JamesBrey

With a solid history of dividend and earnings growth, Barings BDC (NYSE:BBDC) is ranked among the top high-yielding business development companies over the years. Despite tough market conditions, its $2.3 billion investment portfolio continued to generate robust income and net investment income growth so far in 2022. It appears that net investment income growth is likely to accelerate in 2023, enabling it to offer steady special dividends. Moreover, its shares are likely to soar from their current levels because of low valuations, higher earnings, and higher cash returns.

2023 is Likely to Bring Special Dividends for Barings BDC shareholders

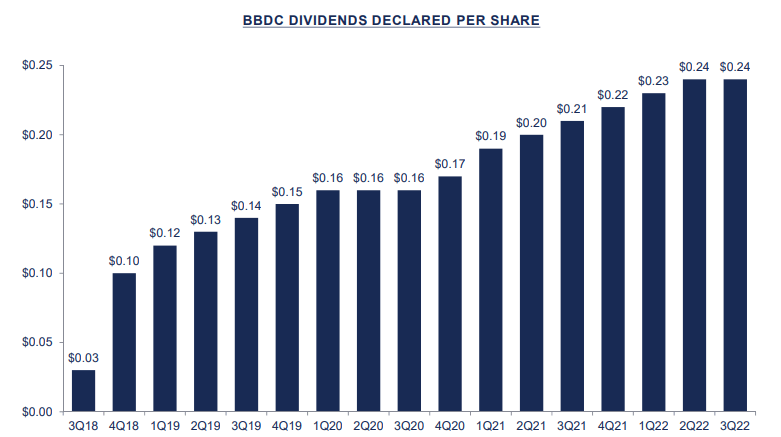

Dividend History (Third Quarter Presentation)

For the final quarter of 2022, Barings has again announced a quarterly dividend of $0.24 per share. It is contrary to its historical dividend distribution trends and raises questions about whether a change in dividend distribution strategy is the result of portfolio deterioration or declining earnings growth potential. In an earnings call, the company addressed these concerns by stating that they want to align their dividend yield on net asset value with a hurdle rate of 8.25%. In fact, Barings seeks to lower its dividend profile correlation with high base rates and protect dividend distributions from incentive fees. With the new dividend distribution strategy, dividends are likely to remain at $0.24 per share in future quarters.

However, its earnings growth potential may force it to declare special dividends or spillovers in 2023 to comply with the requirement of returning at least 90% of earnings to shareholders. For the final quarter of 2022, it expects to earn at least $0.27 per share, bringing the full-year earnings to $1.05 per share, a 16% increase from last year. Consequently, its full-year payout ratio will drop to around 90% from around 100% in the past two years. Furthermore, Wall Street’s median consensus estimate of $1.13 per share and a high estimate of $1.28 per share for 2023 indicate that the payout ratio will fall even further in 2023, which will require the company to declare special dividends.

Increasing portfolio yields also support the bullish case for dividends. As of the end of the third quarter, its portfolio was valued at $2.3 billion with a weighted average yield on performing debt investments of 8.5%, up from 7.6% in the previous quarter and 7.2% at the beginning of 2022. Nonaccrual on the company’s investment portfolio, including the recent acquisitions, was only at 2.8% on a cost basis and 0.7% on a fair value basis. The investment income growth also indicates robust portfolio performance. For the third quarter, the company’s income came in at $56 million, representing an increase of 60.96% over the previous year. Its income is likely to increase to $218 million in 2022 and $263 million in 2023, representing significant growth from $135 million in fiscal 2021.

Stock Offers an Entry Point

Even though Barings’ dividend yield is high and safe, it is still necessary to analyze future stock price movement, since capital appreciation is crucial for maximizing total returns. I believe there are two reasons to be bullish about Barings’ stock price upside. Its lower valuations are the first reason. According to Seeking Alpha’s quantitative grading system, its valuations earned an A grade, which means the stock is trading in a buying zone. In particular, key ratios such as trailing and forward earnings of 8.90 and 8.55 are significantly below the sector median. Further, both its trailing and forward price-to-book ratios are hovering around 0.80 compared to the industry average of 1.30. The stock also looks undervalued based on its net asset value of $11.28 per share, which is up around 20% from the current stock price of $9 a share.

Besides valuations, its earnings growth power is one of the most important factors that could drive investor confidence. Its earnings for the fourth quarter are expected to increase both sequentially and year-over-year, with double-digit growth expected in the following year. The quant grade of A on growth and B+ on profitability also indicates high growth rates and impressive margins when compared to its peers. Therefore, its earnings growth power could help its shares rebound in the coming quarters.

In Conclusion

It appears that prospects for Barings’ steady stock price appreciation along with high dividends could be a perfect recipe for a dividend investor in 2023. Its quarterly dividend of $0.24 per share is completely safe while robust earnings growth will enable the company to announce steady special dividends in 2023. Fortunately, the recent drop in its share price has also created an attractive buying opportunity for investors to capitalize on hefty total returns in 2023.

Be the first to comment