year at least. The plant nutrition business had operational issues. All in all, we were not impressed and apparently neither was the market as shares plunged on the news.

While the valuation looks pretty good here and if management’s ambitions pan out, it could generate great returns, but it is very understandable why there was a stampede out of the stock in the wake of the dividend cut and earnings release. CMP’s traditional investor was likely very turned off by management’s dramatic shift in direction and it will take time for CMP to court a new investor who is more attracted to the long-term growth story.

Given that CMP slashed its dividend and is clearly not prioritizing its dividend at all moving forward, it no longer fit in with our portfolio dividend-focused portfolio profile. While the stock definitely trades at a discount to our estimate of intrinsic value, the path towards unlocking this value appears to be lengthy and fraught with uncertainty. We were not impressed by management’s lack of details when presenting their shift in strategy to shareholders and it struck us as both inconsiderate and unprofessional.

As you can see in the table below, CMP was our first unsuccessful closed investment in that we lost on the net -$2.27 on the investment during a year in which our overall investment universe was up substantially.

That said, given that we essentially broke even on the investment and it is our first unsuccessful closed investment, we consider ourselves fortunate. Nobody bats 1.000 in baseball or investing and in this case what broke our thesis was a dramatic and ill-executed capital allocation strategy shift by management.

The fact that we were able to avoid a steep net loss on this reflects the importance of being very patient and only buying stocks when they trade at a large discount to our fair value estimate. If we can continue to do that successfully, whenever our investment thesis breaks we will be able to mitigate losses and avoid completely undoing our winners.

Investor Takeaway

By avoiding the overhyped stocks, sticking with value investing principles at a time when investors were screaming “value is dead” and “long live growth tech stocks”, we were able to not only hold our own, but actually pummeled the tech investors by year-end and into early 2022. While their portfolios turned sharply into the red, ours not only was green, but substantially outperformed the market.

We were able to further enhance our alpha by performing thorough due diligence on our investment ideas, including asking pointed questions about key investment thesis risks to our target companies, which in turn gave us the courage of our convictions to buy low when the rapid downward momentum in the shares might have otherwise scared us off.

Last, but not least, our opportunistic capital recycling strategy greatly aided our compounding as we were able to buy and sell stable cash flowing businesses in sectors like regulated utilities (XLU) which are almost like fixed income proxies and therefore much easier to value. Nevertheless, as equities their share prices still experience substantial volatility, so we had numerous opportunities to arbitrage Mr. Market’s irrationality in setting prices in this sector.

Going into 2022, we believe these methods will continue to serve us well, particularly as value opportunities are increasingly scarce with indexes continuing to hover near all-time highs, inflation raging, and interest rates appeared poised to rise. While our targeted investment areas might change with changing market conditions, our recipe for success: disciplined adherence to value investing principles, commitment to thorough due diligence practices, and opportunistic capital recycling will not.

We also believe that by continuing to take advantage of opportunities where business models are being unfairly punished by Mr. Market due to COVID-19 fears and/or overblown interest rate hike fears, we will be able to outperform over the long-term. Some examples of this include investing heavily in Latin America via businesses like Coca-Cola FEMSA (KOF) and Credicorp (BAP) – which remain undervalued in part due to lingering COVID-19 fears – as well as buying blue chip gold miners like Newmont Corporation (NEM) and Barrick Gold (GOLD) which are being punished due to fears of rising interest rates even though it is extremely likely that real interest rates will remain negative for the foreseeable future.

Be the first to comment