Dimensions

The Home Depot, Inc. (NYSE:HD) stock has been one of our favorite long-term plays. It has simply been a winner over the years.

The recent market meltdown of 2022, in conjunction with hot inflation and a tremendously rising rate environment which is slowing housing data has led to a strong selloff in Home Depot stock from the highs. Still, the company continues to put up dazzling numbers even in the face of all of this adversity. While performance will undoubtedly slow a bit for a few quarters while the country adapts to the new landscape, we believe this is an opportunity to add to existing positions or start scaling into a new one. This market selloff, this pullback, will create wealth in the longer-term if you start buying selectively. Sure, the market sucks.

The stay-at-home craze is over, so the big bump from people sprucing up their homes has ended. But with housing data getting weak, and new sales slowing to a degree, we think people put money into existing homes now where they will live, or where owners will rent until the market improves. This is not as strong of a catalyst as a hot market, as people may spend to do flips, etc., but we think this is being overlooked. In our opinion, the pullback is a good opportunity as we see the stock as set to return to its usual slow but reliable returns over the long term.

While the immediate valuation is stretched, the long-term story is intact. Long term, we still love Home Depot. Let us go over the most recent results and discuss our expectations.

Home Depot’s sales set a Q2 record despite the worsening environment

Q2 performance was solid following momentum from Q1. Sales growth has consistently been in the mid-single digits for Home Depot. In Q2, the year-over-year comp was stellar. This led to sales up big versus last year, as reported. The company saw Q2 sales of $43.79 billion. This was a 6.5% increase compared to Q2 2021.

These revenues surpassed our expectations by $300 million. They were way above consensus, beating by $460 million. Let us talk about comparable sales. Comparable store sales are one of the most important indicators we watch in all retail names. These numbers provide good numbers on total customer traffic and total ticket purchases.

Well, comparable sales were up nicely. In fact, they were one of the largest highlights of Home Depot’s report. They came in +5.8% in Q2, and comparable sales for U.S. stores continue to drive this, coming in at +5.6%. Now look, this is not nearly as strong as the comps we saw in like 2020, and in 2021 things normalized, whilst in 2022, we are back to about normal. Slow and steady growth. Average ticket sales were up a strong 9.1% to $90.02, while sales per square foot were up 5.7%.

We think Q3 and Q4 will show growth, but we expect the inflationary pressure and rate hikes to slow a bit of spending.

As an anecdote, spending does not have to slow if you have Home Depot’s consumer credit card. Purchases over $299 get 6 months interest free, while purchases over $2,000 often get 24 months interest free. Say what you will, but that zero percent draws in a lot of sales. As rates rise, regular credit rates rise, often with no APR bonus other than an initial offer.

With the slowdown in housing and demand erosion, the truth is, no one really knows, other than the company itself if it is checking its sales numbers daily or weekly, what is really happening. Surely Home Depot is monitoring, but we will have no indication of the outlook without its comment or guidance changes.

We are bullish, but a lot of this is priced in here, but we think as the selloff continues that this is a stock to add to your portfolio. That is the reality. However, the numbers are so strong, and we get a nice dividend. Earnings have really grown, despite the pressure that began to build in Q1 2022.

Earnings growing solidly

With revenues rising strongly in Q2, our earnings expectations were crushed. Home Depot surpassed our expectations by $0.15 per share. The company has historically been exceptional at managing its expenses. Here, in this report, earnings per share were up 11.5% year-over-year.

