Large open cut iron ore mine BeyondImages

Mesabi Trust (NYSE:MSB) is a publicly traded entity that owns a royalty interest in the Peter Mitchel iron ore mine that is operated by Cleveland-Cliffs’ (CLF) Northshore facility.

This current article could be viewed as an update on my bullish article published nearly five years ago here at Seeking Alpha.

A thorough review of the trust can be found in this article by James Duade – the first of a series of excellent articles that he wrote on the trust.

Today, the situation is much changed

Unfortunately for Mesabi’s unitholders, Cleveland-Cliffs’ CEO Lourenco Goncalves has a bone to pick with the Mesabi Trust. He does not like the trust’s royalty structure and (more importantly – thanks to recent acquisitions) has no immediate need for Mesabi’s iron ore.

This is a radical departure from the past, when Northshore (and Mesabi’s ore) was a key asset needed to fulfill customer contracts.

As CEO Goncalves stated in the last Cleveland-Cliffs’ earnings call:

…we are now extending the ongoing idle at our North Shore swing facility to at least April of next year. With the increased use of scrap company-wide in our steelmaking operations made possible by the acquisition of FPT last year, the pellets from North Shore are not needed at this time. Rather than deplete this finite resource for the benefit of the Mesabi Trust and its so-called unitholders we will keep Northshore idle until we decide otherwise.

Mesabi Trust filed an 8-K related to the above (and earlier) statements by Goncalves, which can be found here.

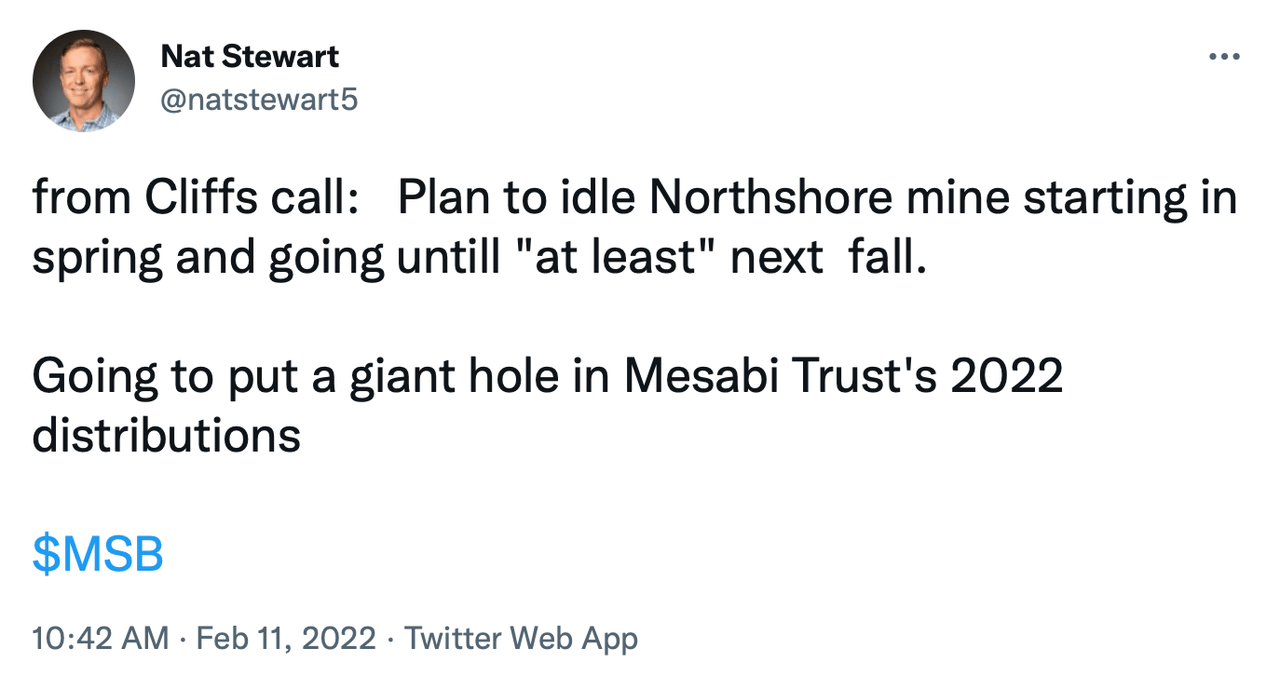

This is much worse than what I originally anticipated based on his earlier comments, as I tweeted in February:

