Maksim Labkouski

Published on the Value Lab 19/7/22

Houlihan Lokey (NYSE:HLI) is a premier investment bank, really one of the most respected firms in the world. They deal with pretty exotic problems and have a strong history of executing well on complicated assignments. The price was way too high before, with restructuring too limited to offset declines in corporate finance. The price has declined 20% now, and the resilience that it does have in its financial sponsor facing businesses and restructuring counts more to the valuation case. However, it is still priced for too much growth in our opinion where none should be expected for at least a year if not two. We see better opportunities on the market in other industries, and definitely prefer Moelis (MC) over HLI among the boutiques.

A Q4 Look

The Q4 figures are the most recently reported due to the later closure of the fiscal year. Naturally, the trends for HLI look better than competitors, but mainly because the ebullience of 2021 is better shared between the 2022 fiscal year and 2021 versus companies with more standard fiscal calendars.

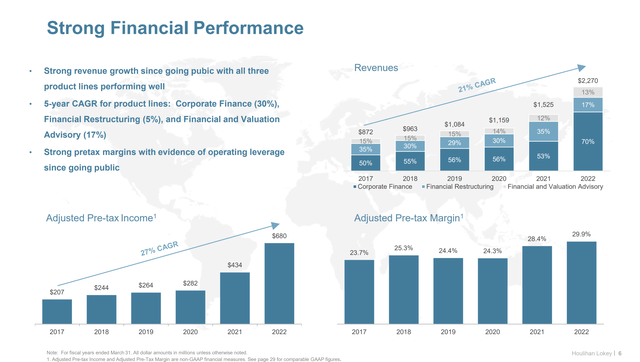

Financial Highlights (HLI Q4 Pres)

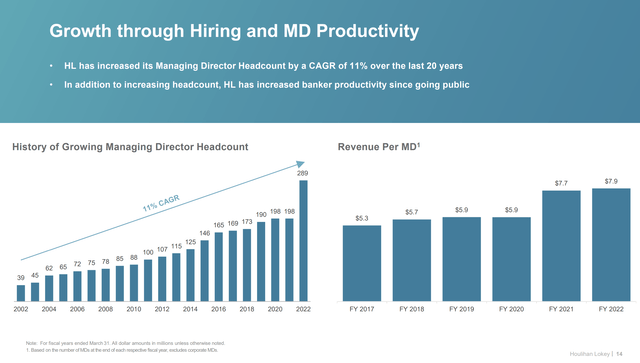

However, the trends are a little better for HLI over some other players with acquisitions and headcount investments adding to the company’s revenues as their productivity becomes ‘consolidated’.

Much of this headcount is coming into restructuring, which typically uses employees for other divisions, but HLI actually has their own designated bench for the unit that includes hundreds of financial professionals and over 50 MDs. With restructuring in a record trough across the board of financial advisors, it is good to see them gearing up for the heightening restructuring dialogue, especially as CPI figures scare markets.

Points of Resilience

Houlihan has come down in price more or less in line with markets, by about 20% since we last covered it. We think that in relative terms, this might be exaggerated, since HLI is exposed to less beta in its businesses than the markets.

- Restructuring – firstly, the restructuring business is dedicated and in 2020 accounted for 33% of revenues. Restructuring is obviously very countercyclical, with the ebullient 2021 being a terrible year for that sort of activity.

- Financial Sponsor Exposure – within corporate finance, which is their biggest business, they have a lot of financial sponsor exposure which is going to be more resilient since there are financial sponsors for down-cycles, and the liquidity and dry-powder are already out there and still need to be allocated.

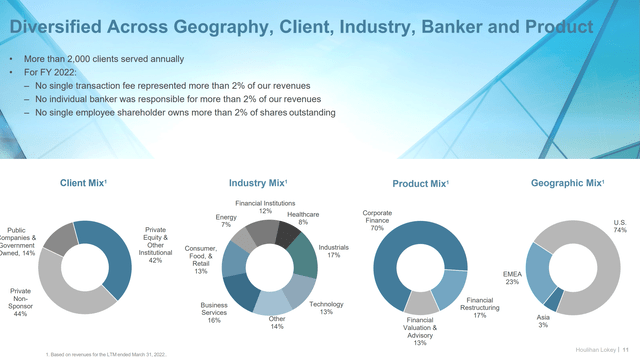

Segment and Market Breakdown (Q4 2022 Pres)

- Mid-market Exposure – across all their businesses, HLI is almost exclusively exposed to the mid-market, which has a more secular and less opportunistic need for consolidation. In 2021, any megadeal that a massive corporate could imagine had a shot of going through, but the environment where everything is possible is already over, and what’s left in M&A is going to be mid-market companies that can usually benefit from strategic M&A regardless, if not especially because of the environment.

Conclusions

The company trades at a 12x P/E however, and while its businesses are more counter-cyclical than most, 12x does imply some meager growth expectations over a typical horizon period. We think that with real economic danger but also the shutdown of leveraged finance markets, things are looking pretty grim for the industry. Moelis has a 7x PE multiple more reflecting of those expectations, where both banks benefited a lot in 2021, and both have restructuring franchises with Moelis albeit lagging in the league tables. Overall, we’d rather risk capital with them, or a company like Perella Weinberg Partners (PWP) which offer more margin of safety but still have the brand to leverage into a harder environment. In the end, we’d not invest in this sector at all and will continue to keep our chips elsewhere in the markets.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment