Imgorthand/E+ via Getty Images

Investment Thesis

The COVID-19 pandemic in FY2020 and FY2021 sparked the equivalent of six years of revenue growth for Home Depot, Inc (NYSE:HD) and Lowe’s Companies, Inc (NYSE:LOW). Its valuations have also steadily risen in the past five years, proving its increasing relevance as a staple stock, while other pandemic stocks have plunged post-reopening cadence. Moreover, given Home Depot’s and Lowe’s steady dividend yields, long-term investors are well insulated against the ongoing inflation and rising interest rates.

Given their growth trajectories, investors can rest assured to buy and forget both stocks for the next five years.

The Pandemic Pulled Forward Six Years’ Worth Of Revenue Growth

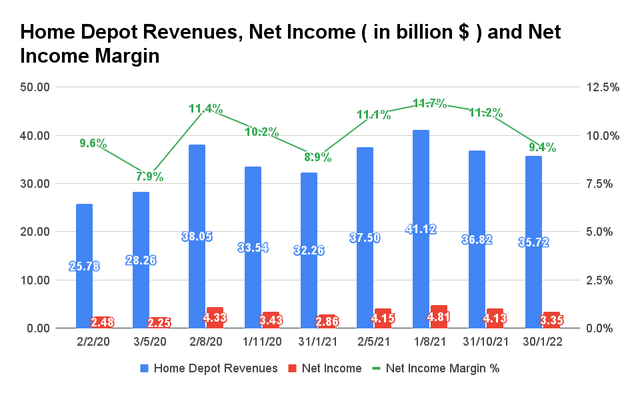

Home Depot Revenue, Net Income, And Net Income Margin

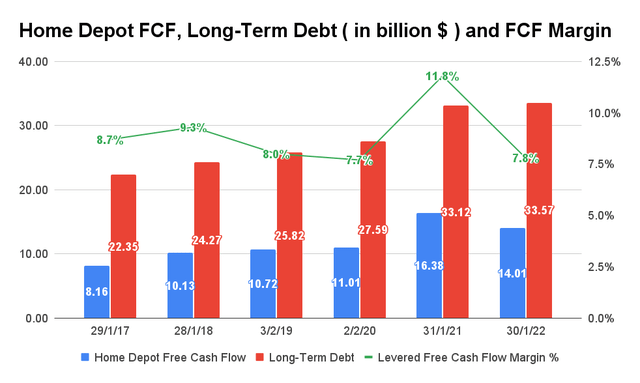

Pre-COVID19-pandemic, Home Depot grew its revenues at a CAGR of 5.23% since FY2016. However, in the past two years, the company’s revenues grew at an impressive rate at a CAGR of 17.1%, with revenues of $132.11B in FY2020 with 19.8% YoY growth and $151.15B in FY2021 with 14.4% YoY growth. Consequently, its net income also rose exponentially in the past two years, from $11.2B in FY2019 to $16.4B in FY2021, with a relatively stable net income margin in the range of 10%. Additionally, Home Depot generated impressive Free Cash Flows in the past two years with $14.01B of FCF in FY2021, despite incurring massive long-term debts of $33.57B. However, its FCF margins tumbled slightly, given the increasing investments in its supply chain networks, i.e.: by chartering its own ships to tackle port bottlenecks during the 2021 year-end season.

Home Depot FCF, Long Term Debt, And FCF Margin

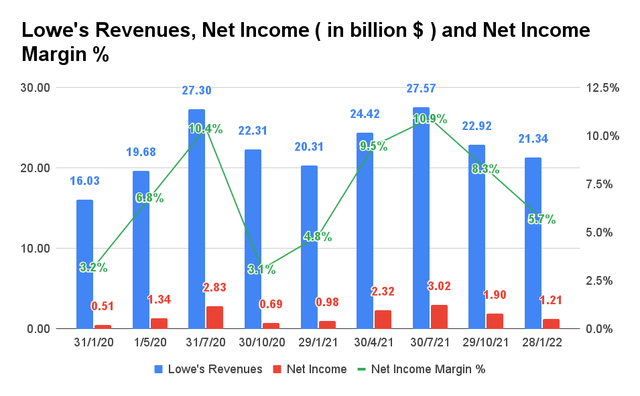

Lowe’s Revenue, Net Income, And Net Income Margin

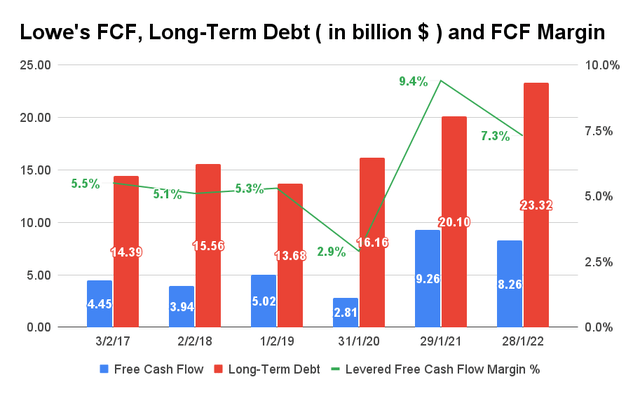

On the other hand, Lowe’s revenue growth was at a CAGR of 3.53% from FY2016 to FY2019, which improved to 15.51% in the past two years during the COVID-19 pandemic. Its net income has also doubled from FY2019 to $8.44B in FY2021, while improving its net income margins from 5.9% in FY2019 to 8.8% in FY2021. Similarly, Lowe’s also generated a robust FCF of $8.26B in FY2021, though with an increasing long-term debt worth $23.32B. Similar to Home Depot, its margins had also declined a little in FY2021, as the company further invests in its supply chain networks given the global shortages, through regional and flatbed distribution centers and last-mile delivery capabilities.

