ismagilov/iStock via Getty Images

This article was first released to Systematic Income subscribers and free trials on June 24.

The price action across the income space has been large and seemingly unrelenting across most sectors. Such an extended drawdown as we have seen this year can make it difficult for investors to get their bearings and formulate a strategy. In this article, we discuss some of the pieces of our allocation strategy in this difficult time for the income market.

Having The Big Picture In Mind

A sense of market behavior during prior difficult episodes can be useful in gaining a broader perspective of the current drawdown. It can also provide investors some intuition of whether a given asset class looks attractively valued relative to the kind of shock markets are going through at any given moment. We discussed a kind of drawdown taxonomy in an earlier article, so here, we just reiterate the key points.

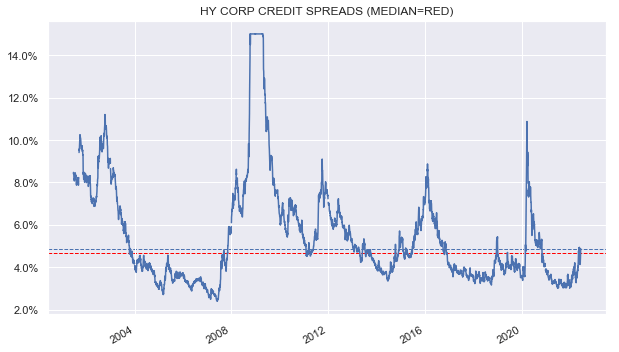

Briefly, the current pricing in credit markets – based on the credit spread chart below – is at the level of either a Fed tantrum (e.g. 2013, end-2018) or a near-recession (e.g. 2015). A relatively mild recession, which increasingly looks to be a growing consensus, will likely require a further fall in prices – perhaps another 7-10% drop in the prices of high-yield corporate bonds, for example.

Systematic Income

However, it’s worth nothing that coupon income will offset a big chunk of this further potential drop in bond prices, leaving defaults as the key driver of returns over the next couple of years. Much also depends on what happens to Treasury yields. A “typical” recession should see Treasury yields move lower, supporting bond prices. A stagflationary recession will drive prices even lower, however. Our base case is for Treasury yields to fall or remain stable in a recession. This has been evidenced by the recent drop in Treasury yields after the Fed acknowledged its willingness to drive the economy into a recession in order to push inflation lower.

It’s Easier To Be Less Wrong

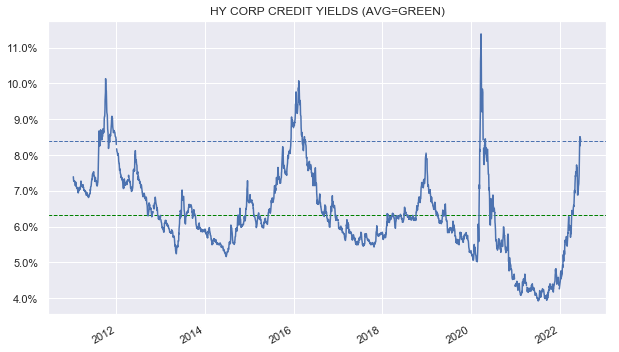

Making allocation decisions have to take into account not just the outlook over the medium term, but also the current level of compensation for taking risk. An important bit of good news is that yields on a wide variety of income assets have risen substantially. For example, high-yield corporate bond yields have risen from a yield of 4% in 2021 to 8.5% now.

Systematic Income

The obvious consequence here is that investors buying high-yield corporate bonds now are earning more than double what they did in 2021. The less obvious consequence is that markets need to deliver a much bigger yield spike in order for investors to break even.

For example, the HY corporate bond market has a duration of about 4.3. This means that an investor earning a yield of 8.5% needs yields to rise by around 2% in order to be left with a zero return after a year (i.e. 8.5% in yield less 2% x 4.3). An investor who bought HY corporate bonds in 2021 at a 4% yield could only afford a yield rise of 0.93% before starting to lose money on the position. We are, of course, ignoring the impact of defaults here, but that would be identical for both cases.

In short, a much higher starting yield makes it easier for investors to be less wrong. This is because the market has to work a lot harder to deliver a negative return outcome for investors. In addition, a rise in yields of similar magnitude as we just saw is also obviously a harder lift for markets the second time around. For example, a 2% rise from current yields would push the yield of high-yield corporate bonds within 1% of its peak over the past decade. That peak happened during a time when markets were pricing in a shutdown of a large part of the global economy – a far cry from what we are looking at over the next year or two.

