Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 12.

Mortgage REITs have had a tough year on the back of high interest rate volatility and a blow-up in Agency MBS valuations, in part driven by the planned Fed portfolio unwind. This sharp underperformance is understandably making investors worried about not just mortgage assets or common shares of mortgage REITs but preferred shares as well. In this article we highlight some of the misconceptions about Agency mREIT preferreds to make sure investors can make the right choice for themselves using all relevant information.

Our key takeaway is that investors should understand the underlying dynamics of agency mREITs and avoid thinking of them as typical companies. Agency mREITs are actively-managed interest-rate hedged portfolios of Agency MBS – more akin to CEFs and BDCs, rather than traditional companies. And rather than being better or worse, this feature has a number of pros and cons which different investors will disagree about.

Misconceptions

One misconception treats mortgage REITS as traditional “widget makers” and expects their equity to rise over time. Investors who have spent any time looking at mREITs have probably noticed that mREIT equity and book values (not the same metric, but roughly directionally similar) have tended to move lower over time. This is in contrast to successful traditional companies which are able to generate value over time and drive a rise in their level of equity or the difference between their assets and liabilities. Preferreds holders want to see equity move higher over time, all else equal, since it increases the amount of so-called equity coverage or cushion that protects the preferreds holders.

The basic reason why mREITs don’t follow this pattern is simply because mREITs are not traditional companies. They are not in the business of making “stuff” – they are just leveraged portfolios of fixed-income securities. The specific reason why mREIT equity / book values tend lower is a bit more involved.

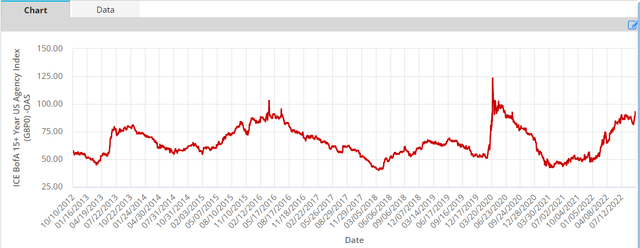

First, current Agency valuations (i.e. Agency “basis” or OAS) are at a historically extreme level i.e. Agencies are unusually cheap versus Treasuries. As an aside, many investors think that mREITs have been hurt by the rise in rates but that’s simply not the case as we discuss here. Any straight line drawn from a previous level of mREIT equity / book value to today is going to be downward sloping given the depressed nature of Agency MBS prices, caused by the planned Fed MBS portfolio unwind, general weakness in fixed-income and high interest rate volatility. The same will be true for many other asset classes, particularly in fixed-income. No one knows what the future will bring but every time Agency valuations have reached the current level they have moved lower over time, if not immediately.

Second, there is an annuity aspect to the MBS portfolio as some of the net income received includes the principal which means the mREIT will be overpaying relative to its actual underlying yield profile, causing its level of equity to fall over time, all else equal.

Third, there are various drags on the portfolio such as hedging costs. As volatility increases the mREIT effectively has to buy high and sell low or more precisely, pay fixed high and receive fixed low when it rebalances its interest rate swap portfolio. This is partly offset by long volatility hedges via swaptions but the swaptions themselves carry an embedded cost via theta or time decay.

Fourth, mREITs tend to go through deleveraging episodes where the book value steps lower as the company sheds assets to ensure its leverage does not rise above its comfort level, something we documented in more detail here.

Active management can push the other way and allow the mREIT to add value, however, historically, it has not been able to override these factors.

Now let’s come back to the original complaint that Agency mREIT equity / book values don’t rise over time. Once we understand that mREITs are just leveraged portfolios of Agency MBS, roughly hedged for parallel interest rate moves it is much easier to see why this complaint makes no sense. To expect mREIT equity to rise over time is equivalent to the demand to see Agency MBS valuations rise continually which is equivalent to the demand to see Agency MBS yields move below Treasury yields and eventually to negative levels. In other words, saying it’s bad that mREIT equity levels don’t rise over time is akin to saying it’s bad that Agency MBS don’t trade at increasingly negative yields. Once investors understand how mREITs actually look internally, this complaint can be easily dismissed as ludicrous.