Lowe’s FCF, Long Term Debt, And FCF Margin

The growth in Home Depot’s and Lowe’s revenues was mainly attributed to the proliferation of DIY home improvement projects during the COVID-19 pandemic lockdowns in the US. In addition, the pandemic brought about a rise in US home demand despite limited supply and, consequently, a surge in prices from 111% in Q1’20 to 130.5% in Q4’21, due to multiple reasons, including large stimulus checks, low mortgage rates, and remote work from home trends.

Moving forward, given that the US accounted for over 90% of Home Depot’s and Lowe’s revenue segment, we believe their future growth will be somewhat insulated from the ongoing Ukraine war, though there might still be some headwinds from the global supply chain issues, rising transport and labor costs, and slowing housing market in the US.

Is It Still A Buy For Dividend Investors?

Home Depot And Lowe’s Stock Dividend Yield And Stock Price

Despite the recent market correction, we must also note that Home Depot and Lowe’s stocks have a discernible uptrend over the past five years, by 232% and 270%, respectively, similar to many staples stocks, such as Costco (COST), Walmart (WMT), and CVS (CVS). In contrast, many high-growth pandemic stocks, such as Airbnb (ABNB), Netflix (NFLX), and Teladoc (TDOC), had declined tremendously to their pre-pandemic prices. In addition, both Home Depot and Lowe’s have maintained relatively stable dividend yields in the past five years. As a result, they look highly attractive to long-term investors seeking stable inflation-proof stocks.

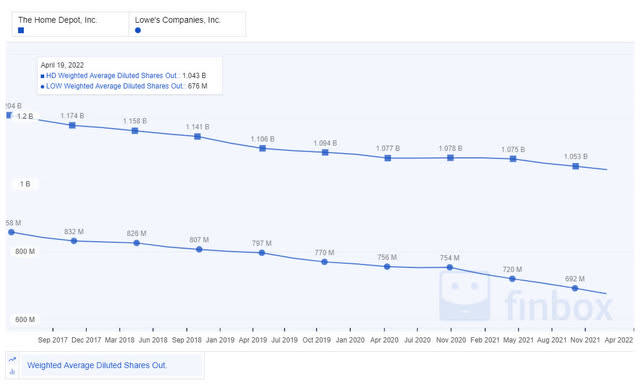

Home Depot And Lowe’s Shares Outstanding

Nonetheless, if we have to choose only one, we reckon Lowe’s would be a better buy, given its 64.4% stock price return in the past five years, though Home Depot also does well for itself with 29%. However, given how both companies have been on aggressive share buyback programs in the past five years, long-term investors of Home Depot and Lowe’s would have seen the value of their stocks raised by 14.3% and 23.9% in the past five years, respectively. It is evident that both companies have been executing excellently.

So, Is Home Depot And Lowe’s Stock A Buy, Sell, Or Hold?

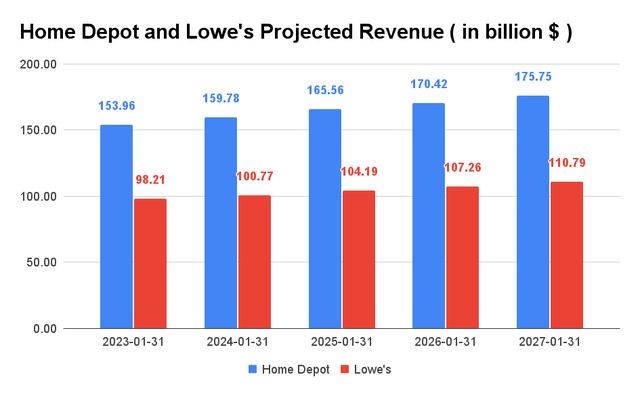

Home Depot And Lowe’s Projected Revenue

Home Depot is expected to grow its revenues at a CAGR of 3.06% over the next five years, while reporting revenues of $153.96B in FY2022, representing YoY increases of 1.8%. Despite the normalization of revenue growth moving forward, the company is still expected to report an impressive net income of $16.53B in FY2022, in line with its FY2021 levels. On the other hand, Lowe’s is expected to report revenue growth at a CAGR of 2.85% over the next five years. For FY2022, consensus estimates that the company will report revenues of $98.21B and net incomes of $8.7B, representing a YoY increase of 2% and 3%, respectively.

Home Depot is currently trading at an EV/NTM Revenue of 2.3x, in line with its 3Y mean of 2.56x. The stock is also trading attractively at $300.21 on 18 April 2022, near its 52 weeks low of $293.59 and down 40% from its 1Y highs of $416.18. Similarly, Lowe’s is trading in line with its 3Y mean of 1.63x, at $197.72 on 18 April 2022. The stock has also similarly fallen by 33.1% from its 52 weeks high of $261.38 in December 2021.

Therefore, we rate Home Depot and Lowe’s stock as a Buy.

Be the first to comment