2Ban

Investment Thesis

In a previous analysis for Seeking Alpha about my top 5 dividend growth stocks for a retirement portfolio, I discussed the requirements a company should fulfil in order to increase its dividend significantly over the long-term:

- Strong brand image

- Strong competitive advantages over its competitors

- High economic moat

- High market capitalization

- Low dividend payout ratio

- Relatively high dividend growth rate over the last 5 years

- High financial strength

- High profitability.

In this analysis, I will demonstrate in more detail how you can benefit most from increasing dividend payments of dividend growth stocks. I will use Visa Inc. (NYSE:V) as an example and will assume an investment horizon of 30 years. The company has strong competitive advantages, strong financials and is highly profitable. Furthermore, it has a low dividend payout ratio of just 20.83% and an average dividend growth rate of 17.87% over the last five years. These factors make me believe that Visa should be able to continue increasing its dividend over the next years and even decades. In my opinion, this makes Visa an excellent choice to illustrate how you can benefit from the dividend payments of a dividend growth stock when having a long investment horizon.

Visa’s Competitive Advantages

In a previous analysis on Visa, I mentioned its brand image as being one of the company’s competitive advantages:

“Visa is ranked at position 18 on the Forbes list of the most valuable brands in the world. Competitor American Express (AXP) is at position 28 and Mastercard (MA) is 38. Visa is ranked as the most valuable brand within the financial service industry. This ranking is an expression of the company’s successfully built brand image, the strength of which provides a major competitive advantage.”

Additionally, I highlighted that the high number of credit and debit cards contributes to another important competitive advantage:

“At the end of 2020, Visa had issued a total of 3.586 billion cards. This puts them ahead of Mastercard (with 2.334 billion cards issued at the time) and well ahead of American Express (with 112 million cards issued). The high number of credit and debit cards issued represents another competitive advantage for Visa and is further evidence of its excellent market position.”

I have also writen about why it’s so difficult for competitors to enter into Visa’s business segment:

“Despite the high profit margins when compared to other industries, it is hard for Visa’s competitors to enter into the market. Visa’s reliable payments network, the company’s technological knowledge as well as its broad network within the financial service industry in combination with a strong brand image, protect the company from additional competitors entering the business segment.”

Visa’s competitive advantages bring me to the conclusion that the company should be able to continue increasing its dividend in the upcoming years.

Visa’s Valuation

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Visa. The method calculates a fair value of $294.60 for the company. At the current stock price of $211.80, this results in an upside of 39.1%.

The Average Seeking Alpha EBIT Growth [FWD] Rate of the last 5 years for Visa is 12.06%. I’ve decided to make more conservative assumptions and therefore, I assume a Revenue and EBIT Growth Rate of 10% for the company over the next 5 years.

The GDP Growth Rate of the United States is about 3% per year on average. Due to Visa’s strong brand image as well as its economic moat and growth prospects, I expect it to grow with a higher growth rate and therefore assume a Perpetual Growth Rate of 5%. I have used Visa’s current discount rate [WACC] of 7.5% and its Tax Rate of 23%. Furthermore, I used an EV/EBITDA Multiple of 22.7x, which is its latest twelve months EV/EBITDA.

Based on the above, I calculated the following results (in $ millions except per share items):

Market Value vs. Intrinsic Value:

|

Market Value |

$211.80 |

|

Upside |

39.1% |

|

Intrinsic Value |

$294.60 |

Source: The Author

Dividend Projections for Visa

Projection of Visa’s Dividend Yield When Assuming Average Dividend Growth Rates of 10%, 11%, 12% or 13% per Year

