Mystockimages/E+ via Getty Images

Hilton Grand Vacations, Inc. (NYSE:HGV) remains a formidable figure in the timeshare industry. With the massive revenue and margin expansion, it rebounded and surpassed pre-pandemic levels. It offers more optimistic growth prospects, given its impeccable core operations. The increased preference for timeshare may further stimulate its growth and expansion. Also, the Diamond Resorts will help drive its operating capacity and market penetration.

Meanwhile, the stock price is moving sideways, but the 52-week trend remains in an uptrend. The 20% upside persists, in line with the derived value using the DCF Model. But, investors must still be careful as it still appears quite high.

A Better Year for Hilton Grand Vacations

Hilton Grand Vacations continues to prove it still has a lot of avenues for growth. After the disruptions of the pandemic, it bounced back and exceeded the prior values. Plus, it remained sustainable despite the supply chain disturbance and the decline in demand.

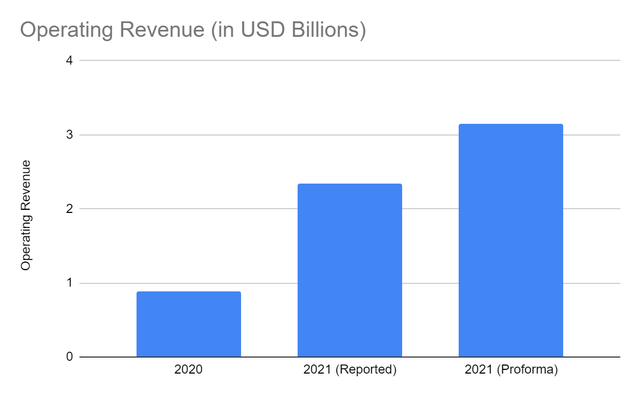

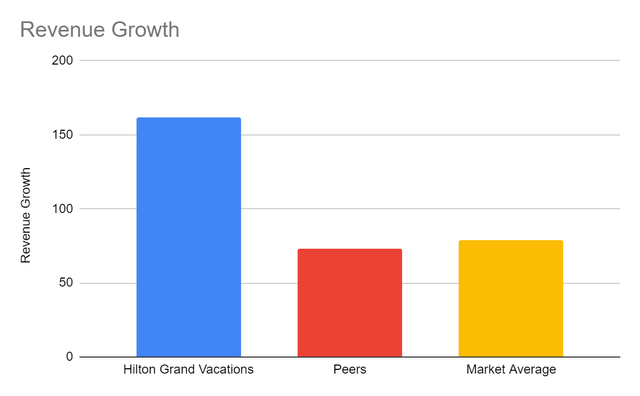

It shows an impressive rebound and expansion in its most recent financial release. The operating revenue amounted to $2.34 billion, a 162% year-over-year increase. Thanks to the reopening of borders, which allowed it to operate at a larger capacity. It was able to cater to more customers amidst the upsurge in pent-up demand.

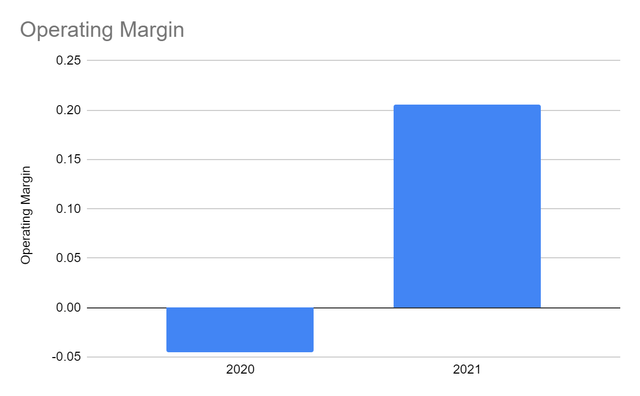

Moreover, it has become more profitable as the operations expanded. Its operating margin reached 20%, which is also higher than the pre-pandemic operations. Given this, we can say that as the pent-up demand spurred growth, it was able to keep its costs and expenses low.

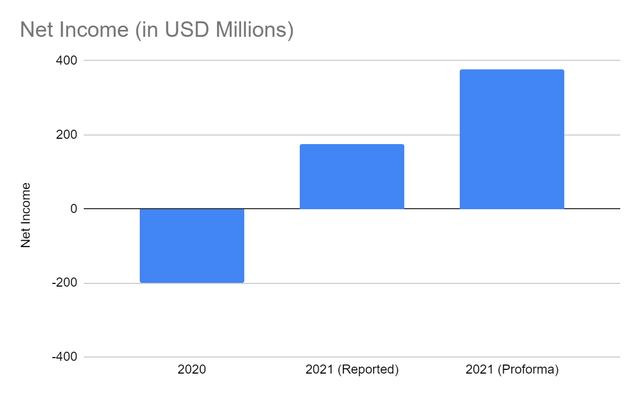

Net income rose as well but was lower than the pre-pandemic values. The difference was due to interest expense and tax. It was logical as Hilton acquired Diamond Resorts, which required more financial leverage. Also, its credit facility skyrocketed. But, if the pro forma values are considered, it will be higher and have more potential. Regarding its core business, its recent earnings are higher than the previous ones. So along with its expansion was its efficient asset management and increased market demand.

Operating Revenue (MarketWatch)

Operating Margin (MarketWatch)

This year, Hilton shows more promising growth prospects as demand for timeshares rises. This upward pattern coincides with the increased attention to travel and leisure. Despite the temporary pause due to Omicron fears, the trend rebounded. In a recent survey, 70% of leisure travelers plan to spend more on travel this year. The major destinations are the US, the UK, Canada, Japan, and Spain. This is a perfect opportunity for Hilton to market itself, since it has more properties there. In luxury travel alone, there was a recent increase of 140%. This shows industry recovery, which will continue with high-flying values. For the next few years, total spending is expected to reach trillions. With more and more people going out of their homes, this spring will see more leisure travelers. The trend was most evident in beaches, resorts, and theme parks. In the US alone, it may increase by over 30% to almost $2 trillion.

Fortunately, HGV is capitalizing on its growth through prudent expansion and acquisitions. The addition of Diamond Resorts will allow it to operate more and penetrate more markets. Now, it is rebranding and renovating its resorts and other properties. It also optimizes the technology to consolidate its systems and launch new membership plans. It will be no surprise to see an upsurge in HGVs revenue for the next few years.

Today, it shows a more compelling growth and financial valuation. Its more robust core operations now have more means to sustain its expansion and efficiency. Also, the rebranding and renovation of its properties remain in line with the increased demand in the industry. Before, its market core was the Gen Xers and the Baby Boomers. Now, more millennials are seeing its appeal. In recent years, more millennials are vacationing in a timeshare. In a survey, 73% of millennials said they liked staying in a timeshare, while 24% planned to buy one. Given all these trends, it was a sagacious move for HGV to add Diamond Resorts to its portfolio. For instance, millennials aged 24-39 make up its fastest-growing membership demographics. The new subsidiary continues to see 25% year-over-year growth in millennial memberships.

How Hilton Grand Vacations Keep Up With The Fast-Paced Uptrend

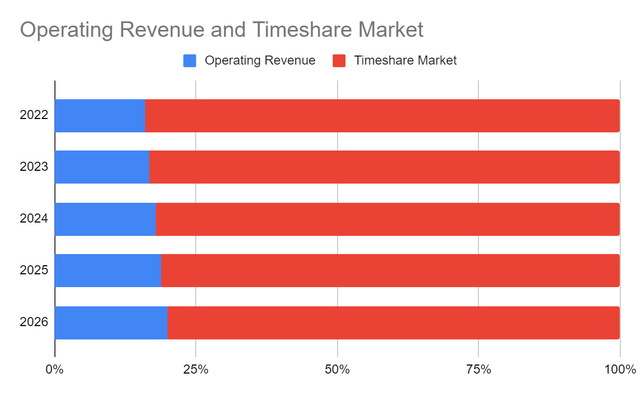

The overall demand for timeshares is exceeding the pre-pandemic levels. That is why the timeshare industry is seeing an expansion in the next few years. The occupancy rate rose from 52.3% to 79% in a recent survey. The influx of more customers will drive its revenues further. Statistics show that it will have a 7.6% CAGR, reaching $28.9 billion.

In HGV, the occupancy rate reached 57.2%, a 16.9% year-over-year growth. Although it is below the market average, HGV has not reached its full capacity yet. It has more avenues for growth and expansion to sustain and achieve its 2022 guidance. So even if its occupancy rate is lower than the average, it has an over 100% revenue growth. It is way higher than its peers and the market average.

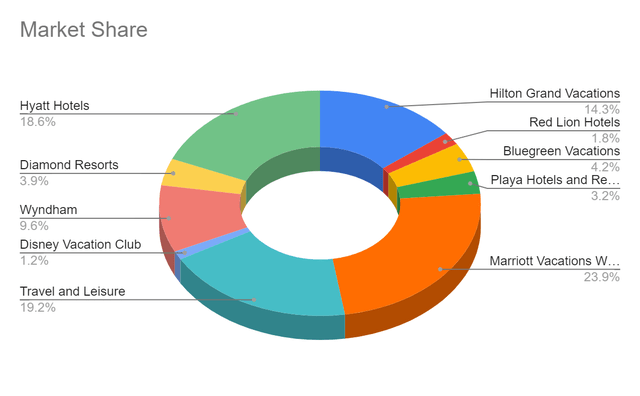

Currently, HGV holds 14.3% of the market share. After its M&A with Diamond Resorts, it gets an additional portion of 3.8%, bringing a total of 18.1% market share. Note that both companies increased their market share in one year. With HGV getting 1,600 net new members from Diamond Resorts, it shows strong brand loyalty and trust in the new management. On top of it, the company got 380,000 existing owners, 92 resorts, and 32 sales centers in 20 markets. It is no surprise that its massive revenue growth will continue and occupy a larger market share.

