Sean Pavone/iStock via Getty Images

Highwoods Properties, Inc (NYSE:HIW) is a real estate investment trust (“REIT”) that owns a portfolio of office properties in some of the most attractive markets in the country. These markets are concentrated in the Sunbelt states and characterized by nation-leading population and employment growth and are also highly coveted regions for business relocations.

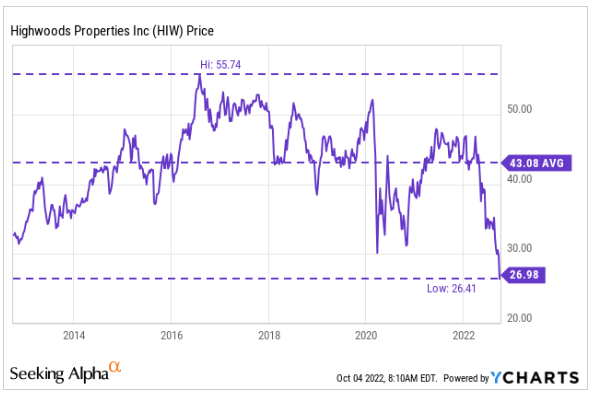

As an office REIT, shares have suffered from significant investor flight and are now trading at some of their lowest levels on record.

YCharts – Share Price History Of HIW

YTD, the stock is down over 40% and are currently trading at new 52-week lows. A recent rebound in the overall markets has helped blunt the downward spiral, but pessimism still abounds. For opportunistic investors, however, HIW presents one of the top value propositions in the overall market, with a dividend yield of nearly 7.5% and a severely depressed share price, whose long-term value from recent expansions and ongoing development activities is not being fully recognized.

A Portfolio Of Assets In The Nation’s Best Business Districts

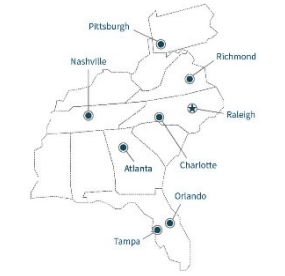

HIW’s portfolio includes approximately 27M rentable square feet (“SF”) of office space located in some of the best business districts (“BBD”) in the country. These markets are characterized as those that outpace the national average in population and employment growth, as well being affordable and business friendly. In this regard, states such as North Carolina, which recently ranked as the top state for business by CNBC, and Virginia, Georgia, and Florida are some states that come to mind as BBD markets.

2021 Form 10-K – Map Of Geographic Concentration (Prior To Dallas Expansion)

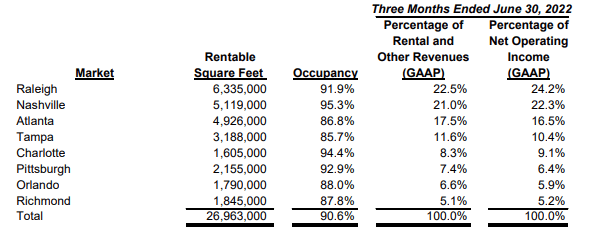

Among their top operating markets are Raleigh, Nashville, Atlanta, and Tampa, who collectively account for approximately 75% of total net operating income (“NOI”). In recent years, these regions have experienced significant inbound migration and continue to post some of the best employment figures in the country. Given the level of concentration in these regions, it’s critically important that this strength is maintained to insulate against any disproportionate downside risk resulting from a downturn in these markets.

Q2FY22 Investor Supplement – Summary Of Portfolio Weighting Of Current Operating Markets

Some of these regions, such as Tampa, are also at heightened risk stemming from natural disasters. Most recently, Hurricane Ian posted a significant threat to HIW’s operating properties. But in a recent update, management noted no notable damages on any of their properties. Still, prospective investors should not discount the potential costs associated with future weather-related disasters in HIW’s operating markets.

Diversified Tenant Base With Extended Lease Terms

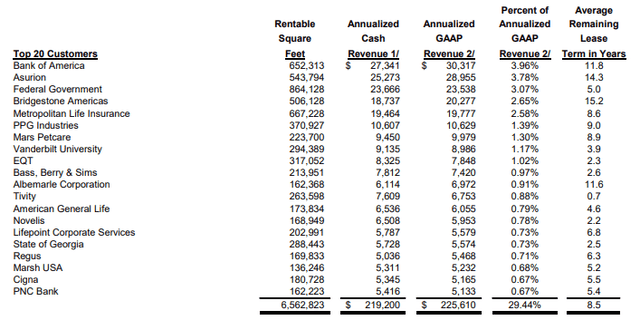

In addition to operating in BBDs, HIW also retains a diversified group of tenants that operate primarily in the Professional, Scientific, and Technical Services, Finance/Banking, and Insurance sectors, three industries that continuously exhibit resilient job and wage growth.

Among their top tenants include Bank of America (BAC), Asurion, and the Federal Government (“USG”), to name a few. Collectively, these three tenants accounted for just over 10% of total annualized revenues (“ABR”), with no single tenant representing over 5% of ABR.

And aside from the USG, these tenants each had average remaining lease terms in excess of 10 years, which is greater than the overall average of 8.5 years for the top 20 subset. This provides an enhanced level of predictability and stability to the company’s cash flows. It also reduces tenant non-renewal risk, which for the office sector is an important consideration, given current trends in teleworking (“WFH”).