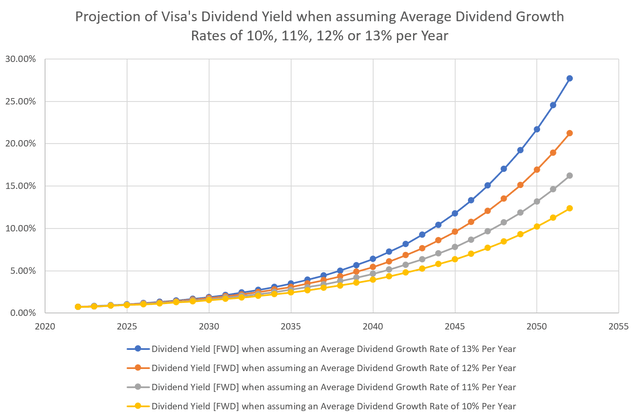

In the graphic below, you can see different scenarios on how you would benefit from dividend growth stocks when having a long-term investment horizon: you can see the results of Visa’s dividend yield when assuming different dividend growth rates and assuming that you would invest at the current stock price of $211.80.

I have made projections of an average dividend growth rate of 10%, 11%, 12% and 13% per year. This is because I think the company could be able to increase its dividend in these ranges due to the following factors: Visa has a strong competitive position, excellent growth prospects, a low dividend payout ratio of only 20.83% and has shown a dividend growth rate of 17.87% on average over the last five years. An additional indicator which shows that Visa should be able to raise its dividend at least in these ranges is the company’s 5 Year Average EPS Diluted Growth Rate [FWD] of 16.16%.

The graphic shows that you would generate a dividend yield of 12.36% in 30 years when assuming an average dividend growth rate of 10% per year; a dividend yield of 16.21% in 30 years when assuming 11%; a dividend yield of 21.22% in 30 years when assuming 12% per year and a dividend yield of 27.7% for 13% per year.

The above graphic also shows the largest effect of increasing dividend results from a long investment-horizon of more than 20 years. Proof of this is the fact that the graphics run relatively evenly in the first 20 years, but then from 2042 on, clear differences will be noticeable, depending on assuming an average dividend growth of 10%, 11%, 12% or 13% per year.

This strengthens my belief that a long investment horizon is very important in order to fully benefit from increasing dividend payments of dividend growth stocks. Furthermore, it shows us that it’s important to analyze the competitive advantages of companies in detail so they are actually able to continuously increase their dividends, and therefore the investor benefits from the effect of increasing dividend payments over the long-term.

Although it is true that it’s hard to predict the next 30 years, I think Visa should be able to significantly increase its dividend due to the strong competitive advantages mentioned, as well as its low dividend payout ratio of 20.83% and the fact that it has been able to increase its dividend by an average of 17.87% over the last five years.

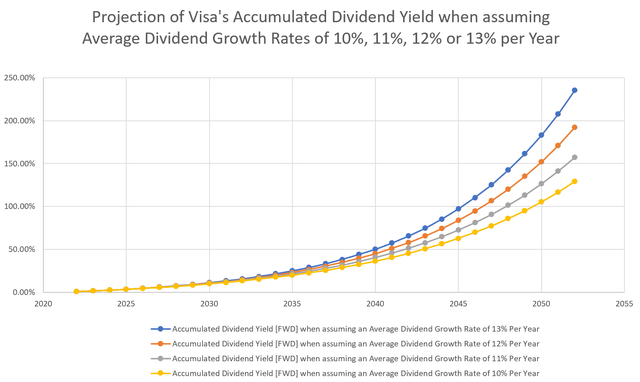

Projection of Visa’s Accumulated Dividend Yield When Assuming Average Dividend Growth Rates of 10%, 11%, 12% or 13% per Year

The graphic below shows that you could generate a high accumulated dividend yield when aiming to invest with a long-term investment horizon.

When assuming an average dividend growth rate of 10% per year for Visa, you would have received 128.86% of your initial investment by dividend payments after 30 years. When assuming 12%, you would have received 192.13% of your initial investment in the form of dividend payments. In the case of an average dividend growth rate of 13% per year, you would have received 235.35% of your initial investment by 2052 (no withholding taxes taken into account in all of these calculations).

This illustration is another indicator of the importance of a long investment horizon in order to benefit most from investing in dividend growth stocks.

We can use different tools to help us find companies that could be able to increase dividends over a very long time horizon:

Seeking Alpha’s Factor Grades

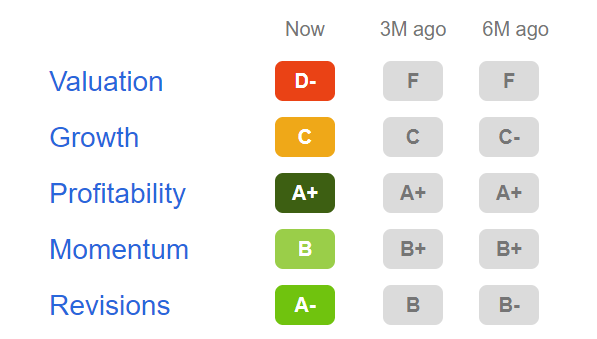

According to Seeking Alpha’s Factor Grades, Visa is rated with an D- in terms of Valuation. For Growth the company gets a C rating and scores an A+ for Profitability. In the graphic below you will find the overview of the Seeking Alpha Factor Grades for Visa:

Source: Seeking Alpha

Seeking Alpha’s Quant Ranking

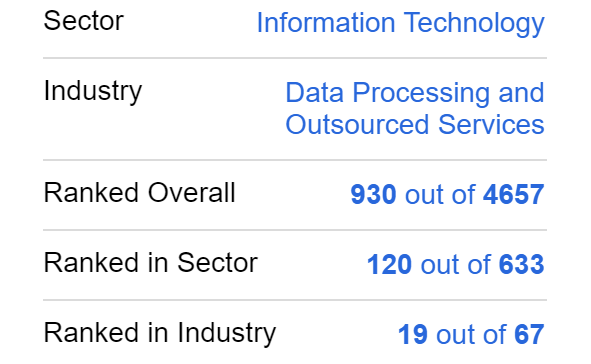

Taking into account the Seeking Alpha Quant Ranking, Visa is ranked 19th (out of 67) within the industry and 120th (out of 633) in the sector.

Source: Seeking Alpha

The Seeking Alpha Quant Ranking reinforces the theory that Visa is a stock that you could benefit enormously from with the effect of growing dividend payments.

Seeking Alpha’s Dividend Grades

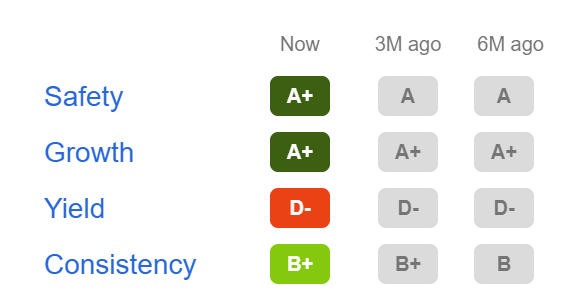

According to the Seeking Alpha Dividend Grades, Visa is rated with an A+ in terms of Dividend Safety and Dividend Growth.

Source: Seeking Alpha

Visa’s superb ratings in these categories strengthen my belief that the company is an excellent choice when looking for a dividend growth stock.

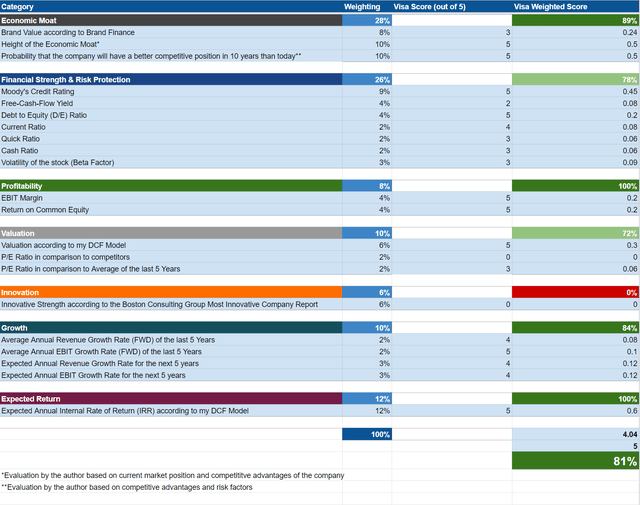

The High-Quality Company [HQC] Scorecard

“The aim of the HQC Scorecard is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description about how the HQC Scorecard works.

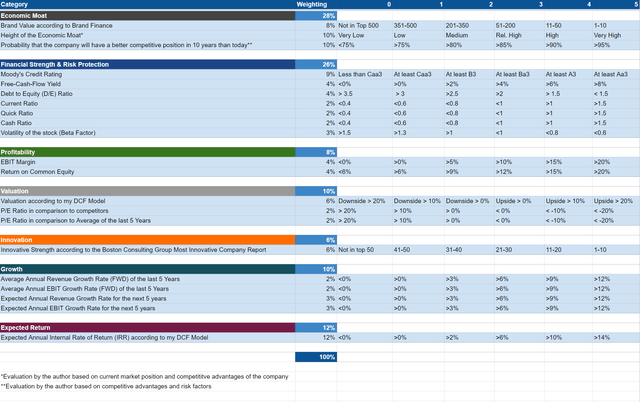

Overview of the Items on the HQC Scorecard

“In the graphic below you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every item that is rated.”

Visa According to the HQC Scorecard

According to the HQC Scorecard, Visa’s overall score is 81 out of 100 points. This means it can currently be classified as a very attractive long-term investment in terms of risk and reward.

The HQC Scorecard indicates that Visa is rated as very attractive in the categories of Economic Moat, Profitability, Growth and Expected Return. Furthermore, Visa is rated as attractive in the categories of Financial Strength and Valuation.

The very attractive overall scoring for Visa, as according to the HQC Scorecard, strengthens my belief that it can be considered as an appealing long-term investment and a company which you could benefit significantly from with the effect of increasing dividend payments.

Risks Factors

In my previous analysis on Visa, I explained that one of the main risk factors facing the company is a recession:

“In times when people consume less, Visa’s revenue will be affected negatively and this in turn effects the company’s profit margins. However, I assume that these effects will only have a temporary impact on Visa’s business and the risk is lower when investing with a long investment horizon.”

In the same analysis, I pointed out that the global payment industry is extremely competitive, which I see as an additional risk factor:

“Visa operates in a market environment, in which new technologies are developed rapidly and new competitors are emerging continuously. Visa competes with fintech companies, digital payment providers and technology companies, which have developed payment systems. A failure to anticipate new technologies in the payment industry, for example, could harm Visa’s business and could have negative effects for its future growth.”

However, I also mentioned that this shouldn’t pose any major problems for the company:

“Over the past years, Visa has demonstrated its ability to successfully anticipate new technologies and has been able to use them to create new opportunities that have contributed to the company’s growth. I expect Visa to be able to do so in the future.”

The Bottom Line

In this analysis, I have shown that you can benefit enormously from an investment in dividend growth stocks when investing with a long investment horizon.

In order to be able to significantly increase its dividends over the long-term, a company should fulfill different characteristics (such as strong competitive advantages, a low dividend payout ratio, a relatively high dividend growth rate over the last 5 years, high financial strength and profitability, etc.)

I consider Visa to be one of the companies that fulfils these characteristics: Visa has a strong brand image, a broad economic moat, is highly profitable and still has excellent growth perspectives. An average dividend growth rate [FWD] of 17.87% over the last five years in combination with a low dividend payout ratio of 20.83%, shows that Visa should be able to increase its dividend significantly over the next years and even decades.

Visa’s excellent rating as according to the Seeking Alpha Dividend Grades, provides further proof of the company’s dividend prospects: Visa is rated with an A+ in terms of Dividend Safety and also when it comes to Dividend Growth. Visa’s very attractive rating in terms of risk and reward, as according to the HQC Scorecard, further confirms the company’s strength.

All of these factors suggest that Visa could be an excellent choice when investing with a long investment horizon and when aiming to benefit most from increasing dividend payments of a dividend growth stock.

Author’s Note:

Thank you very much for reading! Feel free to leave a comment below!

Be the first to comment