peshkov/iStock via Getty Images

The news came out that the Exxon Mobil (XOM) led group in which Hess (NYSE:HES) is a partner could possibly be barred from bidding on more leases in Guyana. The most likely reason for this would be to diversify the production enough so that there would be reasonable future competition among producers for future lease auctions. Such an action would be to the benefit of the country.

The reason that this news probably does not matter much is that the Exxon Mobil partnership has about 6 million acres to explore in the current block. That is probably more acreage than is needed to keep the partnership busy for the rest of my life and possibly another generation as well.

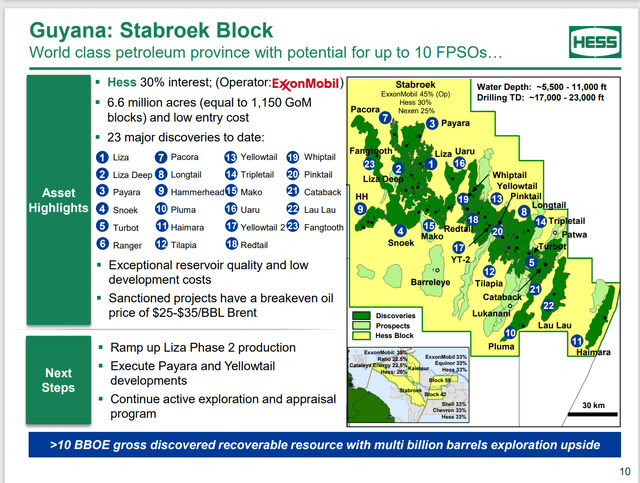

Hess and Exxon Mobil are also partnered to explore and hopefully produce the Kaieteur Block which has more than 3 million acres. This block Hess has a 20% interest in. Obviously, most of the resources are going to develop the discoveries made for obvious economic reasons. It is just as obvious that there is plenty to do if the partnership never picks up another lease to explore and develop. Hess actually has more interests as shown below:

Hess Corporation Guyana Block Discoveries And Hess Interests In Relevant Blocks (Hess Corporation April 2022, Investor Presentation)

The above slide shows that Hess and Exxon Mobil have an interest in a third block. Hess is partnered with Chevron (CVX) for an interest in a fourth block. So, there is obviously so much acreage to be explored and possibly developed that the news has little to no current consequences for the partnership.

As much as companies often would “like to have the whole thing”, that may be too expensive a proposition for practical purposes. These offshore wells are not cheap, and the platforms used to produce the oil frequently cost billions to build. Therefore, having one partnership develop the whole country resources could be quite an initial cash draining experience.

As shown above, the partners have plenty of discoveries on one block. Exploration has really just begun on a second block. It potentially could take several wells before any oil is found or a determination is made that the block is worthless.

Traditionally, the partners update progress with the quarterly earnings report. Therefore, news of any discoveries is likely forthcoming within the next few weeks. Right now, the project seems to be at the point where the partnership makes a little progress or a lot of progress. But it is always progress.

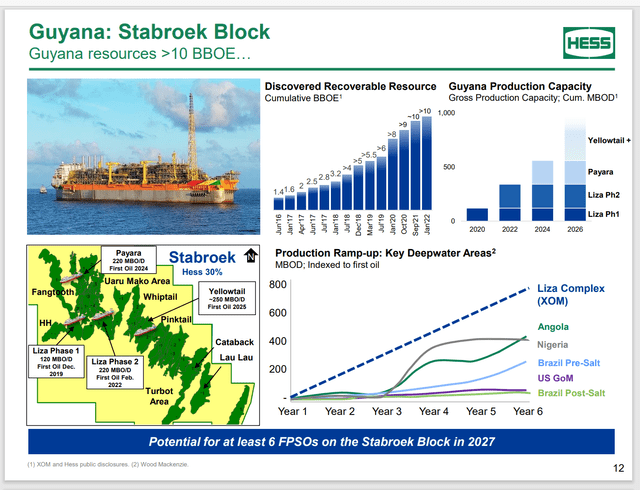

Admittedly, cash flow is rising on the main Stabroek block where discoveries are beginning to produce. A second platform just began production. Now once there are six or seven platforms, it could be very possible to develop 2 blocks at one time.

