TexBr

By Blu Putnam

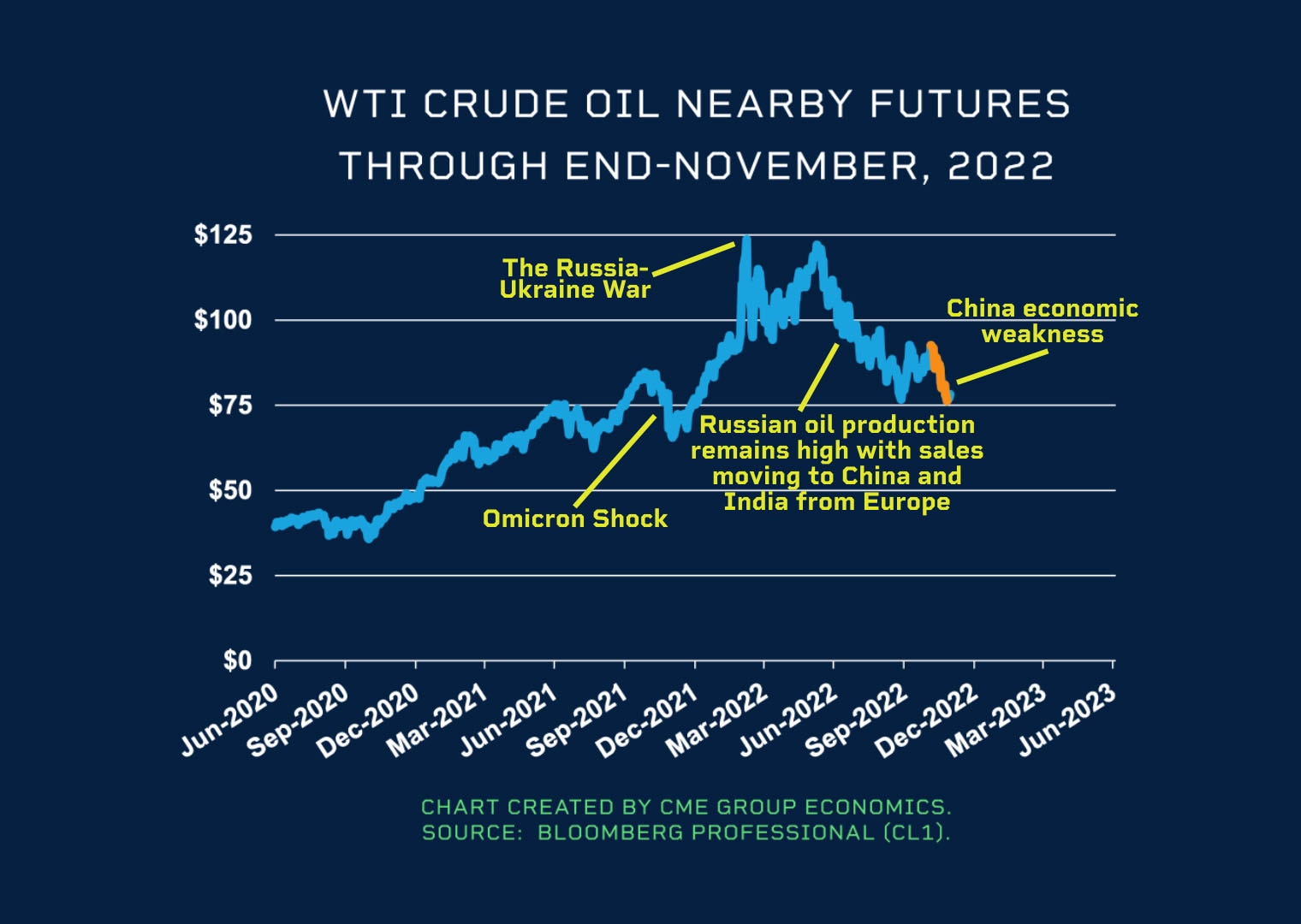

In November, the powerful influence of China on oil prices was on full display as fears of economic weakness associated with the maintenance of its zero-COVID policy shook markets.

