karandaev/iStock via Getty Images

The hotel sector has always fascinated me and perhaps it’s because I watched my grandfather become wealthy by developing motels in Myrtle Beach, SC.

As a kid, I remember playing at T&C Court, a motel that had the very first color TVs in Myrtle Beach.

The amenities were incredibly basic: swimming pool, air conditioning, outdoor trampoline, and of course, the color television.

I guess that’s where the term “limited service” was coined.

Anyway, later in life, as I became a real estate developer, I never had an itch to own motels or hotels. I preferred owning simple net lease properties that required no operations in which the tenants pay for taxes, insurance, and maintenance.

I did venture outside of the net lease safety to build shopping centers for chains like Walmart (WMT) and PetSmart, but once again, the leases were 5 to 10 years and required no house cleaning, cooking, marketing, or customer service.

Later in life, my former business partner had the craving to build a full-service hotel and that was the end of the alliance. I had no desire to participate in this higher-risk development, which by no fault of my own, led me to a number of sleepless nights.

I’ll save that for another day (my lessons learned book), but rest assured, I have seen my share of losses in the hotel sector.

It’s an entirely different animal than most all other property sectors, and of course, the biggest difference is that the tenants check out every morning, and pricing can be adjusted higher during the day if demand allows.

In a recent article, I explained that as a child I remember living with high inflation in the ’70s. I remember visiting my dad in Myrtle Beach, but I was too young to grasp the cost of gasoline.

Also, in the early ’70s, Myrtle Beach was booming, and my grandfather was smart enough to acquire great real estate along The King’s Highway.

As I pointed out in my 2022 REIT Roadmap, “the hotel sector is the best-positioned sector in periods of rising or sustained higher inflation” because room rates can be adjusted in real-time.

I added that “the key issue for 2022 will be the timing of a recovery in business travel demand. That recovery should drive both large Group demand and Business Transient demand.”

The hotel industry’s EBITDA growth in 2022 will depend on how much of a “pent-up demand” factor there can be for business travel, but high inflation should be a material positive for the industry’s top line. As I pointed out,

“Basically, any earnings before interest, taxes, depreciation, and amortization (EBITDA) growth this subsector can achieve in the next 12 months will very much depend on how willing companies are to get back to their typical convention schedules and out-of-office get-aways.”

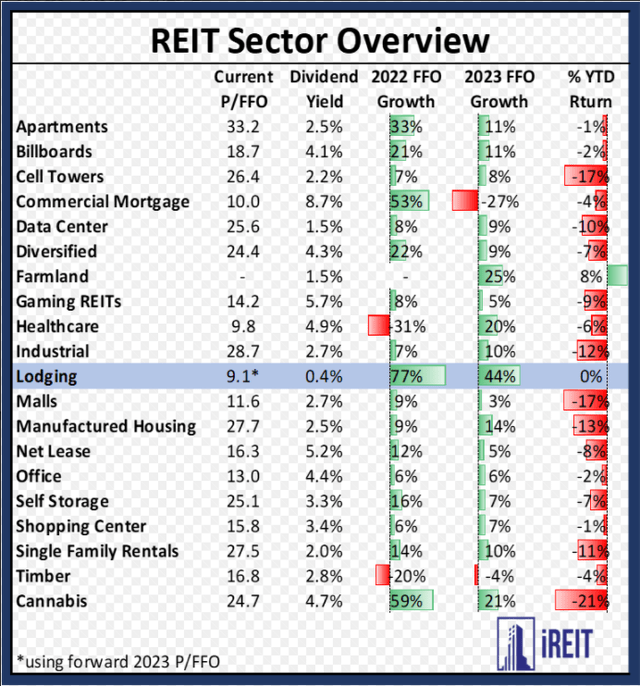

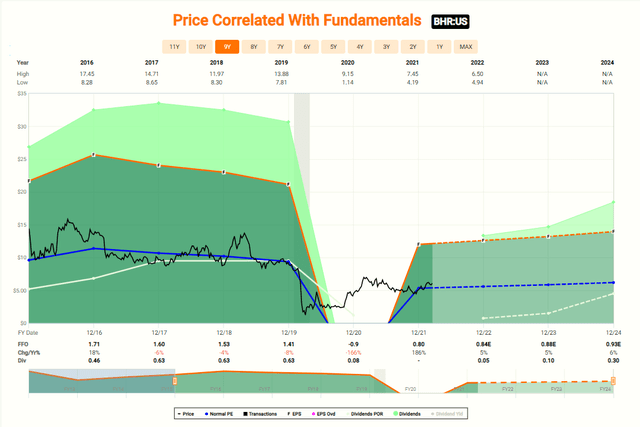

A few days ago, we provided iREIT on Alpha members with a deep dive on all of the Lodging REITs in our coverage spectrum. As viewed below, hotel REIT valuations are very attractive right now, and while I’m still somewhat skeptical of the heavy operational attributes, I cannot ignore their overall cheapness.

iREIT on Alpha

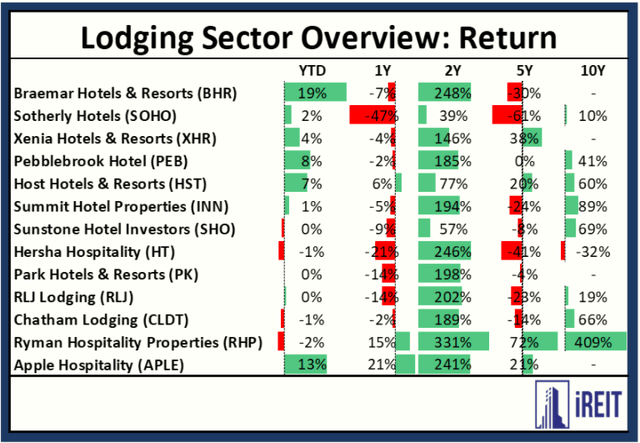

Of course, as iREIT on Alpha members know, we begin to dip a few toes into the Lodging sector, notably a call we made in early January 2022 with Braemar Hotels & Resorts (BHR) – see our NAV article – that incidentally is the best-performing Lodging REIT in 2022:

iREIT on Alpha

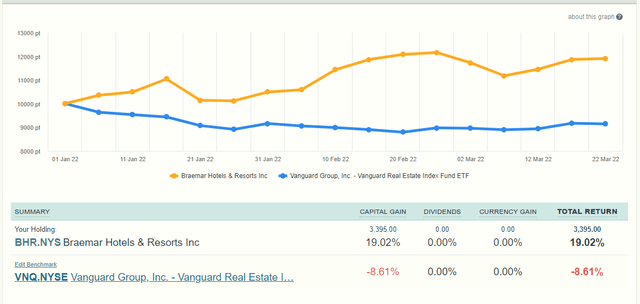

In fact, we added BHR shares to our Small Cap Portfolio and shares have returned 0ver 19% YTD, versus -8.6% for the Vanguard Real Estate ETF (VNQ).

iREIT on Alpha

Now that we have the first quarter in the rear-view mirror, I decided to provide a list of my top-3 Lodging REITs (complete list can be found at iREIT on Alpha).

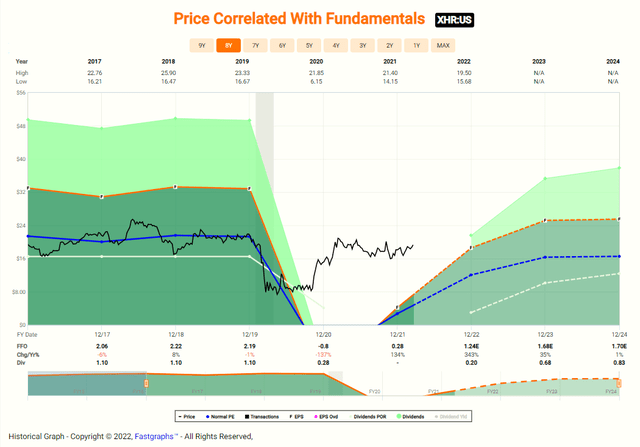

Pick #1: Braemar Hotels & Resorts (BHR)

BHR invests in high “RevPAR” luxury destination resorts and upscale urban hotels. The company now owns 15 properties after completing the acquisition of The Dorado Beach, Ritz-Carlton Reserve in Puerto Rico. This newest property offers a unique, ultra-luxury, beachfront resort and community that saw a 66% occupancy rate in Q4 -22.

The company took advantage of historically low-interest rates to refinance their Park Hyatt Beaver Creek Resort & Spa for an attractive two-year (with three, one-year extension options), interest-only, floating SOFR plus 2.86% interest rate.

Highlighting the portfolio’s recovery from the pandemic, the company announced the reinstatement of common stock dividend payments. BHR will pay $0.01 per share beginning Q1-22. The company emphasized it will continue to analyze and adjust dividend policy as financials continue to improve.

BHR’s portfolio has been a beneficiary of the pent-up demand for leisure travel. The company’s resort destinations allowed the portfolio’s Q4-22 RevPAR to beat the comparable pre-pandemic Q4-19 Portfolio RevPAR by 6.3%. While BHR’s urban hotels lacked their resort peers in terms of occupancy and RevPAR, I believe BHR’s balanced portfolio presents a massive growth opportunity as business travel recovers from the pandemic.

These trends support our Buy rating at a current price of $5.86 and we expect to see both RevPAR and ADR continue to increase at the company’s luxury properties. Although shares have run up (since our purchase), we maintain a Buy.

