Serenethos

Earnings of Home Bancshares, Inc. (Conway, AR) (NYSE:HOMB) will benefit from slight margin expansion in the coming quarters amid a rising rate environment. Further, subdued loan growth will likely offer some support to the bottom line. Overall, I’m expecting Home Bancshares to report adjusted earnings of $1.89 per share for 2022, down 2.6% year-over-year. Compared to my last report on the company, I’ve slightly reduced my earnings estimate as I’ve decreased my topline estimate. For 2023, I’m expecting the company to report earnings of $2.07 per share. Next year’s target price suggests a small upside from the current market price. Therefore, I’m maintaining a hold rating on Home Bancshares.

Positive Loan Trend Likely

Home Bancshares’ loan portfolio declined by 0.7% sequentially in the third quarter, following the Happy Bancshares acquisition in the second quarter of 2022. This reduction in the third quarter is not surprising as some payoffs are natural after M&A transactions. Further, the management mentioned in the third quarter’s conference call that there were some payoffs in the legacy commercial real estate portfolio.

However, the portfolio’s decline drives home the point that Home Bancshares’ management isn’t good at organic growth. The loan portfolio has declined every quarter from June 2020 till December 2021. Even in 2019, the loan portfolio shrank in size, which is far from ideal.

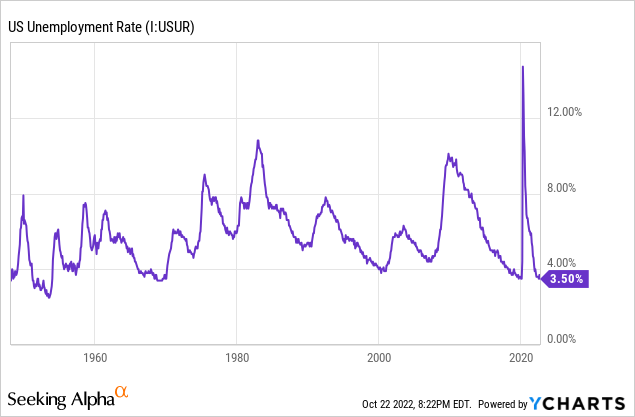

Going forward, I believe Home Bancshares will manage to achieve positive loan growth, partly because of strong job markets. Home Bancshares mainly operates in Arkansas, Florida, and Texas, with a limited presence in southern Alabama and New York City. Due to the large difference between the economies of these regions, it’s appropriate to take the national average. As shown below, the national unemployment rate is near multi-decade lows.

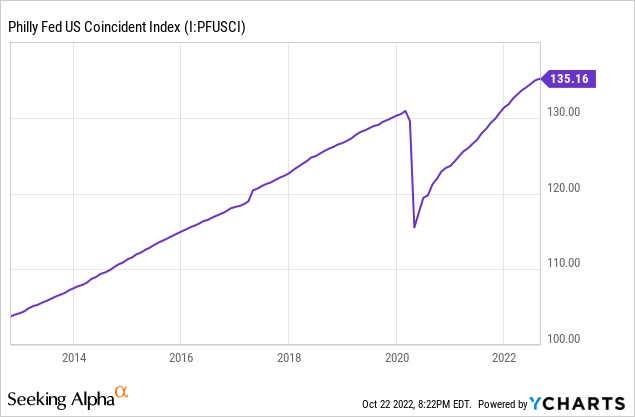

Additionally, the coincident index points towards satisfactory economic activity in the country.

As mentioned in the conference call, the management expects the pay downs to decline in October and November but rise again by the year’s end. Overall, the management expects the loan growth to be flat to up in the last quarter of 2022.

Considering the factors given above and management’s guidance, I’m expecting the loan portfolio to grow by 0.50% every quarter till the end of 2023. This will lead to loan growth of 41.8% for 2022 and 2.0% for 2023. In my last report on Home Bancshares, I estimated loan growth of 43.4% for 2022. I’ve decided to reduce my loan growth estimate for the year due to the third quarter’s performance.

Meanwhile, I’m expecting other balance sheet items to grow somewhat in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 10,963 | 10,768 | 10,975 | 9,599 | 13,608 | 13,882 |

| Growth of Net Loans | 7.3% | (1.8)% | 1.9% | (12.5)% | 41.8% | 2.0% |

| Other Earning Assets | 2,462 | 2,406 | 3,495 | 6,650 | 6,684 | 6,818 |

| Deposits | 10,900 | 11,278 | 12,726 | 14,261 | 18,635 | 19,011 |

| Borrowings and Sub-Debt | 1,985 | 1,140 | 939 | 912 | 967 | 986 |

| Common equity | 2,350 | 2,512 | 2,606 | 2,766 | 3,528 | 3,805 |

| Book Value Per Share ($) | 13.5 | 15.0 | 15.8 | 16.8 | 17.2 | 18.5 |

| Tangible BVPS ($) | 7.7 | 9.0 | 9.7 | 10.8 | 10.1 | 11.5 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin Expansion Likely to Slow Down

Home Bancshares’ net interest margin surged by 41 basis points in the third quarter, following 43 basis points growth in the second quarter of this year. The fed funds rate rose by 150 basis points during the third quarter, which is unlikely to be repeated in the fourth quarter of the year. The Federal Reserve is projecting a 150 basis point hike in rates till the end of 2023; therefore, I’m expecting only a 75 to 100 basis points hike in the fourth quarter of 2022. As a result of softer monetary tightening this quarter, the margin will likely expand to a lower degree in the fourth quarter of 2022 compared to the third quarter.

