Dilok Klaisataporn

Hollysys Automation Technologies Ltd. (NASDAQ:HOLI), which offers industrial automation services, reports more than $575 million in cash, and the market valuation stands at close to $1 billion. Considering the amount of know-how accumulated and new incoming products, free cash flow will likely trend north in the coming years. Under conservative assumptions, I obtained a fair valuation that is significantly higher than HOLI’s market price. I really don’t think that current risks would be sufficient to explain the current price mark.

Hollysys Automation Technologies: Established Brand In China, With Diversified Activities

Hollysys Automation is an IT services company in China, which came into existence in 1993. Its business and services are spread across China and abroad.

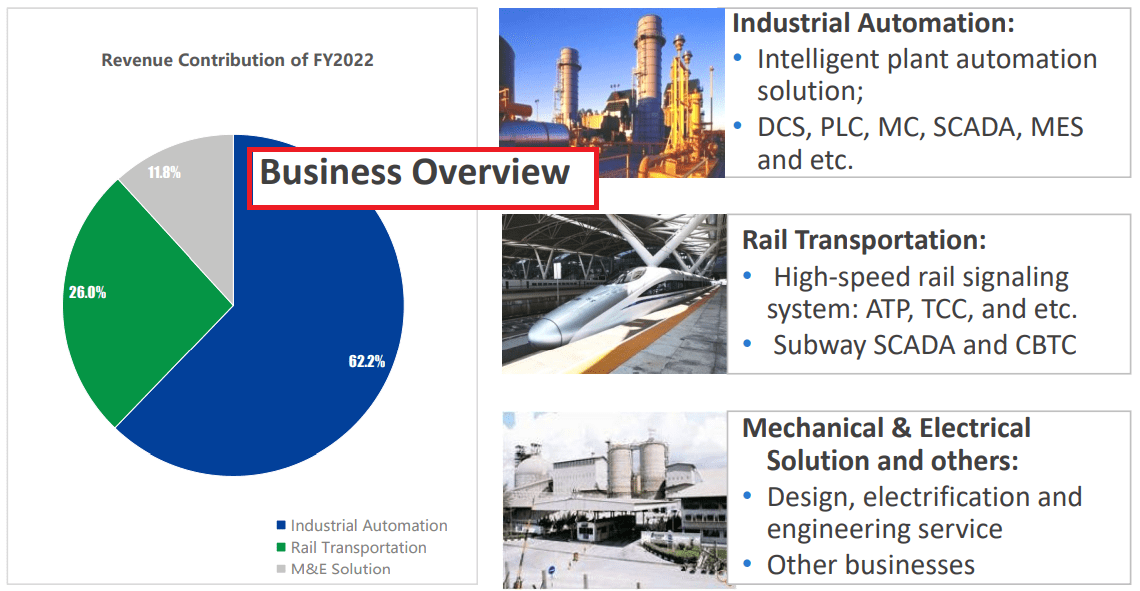

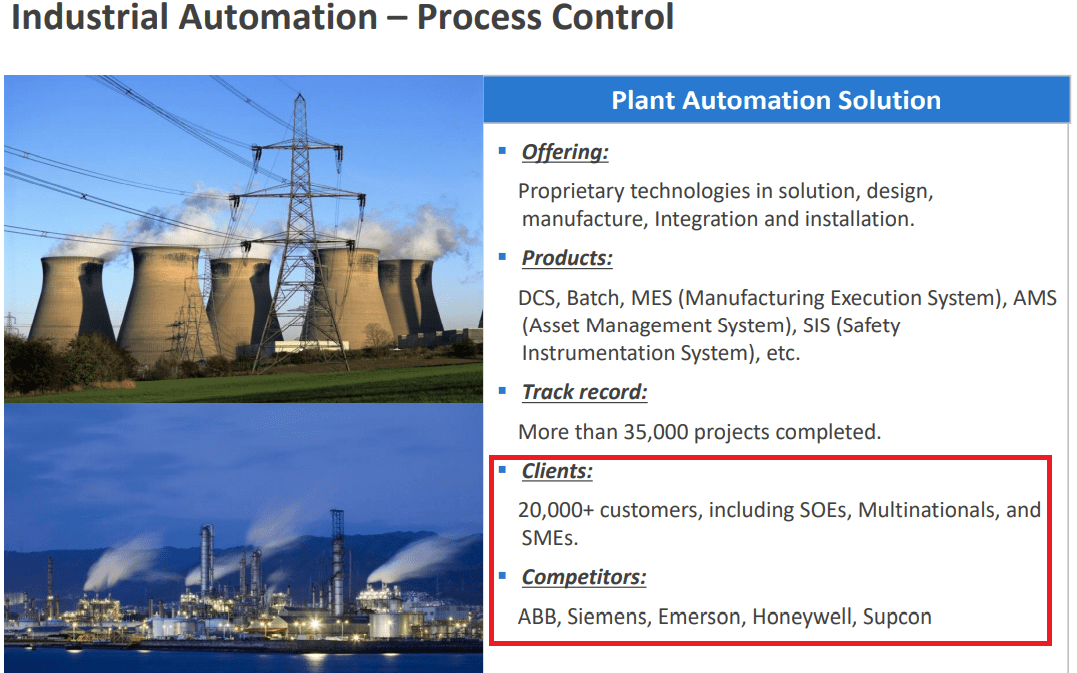

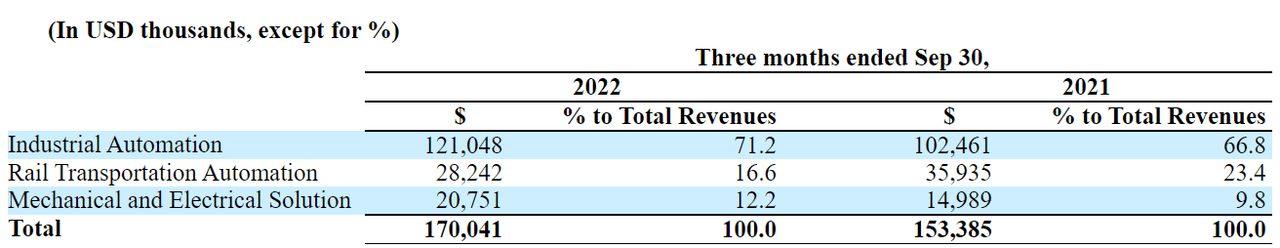

Hollysys appears to be a state-level leader in industrial automation integration services. For forward year 2022, industrial automation appears to be the most relevant business segment. It accounts to more than 62% of the total amount of revenue.

Source: Presentation To Investors

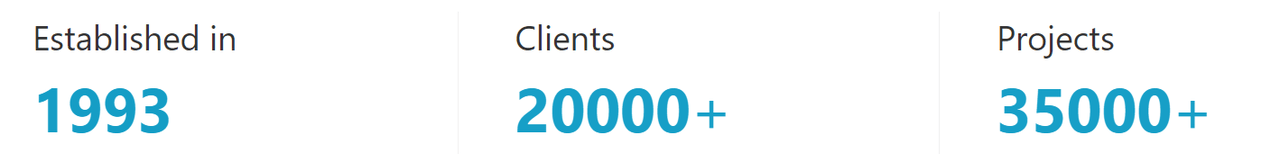

Over the years, Hollysys has served countless customers and successfully completed many projects. Considering the number of projects executed, I believe that the company has already established a well-known brand. On the company’s website, management has mentioned close to 35k projects with more than 20k clients.

Source: ABOUT THE GROUP-HollySys-Automation for Better Life

Source: Presentation To Investors

Let’s also not forget other business segments. The company’s rail transportation business segment also completed many projects. Management received several ministerial awards and honors in China.

Source: CERTIFICATES AND ACCOLADES

I know that the revenue received from rail transportation and mechanical and electrical solutions is not that significant. With that, it is good to note that the company’s activities are diversified. If the most relevant business segment does not perform, management will likely invest in other activities.

In the three months ended September 30, 2022, rail transportation accounted for $28 million revenue. The mechanical and electrical solution segment reported $20 million revenue.

Source: Quarterly Report

Previous Results Include Median Net Sales Growth Of 17% And Median EBITDA Margin Of 19%-20%