FAST Graphs

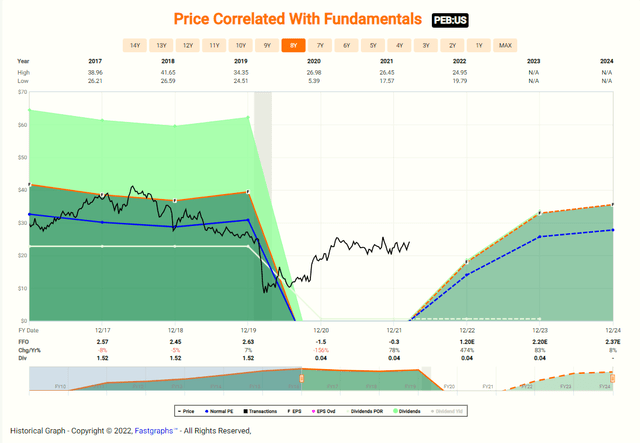

Pick #2: Xenia Hotels & Resorts (XHR)

XHR is an Orlando-based REIT focusing on the top-25 lodging markets in the US. The company owns 32 luxury and upper-upscale hotels that are affiliated with Marriott, Kimpton, Hyatt, Aston, Fairmont, and Loews.

In November 2021, the company completed a sale of Marriott Charleston in West Virginia for $5 million. Later, in January 2022 the company sold the Hotel Monaco Chicago for $36 million. These sales further strengthen the company’s balance sheet and allow XHR to exit challenging markets. Both locations are faced with long and difficult paths to reach previous highs.

XHR announced at the beginning of March 2022 that it reached an agreement to acquire the newly opened W Nashville for $328.7 million. This all-cash investment adds a high growth, top 25 market location to its portfolio. The asset is predicted to produce EBITDA of $25-$30 million upon stabilization. With W Nashville, the company believes they can take advantage of a fast-growing market and provide a value add due to their strong relationship with operator Marriott.

While XHR saw a net loss of $22.9 million in Q4-21, the company saw many positive signs of recovery throughout the portfolio. The same-property portfolio generated an EBITDA margin of 27.2% in Q4-21 fueled by 31 properties posting positive EBITDA for the year. Compared to pre-pandemic metrics, 25 properties had ADR surpassing Q4-19 levels.

As Covid-19 cases and hospitalizations continue to diminish in early 2022, the top 25 lodging markets are poised to see high growth. I believe the location and quality of XHR’s properties will allow the company to benefit from pent-up leisure demand and return to business travel. With liquidity of approximately $950 million, XHR can continue to make strategic acquisitions to maximize its growth. Shares are currently trading at $18.93 and we maintain a BUY.

FAST Graphs

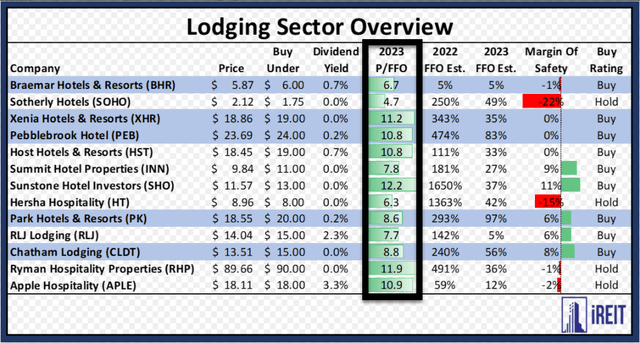

Pick #3: Pebblebrook Hotel (PEB)

Pebblebrook Hotel Trust invests and acquires in upper upscale, full-service hotel and resort properties. The company’s 55 properties across 15 states are uniquely diversified in urban gateway city markets.

PEB has remained very active in investing throughout the pandemic. The company completed over $270 million of sales in 2021, including Sir Francis Drake, the Roger New York, and Villa Florence San Francisco.

With these proceeds and additional capital, PEB completed four acquisitions totaling $492 million in 2021. These additions added high-quality, leisure-focused resorts to the company’s portfolio. I’m a fan of Pebblebrook’s active management to better position itself to capitalize on the pent-up leisure demand exiting the pandemic. I believe PEB will be rewarded in the coming years for this offensive approach to navigating Covid-19 in 2021.

The company doesn’t show any signs of slowing down on the acquisition front. PEB raised more than $740 million in capital in 2021 and currently has $92 million cash on hand and nothing drawn on its $650 million credit facility.

I like management’s focus on cutting costs efficiently throughout the pandemic. Investing in cross-training and technology has allowed the company to eliminate about 100 to 200 bps of expenses. I believe this effort will allow PEB to continue seeing strong margins during this inflationary period. Shares are trading at $23.98 and we support a BUY.

FAST Graphs

Pack Up The Sled, Who Cares About The Fed

One of the best property categories to invest in when rates are rising is Lodging.

That’s because, as a general rule, REITs with shorter leases offer greater inflation protection than those with longer ones. Lodging REITs have the shortest leases because hotel room rates fluctuate daily.

While they can adjust prices to absorb higher costs, pricing power is also a function of supply and demand. Historically, Lodging REITs have not performed well during recessions, and typically you want to own these REITs at the end of the recession, as travel and business are ramping back up.

For now, we’re dipping into the sector, albeit cautiously, recognizing that valuations remain attractive and travel is opening back up. Keep in mind. We’re underweight the sector, only allocating capital to our higher-risk portfolio strategies.

iREIT on Alpha

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment