LewisTsePuiLung

The luxury group Hermès International Société en commandite par actions (OTCPK:HESAF, OTCPK:HESAY) published high-flying first-half results on the 29th of July. This was marked by a sharp rise in profits and a rebound in Chinese sales in June. We already analyzed Hermès’ first three months and the company recorded strong results and also Q2 trend performances confirmed the positive trend.

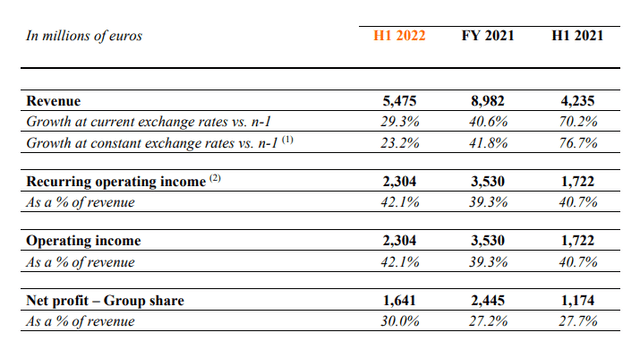

During the second quarter, the group’s turnover reached €2.71 billion and was up at the current FX and at constant FX by 26% and 19.5%, respectively. In detail, this growth reflects a slight deceleration compared to the first quarter but is less pronounced than other players within the sector. In the semester, Hermès’ turnover increased by 29% to reach €5.47 billion. All businesses contributed to the strong momentum with remarkable growth in watches and other Hermès businesses. At the retail level, the strongest sales growth can be attributed to America and Europe excluding France, both at +34%. This was supported by local demand and the gradual tourism recovery. But the family group stands out from the rest by a record operating profit which increased by +34% to more than €2.3 billion compared to €1.7 billion recorded in the first half of 2021 and reached its highest historical margin at 42% against 41% in the same period of 2021. Results were supported by the strengthening of its production capacity in its flagship segments.

“Thanks to the increase in sales in all regions” the luxury group saw its net profit reach €1.64 billion, up by +39.7%. The good news comes from Asia, a region in strong turbulence due to the partial paralysis of mainland China with prolonged lockdown restrictions. As a whole, Asia including Japan saw top-line sales increase by 22.5% and reached €3.2 billion.

According to FactSet consensus, Wall Street analysts expected on average a half-year turnover, recurrent operating income and net profit at €5.34 billion, €1.96 billion and €1.35 billion, respectively. Hermès managed to beat all the P&L lines. Investments were lower in the period and net debt increased due to the dividend payment and the ongoing buyback.

Conclusion and Valuation

Hermès is taking full advantage of this inflationary period and is able to fully pass through all the higher costs thanks to its “unique & fully integrated craftsmanship business model”. In addition to the rising profits, China sales will rebound in the second half of the year and the company will also inaugurate a new flagship store in New York. Despite the period and given the just released performance, the company confirmed its medium-term growth objective.

Concerning the valuation, we remain neutral. Hermès is now exceeding its luxury peer’s multiple (P/E and EV/EBITDA) by more than 100% (against a past average of 80%). This is also supported by our long-term DCF model with a very conservative assumption on the WACC (6.4%) and a long-term growth rate of 2.5%. We currently prefer Kering Group (here is our latest article – looking at its CMD).

Be the first to comment