Justin Sullivan

Introduction

On its way to breach $12 billion in annual revenue (with the chance to get close to $13 billion), Hormel Foods (NYSE:NYSE:HRL) is often a go-to stock for investors seeking low volatility, consistent results and, most importantly, growing dividends. In this article, I would like to share my research on the company whose strategy and outlook I do like. However, there is one particular reason I will share that makes me wait on the sidelines to find a better buying opportunity.

For readers who read for the first time an article of mine, this is the third episode of a coverage of the main players in the packaged goods and meats industry. These are the first two.

- The Hershey Company: High Quality For Dividend Growth Investors

- The Kraft Heinz Company: The 4% Yield Is The Price For Investors’ Patience

If you are interested in one particular stock within this industry, please do write it in the comments and I will do some research to share.

An overview of Hormel Foods

Hormel Foods is sometimes still looked at as if it were only a meat producer. However, while up until 2013 the company was focused on meat, with pork and turkey being its core products, starting from 2013 the company evolved first towards being a protein-centric company de-risking from commodity-driven profits. In fact, Hormel expanded beyond meat protein with the acquisition of SKIPPY peanut butter, or WHOLLY Guacamole, and its foodservice business started to hit its stride and gain traction delivering strong results.

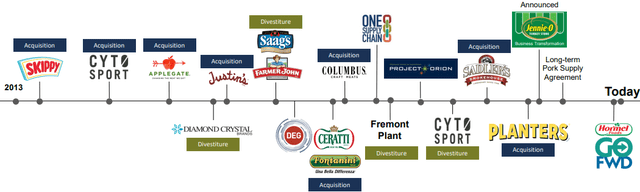

Then, from 2020, Hormel became a true global branded food company that has a portfolio covering many different food sectors. We can see this transformation thanks to the timeline shown below, where acquisitions and divestitures are indicated as the key steps towards the making of a new global company.

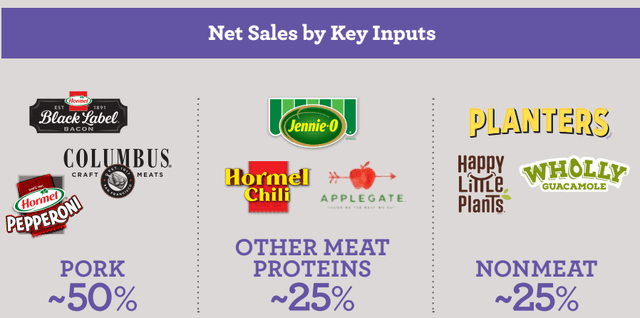

Hormel Barclays 2022 Conference Presentation

At the 2022 Barclays Global Consumer Staples Conference, Hormel foods outlined more than once the importance of its $3.4 billion Planters acquisition from Kraft Heinz (KHC), the largest acquisition ever made by Hormel Foods and the one that actually made the company a big player in the snacking business. As a matter of fact, Hormel was present in this business for many years, but Planters just brought this division’s size up to become the meaningful growth engine the company has. With the acquisition of the Planters snack nuts business, approximately 25% of Hormel’s business is from nonmeat inputs, complementing its positions in pork, poultry and beef.

In addition, Hormel owns core brands such as Spam, Skippy, Jennie-O and many other brands, 40 of which are either #1 or #2 in their retail category.

Hormel Foods is also building ethnic and foodfoward portfolios, with brands such as Herdez, Wholly, La Victoria, Chi-Chi’s, Applegate, Justin’s and Happy Little Plants.

The weak, yet promising, side of the company is its international presence. So far, international sales represent less than 10% of total company sales. Hormel plans on aggressively developing this channel to become a true global branded food company.

Financials and Profitability

First of all, investors should know that we are going to see a company that grows slowly, but steadily and that pays a lot of attention to its balance sheet health.

Assuming the company will reach a revenue of $12.7 billion this year, the revenue CAGR since 2011 would be around 4%. As we move down to the gross profit, we see that the company grows it faster than its revenue at a CAGR of 4.88%. When I see profits growing more than revenues I see a company that executes well and manages its cost of sales. Hormel Foods does even better when we look at the Operating Income which grows at annual rate of 5.80%, not to speak of the Net Income CAGR which could end up at the end of 2022 at a 7.43% assuming a net income around $1.1 billion.

When we move to look at the EPS we see that back inn 2011 this metric was $0.95 and it is now projected to be around $1.82. Here we have a little slower growth, at a CAGR of 6.1%. Part of this, is due to the fact that in the past 11 years, the number of outstanding shares slightly increased at a CAGR of 0.3%.

Indeed, the company has stated more than once that it targets a 2-3% top line growth over the long-term while having a 5-7% bottom line growth.

Hormel Profitability Grade according to Seeking Alpha’s Quant Rating is a B. Its gross profit margin is around 17.4%, which is graded with a D. However, as we have seen above, the company is managed well and as we move towards the bottom line we see that margins are well-protected. The EBITDA margin is 12.3%, which upgrades the company to a B-. The net income margin is 7.93% which earns Hormel a B+. Most importantly, the return on total capital employed is a 7.77%, not staggering, but still enough to earn a B. In my other articles I pointed out that Hershey is the best one according to these metrics. However, Hormel Foods has good enough metrics to consider it as a stable and profitable business.

Up until the Planters acquisition, Hormel Foods had a balance sheet a net cash position having a total debt in 2019 of only $250 million and $672 million in cash. The recent M&As, brought up the total debt to the current $3.3 billion against $868 million in cash. However, the TTM EBITDA of $1.55 billion is enough to consider the company not overleveraged. If we look, in fact, at the net debt leverage ratio, we are still below 2x EBITDA. Moreover, as Hormel management explained during the recent Barclays Conference, because [the Planters] deal put free cash flow well above $1.0 billion, debt reduction is expected to be fast – resulting in an expected net leverage ratio of just 1.0x EBITDA in the 2024 fiscal year.

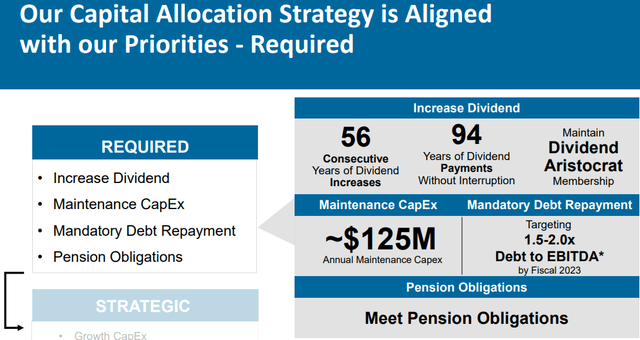

Hormel is not used to having debt and it has made it one of its required capital allocations to pay it down significantly over the next two years. Part of the debt reduction will be made thanks to Planters itself and its accretive cash flow.

Having spoken of debt, we have touched a main topic: capital allocation. Hormel Foods sticks to these priorities: dividend increases, capex under control, debt repayment, pension obligations, as shown below.

Hormel Barclays 2022 Conference Presentation

This is a very balanced use of capital which enables to company to protect its free cash flow thanks to managed capex and low debt, while returning a lot of its free cash flow to the shareholders through dividends, which have been increased for 56 consecutive years, making Hormel a Dividend King.

Q3 2022 Earnings

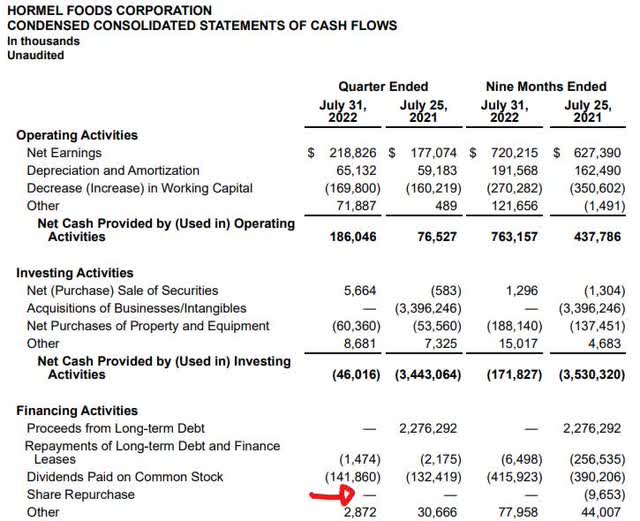

The recent Q3 2022 earnings report showed that the company is performing quite well. Net sales reached a record $3 billion, up 6% YoY, with organic sales increasing 3% YoY. The operating margin grew from 7.2% last year to 9.6% showing that Hormel is able to keep on executing well. Cash flow from operations was of $186 million, up 143% YoY.

While these numbers prove that Hormel is weathering the current situation, I was more curious about the full year guidance. Here investors came across a surprise. During the Earnings call, Hormel’s CEO Jim Snee reported that:

For the full year, we are increasing our net sales expectations to $12.2 billion to $12.8 billion, and we are lowering our diluted earnings per share guidance range to $1.78 to $1.85 per share.

There are two key takeaways from our guidance revision. One, we expect top line strength across our businesses to continue as our portfolio is well positioned for the current macroeconomic climate. And two, an escalation in certain operational, logistical and inflationary costs, which began impacting results in the third quarter, has lowered our earnings expectations for the back half of the year. However, we believe the majority of these cost pressures to be transient in nature and to subside over time.

The lowered EPS guidance led the stock to drop form $50 per share to $47 and is making some investors go over their multiples to assess if the company still deserves a 25 fwd PE and a 23 fwd price/FCF.

That inflation could be a problem was known, however, it is a bit disappointing that after this has been an issue for more than a year the company still has to revise downward its guidance, as if it hadn’t been able find a way to control it. In any case, the management has stated that it believes that through contracts that lock commodity prices the situation should improve starting from 2023.

Shareholder return

Before we end, let’s take a look at one of the most popular aspects of the stock: its dividend.

Last year, Hormel returned a record amount of cash to its shareholders in the form of dividends totaling $523 million. It also announced an increase of 6% to the dividend for fiscal 2022, representing the 56th consecutive year of dividend increases that lead to an annualized rate of $1.04 per share.

The company has paid dividends for 376 consecutive quarters and it has been increasing it for 56 consecutive years, as we have already said. Hormel is dedicated to returning excess cash to its shareholders and it has room to do so. In fact, its dividend yield is currently 2.18%, well supported by a free cash flow yield of 4%. The current payout ratio is 56%, which is a bit high for Hormel if we look at its history. However, it is still under 60% which for me is a sort of limit. The dividend has been growing almost at a CAGR of 10% over the past 5 years and Hormel is almost a safe bet in terms of future dividend growth.

While the dividend is interesting, especially over the long-term, I think that investors should pay attention to a fact. The company has stopped share repurchases in the past year, though a program has been approved and still has several hundred million to spend. While this may be a smart move, it tells that currently the management doesn’t see the stock valued at an interesting price. In a certain way, it is the management itself that is rating the stock as a hold as pointed out by the red arrow below.

Valuation

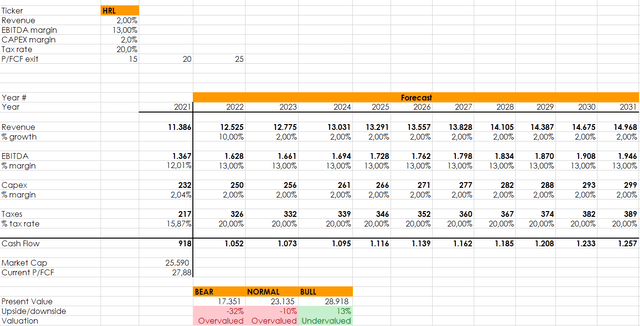

This rating is confirmed by my discounted cash flow model. Even if we plug in a 10% growth for 2022 and then get back to the long-term goal of the company, we see that the current price/fcf multiple is a bit high. Only in a bull case, I see some upside. I usually want to have a margin of safety of at least 20-25% and this time I don’t see it.

Thus, even though I like the efforts Hormel is doing to improve and grow, I will only put it in my watchlist and I will agree with its management on staying on the sidelines while waiting for a better opportunity.

Be the first to comment