macniak/iStock via Getty Images

Investment Summary

After extensive analysis of the contributing factors in Heska Corporation’s (NASDAQ:HSKA) investment debate, we’ve found a lack of equity premia to harvest in this name. Analysis of the company’s latest numbers revealed a slow period of growth, with equally slow cadence looking ahead, primarily due the macro-landscape. Despite this, it remained profitable in non-GAAP terms during Q3 FY22, and the now heavily compressed share price is potentially worth a closer look.

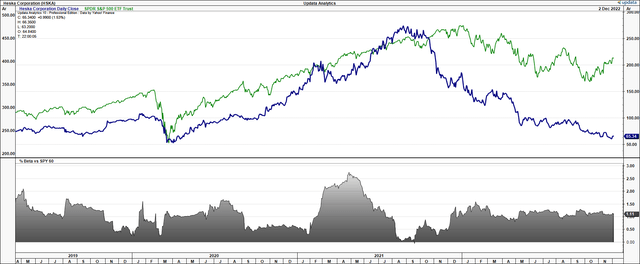

HSKA divergence away to downside from the S&P 500 across FY22. Further divergence from October

However, there have been delays in HSKA launching and accelerating traction for things like the True Rapids internationally, heartworm domestically and Element AIM into Europe and into North America corporate contracts. For instance, its Rapids launch missed the 2022 selling window. These delays resulted in financial impacts for the year 2022, but the calendar is now more favorable for HSKA in FY23, as these delays will become strong contributors and a potential tailwind when revenues are eventually booked. The company also has plans for a cloud-based PIMS and exclusive new cube vet cancer screening in 2023.

Nevertheless, with shares trading in-line with our fair value estimate of $65, and a slow period of growth forecasted ahead, we rate the stock neutral, with more selective opportunities in mind.

Key downside risks to the thesis:

1. Market Risk: The stock market is unpredictable and HSKA may experience greater volatility given its smaller market cap.

2. Company Specific Risk: The company may face specific challenges that could affect its financial performance. This includes changes in the competitive landscape, technological advances, or regulatory changes.

3. Financial Risk: It should be noted that HSKA may fail to grow or generate adequate profits, which in turn could lead to a decline in its stock price should the market penalize the company.

Upside risks:

1. Better-than-expected earnings into the coming quarters.

2. Broad market rally that sees risk assets catch a strong bid back to FY21 levels.

HSKA: Overview of revenue drivers

HSKA has various revenue streams with niche expertise in the advanced veterinary diagnostics market. Specifically, its point of care (“POC”) division sells lab instruments and diagnostic tests. Whereas its practice information software solutions (“PIMS”) segment derives revenue from cytology services, vaccines, immunotherapy and heartworm prevention.

The company’s ‘Element’ line is extensive and covers a wide spectrum on the veterinary treatment scale. For instance, the Element DC, Element DCX, and Element DC5x systems are blood chemistry and electrolyte analyzers designed to quickly and accurately measure clinical chemistry parameters in animal serum, plasma, and other bodily fluids. The systems offer on-board dilution capabilities for high concentration samples, high throughput capabilities, and comprehensive parameter menus.

More recently the company introduced its Element AIM product to the market, helping lift POC revenues for Q3 FY22 per the 10-Q. HSKA’s Element AIM is an automated, in-clinic sediment analyzer for monitoring the health of animals through testing of their fecal and urine samples. The system is designed to detect parasites, bacteria, and other organisms that may be indicative of an animal’s health. It utilizes sophisticated algorithms and innovative technology to provide automated results in as little as 12 minutes.

The market for animal fecal and urine sediment analysis is growing, largely due to the growing demand for more efficient, accurate, and cost-effective methods of testing. This market is expected to be worth over $3 billion by 2025, and $5.2Bn by 2028 [valued at $2.3Bn in 2021]. Veterinarians and animal health care providers are increasingly relying on automated sediment analysis to diagnose a variety of diseases and health conditions, including gastrointestinal tract infections and bladder stones. Rising awareness of the importance of early detection and proper treatment of animal health conditions is driving the demand for these types of tests. Hence, this is the embedded market opportunity for HSKA in this division.

Exhibit 1. Example of the Element AIM unit and integration

Note: This is not an advertisement of Element AIM, nor is this a solicitation to purchase the Element AIM system. We have no affiliation to the company. (Data: Heska Corporation Website)

Q3 financial results: macro-headwinds present, non-restrictive

Turning to HSKA’s Q3 FY22 financials, we note it was a reasonable period of growth for the company, despite the obvious macro headwinds. Chief among these was the USD strength that clamped revenue from international markets.

Revenue growth of 210bps YoY came to $61.5mm on adjusted EBITDA of $6.3mm, a 10.3% margin. In constant currency terms, revenue growth was 710bps compared to same time last year.

Geographically, we saw that with North America segment printed revenue growth of 670bps to $40.3mm, underscored by upsides in POC lab consumables of 11.4 and a 24.3% YoY growth in the pharmaceuticals, vaccines and diagnostics (“PVD”) division. It also saw ~340bps of YoY growth in POC imaging turnover. Meanwhile, we’d note that revenue from its international markets came in to $21.2mm, down 570bps. The decrease was driven by foreign exchange headwinds, as mentioned earlier.

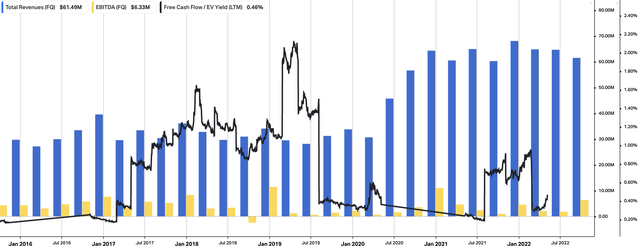

Moving down the P&L, there was decent uplift across the product portfolio’s gross margins. Total gross margin decompressed 180 basis points to 43.7%, with North America segment delivering gross margin of 46.5%, ~50bps downside thanks product mix and more sales volume in lower-margin segments. It pulled OpEx of $27.5mm from this number, around flat versus this time last year, to adjusted earnings of $0.41, up ~78% YoY. A full view of HSKA’s operating performance to date from FY16 can be seen in the chart below [Exhibit 2]. As noted, revenue growth in the last 5-6 quarters has been lumpy, whilst core EBITDA has remained flat, with free cash outflows from Q2 this year.

Exhibit 2. HSKA quarterly operating walk-thru, FY16-date, with core EBITDA

Note: As FCF yield was negative these last few periods, we’ve opted to exclude plotting it on the chart. FCF TTM yield is calculated as: [FCF TTM / rolling enterprise value]. (Data: HB Insights, Refinitiv Eikon, Koyfin)

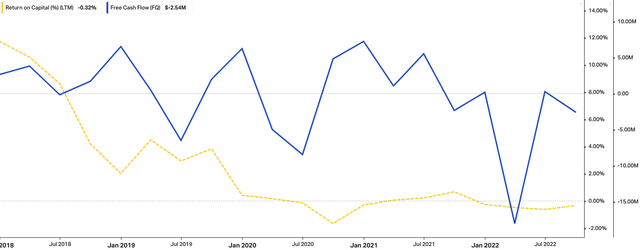

The free cash outflows would be an acceptable and even favourable setup if there was the return on capital to back it up. However, you’ll see below the trend between HSKA’s free cash flows and its return on capital is negligent, with both pushing lower to multi-year lows in recent times.

We’d prefer to see a positive return on capital, or at least net operating profit after tax (“NOPAT”) from the cash outflows to demonstrate a strong capital budgeting strategy from management. This adds weight to our neutral viewpoint on the stock.

Nevertheless, despite some softness in reported revenue, HSKA’s Q3 results demonstrate the company’s resilience in a challenging macro-landscape.

Exhibit 3. Free cash outflows coupled with declining return on capital employed

Data: HB Insights, Refinitiv Eikon, Koyfin

Guidance flat, supports neutral stance

Management said it expects FY22 guidance to fall in-line with the previous year on the earnings call.

By the end of 2022, HSKA expects reported revenue in-line from the prior year. This would represent ~500bps YoY growth in constant currency terms. North America consumables are expected to grow 8-10%, including net subscriber gains for the year, while international consumables, as reported, are expected to decline 12% due to foreign exchange, excluding the forex impact. In terms of profitability, Heska expects to gain 100-200bps on gross margin and an adjusted EBITDA margin of approximately 11% on these revenues.

Looking further ahead, management says that it is primed to transition from its ‘5-year build phase’ to its ‘5-year win at scale and win innovation phase’ in FY23′. Moreover, as mentioned earlier, the company’s Element AIM launch, plus MBio acquisition are expected to contribute to this transition and drive revenues from FY23′ and beyond.

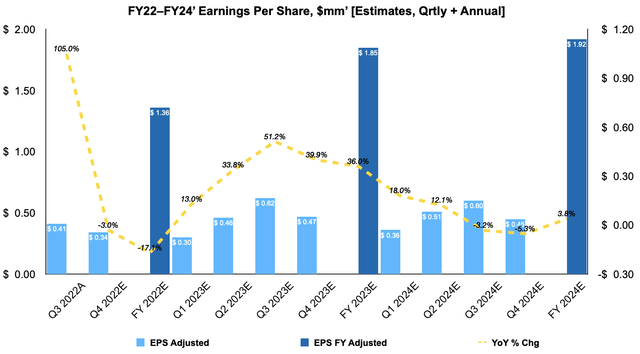

We believe HSKA will continue driving its bottom-line [on a non-GAAP basis]. albeit at a declining rate into FY24. We estimate a strong uplift in quarterly EPS, with YoY growth peaking at 51% in Q2 FY23, before the cadence of growth begins to wind down to single-digits the following year. You can see our full stream of HSKA EPS growth assumptions below. Without the speed of EPS growth to buy into, this also confirms our neutral thesis.

Exhibit 4. HSKA FY22-24′ EPS growth assumptions [quarterly, annual estimates].

Valuation and conclusion

Consensus values the stock at ~48x forward earnings, a more than 140% premium to the sector. Although, we’re comfortable with this growth number across FY23, given our EPS growth assumptions listed above.

Rolling our FY22 EPS assumptions forward and applying the 48x forward multiple derives a price target of $65.30, suggesting the stock is fairly valued at its current market price. Again, this is supportive of a neutral viewpoint. Alas, and unfortunately, we are happy to wait on the sidelines with HSKA and wait until a more compelling opportunity for entry presents itself. Rate hold, $65.30 valuation.

Be the first to comment