LewisTsePuiLung/iStock Editorial via Getty Images

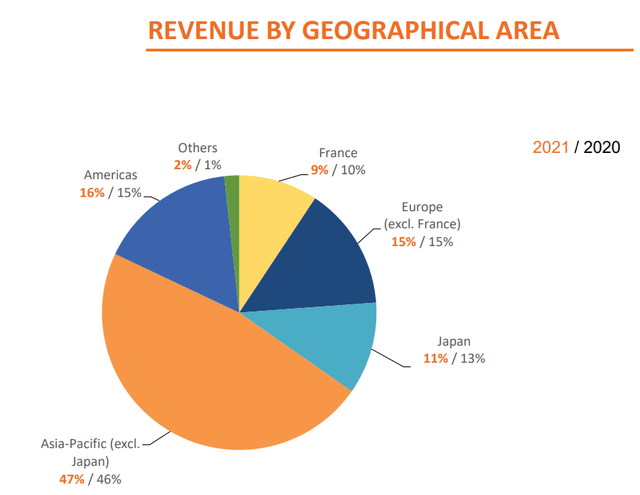

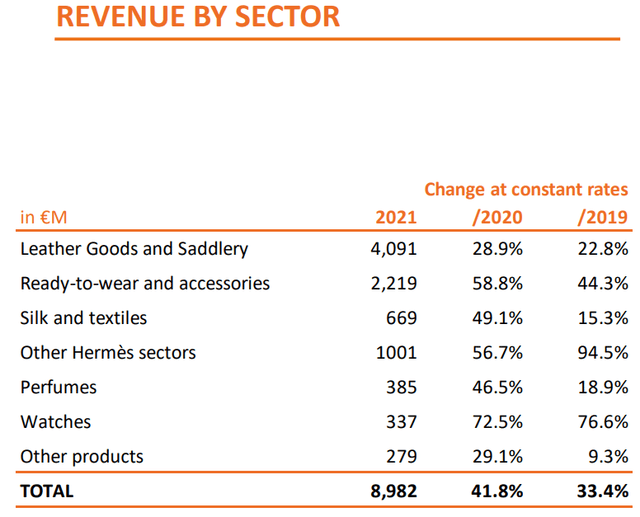

For a few months, here at Mare Evidence Lab, we’ve started to analyse luxury companies as best-in-class businesses for COVID-19 recovery and for inflation hedge protection. We have been researching what we think are the most undervalued (below there is a recap of our latest publications). Today, we are looking at Hermès International Société en commandite par actions (OTCPK:HESAF, OTCPK:HESAY). Within the sector, the French luxury giant is the first company to report Q1 sales, achieving outstanding results. Hermès doesn’t need any introduction. The company engages in the production of leather goods and saddlery such as bags for men and women. It also provides silk textiles such as scarves and ties. The company operates a chain of boutiques (303 stores) under the Hermes name. At a yearly level, we note that the company is very well diversified in terms of revenue by geography as well as the revenue by segment split.

Hermès GEO split Hermès revenue by sector

Q1 Sales

As we already mentioned, we are now covering various luxury companies and Hermès is providing a good benchmark for what we might expect in Q1. The year has started with a bang: sales of the French luxury goods giant reached €2.765 billion in the first three months, increasing by 27% in constant currency compared to the same period in 2021. This was achieved despite the war in Ukraine and the prolonged lockdowns in China. As we already mentioned, the company exceed the FactSet consensus expectations that were set for €2.53 billion. By business line, prêt-à-porter and accessories recorded the highest growth with a 44% increase followed by the leather goods with +16%.

Axel Dumas, Executive Chairman of Hermès commented:

“the strong growth in sales at the beginning of this year reflects the desirability of our collections and the confidence of our customers in our artisanal and responsible approach“.

And then he said: “Despite a still uncertain context, the group is accelerating its strategic investments, recruitments and training to support the growth of all the métiers of the house.“

Russian Exposure Is Limited But China Is A Concern

Hermès was the first luxury industry group to announce in early March the closure of its Russian stores, where it has three stores in Moscow employing 60 people, and to suspend the opening of the fourth store in Saint Petersburg that was scheduled for June. CFO Eric du Halgouet said that “the impact is not significant for the group” and explained that “sales in Russia represent less than 1% of the group’s sales“. Moreover; Hermès has no business in Ukraine.

Instead, regarding the situation in China, the company had an exceptional start to the beginning of the year, until March, when the first new COVID lockdowns began. Hermès, which has 26 stores in China, currently has three stores closed in Shanghai. However, the Q1 was supported by the Americas, which jumped 44% at constant exchange rates thanks to the strong momentum in the United States as well as in Europe thanks in particular to the United Kingdom, Germany, Italy and Spain.

Conclusion And Valuation

Hermès’ medium-term growth objective remains ambitious thanks to high demand and increased production capacity. Given China’s uncertainty, we are not expecting a significant change in EBIT guidance. Having looked at analyst expectations, we see that Hermès together with Ferragamo (OTCPK:SFRGF) have consensus which points at declining margins on an annual basis. Regarding the valuation, Hermès has confirmed once again its superiority over its peers, with the reduction in tourist flows more than offset by its loyal customer base (to note the long waiting lists on its most iconic products). The company is currently trading at almost 100% premium compared to its luxury peers based on FY23 expectations versus a historical average of 80% premium since 2014. Hermès is also trading at an all-time high PE reaching now 54x. We see other companies such as Kering Group (PPRUF, OTCPK:PPRUY) with more interesting upside and compelling valuation, for the above reason we give Hermès a target price of €1,200.00 based on a 10year DCF with a WACC at 6.4% and a long term growth rate of 2,5%.

If you are interested in our research in the luxury sector, please have a look at our recent articles:

- Moncler: Buy Case Supported By Macro To Micro Reasons

- Capri Holdings: On Hold For Now

- Zegna: Solid Numbers Ahead Of Planned IPO

- Kering: Trading Multiple Too Low

Be the first to comment