sewer11/iStock Editorial via Getty Images

We were not particularly lucky with Holcim’s (OTCPK:HCMLF) start of coverage. However, we still believe in the company’s long-term upside potential and despite the negative stock price performance, Holcim is delivering on its promises, and we once again confirmed our thesis.

The Mare tower buy case recap was based on the following:

- A multiple arbitrage opportunity thanks to the Firestone acquisition (with supportive bolt-on acquisitions);

- Keynesian government spending;

- Solid quarterly performances not priced in by Wall Street.

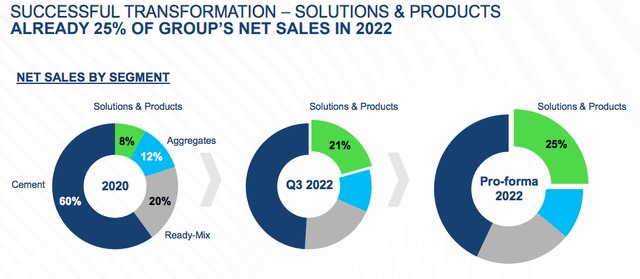

Looking at the press release, we could not be more optimistic. Reporting the CEO’s words, Holcim delivered “a quarter of record performance and successful transformation“. The company is continuing to expand its Solutions & Products division “with four acquisitions and delivered ten bolt-ons in aggregates and ready-mix this year“. He also emphasized that “Solutions & Products is already reaching 25% of the company’s net sales in 2022“, and more in detail, the Holcim business segment is delivering a recurring operating profit margin of 20%.

Holcim sales mix (Holcim Q3 results presentation)

Q3 Results

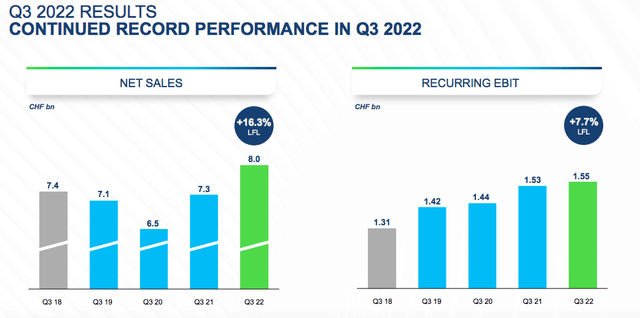

Aside from the outstanding result in the roofing division, the company achieved an operating profit of CHF 1.5 billion, up 1.1% on a yearly basis and outperforming Visible Alpha consensus estimates. EBIT growth was supported by higher volumes and slightly lower depreciation coupled with a positive pricing delta between price/cost. Currency developments were not playing any favor to Holcim and recorded a negative impact of CHF 9 million on the company’s bottom line.

Holcim sales and EBIT development (Holcim Q3 results presentation)

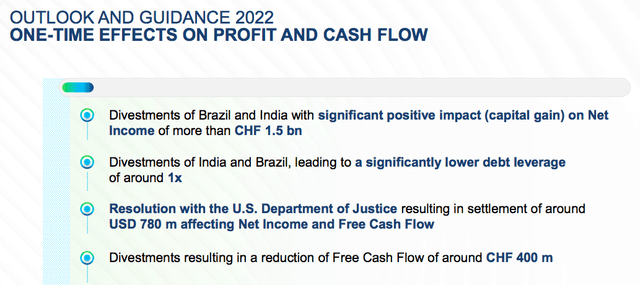

Important to note were Holcim’s disinvestments in Brazil and India. Total transaction enterprise value was approximately CHF 7.5 billion, with the Indian entity sold at an EV/EBITDA of more than 14x. These disposals should materially lower Holcim’s FX development and its implied earnings volatility. Moreover, debt was further reduced and the company is targeting a year-end leverage of 1.0x, providing further support for bolt-on acquisitions. Moreover, during the quarter, Holcim finally settled an agreement with the Department of Justice, with a payment of $777.8 million. Despite the important outflow, here at the Lab, we see this development as a positive catalyst and relief of a negative sentiment that has weighed on the company’s stock since the news.

Holcim positive and negative one-off (Holcim Q3 results presentation)

Conclusion and Valuation

Rising interest rates and real estate construction expectations are weighing on the company; however, our internal team expects infrastructure to remain resilient. We should note that new orders are weakening, but Holcim is fundamentally more solid to deal with these ongoing macroeconomic challenges. EBIT was a 5% beat, and we believe that Wall Street analyst should positively revert their expectations. Holcim raised its outlook both on the revenue line as well as on operating profit growth, announcing also a new buyback plan for a total consideration of CHF 2 billion. Key to note is the net sales in Solutions & Product development that should reach 25% of the company’s total sales in 2022. This division is too important now to be unnoticed. Therefore, we reiterate our outperform rating, valuing the entity at CHF 67 per share.

Be the first to comment