Given the trend in the industry and HGV expansion, I estimate the revenue to increase by 14-15%. The value may increase from $3.52 billion to $6.2 billion, with market share rising from 20% to 25%.

HGV and Market Operating Revenue (Author Estimation)

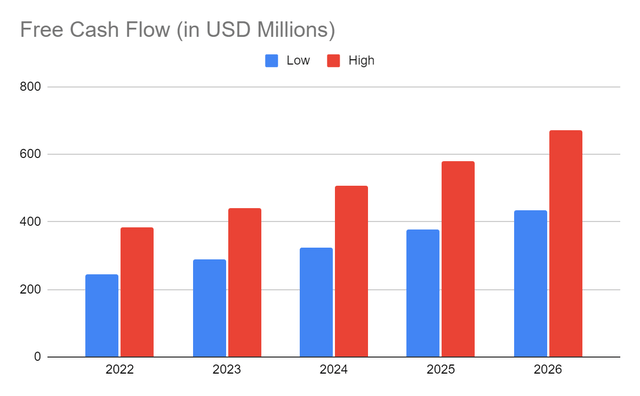

But, HGV does not rely on revenue and demand increase solely. It has sound financials. Its most recent Free Cash Flow (FCF) is $150 million, an increase after its four-year decline. This shows that the company’s actual transactions generate more cash inflows. Note that it also increased its CapEx. And even if it is the same as the amount in 2019, FCF will remain 17% higher than the pre-pandemic levels. Likewise, the most recent FCF-to-Sales Ratio is 6.4%, compared to 5.8%. So, the increased operating capacity offers more efficiency even without Diamond Resorts. For the next few years, the ratio may remain between 6-7%. I estimate it to rise from $244 billion to $434 billion.

Free Cash Flow (Author Estimation)

But, the company must be careful with its finances, given its increased borrowings. It must consider the inflation rate that may affect its costs, expenses, and demand. The ongoing war may also impact it since its development in Russia stopped.

Price Valuation

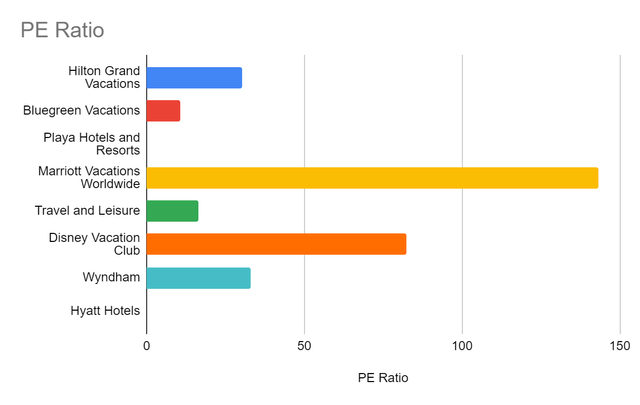

I was in a strong buy position in my previous article, and it paid off. Thanks to its continued expansion and the surge in the industry, which push the price upward. Today, the stock price of HGV has been moving sideways. The investors must start to reflect more as the momentum slows down. Also, the price still appears high relative to EPS.

Meanwhile, its 52-week trend shows that it stays at an elevated trend, and the three-week uptrend continues. At $53.03, it is already 20% higher than its most recent dip. The PE Ratio suggests potential overvaluation as earnings are not in line with the price. But, it remains lower than the market average of 52.68. So, relative to Wyndham Hotels & Resorts, Inc. (NYSE: WH) and Marriott Vacations Worldwide Corporation (NYSE: VAC), the price appears lower.

With the addition of Diamond Resorts and the uptrend in the timeshare industry, I estimate EPS at $3.23-4.20 in 2023-2024. If the stock price stays in the current range, the PE Ratio will decrease to 16-20, making the stock cheaper. To value the price further, I employed the DCF Model using the FCFF method.

|

FCFF |

$177,000,000 |

|

Cash |

$695,000,000 |

|

Borrowings |

$518,000,000 |

|

Perpetual Growth |

4.60 |

|

WACC |

7.00 |

|

Common Shares Outstanding |

119,900,000 |

|

Stock Price |

53.03 |

|

Derived Value |

$62.99 |

There must be a 19% upside over the next twelve months, given the derived value. The company must do its best to take advantage of the market hype and accommodate more customers. The expansion through its acquisition is its first move, which is timely and relevant. Given its strong market position, the estimated figures are attainable. So, the price increase may continue if it sustains its financial rebound.

Bottom Line

Hilton Grand Vacations continues to show more growth potential. Given the increase in demand, its broader operating capacity may help it penetrate more markets. The increased operating revenue and margin must be expected. Its subsidiary, Diamond Resorts, is a great addition, given the massive net increase in new members. The company will have more means to stimulate its operations and expand further. This may fortify its strength and position in the market.

Meanwhile, the stock price appears confusing, given the sideways trend and lower earnings. But, its growth prospects show that higher earnings will justify the range and may lead to an upside. The recommendation is that Hilton Grand Vacations is still a buy.

Be the first to comment