svetikd

Co-produced with Treading Softly

We’re often forced into choices that involve some level of compromise. We’re not talking about compromising morals or ethics here, but choices often contain a combination of positives and negatives mixed together. Rarely are we given something that’s all positive or all negative.

Do you want a hamburger or a hotdog?

A Wrangler Jeep or any other car?

Own or rent?

Spend today or invest for the future?

We make millions of judgment calls each day and often end the day with what is called decision fatigue. We don’t want to think about, weigh out, and evaluate the outcomes any longer. We’re exhausted from making so many decisions!

When it comes to the market, we have thousands of options to choose from. For every stock we come across, we must decide whether or not to buy. As income investors, we are categorized as “dividend investors”, those who primarily buy dividend-paying securities. This makes the decision of whether or not to buy easy for all those stocks that don’t pay and are unlikely to ever pay a dividend.

Sometimes, the choice isn’t that easy. We are often left choosing between dividend growth – a growing dividend income stream by the company – or immediate income – high yields now that are not expected to grow over time.

Both have pros and cons. Both appeal to our sensibilities and desires.

Today is a special day! You don’t have to choose between the two options as these picks are high-yield dividend growers. A unique group of investments that strive to do it all, paying us a high yield today and growing the dividend in the future. In our book, that makes for an easy decision.

Let’s dive in.

Pick #1: CSWC – Yield 9.5%

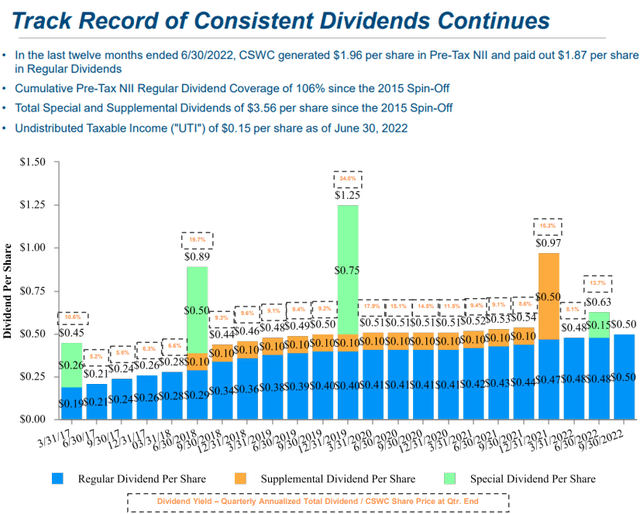

We are seeing a pattern in BDCs this quarter that we love. Dividends are being hiked! Capital Southwest Corporation (CSWC) joined in hiking its regular dividend to $0.50/quarter. This is up 13% year over year.

CSWC is creating a very impressive track record of dividends. Consistently hiking its “regular” dividend with frequent “supplemental” and “special” dividends over the years. (Source: CSWC Q1 2023 Presentation)

What is the difference between these different types of dividends? To understand this, we need to understand how BDCs make money. CSWC invests in debt but also makes an equity investment as well. This creates a portfolio of debt that pays a scheduled amount of interest and has a maturity date – in other words, predictable income. The equity investment is a lot less predictable. If a portfolio company is acquired or if the current equity owners decide to recapitalize the company, CSWC can recognize a substantial gain on equity. However, the timing and size of such gains are unpredictable and lumpy.

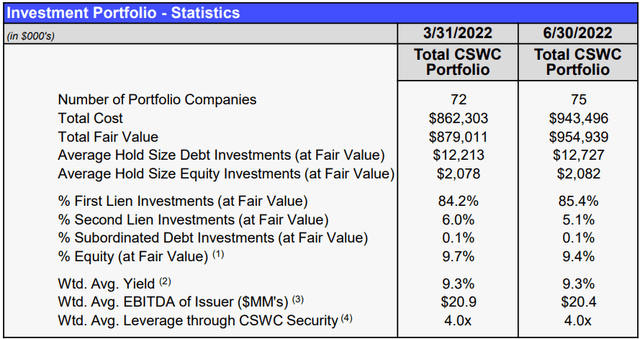

Here is a look at CSWC’s current portfolio:

Regular Dividends

“Regular” dividends are dividends that are funded out of recurring cash flow produced by the debt side of the portfolio. CSWC’s policy is to match the regular dividend with recurring interest income from its loan portfolio. This is a durable, predictable, and recurring income stream.