My note on Lourenco’s earlier comment (Nat Stewart’s twitter account @natstewart5)

A shutdown until April will blow a massive hole in Mesabi’s next three distributions

This is because Mesabi’s distributions correspond with Cliff’s prior quarter earnings – there is a three month lag. Up until this point, Mesabi unitholders have not been impacted by the shutdown. This will change with the next three distributions.

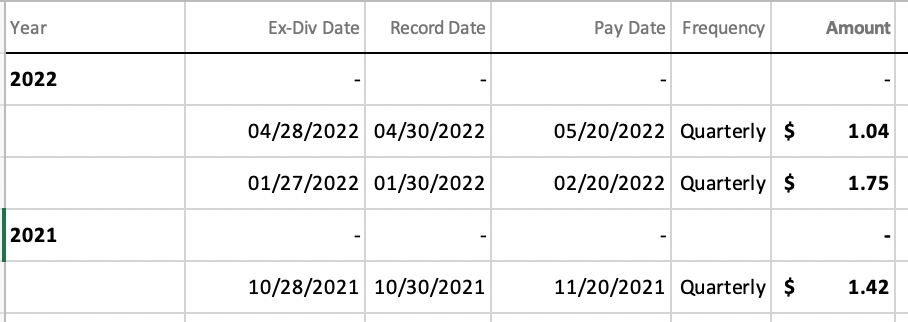

Last year, the October distribution was substantial

Mesabi Distributions: 10/22/2021, 1/27/2022, 4/28/2022 (Dividend History – Mesabi Trust)

The current royalty report confirms that this October will be much worse

The royalty report published yesterday (8/2/2022) confirms the above facts.

Last year, the trust received $19,495,040 for Cliff’s second quarter production – enough to support October 2021’s large $1.42 distribution.

This year, they received just $2,314,994 for the same period. After a $.04 estimate for trust expenses (assuming they choose to pay out proceeds and maintain current reserve levels) this trust will have around $.13/unit ($2.314M / 13.12 units – $.04) from the current period available for distributions – suggesting a 91% year-over-year distribution cut.

Given Lourenco’s shut down plans, I don’t see potential for the January or April distributions to be any better.

Why are Mesabi Trust’s units holding up so well, given the above reality?

I don’t know, but it does not surprise me. I noticed the borrowing cost to sell short spiked recently, as well as a very limited availability of shares to short – both items suggest that some traders are aware of the situation and have started to act on it.

My guess – the stock is holding up due to simple ignorance – the often wacky trading dynamics in small, unfollowed securities.

Like with many yield securities, a good number of folks look only to the last distribution (which right now, looks good, with the ex date for the last $.84 announced dividend being 7/28) to set their expectations. As of right now, these folks see zero problems.

There is also the potential that a large institutional unitholder could be supporting the unit price – a specific fund group owns a large percent of units outstanding after aggressive purchases over the past several years.

I view this as unlikely

This fund group tends to take a very long-term view (owning a few of their large positions for ~25 years or so). I would think they would be happy to see the unit price go down over the intermediate term (and then at that point, perhaps resume buying). The trust still has claim to an excellent long-term asset, so this point of view is still valid for large, long-term investors positioned to weather the current storm.

Bottom line

Mesabi Trust’s unit price does not currently reflect the coming collapse in distributions and (more importantly) its degraded economic position with Cliffs.

Mesabi Trust’s ore is now used exclusively for internal consumption and alternative sources of raw material are now available (thanks to Cliff’s recent acquisitions). As a result, the leverage the Trust once had with Cliffs has been severely degraded – and I don’t see this fundamental problem getting fixed any time soon. This highly uncertain situation is in no way reflected in the trust’s current unit price.

In my view, Mesabi’s units have at least 50% downside potential from here.

Be the first to comment