kool99

Earnings of Hope Bancorp, Inc. (NASDAQ:HOPE) will most probably continue to surge in the years ahead thanks to anticipated loan growth. Further, the large balance of variable rate loans will allow quick re-pricing of the loan book, thereby leading to higher interest income. Meanwhile, the provisioning will likely remain at a normal level. Overall, I’m expecting Hope Bancorp to report earnings of $1.87 per share for 2022, up 12% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimate mostly because I’ve revised upwards my loan growth estimate. For 2023, I’m expecting Hope Bancorp to report earnings of $1.97 per share, up 6% year-over-year. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Hope Bancorp.

Strength in Job Markets Nationwide to Sustain Loan Growth

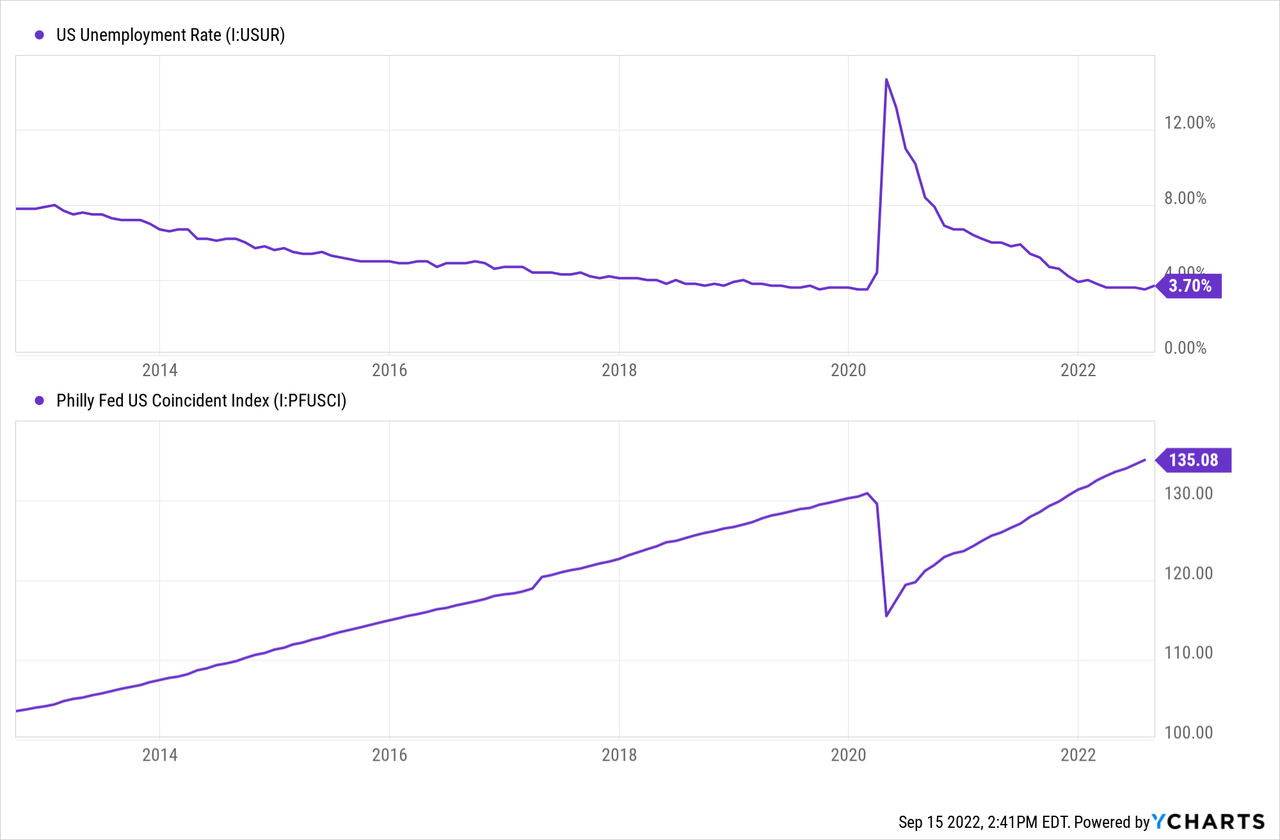

Hope Bancorp’s loan portfolio grew at an annualized rate of 8% in the first half of the year, which was close to the growth witnessed in previous years. I’m expecting loan growth to continue at this rate because of certain conflicting economic factors. Firstly, strong job markets will likely lift loan growth. Despite its Korean-American origin, Bank of Hope presently caters to all ethnicities and regions across the country. By loan segment as well, the loan portfolio is quite diverse, from residential mortgages to commercial business loans. As a result, it is appropriate to consider broad macroeconomic indicators to determine credit demand. As shown below, both the unemployment rate and the coincident index indicate that the country’s economic activity is currently in good shape.

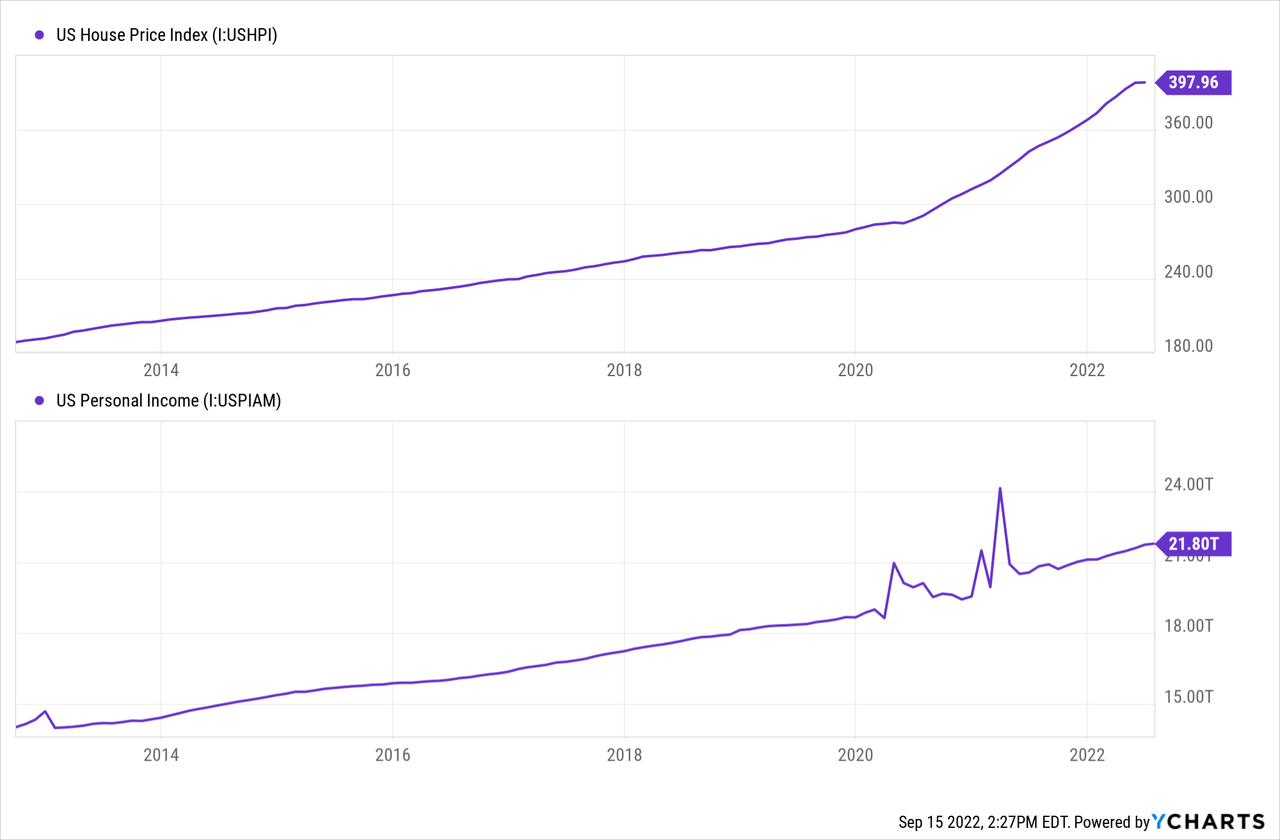

On the other hand, high interest rates will contain loan demand. Loan growth in the residential mortgage section will especially slow down as it is highly dependent on borrowing costs. Further, home prices have recently increased rapidly and out of step with income growth, which hurts home affordability.

Management is hoping to achieve high-single-digit to low-double-digit loan growth for 2022, as mentioned in the latest earnings presentation. Considering the factors given above, I’m expecting loan growth to remain at the lower end of management’s guidance. I’m expecting the loan portfolio to grow by 8% annualized every quarter till the end of 2023. This will lead to full-year 2022 loan growth of 8.4%. In my last report on Hope Bancorp, I estimated loan growth of 5.9% for this year. I’ve revised upwards my loan growth estimate partly because of the solid performance in the second quarter as well as an improvement in my outlook.

Meanwhile, deposits will likely grow in line with loans. However, other balance sheet items will likely trail loan growth. As interest rates have increased, the market value of available-for-sale securities has dropped. The resultant unrealized losses have eroded the equity book value (income statement not affected as per relevant accounting standards). The tangible book value per share dropped to $12.80 at the end of June 2022 from $13.10 at the end of June 2021. Further pressure on the book value is likely from the 75-basis point hike in the fed funds rate in July. Moreover, I’m expecting a further 75 basis point hike in the remainder of the year. On the other hand, retained earnings will lift the equity book value.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 12,006 | 12,182 | 13,356 | 13,812 | 14,976 | 16,211 |

| Growth of Net Loans | 9.0% | 1.5% | 9.6% | 3.4% | 8.4% | 8.2% |

| Other Earning Assets | 2,316 | 1,868 | 2,486 | 2,853 | 2,615 | 2,831 |

| Deposits | 12,156 | 12,527 | 14,334 | 15,040 | 15,637 | 16,926 |

| Borrowings and Sub-Debt | 1,118 | 927 | 559 | 622 | 932 | 1,009 |

| Common Equity | 1,903 | 2,036 | 2,054 | 2,093 | 2,079 | 2,250 |

| Book Value Per Share ($) | 14.5 | 16.0 | 16.6 | 17.0 | 17.2 | 18.6 |

| Tangible BVPS ($) | 10.8 | 12.3 | 12.7 | 13.2 | 13.3 | 14.7 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Loan Mix, Loan Additions to Lift the Margin

The average loan yield is moderately rate-sensitive because of the variable-rate loans, which made up 44% of total loans at the end of June 2022, as mentioned in the presentation. Moreover, $498 million in hybrid-rate loans, representing 3% of total loans, will change from fixed to variable within the next twelve months. Moreover, the average earning asset yield will continue to grow as a result of loan additions in the coming quarters. This is because the average rate of new loans was 4.26% in the second quarter of 2022, which is higher than the existing portfolio’s average yield of 4.06% (source: the 2Q 2022 presentation and 10-Q filing).

The deposit book is also quite rate-sensitive as it is heavy on money-market and savings deposits, which re-price frequently. These deposits made up 44% of total deposits at the end of June 2020.

Considering these factors, I’m expecting the margin to grow by 10 basis points in the second half of 2022 before stabilizing in 2023.

Expecting Earnings to Grow by 12%

The anticipated loan growth and margin expansion discussed above will likely drive earnings this year. On the other hand, higher noninterest expenses will likely constrain earnings growth. Management has increased its guidance for noninterest expenses to 1.75% – 1.78% of average assets from the previous guidance of 1.70%, as mentioned in the presentation. Meanwhile, the provisioning will likely remain at a normal level from now until the end of 2023. Due to the large net provision reversal reported in the first quarter of the year, the provisioning for the full-year 2022 will be below normal.

Overall, I’m expecting Hope Bancorp to report earnings of $1.87 per share for 2022, up 12% year-over-year. For 2023, I’m expecting earnings to grow by 6% to $1.97 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 488 | 467 | 467 | 513 | 575 | 637 |

| Provision for loan losses | 15 | 7 | 95 | (12) | 2 | 20 |

| Non-interest income | 60 | 50 | 53 | 44 | 52 | 52 |

| Non-interest expense | 278 | 283 | 284 | 293 | 321 | 352 |

| Net income – Common Sh. | 190 | 171 | 112 | 205 | 225 | 238 |

| EPS – Diluted ($) | 1.44 | 1.35 | 0.90 | 1.66 | 1.87 | 1.97 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

In my last report on Hope Bancorp, I estimated earnings of $1.73 per share for 2022. I’ve revised upwards my earnings estimate mostly because of the upward revision in my loan growth estimate. I’ve also tweaked all income statement line items following the second-quarter results.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Maintaining a Buy Rating

Hope Bancorp has maintained its dividend at $0.14 per share since the second quarter of 2018. Based on my earnings outlook and the historical payout trend, I’m expecting no change in the dividend level next year. My estimates suggest a payout ratio of 28% for 2023, which is below the past five-year average payout ratio of 45%. My dividend estimate suggests a dividend yield of 4.0%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Hope Bancorp. The stock has traded at an average P/TB ratio of 1.12 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 10.7 | 10.8 | 12.3 | 12.7 | 13.2 | |

| Average Market Price ($) | 15.5 | 14.6 | 12.5 | 9.1 | 14.0 | |

| Historical P/TB | 1.45x | 1.35x | 1.01x | 0.71x | 1.06x | 1.12x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $13.30 gives a target price of $14.90 for the end of 2022. This price target implies a 6.4% upside from the September 14 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.92x | 1.02x | 1.12x | 1.22x | 1.32x |

| TBVPS – Dec 2021 ($) | 13.3 | 13.3 | 13.3 | 13.3 | 13.3 |

| Target Price ($) | 12.2 | 13.5 | 14.9 | 16.2 | 17.5 |

| Market Price ($) | 14.0 | 14.0 | 14.0 | 14.0 | 14.0 |

| Upside/(Downside) | (12.6)% | (3.1)% | 6.4% | 16.0% | 25.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.6x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 1.03 | 1.44 | 1.35 | 0.90 | 1.66 | |

| Average Market Price ($) | 15.5 | 14.6 | 12.5 | 9.1 | 14.0 | |

| Historical P/E | 15.1x | 10.1x | 9.2x | 10.1x | 8.4x | 10.6x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.87 gives a target price of $19.80 for the end of 2022. This price target implies a 41.3% upside from the September 14 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.6x | 9.6x | 10.6x | 11.6x | 12.6x |

| EPS 2022 ($) | 1.87 | 1.87 | 1.87 | 1.87 | 1.87 |

| Target Price ($) | 16.0 | 17.9 | 19.8 | 21.6 | 23.5 |

| Market Price ($) | 14.0 | 14.0 | 14.0 | 14.0 | 14.0 |

| Upside/(Downside) | 14.6% | 28.0% | 41.3% | 54.7% | 68.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $17.30, which implies a 23.9% upside from the current market price. Adding the forward dividend yield gives a total expected return of 27.9%. Hence, I’m maintaining a buy rating on Hope Bancorp.

Be the first to comment