This cash flow source benefits from rising interest rates since 98% of the loans are floating-rate.

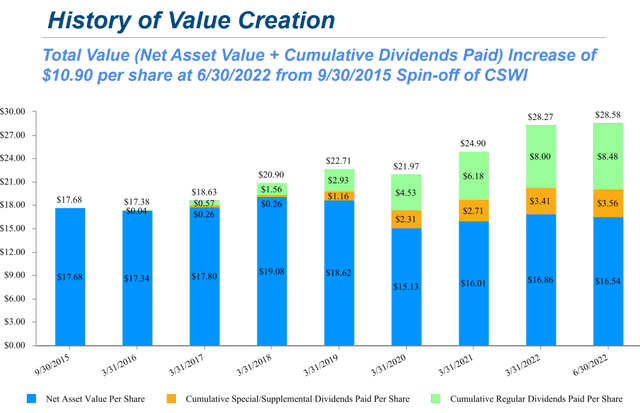

It is also benefiting from CSWC’s ability to grow. CSWC sold new equity at a 23% premium to NAV. CSWC’s NAV is $16.58. When CSWC sells shares for over $20 and invests that new money into investments that have a similar return, per/share earnings will grow. Many refer to this as the “circle of virtue”.

When a company can sell shares at a significant premium to NAV, NAV per share grows. When it invests that money at similar returns as prior capital, earnings per share grows, this benefits existing investors through earnings and dividend growth per share. It also reinforces the premium because investors who pay a premium will see NAV, earnings, and the dividend growing. Is it worth a premium to buy a company with growing NAV, earnings, and dividends? Yes.

CSWC’s ability to consistently issue shares at a premium to NAV has played a significant role in increasing recurring income and also reducing expenses as a percentage of assets making the company more efficient.

Special/Supplemental Dividends

Special and supplemental dividends primarily stem from the equity portion of CSWC’s portfolio. Currently, about 9.4% of assets. These are companies that CSWC has or had a debt position in. CSWC focuses on companies with an average EBITDA of only $20 million/year. These are small companies, which means that equity typically has a low value and is not particularly liquid. Other than the other equity owners, there is no market for this equity.

As a result, CSWC realizes gains when there is a “liquidity event”. This might be a competitor buying out the company as it expands. It could be a private equity company deciding to buy it out. Or the existing equity owners might decide to recapitalize the business. When these liquidity events occur, it can result in large gains.

In the meantime, many of these equity positions do pay dividends. Last quarter, CSWC booked $2.186 million in dividends. But since this is equity, such payments are not as predictable as interest payments.

As a BDC, CSWC must substantially distribute all of its taxable income. When it comes to less predictable income, it distributes it through a “special” dividend which is a one-time lump payment to shareholders. Or it might declare a “supplemental” dividend which is smaller payments over a number of quarters.

In short, the “regular” dividend is what we can look at as a predictable and recurring income – and that’s what the 9.5% current yield is based on. We should look at specials and supplements as a temporary bonus. Though over the long run, CSWC has a remarkable history of paying extra dividends frequently:

Over the past 7 years, CSWC has paid out $12.04 in dividends. About 70% was the “regular” dividend, and 30% was specials and supplemental.

The pace is increasing as CSWC continues to fire on all cylinders. With rising interest rates, low default rates, and CSWC’s ability to raise capital at a healthy premium to NAV, this BDC will keep growing its dividends!