Similarly, from the company point of view, diversification is a good thing. This Guyana partnership is a fantastically profitable partnership. But as the nationalization of assets first in the Middle East and then in Venezuela proved, too much dependency on one project may not be a good thing. Guyana is currently supportive of the partnership and the rising cash flow. But previous nationalizations prove that the attitude can change. The lure of potentially more money is hard to resist even if the nationalizing country has no idea how to manage the assets.

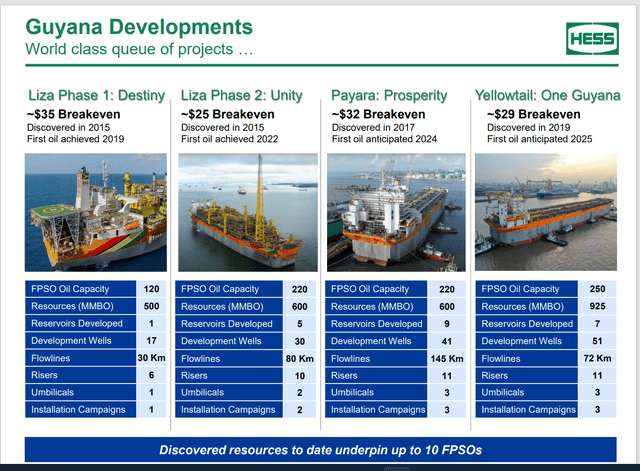

Hess Corporation Presentation Of Sanctioned Production Projects (Hess Corporation April 2022, Corporate Presentation)

At the same time that management announced the beginning of production from the second FPSO, the managing partner, Exxon Mobil also announced an increase in the production capability of the first platform to 140,000 BOD. Therefore, Hess will get the expected boost from the production of the second platform plus another unexpected boost from the increased production capability of the first platform. The Hess share of production from these two platforms when they run at capacity should exceed 100,000 BOD. That amount is approaching half of the company reported production at the current time.

Current oil prices should allow the company to gross about $9 million to $10 million (before any deductions) per day. By the end of the fiscal year, when things are expected to have reached guidance, this project will have expanded the revenue of the company significantly.

Hess Presentation Of Guyana Future Production Guidance (Hess Corporation Investor Presentation April 2022.)

Exxon Mobil is planning an FPSO with a still larger ability to produce oil. The result will be steadily increasing production that should result in an incredible long-term increase in cash flow.

The currently strong commodity price environment aids the project by providing some unexpectedly short payback periods for major cash projects like building FPSOs. A lot of cash returned early in a project tends to raise the internal rate of return of the project to provide an overall greater expected profitability.

For most companies, cash back sooner is worth a whole lot more than cash back later or if at all. The current oil price environment is providing an excellent opportunity to recover a lot of early project costs. The result will be that the cash flow of the project will fund future development as essentially “paid off assets” in the eyes of the partnership.

This gives the partnership a huge advantage over partnerships that are still in the exploration stage. Those partnerships are likely to begin production when commodity prices are lower. They would therefore be looking at lower profits and a longer payback period.

In the meantime, there have been enough very profitable partnership discoveries that Hess is probably looking at a compound cash flow growth of 20% per year on average. Year-to-year cash flow changes will be influenced by commodity prices. But the growth in production from the discoveries noted is significant enough to grow cash flow a lot even though the cyclical nature of the industry. Hess is one of the few companies I follow that will likely more than triple production by the end of the decade. Few companies the size of Hess can grow that rapidly.

The best part is that no more discoveries are needed for the projected growth in the decade. All Hess and partners need to do is produce the discoveries already made. That is a relatively low risk development proposition. There are likely more discoveries to be made that will be “icing on the cake” while extending the growth period of this project.

That makes Hess a true growth company in an industry known for cyclical growth followed by getting through the next downturn in any way possible. Offshore projects generally are not developed unless they are extremely profitable due to the high risks and very high costs of offshore development. Right now, the Guyana project appears to make Hess a far more profitable company in the future with rapidly growing production. That is going to lead to a far higher stock price than is the case at the present time.

Be the first to comment