Q2FY22 Investor Supplement – Summary Of Top 20 Tenants

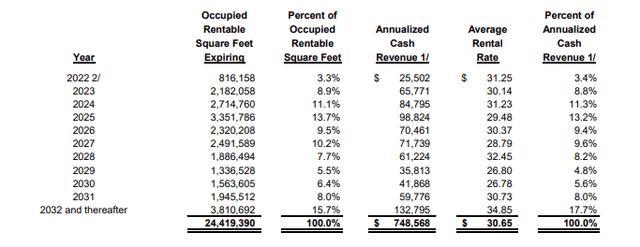

Over the coming years, HIW does have some expirations to work through, but they are weighted more heavily to the later years. This mitigates some of the risks associated with more near-term expirations, such as non-renewals and declining spreads.

Q2FY22 Investor Supplement – Lease Expiration Schedule

HIW’s Leasing Pipeline Remains Robust

In their most recent quarter ended June 30, 2022, leasing volumes remained robust, with over 680K SF signed, 65% of which was attributable to renewals, at overall GAAP and cash spreads of 12.6% and 0.5%, respectively.

At over 240K SF, new deals and expansions exceeded their historical averages and outnumbered total contractions by two to one. Additionally, net effective rents came in 10% above their five-year average and are at their highest levels since the third quarter of 2020.

The strong level of leasing during the quarter came in addition to occupancy levels that continue to hold above 90%. While occupancy did decline from Q1FY22, it is up 30 basis points (“bps”) from last year on a same-property basis.

Though asset acquisitions, dispositions, and new developments could result in timing swings in occupancy, management nonetheless expects average occupancy for the portfolio to remain between 90-91% for the reminder of the year.

Expansion Into Dallas, Texas And Ongoing Development Pipeline Will Drive Future NOI Growth

In an effort to diversify their geographic exposure and to increase their long-term growth rate, HIW recently announced plans to exit the Pittsburgh market in favor of redirecting resources to Dallas, Texas through the formation of joint ventures with Granite Properties, a well-known local developer, on two major development projects that are 12-17% pre-leased and projected to contribute significantly to NOI in later years.

Though assets within their Pittsburgh market boasted of some of the best occupancies in their portfolio, the transition away from the region fits the company’s strategy of targeting BBD markets. In this case, the Dallas Metro area is one of the fastest growing areas of the country and is among the top in the nation in overall population growth, while also being a highly sought after destination for business relocations.

The addition of the two Dallas developments increases HIW’s total at-share pipeline to +$559M, with an overall pre-leased rate of 32.7%. Within this total is about +$95M in completed but not yet stabilized projects in Nashville and Tampa that are 93.6% pre-leased but just 46.6% physically occupied. As lease-up continues, HIW should begin to realize incremental gains in these properties through stabilization.

To fund the transition into Dallas, HIW intends on marketing their properties in Pittsburgh, though there is no determined timetable for an exit. Given current market conditions, it’s likely the dispositions will take longer than originally expected due to the uncertainty in price discovery between buyers and sellers. The company was able to dispose of +$101M in non-core properties during Q2, but conditions have significantly changed since then.

Strong Balance Sheet Provides Enhanced Flexibility In Achieving Objectives

Despite the uncertain market environment, management did rule out the need to raise external capital to fund their acquisition and development pipeline. Adequate liquidity consisting of cash on hand and over +$600M of availability on their credit facility provides further confidence of the company’s financial position.

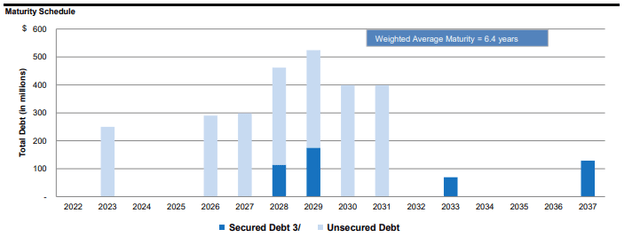

Low net leverage levels that continue to hold below the company’s target level of 6.0x are complemented by a well-laddered maturity schedule with just +$250M due prior to 2026. This provides HIW with an increased level of flexibility to not only fund their growth opportunities, but also to maintain their current dividend payout levels.

Q2FY22 Investor Supplement – Debt Maturity Schedule

At present, the quarterly payout is $0.50/share, which represents an annualized yield of nearly 7.5% at today’s share price of approximately $27.00. Furthermore, this payout has steadily increased, with the most recent increase being about 4% in the middle of 2021.

Adequate coverage levels and a strong history of generating positive cash flows provides confidence of further increases in the periods ahead. Though yields on risk-free assets have increased and have provided income investors with an attractive alternative to dividend-paying stocks, the yields are still not as attractive as the growing payout of HIW.

A Materially Undervalued Office REIT

HIW is an office REIT with operations in some of the best markets in the country. And following their announced entry into the Dallas market, well over 80% of their NOI will now be derived from a top 2022 market, as identified by Urban Land Institute.

Favorable population and employment trends in their markets provides enhanced durability to cash flows, which continue to benefit from overall occupancy levels of more than 90% and double-digit increases in GAAP rent spreads. In future periods, HIW should also begin to realize significant incremental benefits from their development pipeline, which now includes two major projects in Dallas, Texas that are expected to reach stabilization in later years.

For income investors, the stock currently offers an annualized yield of nearly 7.5% at current pricing. This is more attractive than many other alternatives in the current market, such as other REITs and risk-free Treasurys. In addition, the payout has steadily increased, with the most recent increase being about 4%. Given the company’s current liquidity position and outlook, investors should expect further increases in the periods ahead.

Though the business has not yet fully recovered, the quality of their portfolio has significantly improved for the better, especially in the context of their expansion into the Dallas market. At less than 7.0x forward FFO, I don’t think the expected benefits are being fully realized in the stock price. Prior to 2020, the company traded at about 14.7x. Even at a 10x multiple, shares would present upside potential of nearly 50%, excluding dividends. This is market-beating potential and significant for any investor seeking an attractive entry point for a quality REIT in the office sector.

Be the first to comment