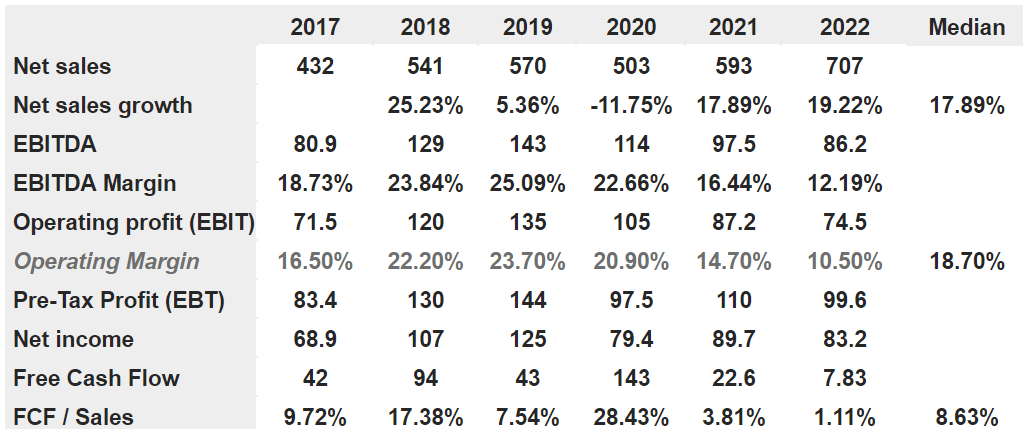

The results for 2022 include a net sales of $707 million with a net sales growth of 19.22%, EBITDA of $86.2 million with an EBITDA margin of 12.19%. Operating profit stands at $74.5 million with an operating margin of 10.50%, pre tax profit of $99.6 million, and with a net income of $83.2 million. Finally, 2022 free cash flow stands at $7.83 million with FCF/sales of 1.11%.

Source: Marketscreener.com

Balance Sheet: Cash On Hand Is Quite Significant

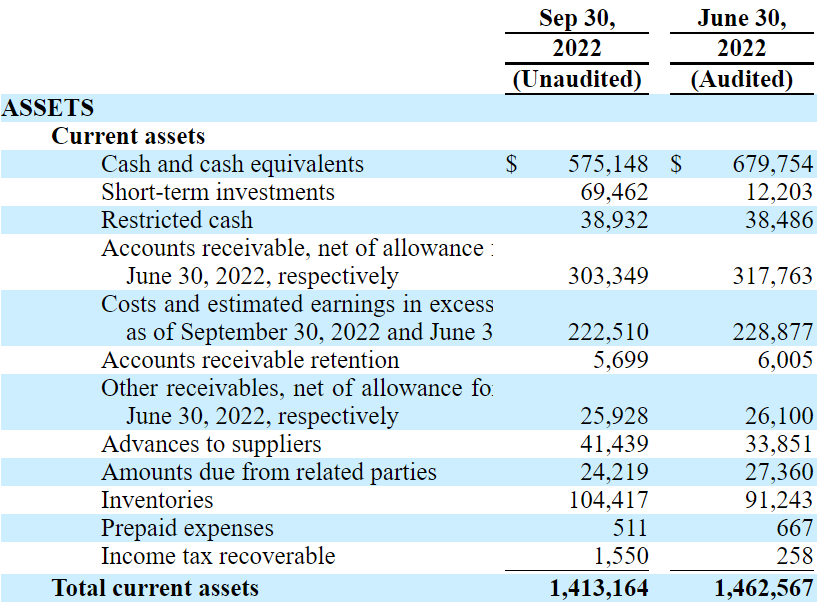

I believe that the most interesting thing in the balance sheet is the cash on hand. As of September 30, 2022, the company reported cash of $575.148 million along with short term investments of $69.462 million. The current market capitalization is close to $1 billion, which is about two times the total amount of cash in hand. The company also reported accounts receivable of $303.349 million, cost and estimated earnings of $222.510 million, other receivables of $25.928 million, and total current assets of $1.4 billion. Hence, current assets appear more significant than the current market capitalization.

Source: Quarterly Report

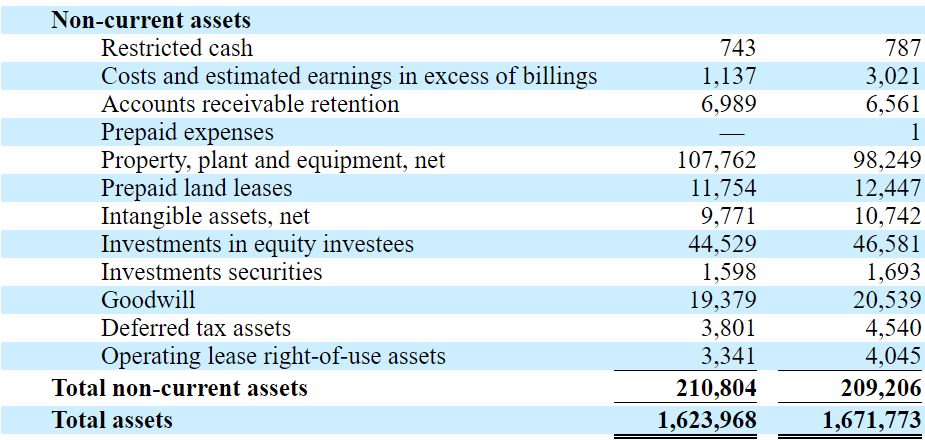

Non-current assets include accounts receivable worth $6.989 million, property, plant and equipment of $107.762 million, and prepaid land leases of $11.754 million. Together with the intangible assets of $9.771 million, goodwill stands at $19.379 million. Finally, total assets are equal to $1.6 billion, close to three times the total amount of liabilities. In sum, the balance sheet appears in good shape.

Source: Quarterly Report

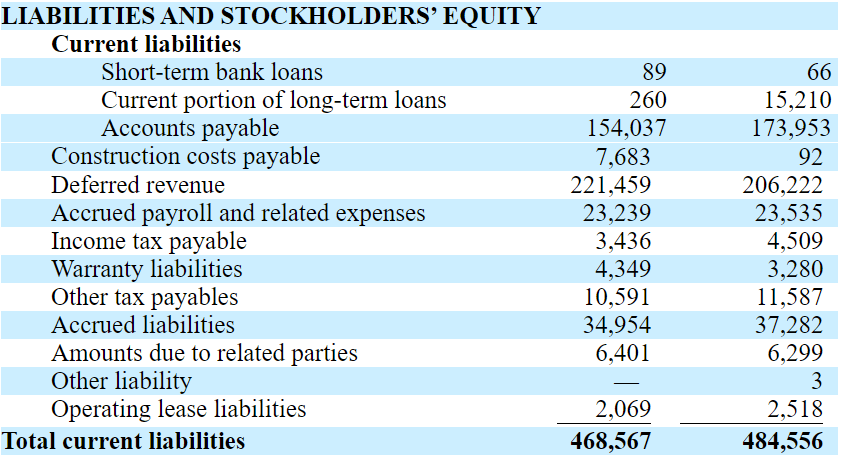

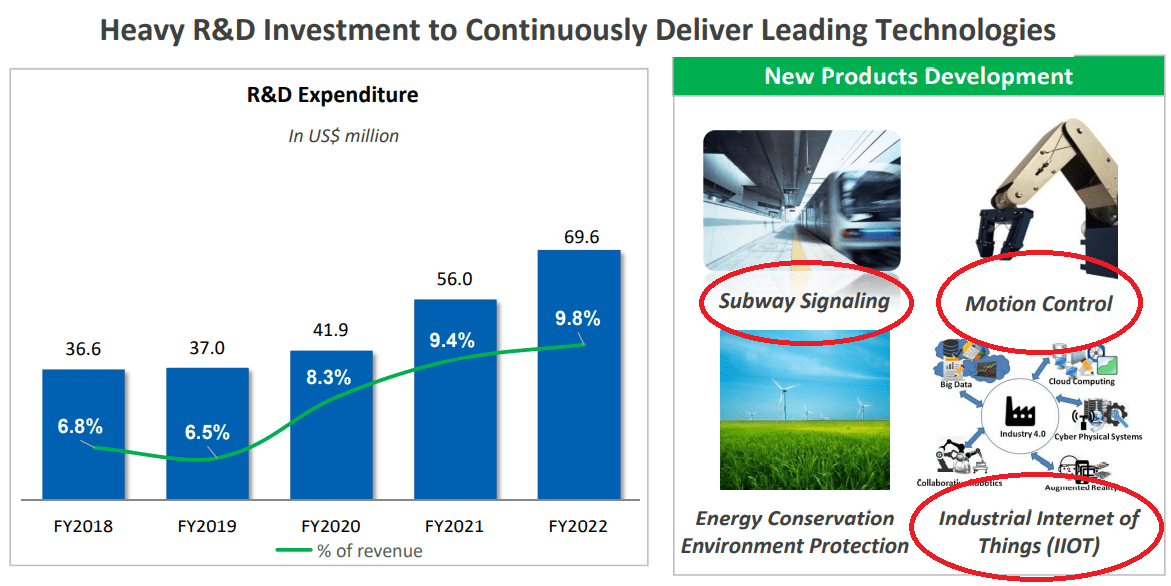

Liabilities include accounts payable worth $154.037 million, deferred revenue of $221.459 million, and accrued payroll of $23.239 million. Total current liabilities are equal to $468.567 million. Long term liabilities are not worrying. Long term loans are equal to only $15.439 million, and total liabilities stand at $505.954 million.

Source: Quarterly Report

Source: Quarterly Report

Base Case Scenario: New Upcoming Products From R&D Efforts And Growth In The Industrial Automation Market In Asia Would Imply A Valuation Of $43 Per Share

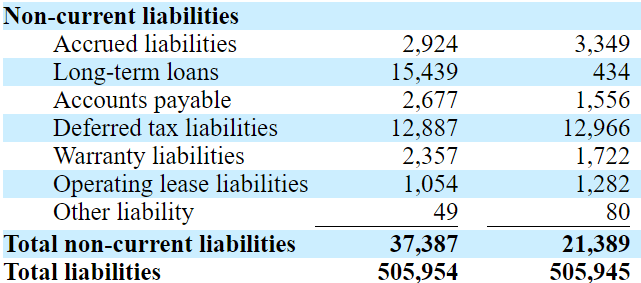

Under my base case scenario, I assumed that HOLI will likely benefit from the increase in the Chinese nuclear market. Let’s keep in mind that the number of reactors in the country increased at a CAGR of 17% from 2013 to 2021.

Source: Presentation To Investors

I would expect the sales growth to be a bit more than the growth of the Industrial Automation Market in Asia, which is about 12.1%. From 2025 to 2032, I assumed that sales growth would be close to 11%-14%. The company has to perform only a bit better than other competitors to report such sales growth. I believe that I am not that ambitious.

Industrial Automation Market – Asia-Pacific is Projected to Grow at CAGR of 12.1% from 2022 to 2030, owing to rise in Digital and Economic Transformation in the Region. Source: Industrial Automation Market

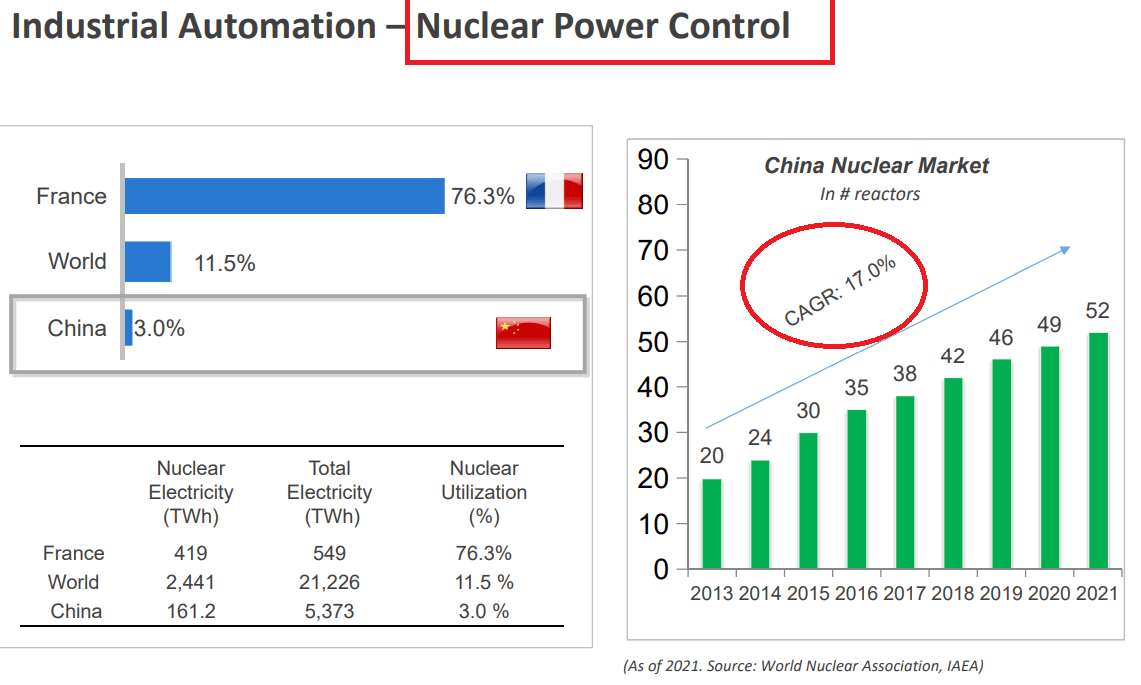

If we also take into account HOLI’s investments in research and development and recent new products, I believe that the EBITDA margin may grow. Let’s keep in mind HOLI’s new developments in the industrial internet of things, motion control, and subway signaling. New products will likely be introduced with decent gross margins, which will likely benefit the company’s free cash flow lines.

Source: Presentation To Investors

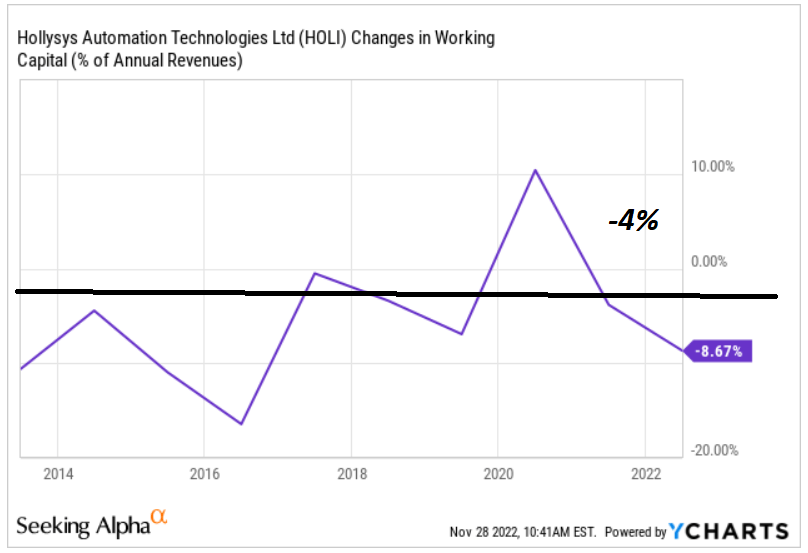

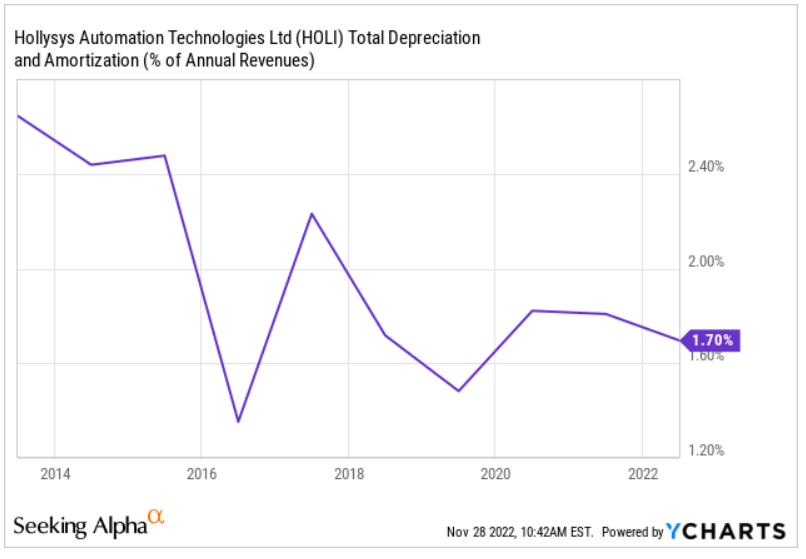

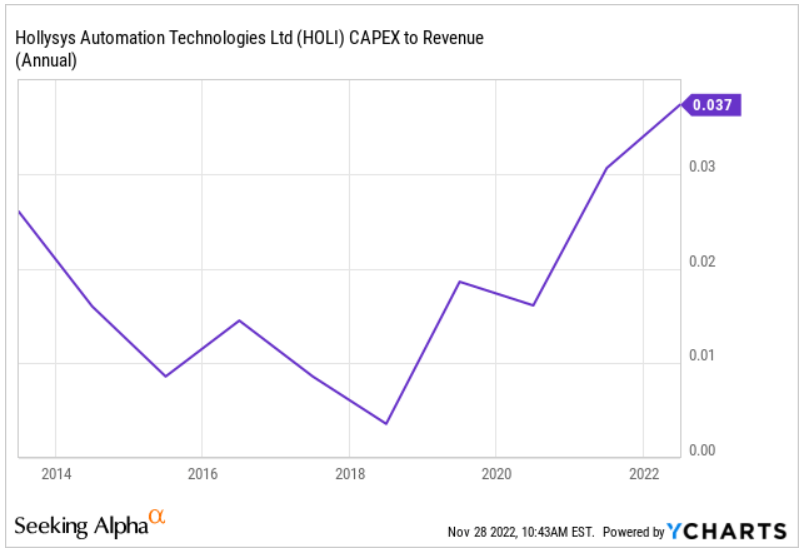

In the past, the company reported changes in working capital/sales close to 10% and -8%, D&A/Sales at around 1.7%, and capex/sales of 3.7%. In my financial model, I used figures close to the numbers reported by HOLI.

Source: Ycharts

Source: Ycharts

Source: Ycharts

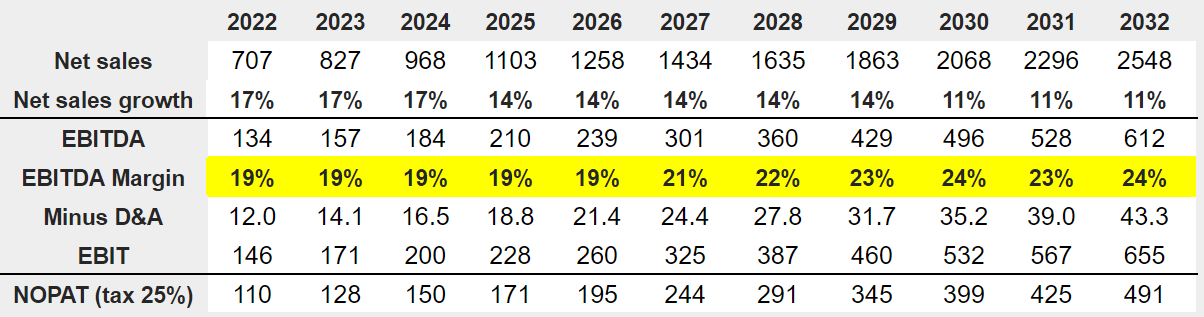

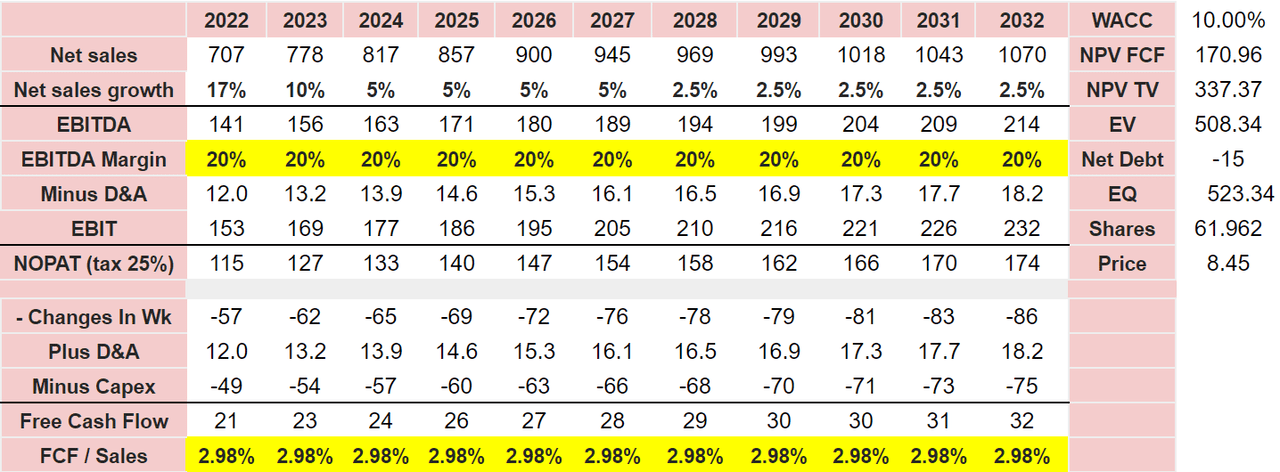

Under the previous results and assumptions, I obtained a growing EBITDA margin from 19% in 2022 to 24% in 2032. 2032 EBITDA would be close to $612 million, and 2032 NOPAT would be $491 million. Notice that sales growth would be close to 17%-11%.

Source: Chatool’s Financial Model

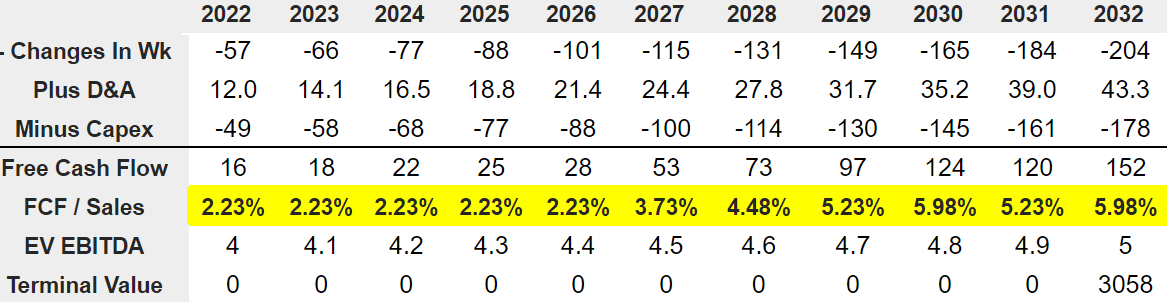

Adjusting for changes in working capital, D&A, and capital expenditures, free cash flow would grow from $16 million in 2022 to $152 million in 2032. The FCF margin would be close to 2%-5.9%. I also assumed terminal EV/EBITDA multiple of 4.9x.

Source: Chatool’s Financial Model

Finally, with a WACC of 5.7%, the implied enterprise value would stand at $2.1 billion, and the fair price could be around $43 per share.

Source: Chatool’s Financial Model

Bearish Case Scenario: Technical Issues, Larger Costs Than Expected In The Bidding Process for Contracts, Or Declines In Public Funding Could Push The Stock Price Down To $8.45 Per Share.

HOLI receives contracts as a result of a competitive bidding process to provide integrated solutions to furnish an automation system. If management fails to calculate future efficiency, technical issues could occur, and opex may be larger than expected. FCF may also be lower than anticipated. Management wrote a few lines in this regard.

These contracts require us to complete projects at a fixed price, and therefore expose us to the risk of cost overruns. Cost overruns, whether due to efficiency, estimates or other reasons, could result in lower profit or losses. Other variations and risks inherent in the performance of fixed-price contracts such as delays caused by technical issues, and any inability to obtain the requisite permits and approvals, may cause our actual risk exposure and costs to differ from our original estimates. Source: 20-F

HOLI works with local urban mass transit providers and railway authorities like the MTR Corporation Limited in Hong Kong and the Land Transport Authority of Singapore. In sum, HOLI receives money, and offers services to clients that depend on public funding policies. In my experience, future projects with such types of clients may be a bit unpredictable. Under my bearish case scenario, I assumed that HOLI would lose a few of these large clients, which may lead to a decrease in sales growth.

As such, our cash flows may become dependent on those customers’ payment practices and overall public funding policies, including the lengthening of collection times under contracts that have been performed. Source: 20-F

HOLI makes a significant part of its business in China, wherein management will have to respect and receive permits or approvals from the PRC. In my view, investors in the United States may have a hard time understanding some of the regulations in China. As a result, less investors may buy shares, which would increase the cost of equity. In sum, the cost of capital could increase, which would bring HOLI’s fair valuation down.

Our activities are primarily conducted in the PRC through our Chinese operating subsidiaries. These subsidiaries are required to, and have obtained, from PRC authorities all permits or approvals required to engage in our business in China, including the business licenses from local authorities for their operations. Source: 20-F

In particular, let’s mention that the HOLI does not believe that the company needs approval from the Securities Regulatory Commission, the Cyberspace Administration of China. However, management noted that other regulatory authorities may make it very difficult for HOLI to continue its listing in the NASDAQ. In the last annual report, the company discussed these matters.

While we believe we are currently not required to obtain permissions from the China Securities Regulatory Commission, the Cyberspace Administration of China or other entity in China for our operations in China, we cannot assure you that we will not be required to obtain the approval of the CSRC, the CAC or of potentially other regulatory authorities to maintain the listing status of our ordinary shares on the NASDAQ or to conduct offerings of securities in the future. Source: 20-F

The fact that HOLI is currently not subject to PCAOB inspections may create significant problems. The SEC may decide to prohibit the NASDAQ from listing HOLI shares. As a result, I would expect a significant decline in the stock price.

The Holding Foreign Companies Accountable Act was enacted on December 18, 2020. The HFCA Act states that if the auditor of a U.S. listed company’s financial statements is not subject to PCAOB inspections for three consecutive “non-inspection” years after the law becomes effective, the SEC is required to prohibit the securities of such issuer from being traded on a U.S. national securities exchange, such as the NASDAQ, or in U.S. over-the-counter markets. Source: 20-F

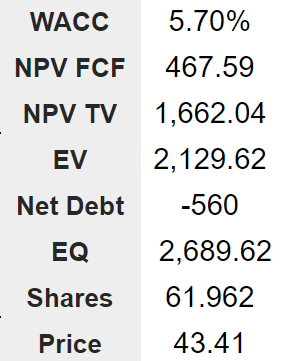

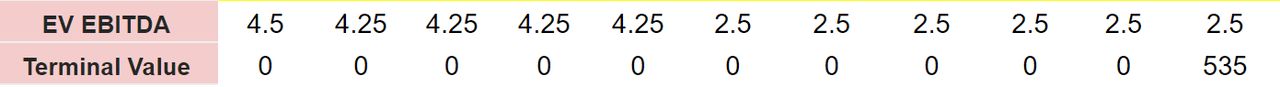

Under my bearish case scenario, I included an EBITDA margin around 20%, which would imply 2032 NOPAT close to $175 million. 2032 EBITDA would be close to almost $215 million, and 2032 FCF would be $32 million.

Using a discount of 10% and a terminal EV/EBITDA multiple of 2.5x, the implied equity valuation would be around $523 million. Finally, the fair price would stand at $15 per share.

Source: Chatool’s Financial Model Source: Chatool’s Financial Model

Conclusion

Hollysys Automation Technologies reports a large amount of cash on hand. I believe that HOLI has accumulated a lot of know-how in industrial automation and transportation automation. With clients in the public sector in China and operating in the growing nuclear power control market, HOLI will likely experience revenue growth and FCF growth in the coming years. Under my base case scenario, HOLI’s share price may work close to $43 per share. Even considering potential risks from delisting or decreases in funding from public entities, the current market price is too low.

Be the first to comment