Tim Boyle/Getty Images News

Dear readers,

In this article, we’ll take a look at Hostess Brands (NASDAQ:TWNK). The company, even the symbol implies it, is the owner of the well-known Twinkies soft cakes – as well as a whole host of other products.

In this article, we’ll look at if TWNK can offer your portfolio safety in the storm because this was the subscriber question – if the company is worth investing in while everything seems to be crumbling around us.

Let’s see what the numbers, the fundamentals, and the upside says.

Hostess Brands – What the company is

Hostess Brands, together with its subsidiaries, is a leading sweet snacks company. It’s focused on the research, development, manufacturing, marketing, and distribution of snack products in the North American market.

Hostess Presentation (Hostess IR)

The company’s primary brands are called Hostess and Voortman, and under these brands (and others), the company produces iconic snacks that have been around for entire decades. The company distributes products such as the Hostess, Donettes, Twinkies, CupCakes, Ding Dongs, Zingers, and Voortman-branded cookies and wafer products.

Hostess Products (Hostess IR)

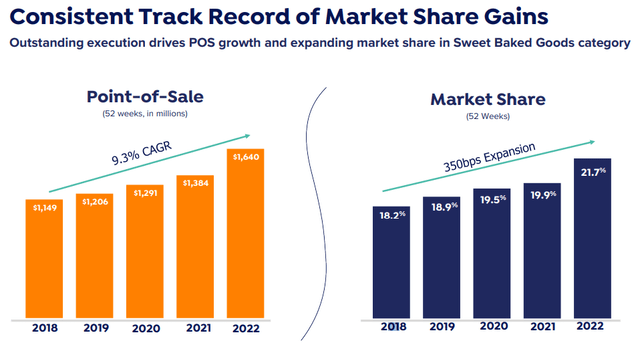

From a high level, it’s fair to say that this company operates a best-in-class business model with a market-leading consumer insights division and incredible capabilities. The company’s Sweet Baked goods products represented a full 21.3% of the relevant market share in their category, according to Nielsen. For cookies and wafers, the same share was around 2%, which technically provides an excellent growth opportunity.

Hostess Presentation (Hostess IR)

The company’s very strong and iconic brands are really part of the selling point here. The company acquired Voortman in 2020 and is looking to work this part of the business into significant growth. The company operates in the highly competitive sweet snacking category. This is a $91B market, that’s been growing at an annual rate just south of 5% per year over the past 3 years. The number of consumers eating five or more snacks per day has increased by double digits since 2018.

The company has one of the best brand awareness ratings in the entire market for Hostess, with 92% of customers being aware of the brand according to AccuPolls in adults between 18-65.

Hostess Presentation (Hostess IR)

The company seeks to grow its business through a combination of innovative marketing, new product development, targeted marketing efforts, new partnerships, and adjacent categories. Hostess recently forayed into popcorn and pudding mixes, and the company seeks to expand further.

There’s some uniqueness to Hostess Brand’s model. It ensures wide availability of products and uses a unique go-to-market approach with centralized distribution and common carriers. The company ships most of its products from its center in Kansas, and this centralization of distribution improves visibility and simplification. This is further made possible by the company’s extended shelf-life technology – I’m sure you’ve heard the theory that Twinkies can last for decades. The simple fact is that Hostess brands operate a superb model with good margins while having their logistics simplified to a relatively high degree.

There’s some seasonality to the company’s sales, with early winter being a boom period due to altered consumption behavior at this time – and the company expects this, generally speaking, to continue.

Hostess Presentation (Hostess IR)

Manufacturing for Hostess is done at one of five giant bakeries located in Kansas, Georgia, Indiana, Illinois, and Ontario. These auto-bake factories are state-of-the-art and fully automated industrial baking ovens and solutions that can be custom-configured. Its centralized distribution system is also state of the art and was opened back in 2020, expanding Hostess’s distribution capacity by no less than 75%.

The company’s input is primarily flour, cooking oil, sugar, and coatings – as well as the corrugated and film for packaging. The company buys as well as it can to reduce pricing volatility.

Customer-wise, the company’s 10 top customers made up almost 60% of annual revenues. The biggest customer is Walmart (WMT), which represents nearly 19% of revenues, with no other more than 10% of 2021 revenues. It’s doubtful that any of the top 10’s would change its relationship with Hostess, but if it did, this would obviously be a disaster for the company’s sales.

The company presents industry-leading margins. Adjusted GM is around 37%, and adjusted EBITDA/FCF margins are around 24-25%. Compared to a margin in the sector that’s usually below 20%, this is excellent, and part of the reason to invest in Hostess. Other reasons include very low private label exposure, which is otherwise the death of margins, broad access to virtually all sales channels, and exposure to the indulgent snacking segment – which is the fastest-growing snacking segment out there.

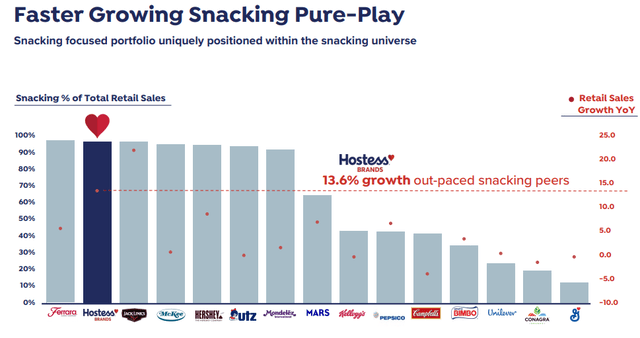

The company has also ventured into more sugar-free, modern snacking alternatives. But the fact is that this company outperforms almost every single peer. The snacking universe grows at 4.8% per year – Hostess grows at 9% – and for the time being, this is set to continue.

Recent results confirm this.

Hostess Presentation (Hostess IR)

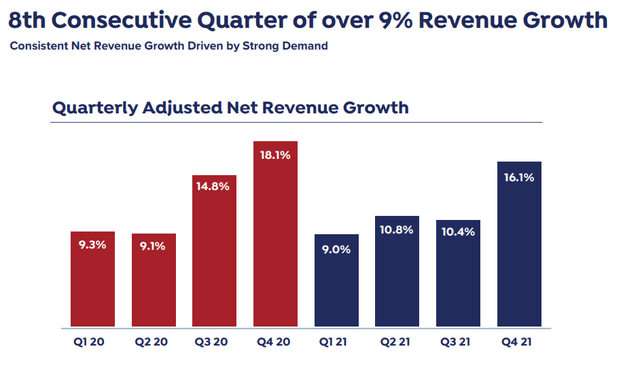

This is the 9th consecutive quarter of a 9% or higher net revenue growth. The company has been growing this way through almost the entire pandemic. The company is accelerating its point-of-sale growth across its entire portfolio. It presents a convincing case for continued market share gains over time.

Hostess Presentation (Hostess IR)

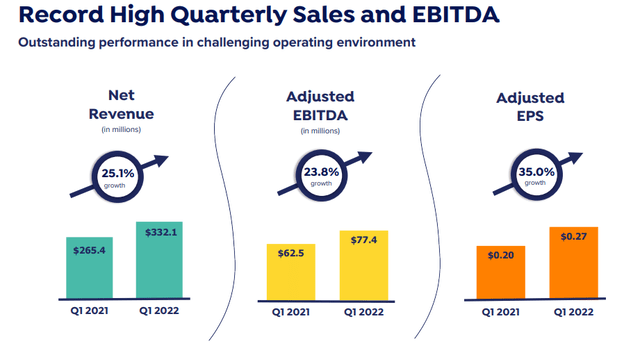

We now have raised 2022E guidance of at least 12% revenue growth, and adjusted EPS of close to a dollar per share, and an annual EBITDA of almost $300M. The company has no plans to institute a dividend. Capital return to shareholders comes in the form of buybacks. The company combines this with targeted M&As, and the ambition to keep leverage below 3-4X.

The potential growth here is into the $50B snacking occasions, which the company has yet to crack more. Current revenues are $7B in the sweet baked goods category and $8B in cookies – but that is before the $50B market potential. There’s significant growth to be had here if the company continues to execute well.

I have every reason to believe that it will do just that.

Hostess Valuation

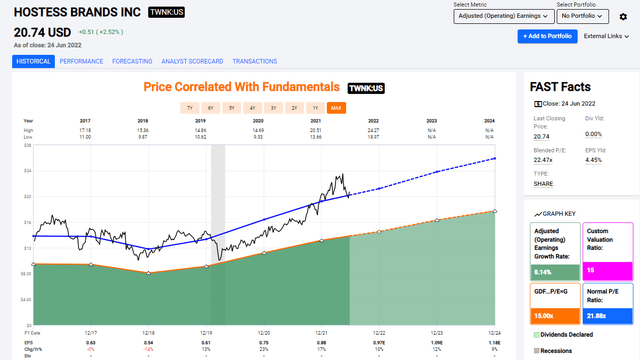

The crux of the matter is, as always, the valuation. Hostess has a history of trading at a premium to the sector, and to peers. The 5-year average is close to 22X P/E – and the company is at a slight premium even to this.

A snacking company growing EPS double-digits is, of course, a good investment – at least in theory. But in today’s market environment we also need to consider the downside. The potential downside for Hostess is at least as low as we saw in the pandemic, at which time the company trended close to that 15X P/E line.

Hostess Valuation (F.A.S.T Graphs)

This complicates things. TWNK is a company with a record, market-leading growth rate and a legacy that spans decades, with some of the most well-known products out there. Calling such a company “overvalued” needs to be based on sound considerations, forecasts, and facts. So let me try to do just that.

The company’s 5-year P/E is around 21.8X. Based on that, if we assume the growth rates forecasted to be accurate, and I tend to believe that they are, this means TWNK investors get an annualized RoR that’s close to the rate that the company grows earnings at – 9%.

Normally and in a normal market situation, this might have been enough. However, because we’re battling a 6-8% annual rate of inflation, this puts things into different perspectives. Because the complete lack of any dividend, this means that this return, gross of any buybacks of course, is all that we can expect from Hostess.

To me, that isn’t enough.

If we were at 16-18X P/E, that rate of return might have been as high as 15-20%. But that’s not where we are – and I’m unwilling to rate it any higher. The fact is that over 22X, the company competes with business like Nestle (OTCPK:NSRGY) and others – and while Hostess is great, it’s certainly no Nestlé.

Simply put, it’s too much of an ask for too much risk, for too little reward. 9% isn’t enough – 25% RoR until 2024E isn’t enough when inflation might kill at least 15-16% of that, and that’s calculating generously and assuming the FED gets inflation relatively under control until then.

When the math doesn’t make sense, I’m not that interested, even if the company is great. And to me, this math doesn’t make sense. 11 analysts call this company a “BUY” with an average PT of $26.50, which is a premium. It also implies an undervaluation of 28% at this time.

I say what I mentioned above – yes, the company has an upside – almost 10%, and it might even be 10% conservatively if the company retains that premium. But because it’s a premium, because the company has no yield, because of the low visibility of supply chains, input costs, FX, logistical and energy costs (the company uses Natgas to fire its ovens in every autobakery), I’m not willing to gamble much in this environment.

I say “HOLD” – and I say eat a twinkie but stay away from Hostess for the time being.

Thesis

My thesis for Hostess is, therefore:

- Hostess is one of the greatest snack brand companies out there – with industry-leading margins, a great organization and good growth prospects. It’s not outside the realm of possibility that growth could be even higher than expected.

- However, Hostess also comes at a substantial premium, has no yield whatsoever, faces supply chain, inflation, and energy risks as well as the general movement against sugar snacks, and because of that, I’m a bit hesitant to go in here.

- I’ll consider the company a “BUY” at around $19/share, when the company’s upside is higher than 10% – and even then, I’d be careful.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment