Timothy Hiatt/Getty Images Entertainment

Hormel Foods Corporation (NYSE:HRL) is a good consumer staples company with good brands and an excellent track record of paying dividends. But the stock is overvalued based on the valuation metrics and a discounted cash flow model. The near-zero interest rates of the past decade were an aberration that helped expand the valuation multiples placed on companies. The increase in interest rates may be beginning to reset valuations. Existing shareholders can generate income by opportunistically selling covered calls. Investors looking to add to their holdings can wait for a lower valuation.

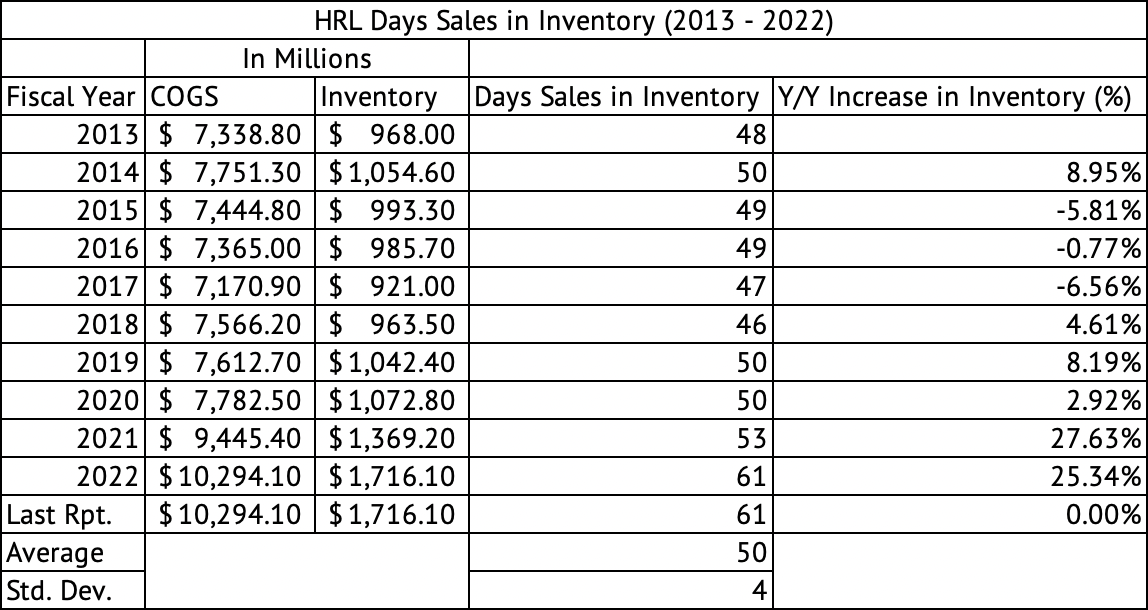

High inventory may pressure margins

High inflation over the past year has increased Hormel’s cost of inventory. The company typically carried, on average, about 50 days’ worth of sales in inventory over the past decade, with a standard deviation of 4 days (Exhibit 1). The company is now carrying over 60 days’ worth of sales in stock, well above two standard deviations from the mean, possibly indicating that the company may have to sacrifice margins to sell through this inventory. The company’s operating cash flows eroded in May and July 2022 quarters, with margins at 6%. The company’s operating cash flow margin averaged 10.06% over the past decade, but the average dropped to 9.8% between April 2020 and October 2022, a drop of 26 basis points. The company has increased revenues by increasing prices, but sales volumes have declined. It may not have much flexibility to increase prices further.

Exhibit 1:

Hormel Foods Days’ Sales in Inventory (Seeking Alpha, Author Calculations)

Hormel has no positive price momentum

Consumer Staples showed a strong performance over the past year during high market volatility. Hormel has performed poorly during this period, with a return of negative 6.2%, and has underperformed the consumer staples sector. The Vanguard Consumer Staples ETF (VDC) has dropped just 2.8% over the past year.

Between June 2019 and January 2023, Hormel Foods had an average monthly return of just 0.46%, compared to a 1% return for the Vanguard S&P 500 Index ETF (VOO). The monthly returns of Hormel Foods had a mild correlation of 0.24 during this period. The stock has low volatility (Beta) of 0.23, as measured by a linear regression model. Low-beta stocks, many of which are in the consumer staples sector, have performed well during this bear market. Over the past ten years, the company had a lower total return of 203.7% compared to the return of 226.7% of the S&P 500 Index, returning 203.7%.

Good dividend, manageable debt and an underwhelming share repurchase

The company offers a dividend yield of 2.45%, low compared to the 4.5% provided by the U.S. 2-Year Treasury but far better than the 1.59% offered by the Vanguard S&P 500 Index ETF. The company has increased its dividend for the 57th consecutive year and paid its 377th quarterly dividend, a fantastic track record.

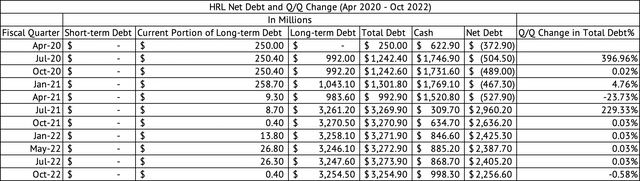

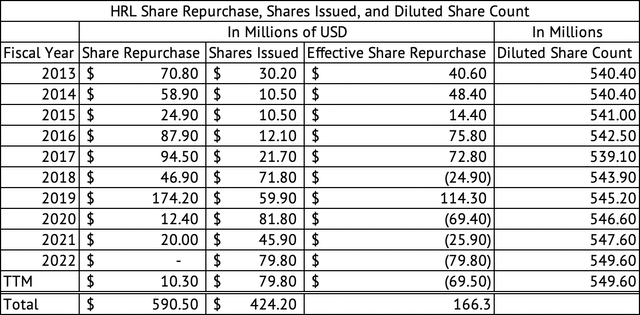

The company’s net debt-to-free cash flow multiple is 2.6x, and its debt-to-EBITDA ratio is 2.06; both ratios indicate a manageable debt level. Its net debt was $2.25 billion at the end of the October 2022 quarter (Exhibit 2). The company made share repurchases worth $590.5 million since 2013, but the company issued shares worth $424.20 (Exhibit 3). For the most part, the share repurchases helped prevent further dilution in shares rather than reducing the overall share count. The diluted share count stood at 549.6 million over the past twelve months; it was 540.4 million in 2013.

Exhibit 2:

Hormel Foods Debt and Cash (Seeking Alpha, Author Compilation)

Exhibit 3:

Hormel Foods Share Repurchase, Shares Issued, and Diluted Share Count (Seeking Alpha, Author Compilation)

Hormel Foods is overvalued

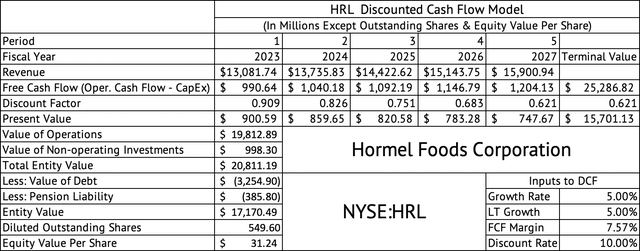

A discounted cash flow (DCF) model estimate of $31 per share shows the stock may be overvalued (Exhibit 4). This DCF model assumes a generous 5% growth rate in revenue, a 7.5% free cash flow margin (Operating Cash – CapEx), and a 10% weighted average cost of capital. The company has grown its revenue by an average of 4.18% over the past decade, but this rate includes revenue growth due to acquisitions. The company has struggled to grow revenues organically. For example, the company generated 2% organic net sales growth in the fourth quarter of 2022.

Exhibit 4:

Discounted Cash Flow Model for Hormel Foods (Seeking Alpha, Author Calculations)

Acquisitions may be too expensive in this high-interest rate environment. Newell Brands and the Goodyear Tire Company are examples of companies that made expensive acquisitions during a low-interest rate environment and are now struggling to reduce their leverage. A drop in demand has caused their operating cash flows to erode. Being a consumer staples company, Hormel may have better protection against demand erosion than Newell Brands and the Goodyear Tire Company, which operate in the discretionary segment of consumer spending.

The stock trades at a forward GAAP PE of 23x. The company has averaged a forward GAAP PE of 24x over the past five years. But, for most of the past five years, the cost of capital was close to zero. In the past year, the cost of capital and investors’ expectation of a return have changed. Cash is no longer trash, as Ray Dalio had remarked during the period of low-interest rates.

For fiscal 2023, the company is guiding for a 1% to 3% increase in revenue and a 6% increase in diluted earnings per share at the high end. But, investors may need to pay close attention to operating cash flow margins to ensure the company can generate enough cash to fund its capital expenditures and dividends comfortably. Investors must pay close attention to operating cash flows rather than EPS growth. The EPS growth does not accurately represent a company’s cash flow generation capacity. A company’s cash flow strength, growth, and predictability will determine its value.

Sell covered calls to generate income

An investor sitting on considerable gains may choose to generate extra income by selling covered calls on Hormel. It may be wise to sell a call when there is positive momentum in the stock in the coming weeks. For example, calls expiring on March 17, 2023, with a $47 strike price last sold for $0.43, generating a 0.9% yield based on the strike price. A nearly 1% yield is a reasonable premium for about five weeks. The stock would have to rise by 4.5% from the current $44.95 for the call to be assigned. Based on the monthly return data between June 2019 and January 2023, the stock returned more than 4.5% in 16% or about seven months.

An investor can be more conservative in selling covered calls if the yield on cost exceeds 3.5%. Investors should closely watch the stock’s momentum going to the earnings call on March 2 and act accordingly. A solid positive momentum going into its earnings release may generate reasonable call premiums while reducing the risk of call assignment.

Hormel Foods has great brands and may make an excellent long-term holding in a portfolio. The stock’s valuation is stretched, leaving no room for execution errors. The company carries a manageable debt load but does not offer enough dividend yield to justify buying at current prices. Existing shareholders may consider generating extra income by opportunistically selling covered calls. Investors may be better off waiting to purchase Hormel Foods Corporation.

Be the first to comment