It’s also important to highlight that the large drop in equity or book values has not been universal and there is wide variation within Agency mREITs. For example, Dynex Capital (DX) whose preferreds we continue to hold in our Income Portfolios have seen an increase in equity over the recent past – a gain of 25% since December 2019.

It should also be said that it’s not so much equity or book value that preferreds investors care about – it’s really the equity / preferreds liquidation preference ratio. mREITs can push this ratio up not just by increasing equity (organically or through share issuance) but also by redeeming preferreds which has been happening across names like TWO and IVR – a trend we expect to continue. This is because it makes a lot of sense for mREITs to redeem their preferreds as their equity falls since otherwise preferreds would have a disproportionate weight in the company’s financing profile, particularly as preferreds are more expensive than repo.

Finally, to say that equity has been falling is very different from saying equity is too low and preferreds are in serious danger. It’s important to have a good sense of what needs to happen for equity to move below the liquidation preference of the preferreds for any given mREIT. This is why investors need to track the level of equity, the preferreds liquidation preference as well as leverage to make sure they are choosing appropriately on the risk/reward spectrum.

Another misconception is that Agency mREIT leverage is too damn high. It’s very true that Agency mREIT leverage is high – often in the mid-to-high single digits, however, this complaint again treats mREITs like traditional companies where a high single-digit leverage would be very worrying indeed.

All else equal, high leverage is a concern but all else is not equal. Agency mREITs use high leverage because Agency MBS are lower risk. Hybrid mREITs use much lower leverage because they hold residential whole loans which bear credit risk. Simply put – you can’t have one and the other. You can’t say – well I want this mREIT to hold assets like Agency MBS with no credit risk and I want them to have no leverage – that’s not a sensible thing to say. You need to choose where on the spectrum you want to allocate – between credit risk and leverage. mREITs with a high amount of credit risk run at lower leverage and vice-versa.

Stance And Takeaways

It has indeed been a tough time for the mREIT preferreds sector as high volatility, broad based weakness in fixed-income and a planned Fed unwind of its MBS portfolio have all piled on to pressure the sector. That said, we continue to see value in Agency mREIT preferreds for a number of reasons.

As discussed above, the focus on high leverage and lower equity levels over time is a one-sided story that doesn’t capture the full picture and treats mREITs like traditional companies which they simply are not.

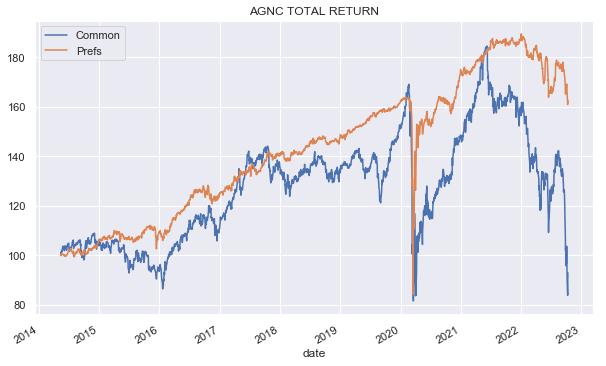

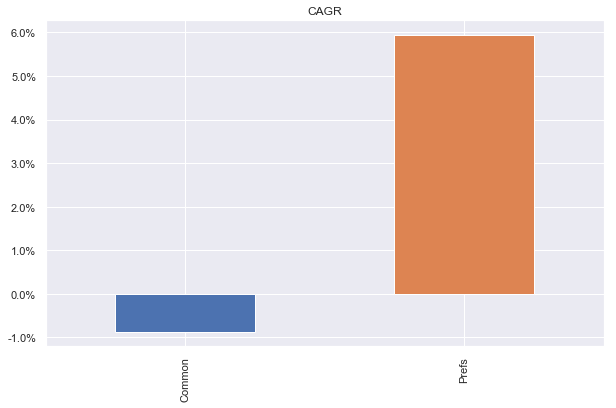

Historically, Agency mREIT preferreds by-and-large have delivered strong results. The chart below shows the profile of AGNC common vs. its preferreds for the longest period for which we have preferreds data.

Systematic Income

In terms of annualized performance, the preferreds have delivered a nearly 6% CAGR since mid 2014 despite trading at fairly depressed prices at the moment.

Systematic Income

One key takeaway of this article is that investors should be wary of the pile-on syllogism kind of “analysis” they see cross their screen which goes something like this: 1) bad securities go down, 2) this security went down, 3) therefore, this is a bad security. You don’t tend to hear this kind of analysis when the market is doing well – it’s only when things drop that you get a lot of this pile-on kind of commentary where people pat themselves on the back for not having held this or that stock. This is not particularly enlightening – if we wrote an article about each stock that we didn’t hold over a market drawdown we could write 10 a day until the day we died.

The second takeaway is that investors should be careful in trying to fit mREITs into the traditional security frame – they are just different. Unlike traditional companies, Agency MBS carry no credit risk, however, they do carry a significant amount of Agency MBS spread risk. It’s not a question of better or worse – it’s just different.

Ultimately, investors should approach the sector in a nuanced way. Rather than all-in or all-out, the right questions to ask in our view are the following. How do agency mREIT preferreds look versus other preferreds in terms of their risk/reward? Do some agency mREIT preferreds look better or worse than others? Are hybrid mREIT preferreds more or less attractive versus agency mREIT preferreds. And are some preferreds in a given suite e.g. AGNC or NLY more or less attractive.

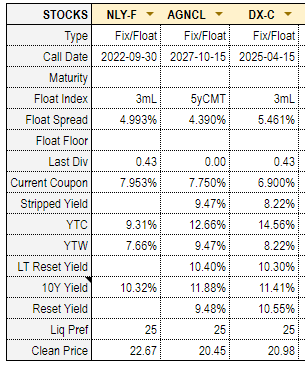

In the Agency mREIT preferreds space we continue to like the NLY Series F (NLY.PF), the AGNC Series G (AGNCL) and the DX Series C (DX.PC) whose key features are shown in the table below. We currently hold NLY.PF and DX.PC in our Income Portfolios.

Systematic Income Preferreds Tool

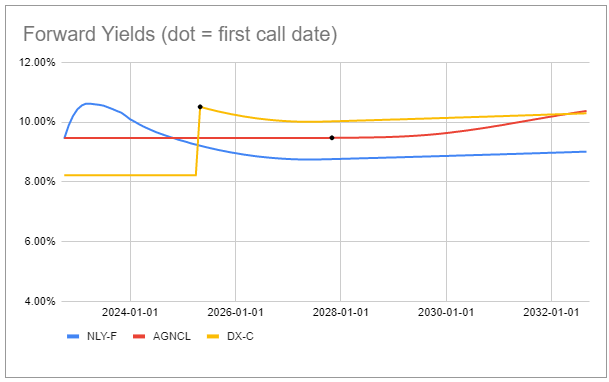

The forward yields of these preferreds are represented in the chart below which are based off current forward rates.

Systematic Income Preferreds Tool

NLY.PF is the only preferred in this selection that currently floats and has a yield of around 9.3% at its LIBOR reset and stripped price. Its yield will continue to rise until roughly the peak in the Fed Funds rate. NLY.PF (as well as AGNCN which has a similar coupon profile) has outperformed the broader retail preferreds space this year by around 15% by virtue of its now floating-rate coupon and the direction of short-term rates. The other two preferreds will reset to a floating-rate at a later time – their stripped yields are shown in the table above. In our view, these continue to offer decent risk/reward for income investors in a diversified portfolio.

Be the first to comment