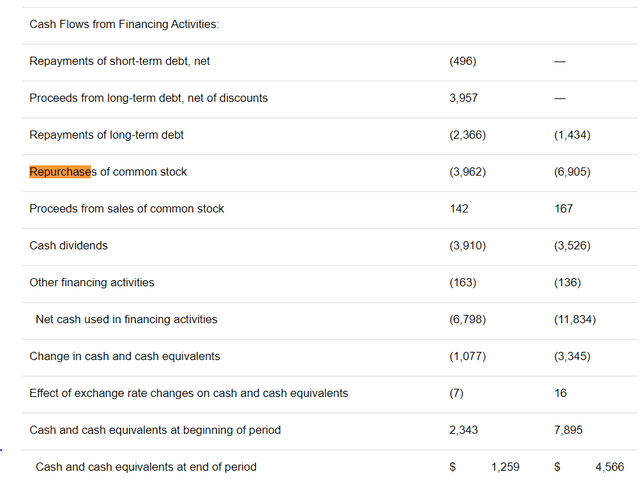

This is solid. Net earnings for Q2 2022 were $5.2 billion, or $5.05 per share, compared to net earnings of $4.8 billion, or $4.53 per diluted share, in Q3 2021. This was even with a big slowdown that began really in January and has continued to date. These results were far above analysts’ overall expectations, surpassing them by $0.12. The earnings per share bump also reflects the company’s buyback, with the company buying back another $3.9 billion so far this fiscal year.

Speaking of shareholder friendly returns, the company also just reauthorized another $15 billion repurchase program along with announcing a $1.90 quarterly dividend. Winning.

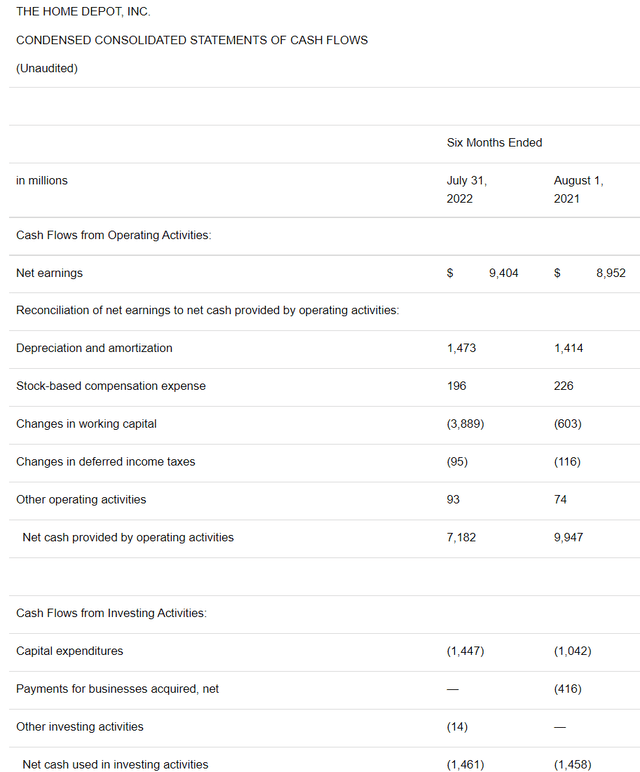

Healthy balance sheet

Find companies with good balance sheets in this mess; solid companies that grow dividends and have good balance sheets. That is our best advice we have right now.

The Home Depot balance sheet is solid:

As we review the situation, when we compare total assets to liabilities, there is no major cause for concern. Looks good. Liabilities are more than covered with cash flows, and the leverage is more than acceptable overall, in our opinion. There is still long-term debt, which we would like to see get paid down, but as we know, the company is making big investments for future growth.

That said, cash is now $1.26 billion, down from 2021 as more long-term debt was paid off. Still, with the impressive financial performance, particularly in free cash flow generation, this has allowed Home Depot to raise its dividend substantially over the years.

2022 overall expectations

At this point, we think that comparable sales remain strong but will start to dip in Q3 and Q4 to the low single digits. For 2022, we are now looking for $16.50-16.60 in earnings. But buying here at $274, you would be acquiring shares at 16.6x forward EPS at the middle of this expectation. This is much more reasonably valued now than the stock had been earlier this year. This is particularly true when we consider that the dividend is consistently raised and they are buying back a substantial amount of the float. Let the market walk this back, and do some buying.

Be the first to comment