The sensitivity of the margin to the above-mentioned hike in interest rates will be restrained by a high deposit beta. Home Bancshares’ deposit beta is quite high as savings and interest-bearing transaction accounts made up 65% of total deposits at the end of September 2022.

The management’s asset-liability model shows that a 100-basis points hike in rates can lift the net interest income by 4.5% over twelve months, as mentioned in the conference call. Considering the factors given above and the management’s guidance, I’m expecting the margin to grow by 10 basis points in the last quarter of 2022 and a further 10 basis points in 2023.

Topline Growth to Support Earnings

The anticipated subdued loan growth and moderate margin expansion will likely lift the top line next year which will boost earnings. Further, the non-interest expenses will be lower next year because merger-related expenses will not recur. However, heightened inflation and tight labor markets are likely to continue to pressurize salary expenses next year. Meanwhile, I’m expecting the provisioning for expected loan losses to remain near the historical average.

Adjusting for the merger-related expenses, I’m expecting Home Bancshares to report earnings of $1.89 per share for 2022, down by just 2.6% year-over-year. On a GAAP basis, I’m expecting the company to report earnings of $1.50 per share for 2022. For 2023, I’m expecting Home Bancshares to report earnings of $2.07 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Income Statement | ||||||

| Net interest income | 561 | 563 | 583 | 573 | 756 | 881 |

| Provision for loan losses | 4 | 1 | 112 | (5) | 69 | 40 |

| Non-interest income | 103 | 100 | 112 | 138 | 162 | 176 |

| Non-interest expense | 264 | 276 | 304 | 299 | 472 | 465 |

| Net income – Common Sh. | 300 | 290 | 214 | 319 | 291 | 425 |

| EPS – Diluted ($) | 1.73 | 1.73 | 1.30 | 1.94 | 1.50 | 2.07 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report, I estimated GAAP earnings of $1.55 per share for 2022. I’ve reduced my earnings estimate mostly because I’ve tweaked downwards both my loan growth and margin estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Next Year’s Target Price is Close to the Current Market Price

Home Bancshares has a long-standing tradition of increasing its quarterly dividend every year. Given the earnings outlook, it’s likely that the company will maintain the dividend trend next year. Therefore, I’m expecting the company to increase its quarterly dividend to $0.18 per share in the first quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 35% for 2023, which is in line with the five-year average. Based on my dividend estimate, Home Bancshares is offering a forward dividend yield of 3.0%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Home Bancshares. The stock has traded at an average P/TB ratio of 2.23 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 7.7 | 9.0 | 9.7 | 10.8 | ||

| Average Market Price ($) | 22.3 | 18.7 | 16.4 | 24.5 | ||

| Historical P/TB | 2.89x | 2.07x | 1.69x | 2.27x | 2.23x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $11.5 gives a target price of $25.5 for the end of 2023. This price target implies a 7.0% upside from the October 21 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.03x | 2.13x | 2.23x | 2.33x | 2.43x |

| TBVPS – Dec 2023 ($) | 11.5 | 11.5 | 11.5 | 11.5 | 11.5 |

| Target Price ($) | 23.2 | 24.4 | 25.5 | 26.7 | 27.8 |

| Market Price ($) | 23.9 | 23.9 | 23.9 | 23.9 | 23.9 |

| Upside/(Downside) | (2.6)% | 2.2% | 7.0% | 11.8% | 16.6% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.3x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.73 | 1.73 | 1.30 | 1.94 | ||

| Average Market Price ($) | 22.3 | 18.7 | 16.4 | 24.5 | ||

| Historical P/E | 13.0x | 10.8x | 12.6x | 12.6x | 12.3x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.07 gives a target price of $25.4 for the end of 2023. This price target implies a 6.4% upside from the October 21 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.3x | 11.3x | 12.3x | 13.3x | 14.3x |

| EPS – 2023 ($) | 2.07 | 2.07 | 2.07 | 2.07 | 2.07 |

| Target Price ($) | 21.3 | 23.3 | 25.4 | 27.5 | 29.5 |

| Market Price ($) | 23.9 | 23.9 | 23.9 | 23.9 | 23.9 |

| Upside/(Downside) | (10.9)% | (2.2)% | 6.4% | 15.1% | 23.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $25.5, which implies a 6.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 9.5%. This total expected return is not high enough for me; therefore, I’m maintaining a hold rating on Home Bancshares.

Be the first to comment