Pick #2: EPR – Yield 5.9%

EPR Properties (EPR) enjoyed a modest beat and a minor increase in guidance with its recent earnings report. They now expect $4.50 FFOAA (FFO “as adjusted”), which is the metric that management likes to use to judge the dividend. They have historically had a payout ratio of 80%-85% of FFOAA. The current dividend comes in at 72%, so it is a much more conservative payout ratio than they operated at historically.

EPR is still targeting $500-$700 million investments in 2022, despite investing only $239 million in the first half. During the earnings call, management had a lot to say about their pipeline, noting that cap rates have started increasing. Where they previously expected to invest at 7-8%, they now expect to be able to invest at over 8% as credit spreads have widened and there are fewer buyers in the market. EPR is in a very strong position with a healthy balance sheet and low leverage.

Management described the guidance as “conservative” as far as the timing of acquisitions, and that closings late in the year would not have a significant impact on guidance. It should also be noted that collections of deferred payments are completely excluded from guidance. EPR is scheduled to be paid back approximately $0.08/share for the next two quarters. In short, EPR should easily beat current guidance.

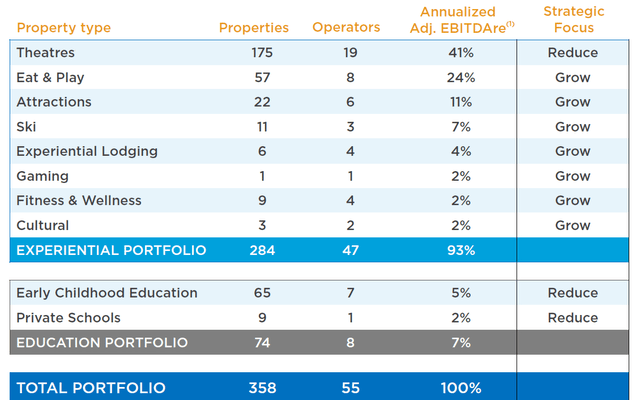

EPR did not discuss specific acquisitions, though management implied that yields were better on development/redevelopment opportunities. So we expect that EPR might participate in some “build to suit” projects. Their last major foray into build-to-suit was with Top Golf, an investment that turned out to be very successful. Their portfolio detail as of June 30, 2022:

EPR remains highly exposed to theaters but is committed to its plan to reduce exposure to theaters by investing in other types of assets.

We expect that EPR will likely hike the dividend early next year. Choosing instead to retain capital in 2022 for reinvestments and hiking the dividend only after they have new properties up and operating.

EPR has been very patient and deliberate in reinvesting its capital. This patience is paying off. Here is a very interesting comment from CEO Silvers on the prices that current and potential tenants are willing to pay to expand:

…we’ve seen the idea of a lot of tenants and operators who’ve kind of capitulated that, yes, costs are really staying higher. And they were holding out thinking like we started kind of many times at the beginning of the year and saying, okay, this is the year that rates are going to go higher and then they don’t.

So I think the first half of the year where people kind of continuing to fight that trend. And now it’s kind of like if you want to grow the business, this is just the cost of doing it and people are getting more comfortable with that.

When you are in the business of providing the capital for expansion, the willingness of tenants to pay more is a positive.

EPR’s patience is paying off, and investors who were buying EPR during the COVID crash are being well rewarded for their patience. Slow and steady wins the race. EPR is returning to normalized operations and next year we can expect significant growth in earnings. That will translate to above-average dividend growth for 2023 and 2024.

Dreamstime

Conclusion

With EPR and CSWC, we get high yield income today. We get growing dividends tomorrow! It’s a win-win in the book of income investing.

I don’t like to get a growing dividend when its yield is a pittance. I also don’t want a high yield that cannot be relied upon. So when I find opportunities like EPR and CSWC, I bring a bucket, not a thimble.

In retirement, it can be hard to find means to grow your income stream when you live off a fixed amount of money and have rising costs from inflation. Investments that offer you a liveable yield now and the outlook for future growth are opportunities you don’t want to miss.

I love a good high-yield investment. I think a great dividend-growing company is excellent. Together? I think it’s a no-brainer.

Goodbye decision fatigue and hello income!

Be the first to comment