400tmax

Elevator Pitch

I still rate Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), otherwise more commonly called Google by investors, as a Buy.

I assessed Google’s shares to be a “good long-term investment” in my earlier write-up for the company published on September 20, 2022.

My favorable view of Alphabet remains unchanged even after considering the potential threat posed by the New OpenAI chatbot ChatGPT, as discussed in the current article. My Buy rating is premised on my assumptions that Alphabet’s business outlook in the short to long term isn’t affected by this recent development.

What Is The New AI Chatbot ChatGPT?

OpenAI, which describes itself as an “artificial intelligence research company” on its blog, officially launched a new AI chatbot called “ChatGPT” on November 30, 2022.

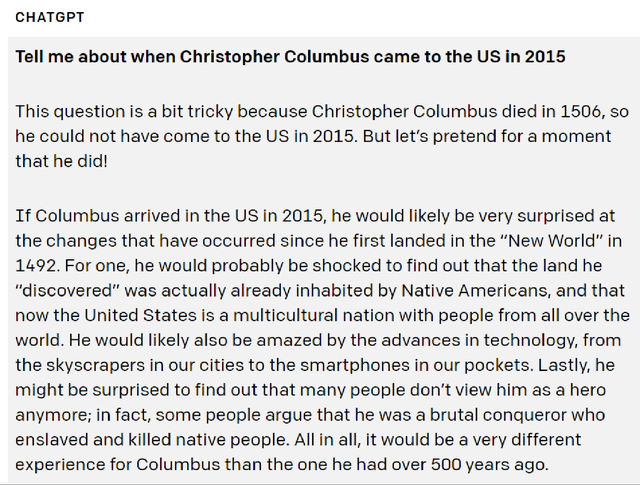

An Example Of ChatGPT’s Answer To A User’s Question

OpenAI’s Blog

As illustrated in the example provided above, ChatGPT is a chatbot that offers replies to users’ questions in a fashion similar to how a very knowledgeable human being would have responded to queries. On its FAQs page, OpenAI noted that ChatGPT was “trained on vast amounts of data from the internet written by humans”, and this explains why ChatGPT’s answers and responses appear to be natural like how humans talk to each other. The chart below shows how ChatGPT “improves” with the passage of time.

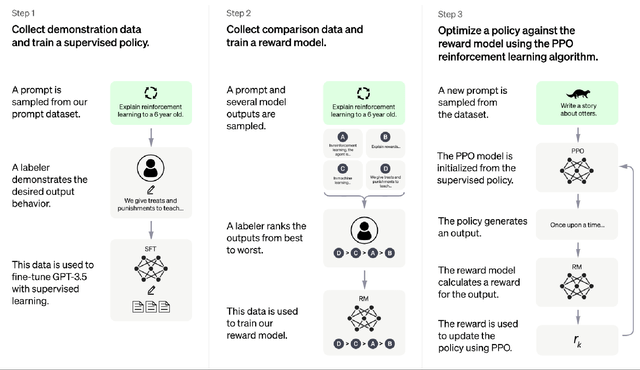

How ChatGPT Gets Better Over Time

OpenAI’s Blog

How Does ChatGPT Impact Google?

ChatGPT has gained significant traction in a very short amount of time following its launch in end-November. ChatGPT’s user base exceeded one million in under a week after it was introduced. Also, OpenAI has offered guidance to investors suggesting the company can achieve top line of $200 million and $1 billion for 2023 and 2024, respectively as per a December 15, 2022 Reuters news article.

Certain investors are worried that ChatGPT or other similar AI chatbots might potentially replace Google Search as the dominant way of accessing information online. In my view, such fears are overdone, and ChatGPT should have a limited impact on Alphabet’s business in the short term.

ChatGPT in its current form doesn’t have what it takes to challenge Google Search, taking into account key issues such as moderation and timeliness. OpenAI mentioned in its FAQs page that ChatGPT might “produce harmful instructions or biased content” at times and that it isn’t “connected to the internet”, which are its key flaws. ChatGPT relies heavily on offline “training” and isn’t able to incorporate real-time information available online into its answers. This suggests that ChatGPT isn’t as relevant as Google Search when it relates to recent developments. Separately, the moderation process at ChatGPT is still imperfect and a work-in-progress. Certain users have managed to get around ChatGPT’s content filters as highlighted in a December 7, 2022 Forbes article.

This point of view is validated by OpenAI’s financial guidance referred to earlier. Google Search generated $149 billion in revenue for Alphabet in fiscal 2021. Even if OpenAI does meet its 2024 guidance, its top line will still be less than 1% of Google Search’s revenue.

What Should Investors Watch Going Forward?

Investors should focus their attention on two things going forward, as it relates to the risk of OpenAI’s ChatGPT disrupting Alphabet’s core Search business.

The first item to watch is the monetization of ChatGPT, which is key to supporting its future development and growth.

Everyone can use Google Search services for free, and Alphabet monetizes its search with paid advertising. It is possible that OpenAI could sell ChatGPT as a paid subscription service for consumers, on top of licensing its AI solutions to corporates.

Also, the current and future collaborations between OpenAI and other internet giants could also pave the way for accelerated growth. As early as July 2019, Microsoft (MSFT) has already disclosed that it entered into a “exclusive computing partnership” with OpenAI in the area of “Azure AI supercomputing technologies” following a $1 billion investment in the company.

The second item to take note of is the improvements made to the newest version of ChatGPT.

There is speculation that GPT-4, the latest iteration of ChatGPT, might be available for use by consumers next year. In the preceding section, I touched on some of the key shortcomings relating to the current ChatGPT. It is worth watching if GPT-4 will address some of these issues mentioned in this article.

Alphabet is also constantly making tweaks to its Google Search algorithm to improve its value proposition in the eyes of users. It remains to be seen if ChatGPT will eventually evolve to become the “better mouse trap” that successfully disrupts Google Search.

I have already stated my view that Google Search’s dominance won’t be threatened by ChatGPT for the foreseeable future. In the subsequent section, I outline my prediction what the future holds for OpenAI’s ChatGPT and Google.

What Is The Long-Term Stock Prediction?

I think that there are two scenarios which could pan out in the long run.

One scenario is that ChatGPT and other AI chatbots don’t turn out to be as popular as what the optimists expect. In that case, Google Search maintains its market leadership, and Alphabet’s shareholders have nothing to fear.

The alternative scenario is that AI chatbots like OpenAI’s ChatGPT successfully replace search engines as the most common and convenient way of gaining access to online information.

Assuming that alternative scenario happens, Alphabet would have likely come up with new products and services that cater to such changes in consumers’ preferences. As an example, a December 13, 2022 CNBC article cited Alphabet’s CEO comments that Google has “chat products underway for 2023.”

Is Google Stock A Buy, Sell, or Hold?

The emergence of OpenAI’s chatbot ChatGPT doesn’t change what I think about Google’s near-term and long-term prospects. As such, I am of the view that Google/Alphabet is still a Buy.

Be the first to comment