Top-Down As Well As Bottom-Up

One thing we don’t do is forecast market outcomes. This is for the simple reason that a reliance on forecasts requires one to have never been wrong. And this is because being wrong even once can have a catastrophic outcome on overall portfolio wealth.

Rather, we recognize that we operate in an uncertain environment and operate from a probabilistic scenario perspective, rather than a single target outcome. This is something we highlighted in our All-Weather Income Portfolio discussion.

The way we operationalize this is to build portfolios that have pockets of resilience or securities that can outperform in a particular market scenario. This can allow investors to use those securities to rebalance into attractive securities that haven’t held up as well.

That may seem an odd thing to do, i.e., to throw good money after bad, however, it simply reflects the mean-reverting nature of income markets where rebalancing, if not quite the free lunch it has been suggested to be, is certainly a way for investors to generate alpha and sustainably grow the income level of their portfolios.

You Are Crazy To Be Buying Now

We often get pushed back when we discuss our process of rebalancing from more resilient to less resilient securities during drawdowns.

Obviously, it is a bit uncomfortable to be adding risk during particularly volatile periods. However, we simply haven’t found a better alternative.

At the risk of oversimplifying a bit, there are basically two states of the world. One is a good macro picture when asset prices are high. The other is a bad macro picture when asset prices are low. Unfortunately, the third scenario where the macro picture is fantastic and assets are also fantastically cheap is just that – fantastic.

So the question is in which scenario would you want to add risky assets? In our view, buying assets in the latter scenario is better, even though it’s less comfortable than buying assets when there are no clouds on the horizon, but valuations are rich.

In our view, investors should allocate through-the-cycle, i.e., with the view that we could go through a recession at just about any time. The point here is that a recession will come, and asset prices will drop so, given the recession and the next market drawdown will come, wouldn’t it have been better holding a full allocation when prices fell 30% than holding a full allocation at the peak?

Why Don’t You Just Wait For The Uptrend?

A key question for investors is how to allocate during drawdown periods? There are basically two main views here.

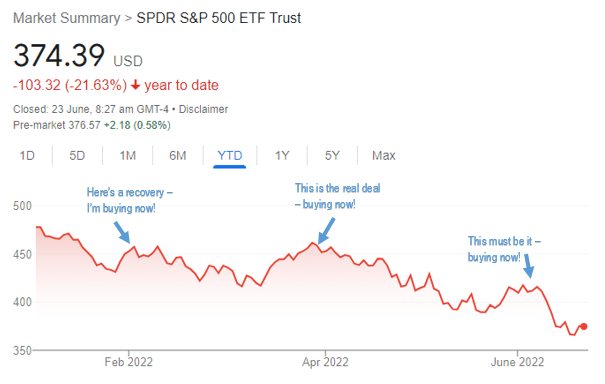

The first (suggested by among others Ken Fisher) is that you just wait till the price reaches a trough and bounces back. The problem is the volatility is so high that the bounces can look like a recovery from the trough. Already this year, we have seen rallies of 7% and 9% off the bottom in the SPX. However, in an extended selloff, trying to buy after what looks like a trough will probably just add on dead cat bounces, i.e., buying at the local highs.

Google

That’s why we just like to add at fixed (or even increasing) price intervals on the way down. As a technical aside, adding in fixed percentage intervals is less compelling because the same percentage will buy at smaller and smaller price intervals since the price of the given asset will be decreasing.

Another important point is that a convincing bounce from the lows such as the one we saw in the third week of March will be quickly followed in the commentaries with – no, no, this is a false dawn, and we are going to see a second drawdown.

Investors who were following the market in Q2 and Q3 of 2020 will surely remember multiple well-known market pundits calling for a double-dip in markets, which never happened. The point isn’t that a double dip can’t possibly happen, but that allocating in a post-bounce environment will not be as trivial to execute as it seems today.

Finally, one thing we definitely don’t like doing is to “BUTT” or to “back-up the truck”. First, it’s not clear how many investors keep a “truck” in the garage just waiting for a sizable drawdown. And two, making binary all-in decisions is an odd thing to do in a highly uncertain environment. Clearly, the BUTT calls we have seen in the first 3-4 months of this year were misguided, and better opportunities are present to those investors who instead patiently added at regular intervals.

Takeaways

Navigating the income market during a steep drawdown is never easy. However, having a number of heuristics and anchors in mind can make the process less emotional and less potentially fraught with regret. The heuristics discussed above are based on a good dose of humility as well as an awareness of historical patterns, and they make sense to us. Hopefully, they can be of use to other investors in the second half of this difficult year.

Be the first to comment