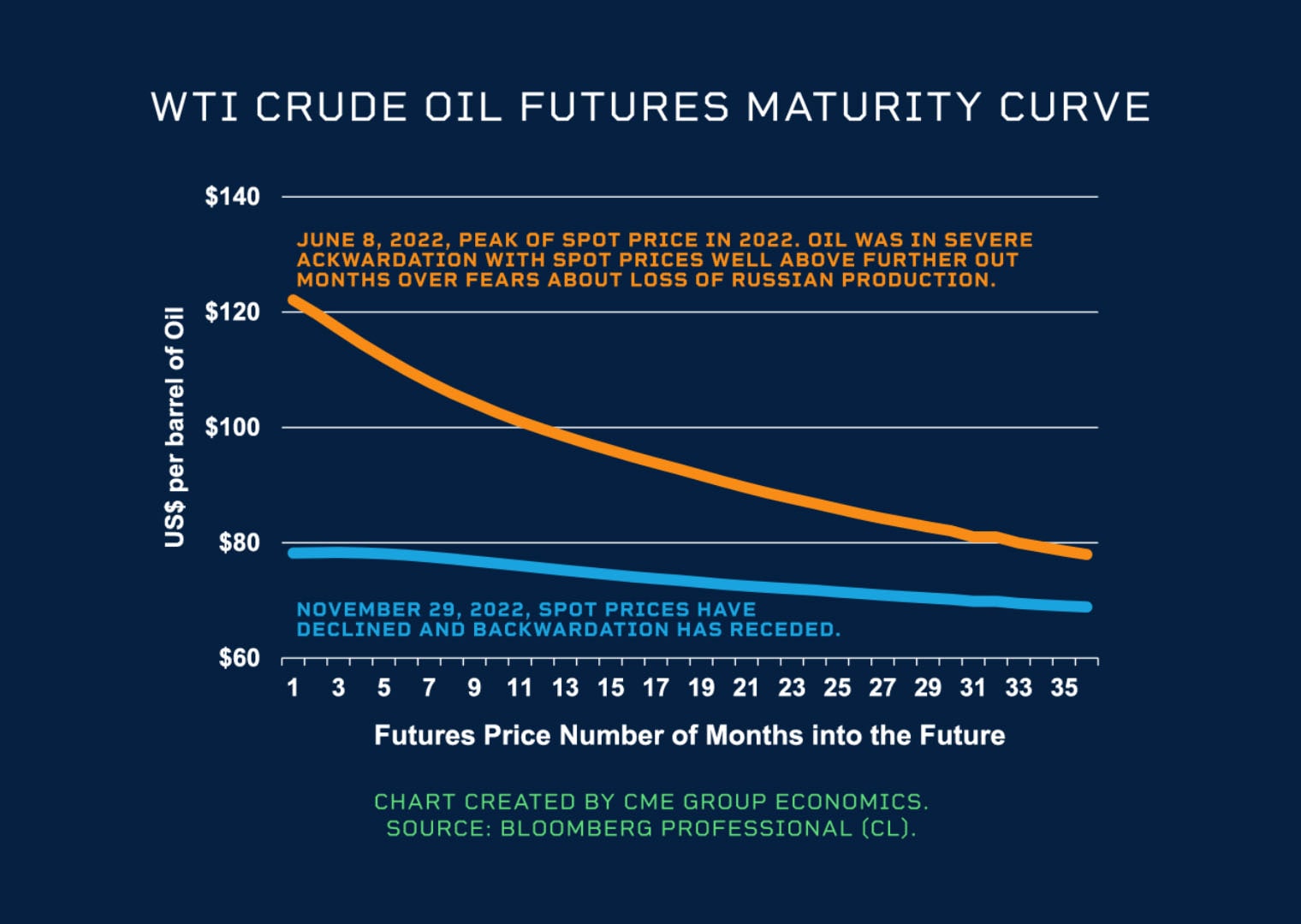

WTI crude prices dropped $10 per barrel from around $88 to $78 between Nov. 1 – 29. Interestingly, the damage was mostly done on the front end of the maturity curve; the 3-year futures price hardly fell at all, as the degree of backwardation lessened.

The evidence for risk from China on the price of oil comes on top of the risk experienced at the beginning of 2022 when Russia invaded Ukraine. In the early stages of the Russian invasion, oil prices shot higher, peaking in June 2022 at around $125 per barrel of WTI crude. At the time, as fears spread, a few Wall Street analysts even talked of $175 or $200 oil. That did not occur, however, as Russia continued to produce oil, while selling it to China and India at huge discounts instead of to Europe.

Beware of political risks in both Russia and China in the coming months. Conditions are extremely fluid and not stable. Prices can shift abruptly in either direction, as the oil market responds to changes in expectations regarding global economic growth and future oil demand.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment